Credit Markets: Kraft Debt Sinks After Fitch, S&P Downgrade -- WSJ

February 15 2020 - 3:02AM

Dow Jones News

By Matt Wirz

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (February 15, 2020).

Investors dumped bonds of Kraft Heinz Co. Friday when Fitch

Ratings and S&P Global Ratings pushed their ratings of the

company into junk territory following a disappointing earnings

report.

A downgrade by two of the three major ratings firms typically

forces index operators to classify Kraft as below investment grade

and prohibit many bond funds from holding the debt.

Kraft's bond due 2046 fell to about 90 cents on the dollar

Friday from 96 cents Thursday and 101 cents before the earnings

disclosure. About $4.5 billion of the company's bonds traded in the

two days following the disclosure, according to data from

MarketAxess. That figure represents about 20% of the company's $23

billion face amount of bonds outstanding, according to data from

Bank of America Corp.

Fitch and S&P pointed to Kraft's commitment to keep paying

shareholder dividends despite decreased earnings as a risk to

bondholders.

"We believe it's important to Kraft Heinz shareholders to

maintain our dividend during this time of transformation," said

Michael Mullen, senior vice president of corporate affairs for

Kraft. "We also remain committed to reducing leverage over time as

we reposition the company for sustainable growth and returns."

Moody's Investors Service changed the outlook on its Kraft

rating -- currently at the lowest rung of investment grade -- to

"negative" from "stable" on Friday but didn't cut the rating.

The downgrades by Fitch and S&P will likely make Kraft the

largest "fallen angel" to enter the junk-bond market since 2005,

according to research by Bank of America. That change would make

Kraft bonds account for 1.9% of a widely tracked high-yield bond

index, the bank's analysts said.

The food maker's sales have fallen in recent years as consumers

shift away from the processed products that make up its core brands

toward fresher and healthier options.

"The company lost sight of investing to manage long-term trends

facing the business, such as the overall shift toward healthier

eating by Kraft Heinz consumers," said Abigail Ingalls, an analyst

at Breckinridge Capital Advisors, which doesn't own Kraft

bonds.

Treasury bonds rallied Friday after the release of a U.S. retail

sales report that, while reasonably strong, was somewhat

disappointing in its details, according to analysts. The 10-year

bond yield, which falls when prices rise, climbed to 1.587% Friday

from 1.616% Thursday, according to data from Tradeweb.

Sam Goldfarb contributed to this article.

Write to Matt Wirz at matthieu.wirz@wsj.com

(END) Dow Jones Newswires

February 15, 2020 02:47 ET (07:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

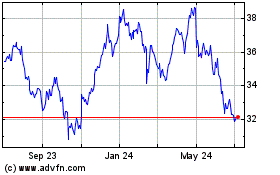

Kraft Heinz (NASDAQ:KHC)

Historical Stock Chart

From Mar 2024 to Apr 2024

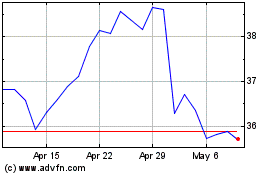

Kraft Heinz (NASDAQ:KHC)

Historical Stock Chart

From Apr 2023 to Apr 2024