CleanSpark, Inc. (Nasdaq: CLSK), a software and services company

which offers proprietary software and controls for microgrid and

distributed energy resource management systems and innovative

software marketing and design services, is pleased to announce and

provide a statement on the Company’s financial results presented in

its Form 10-Q. The Company recommends that readers also

review the Company’s 10-Q in its entirety, a free copy of which is

available to all interested parties on the Company’s website or on

www.sec.gov.

Dear Fellow Shareholders,

We move into 2020 having achieved one of

CleanSpark’s primary stated goals of up-listing to the Nasdaq stock

exchange. This up-listing to Nasdaq is a major corporate

achievement reflecting growing momentum and financial performance

throughout 2019. We believe our Nasdaq listing will help to

increase long-term shareholder value by improving awareness,

liquidity, and expanding our investor base to include more

institutional investors.

We are well capitalized and positioned to

continue to leverage our mPulse and mVSO software platform.

We have committed to focus our fiscal year 2020 on revenue growth

as we continue our path to profitability through both sales and

acquisitions. CleanSpark has now delivered its sixth

consecutive record-setting quarter, creating a significant increase

in year-over-year revenues. As we have expanded our product

offerings and customer base, we are optimistic that we will

continue to see increased adoption of our solutions. As a result,

we expect our year-over-year quarterly revenues continue to

increase through our 2020 fiscal and calendar year.

We are focusing on marketing our Software as a

Service (SaaS) platform mVSO which generates revenues recurring in

nature and carry high margins. Our expectation is that our SaaS

revenues will continue to increase rapidly over the fiscal year

ending 2020 as we further increase our marketing efforts to take

advantage of the opportunities we see in front of us. More

specifically, our plan is to focus on a highly targeted online

campaign paired with traditional marketing. We are targeting $1.0

million in annualized SaaS revenue under contract before the end of

calendar 2020. Based upon historical trends, we expect this

revenue to carry profit margins of 70-85%.

In addition to our online marketing efforts we

have continued to increase our sales team who are focused on mPulse

controls sales and expect these efforts to continue to increase

revenue outputs. We currently have $1.0 million in mPulse and

energy storage orders under contract, which we expect to deliver

over the next two quarters. We are targeting $3.5 million in

mPulse and energy storage sales over the next calendar year.

We are limited to some degree by the long sales cycles

associated with system integration, but as our adoption rate

increases and our contracted pipeline continue to build we expect

our mPulse and energy storage sales to increase significantly into

2021 and beyond. Based upon historical trends, we expect

these revenues to carry profit margins between 20-70% depending on

total system size.

Our sales in fiscal 2020 have largely been led

by sales of our equipment division with over $2.6 Million in new

orders received this fiscal year to date, with most orders being

placed by repeat customers. We expect this trend of increased

sales to continue throughout 2020. Currently, we have a total of

$5.1 million in equipment purchase orders under contract which we

expect to deliver over the next two quarters. We are

targeting $7.0 million in delivered equipment sales prior to the

end of fiscal 2020. We expect this revenue to carry

profit margins of 9-12%, based on historical trends.

We have also begun to further diversify our

revenue streams with a strong focus on increasing profit

margins. As part of this strategic initiative, on January 31,

2020, CleanSpark completed the acquisition of p2klabs, Inc., a

design and innovation consulting firm that specializes in applying

transformational design, technology, and business methodologies to

transform and grow businesses. This acquisition enables

CleanSpark to accelerate the development and deployment of its

software platforms and expand overall sales and marketing

capabilities. The addition of p2klabs adds significant depth

in software sales experience and a top-tier sales and marketing

team. As a result of the acquisition, Mr. Amer Tadayon has

joined the CleanSpark executive team as the Company’s Chief Revenue

Officer to oversee our sales and marketing strategy. Mr.

Tadayon has more than 25 years of experience working with

world-class companies including IBM, Cognizant and frog Design.

