|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH:

|

5

|

SOLE VOTING POWER

0

|

|

6

|

SHARED VOTING POWER

101,830

|

|

7

|

SOLE DISPOSITIVE POWER

0

|

|

8

|

SHARED DISPOSITIVE POWER

101,830

|

|

9

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

101,830

|

|

10

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN

SHARES (See Instructions)

¨

|

|

11

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

0.07% *

|

|

12

|

TYPE OF REPORTING PERSON (See Instructions)

CO

|

|

|

*

|

This percentage is based

on 153,320,667 shares of common stock outstanding as of December 31, 2019, as reported in the Proxy Statement. Does not give effect

to a 1-for-10 reverse stock split effected by the Issuer on February 3, 2020.

|

This Amendment No. 2 to Schedule 13G

(this “Amendment No. 2”) is being filed with respect to the common stock, par value $0.0001 per share

(“Common Stock”), of ContraFect Corporation, a Delaware corporation (the “Issuer”), to amend the

Schedule 13G filed on March 21, 2018, as previously amended by Amendment No. 1, filed on February 8, 2019 (the

“Schedule 13G”), in accordance with the annual amendment requirements. This Amendment No. 2 is being filed on

behalf of Oracle Partners, LP, a Delaware limited partnership (“Oracle Partners”), Oracle Ten Fund, LP, a

Delaware limited partnership (“Oracle Ten Fund”), Oracle Institutional Partners, LP, a Delaware limited

partnership (“Institutional Partners” and, collectively with Oracle Partners and Oracle Ten Fund, the

“Oracle Partnerships”), Oracle Investment Management Inc. Employees Retirement Plan, an employee benefit plan

organized in Connecticut (the “Retirement Plan”), Oracle Associates, LLC, a Delaware limited liability company

and the general partner of Oracle Partners, Oracle Ten Fund and Institutional Partners (“Oracle Associates”),

Oracle Investment Management, Inc., a Delaware corporation and the investment manager to the Oracle Partnerships and plan

administrator to the Retirement Plan (the “Investment Manager”), The Feinberg Family Foundation, a foundation

organized in Connecticut (the “Foundation”), and Larry N. Feinberg, the managing member of Oracle Associates, the

sole shareholder, director and president of the Investment Manager and the trustee of the Foundation (each of the foregoing,

a “Reporting Person” and collectively, the “Reporting Persons”). Capitalized terms used but not

defined herein have the meaning ascribed thereto in the Schedule 13G.

|

|

Item 2(a).

|

Name of Filing Person:

|

This statement is filed

by:

|

|

(i)

|

Oracle Partners, L.P., a Delaware limited partnership (“Partners”), with respect to

the shares of the Issuer’s common stock, par value $0.001 per share (“Shares”), directly owned by it;

|

|

|

(ii)

|

Oracle Institutional Partners, L.P., a Delaware limited partnership (“Institutional Partners”).

with respect to the Shares directly owned by it;

|

|

|

(iii)

|

Oracle Ten Fund, LP, a Delaware limited partnership (“Ten Fund”), with respect to shares

directly owned by it;

|

|

|

(iv)

|

Oracle Associates, LLC, a Delaware limited liability company (“Oracle Associates”),

which serves as the general partner of Partners, Institutional Partners and Ten Fund, and may be deemed to indirectly own, by virtue

of the foregoing relationship, the Shares directly owned by Partners, Institutional Partners and Ten Fund;

|

|

|

(v)

|

Oracle Investment Management Inc. Employees Retirement Plan, an employee benefit plan organized

in Connecticut (the “Retirement Plan”), with respect to the Shares directly owned by it;

|

|

|

(vi)

|

The Feinberg Family Foundation,

a foundation organized in Connecticut (the “Foundation”),

with respect to the Shares directly owned by it;

|

|

|

(vii)

|

Oracle Investment Management, Inc., a Delaware corporation (the “Investment

Manager”), which serves as the investment manager of Partners, Institutional Partners and Ten Fund and the plan

administrator to the Retirement Plan, and may be deemed to indirectly own, by virtue of the foregoing relationship, the

