Current Report Filing (8-k)

February 11 2020 - 9:01AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

February 11, 2020

CMG HOLDINGS GROUP, INC.

(Exact name of Registrant as specified in

its Charter)

|

Nevada

|

|

000-51770

|

|

87-0733770

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File No.)

|

|

(IRS Employer

Identification No.)

|

2130 N Lincoln Park W Suite 8N, Chicago, IL

60614

(Address of principal executive offices)

(773) 770-3440

(Registrant’s Telephone Number)

(Former name or address, if changed since last

report)

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

(see General Instruction A.2. below):

|

[ ]

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR 230.405) or Rule 12b-2 of the Securities

Exchange Act of 1934 (17 CFR 240.12b-2) [X]

If an emerging growth company, indicate by

check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act [X]

CMG Holdings Group, Inc. is referred to herein as “we”,

“us”, “our”, or "CMGO".

Item 8.01. Other Events

CMG Holdings Group, Inc. (CMGO) reports that the Company has recently

repurchased 1.2 million shares in the open market at an average price of .00625, for retirement to Treasury. To date, the Company

has repurchased in excess of 8.6 million shares under its 2019 Board-approved share repurchase program of up to 100 million shares.

Management continues to believe the shares are significantly undervalued.

The Company has engaged the accounting firm of B F Borgers CPA PC.

Mr. Borger's firm is PCAOB-registered and will be performing the audit and providing guidance necessary for CMGO to become fully-reporting

with the SEC. We expect the process to take approximately 60-75 days. After the process is complete, it is the intention of management

to uplist CMGO to the OTCQB for greater liquidity and transparency for investors subject to exchange listing requirements.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

CMG HOLDINGS GROUP, INC.

|

|

|

|

|

Date: February 11, 2020

|

By:

|

/s/ Glenn Laken

|

|

|

|

Glenn Laken

|

|

|

|

Chief Executive Officer

|

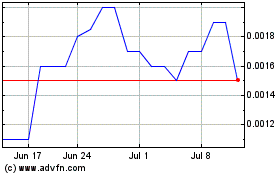

CMG (PK) (USOTC:CMGO)

Historical Stock Chart

From Mar 2024 to Apr 2024

CMG (PK) (USOTC:CMGO)

Historical Stock Chart

From Apr 2023 to Apr 2024