We expect the acquisition to not only enhance

and increase our existing software platform sales, but we also

expect it to add up to $2.0 million in new services-based revenue

directly related to the acquired business over the next twelve

months. Based upon historical trends, we expect this revenue

to carry profit margins of 55-65%.

Quarter ending December 31, 2019 US GAAP

Financial and Operating Highlights:

All amounts below are presented in accordance

with accounting principles generally accepted in the United States

of America (“US GAAP”) unless otherwise indicated.

- Quarter ending December 31, 2019 Revenue of $976,824, up 372%

from $262,907 in 2018.

- Quarter ending December 31, 2019 Gross profit increased 238% to

$94,103, up from $39,581 in 2018.

- Quarter ending December 31, 2019 Net loss per share improved by

$0.23 per share to $(0.40) from $(0.63) in 2018.

- CleanSpark announced a 10-year exclusive agreement with

International Land Alliance (ILAL). The agreement calls for

CleanSpark to provide its microgrid Value Stream

Optimizer (mVSO) software services to support system design

and engineering as well as integrating CleanSpark’s mPULSE software

into the final systems on all future energy projects across the

ILAL portfolio of properties. We are currently working with ILAL on

two initial feasibilities studies and we anticipate that in 2020 we

will recognize at least $200,000 in related revenue with a large

increase expected in 2021 as ILAL’s development efforts begin to

accelerate.

- CleanSpark announced the signing of a Memorandum of

Understanding (“MOU”) with the Shoreline Unified School District to

form a Strategic Alliance for Microgrid Assessment and

Deployment. In accordance with the MOU, CleanSpark will

evaluate two stages of grid resiliency for the District. The

intended Resiliency Zones would utilize Solar Energy, Storage and

Back-up Generation controlled by our mPulse controls platform to

meet the School District’s energy needs and provide back-up energy

to the surrounding communities during emergencies.

- Release of new features and improvements to our SaaS Microgrid

Value Stream Optimizer (mVSO) platform, which includes the enhanced

equipment library, the ability to run scenario comparisons and

upload site plans. We believe these features further distinguish

CleanSpark as a market leader in the space.

- Release of new features and improvements to our mPulse Controls

platform, which includes enhanced reporting and the release of a

low costs ‘light-version’ for smaller systems. We expect this

enhancement to further allow us to not only compete on price but

also on functionality.

Certain Non-U.S. GAAP Financial

measures:

The Company assesses its results of operations

using certain non-U.S. GAAP financial measures, in addition to U.S.

GAAP financial measures. The Company believes these non-U.S. GAAP

financial measures provide useful information to investors and

others in understanding and evaluating its operating performance in

the same manner as management does.

The non-U.S. GAAP financial measures should be

considered in addition to, and not as a substitute for or superior

to, any financial measures prepared in accordance with U.S. GAAP.

The Company’s non-U.S. GAAP financial measures may be defined

differently from time to time and may be defined differently than

similar terms used by other companies, and accordingly, care should

be exercised in understanding how the Company defines its non-U.S.

GAAP financial measures.

Reconciliation of non-GAAP Adjusted

EBITDA (after elimination of stock based and other

non-cash expenses)