Shares directly owned by Partners, Institutional Partners, Ten Fund and the Retirement Plan; and

|

|

|

(viii)

|

Mr. Larry N. Feinberg (“Mr. Feinberg”), who serves as the managing member of Oracle

Associates and as the sole shareholder, director and president of the Investment Manager and as a trustee of the Foundation, and

may be deemed to indirectly own, by virtue of the foregoing relationships, the Shares directly owned by Partners, Institutional

Partners, Ten Fund, the Retirement Plan and the Foundation.

|

The foregoing persons are hereinafter sometimes

collectively referred to as the “Reporting Persons.” Any disclosures herein with respect to persons other than the

Reporting Persons are made on information and belief after making inquiry to the appropriate party.

The share of Common Stock

disclosed in this Amendment No. 2 do not give effect to a 1-for-10 reverse stock split effected by the Issuer on February 3, 2020.

|

|

(a)

|

Amount beneficially owned: 2,502,766

|

|

|

(b)

|

Percent of class: 1.62%

|

|

|

(c)

|

Number of shares as to which such person has:

|

|

|

(i)

|

Sole power to vote or direct the vote: 0

|

|

|

(ii)

|

Shared power to vote or direct the vote: 2,502,766

|

|

|

(iii)

|

Sole power to dispose or direct the disposition: 0

|

|

|

(iv)

|

Shared power to dispose or direct the disposition: 2,502,766

|

|

|

(a)

|

Amount beneficially owned: 1,501,900

|

|

|

(b)

|

Percent of class: 0.97%

|

|

|

(c)

|

Number of shares as to which such person has:

|

|

|

(i)

|

Sole power to vote or direct the vote: 0

|

|

|

(ii)

|

Shared power to vote or direct the vote: 1,501,900

|

|

|

(iii)

|

Sole power to dispose or direct the disposition: 0

|

|

|

(iv)

|

Shared power to dispose or direct the disposition: 1,501,900

|

|

|

C.

|

Oracle Institutional Partners, L.P.

|

|

|

(a)

|

Amount beneficially owned: 193,584

|

|

|

(b)

|

Percent of class: 0.13%

|

|

|

(c)

|

Number of shares as to which such person has:

|

|

|

(i)

|

Sole power to vote or direct the vote: 0

|

|

|

(ii)

|

Shared power to vote or direct the vote: 193,584

|

|

|

(iii)

|

Sole power to dispose or direct the disposition: 0

|

|

|

(iv)

|

Shared power to dispose or direct

the disposition: 193,584

|

|

|

(a)

|

Amount beneficially owned: 282,800

|

|

|

(b)

|

Percent of class: 0.18%

|

|

|

(c)

|

Number of shares as to which such person has:

|

|

|

(i)

|

Sole power to vote or direct the vote: 0

|

|

|

(ii)

|

Shared power to vote or direct the vote: 282,800

|

|

|

(iii)

|

Sole power to dispose or direct the disposition: 0

|

|

|

(iv)

|

Shared power to dispose or direct the disposition: 282,800

|

|

|

E.

|

Oracle Associates, LLC

|

|

|

(a)

|

Amount beneficially owned: 1,978,554

|

|

|

(b)

|

Percent of class: 1.28%

|

|

|

(c)

|

Number of shares as to which such person has:

|

|

|

(i)

|

Sole power to vote or direct the vote: 0

|

|

|

(ii)

|

Shared power to vote or direct the vote: 1,978,554

|

|

|

(iii)

|

Sole power to dispose or direct the disposition: 0

|

|

|

(iv)

|

Shared power to dispose or direct the disposition: 1,978,554

|

|

|

F.

|

Oracle Investment Management, Inc.

|

|

|

(a)

|

Amount beneficially owned: 2,400,936

|

|

|

(b)

|

Percent of class: 1.56%

|

|

|

(c)

|

Number of shares as to which such person has:

|

|

|

(i)

|

Sole power to vote or direct the vote: 0

|

|

|

(ii)

|

Shared power to vote or direct the vote: 2,400,936

|

|

|

(iii)

|

Sole power to dispose or direct the disposition: 0

|

|

|

(iv)

|

Shared power to dispose or direct the disposition: 2,400,936

|

|

|

G.

|

Oracle Investment Management, Inc. Employees’ Retirement Plan

|

|

|

(a)

|

Amount beneficially owned: 422,382

|

|

|

(b)

|

Percent of class: 0.28%

|

|

|

(c)

|

Number of shares as to which such person has:

|

|

|

(i)

|

Sole power to vote or direct the vote: 0

|

|

|

(ii)

|

Shared power to vote or direct the vote: 422,382

|

|

|

(iii)

|

Sole power to dispose or direct the disposition: 0

|

|

|

(iv)

|

Shared power to dispose or direct the disposition: 422,382

|

|

|

H.

|

The Feinberg Family Foundation

|

|

|

(a)

|

Amount beneficially owned: 101,830

|

|

|

(b)

|

Percent of class: 0.07%

|

|

|

(c)

|

Number of shares as to which such person has:

|

|

|

(i)

|

Sole power to vote or direct the vote: 0

|

|

|

(ii)

|

Shared power to vote or direct the vote: 101,830

|

|

|

(iii)

|

Sole power to dispose or direct the disposition: 0

|

|

|

(iv)

|

Shared power to dispose or direct the disposition: 101,830

|

|

Item 5.

|

Ownership of Five Percent or Less of a Class.

|

If this statement is being filed to report the fact

that as of the date hereof the reporting person has ceased to be the beneficial owner of more than five percent of the class of

securities, check the following x.

By signing below, I certify that, to the best of

my knowledge and belief, the securities referred to above were not acquired and are not held for the purpose of or with the effect

of changing or influencing the control of the issuer of the securities and were not acquired and are not held in connection with

or as a participant in any transaction having that purpose or effect.

SIGNATURE

After reasonable inquiry

and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: February 14, 2020

|

|

/s/ Larry Feinberg

|

|

|

Larry Feinberg, Individually

|

|

|

|

|

|

ORACLE PARTNERS, LP

|

|

|

By: ORACLE ASSOCIATES, LLC, its general partner

|

|

|

|

|

|

By: /s/ Larry Feinberg

|

|

|

Larry Feinberg, Managing Member

|

|

|

|

|

|

ORACLE INSTITUTIONAL PARTNERS, LP

|

|

|

By: ORACLE ASSOCIATES, LLC, its general partner

|

|

|

|

|

|

By: /s/ Larry Feinberg

|

|

|

Larry Feinberg, Managing Member

ORACLE TEN FUND, LP

By: ORACLE ASSOCIATES, LLC, its general partner

By: /s/ Larry N. Feinberg

Larry N. Feinberg, Managing Member

|

|

|

|

|

|

ORACLE ASSOCIATES, LLC

|

|

|

|

|

|

By: /s/ Larry Feinberg

|

|

|

Larry Feinberg, Managing Member

|

|

|

|

|

|

ORACLE INVESTMENT MANAGEMENT, INC.

|

|

|

|

|

|

By: /s/ Larry Feinberg

|

|

|

Larry Feinberg, Managing Member

|

|

|

|

|

|

ORACLE INVESTMENT MANAGEMENT, INC.

|

|

|

EMPLOYEES’ RETIREMENT PLAN

|

|

|

|

|

|

By: /s/ Larry Feinberg

|

|

|

Larry Feinberg, Trustee

|

|

|

|

|

|

THE FEINBERG FAMILY FOUNDATION

|

|

|

|

|

|

By: /s/ Larry Feinberg

|

|

|

Larry Feinberg, Trustee

|

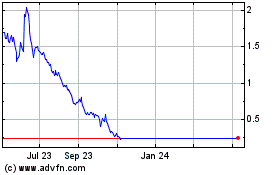

ContraFect (NASDAQ:CFRX)

Historical Stock Chart

From Mar 2024 to Apr 2024

ContraFect (NASDAQ:CFRX)

Historical Stock Chart

From Apr 2023 to Apr 2024