| |

|

For the Quarter Ended |

| |

|

December 31, 2019 |

|

December 31, 2018 |

|

Net loss (US GAAP) |

$ |

(1,916,254 |

) |

$ |

(2,283,551 |

) |

| Less: Depreciation,

Amortization and other non-cash items: |

|

|

|

|

| Depreciation and

amortization |

|

626,777 |

|

|

157,483 |

|

| Software amortization |

|

39,287 |

|

|

348,660 |

|

| Stock based compensation |

|

636,269 |

|

|

554,206 |

|

| Non-cash interest charges,

amortization of debt discounts and other |

|

1,504,073 |

|

|

517,417 |

|

| Unrealized gains on

investments |

|

(2,635,522 |

) |

|

- |

|

| Loss on settlement of

debts |

|

- |

|

|

26,225 |

|

| Total Depreciation,

Amortization and other non-cash items: |

|

170,884 |

|

|

1,761,474 |

|

| |

|

|

|

|

| Non-GAAP Adjusted EBITDA

(after elimination of stock based and other non-cash expenses) |

$ |

(1,745,370 |

) |

$ |

(679,560 |

) |

Update on Fiscal 2020 Strategic

Objectives

We have executed on our first acquisition as

stated in our prior shareholder letter and we plan to continue to

seek out accretive acquisition opportunities for software and

software-design companies. We believe that growth through

acquisition will accelerate profitability. We are evaluating

acquisition targets based on a few key criteria which include, a)

the target company should be cashflow positive; b) the target

company’s core-revenues must be derived from software or related

services, and c) our team’s impact and expertise must be able to

create an immediately accretive result and create increased

efficiency and/or decreased costs. We are currently

evaluating additional target companies at this time and although

there can be no assurance that we will come to agreements on terms

with these targets, we are optimistic as to the progress. If

these targets do not result in an acquisition or similar

transaction we intend to seek out and continue to evaluate

additional opportunities.

We are resolved to put all our efforts towards

achieving profitability in the coming year by endeavoring to

significantly improve our margin profile by focusing on increasing

software sales specifically our mVSO Software and a Services (SaaS)

platform. We are properly capitalized and believe we have the

tools available to us to achieve our 2020 revenue targets.

Through our planned initiatives we expect to begin approaching

break-even in late 2020 and expect to achieve profitability in

2021.

We greatly appreciate the continued support from

all our shareholders.

Sincerely,

Zachary Bradford, CEO and S. Matthew Schultz,

Chairman

Parties interested in using CleanSpark’s

platform are encouraged to inquire by contacting the Company

directly at info@cleanspark.com or visiting the Company’s

website at www.Cleanspark.com

About CleanSpark:

CleanSpark a software and services company which

offers software and intelligent controls for microgrid and

distributed energy resource management systems and innovative

software marketing and design services. The Company provides

advanced energy software and control technology that allows energy

users to obtain resiliency and economic optimization. Our software

is uniquely capable of enabling a microgrid to be scaled to the

user's specific needs and can be widely implemented across

commercial, industrial, military, agricultural and municipal

deployment. Our product and services consist of intelligent energy

controls, microgrid modeling software, and innovation consulting

services in design, technology, and business process methodologies

to help transform and grow businesses.

Forward-Looking Statements:

CleanSpark cautions you that statements in this

press release that are not a description of historical facts are

forward-looking statements. These statements are based on

CleanSpark's current beliefs and expectations. The inclusion of

forward-looking statements should not be regarded as a

representation by CleanSpark that any of our plans will be

achieved. Actual results may differ from those set forth in this

press release due to the risk and uncertainties inherent in our

business, including, without limitation: the expectations of future

growth may not be realized, timing of deliveries, demand for our

software products; and other risks described in our prior press

releases and in our filings with the Securities and Exchange

Commission (SEC), including under the heading "Risk Factors" in our

Annual Report on Form 10-K and any subsequent filings with the SEC.

You are cautioned not to place undue reliance on these

forward-looking statements, which speak only as of the date hereof,

and we undertake no obligation to revise or update this press

release to reflect events or circumstances after the date hereof.

All forward-looking statements are qualified in their entirety by

this cautionary statement, which is made under the safe harbor

provisions of the Private Securities Litigation Reform Act of

1995.

Contact - Investor

Relations:Shawn SeversonIntegra Investor Relations(415)

233-7094info@integra-ir.com

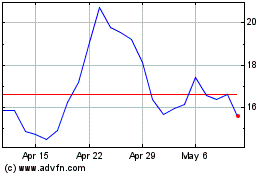

CleanSpark (NASDAQ:CLSK)

Historical Stock Chart

From Mar 2024 to Apr 2024

CleanSpark (NASDAQ:CLSK)

Historical Stock Chart

From Apr 2023 to Apr 2024