Pitney Bowes Inc. (NYSE: PBI) (the “Company” or “Pitney Bowes”)

announced today that it has commenced cash tender offers

(collectively, the “Tender Offers,” and each offer to purchase a

series of notes individually, a “Tender Offer”) to purchase up to

$950,000,000 aggregate principal amount (the “Aggregate Maximum

Principal Amount”), of the outstanding notes of the Company as set

forth in the table below (collectively, the “Notes”). The Company

will accept for purchase its outstanding (i) 3.375% Notes due 2021

(the “3.375% Notes”), and (ii) 3.875% Notes due 2022 (the “3.875%

Notes”), 4.700% Notes due 2023 (the “4.700% Notes”) and 4.625%

Notes due 2024 (the “4.625% Notes” and together with the 3.875%

Notes and the 4.700% Notes, the “Waterfall Notes”), up to the

Waterfall Series Tender Cap applicable to such series of Notes as

set forth on the table below (each, a “Waterfall Series Tender Cap”

and together, the “Waterfall Series Tender Caps.”)

The terms and conditions of the Tender Offers and the Consent

Solicitation are described in an Offer to Purchase and Consent

Solicitation Statement dated February 10, 2020 (the “Offer to

Purchase and Consent Solicitation Statement”). Terms used but not

defined herein have the meaning ascribed to them in the Offer to

Purchase and Consent Solicitation Statement.

Dollars per $1,000 Principal

Amount of Notes

Series of Notes(3)

CUSIP Number(s)

Aggregate Principal

Amount Outstanding

Waterfall

Series

Tender Cap

Acceptance

Priority

Level

Tender Offer

Consideration(1)

Early Tender

Premium (1)

Total Consideration

(1)(2)

3.375% Notes due 2021

724479AK6

$600,000,000

None.

1

$1,005.00

$30.00

$1,035.00

3.875% Notes due 2022

724479AL4

$400,000,000

$250,000,000

2

$1,020.00

$30.00

$1,050.00

4.700% Notes due 2023

724479AN0

$400,000,000

$125,000,000

3

$997.50

$30.00

$1,027.50

4.625% Notes due 2024

724479AJ9

$500,000,000

$125,000,000

4

$962.50

$30.00

$992.50

(1) Per $1,000 principal amount of Notes validly tendered (and

not validly withdrawn) and accepted for purchase by the

Company.

(2) Includes the Early Tender Premium (as defined herein) for

Notes validly tendered prior to the Early Tender Time (and not

validly withdrawn) and accepted for purchase by the Company.

(3) Interest rates included herein represent the respective

initial interest rate of each series of Notes subject to the Tender

Offers. Due to the occurrence of certain triggering events since

they were originally issued, the 3.375% Notes, 3.875% Notes and

4.700% Notes currently bear interest at a rate of 4.125% per annum,

4.625% per annum and 5.200% per annum, respectively.

In connection with the Tender Offer for the 3.375% Notes, the

Company has commenced a solicitation of consents (the “Consent

Solicitation”) from holders of the 3.375% Notes to amend certain

provisions (the “Proposed Amendments”) of the senior debt indenture

dated February 14, 2005, as thereafter supplemented and amended

(the “Base Indenture”), by and between the Company and Citibank,

N.A., as trustee, as supplemented by the first supplemental

indenture, dated as of October 23, 2007, by and among the Company,

The Bank of New York Mellon Trust Company, N.A. (formerly known as

The Bank of New York), as trustee (the “Trustee”), and Citibank,

N.A., as resigning trustee (the “First Supplemental Indenture”, and

together with the Base Indenture, the “Indenture”), and certain

provisions of that certain Officers’ Certificate of the Company,

dated as of September 22, 2016 (the “3.375% Notes Officers’

Certificate,” and together with the Indenture, the “Indenture

Documents”), pursuant to which 3.375% Notes were issued. The

Proposed Amendments would amend the Indenture Documents with

respect to the 3.375% Notes only, to, among other things, eliminate

substantially all of the restrictive covenants and certain events

of default under such Indenture and reduce the minimum notice

period required for redemptions of the 3.375% Notes from 30

calendar days as currently required by the Indenture to 3 business

days.

Each of the Tender Offers and the Consent Solicitation will

expire at 11:59 p.m., New York City time, on March 9, 2020, or any

other date and time to which the Company extends such Tender Offer

or the Consent Solicitation (such date and time with respect to a

Tender Offer or the Consent Solicitation, as it may be extended for

such Tender Offer or, with respect to the 3.375% Notes only, the

Consent Solicitation, the “Expiration Time”), unless earlier

terminated. No tenders of Notes or, with respect to the 3.375%

Notes only, deliveries of the consents pursuant to the Consent

Solicitation will be valid if submitted after the Expiration Time.

Tendered Notes may be validly withdrawn (and consents, with respect

to the 3.375% Notes only, may be validly revoked) from the 3.375%

Notes Tender Offer and the Consent Solicitation at or prior to, but

not after, 5:00 p.m., New York City time, on February 24, 2020

(such date and time with respect to a Tender Offer or the Consent

Solicitation, as it may be extended for such Tender Offer or the

Consent Solicitation, the “Withdrawal Deadline”). Holders of Notes

who tender their Notes (and, with respect to the 3.375% Notes only,

revoke their consents) after the Withdrawal Deadline, but prior to

the Expiration Time, may not withdraw their tendered Notes (or,

with respect to the 3.375% Notes only, revoke their consents),

except for certain limited circumstances where additional

withdrawal rights or revocation rights are required by law.

Upon the terms and subject to the conditions of the Tender

Offers and the Consent Solicitation, the consideration for each

$1,000 principal amount of Notes validly tendered (and, with

respect to the 3.375% Notes only, any consents that have been

validly delivered) and accepted for purchase pursuant to the Tender

Offers will be the tender offer consideration for the applicable

series of Notes set forth in the table above (with respect to each

series of Notes, the “Tender Offer Consideration”). Holders of

Notes that are validly tendered (and, with respect to the 3.375%

Notes only, any consents that have been validly delivered) at or

prior to 5:00 p.m., New York City time, on February 24, 2020 (such

date and time with respect to a Tender Offer or the Consent

Solicitation, as it may be extended for such Tender Offer or the

Consent Solicitation, the “Early Tender Time”) and accepted for

purchase pursuant to the Tender Offers will receive the applicable

Tender Offer Consideration plus the early tender premium for the

applicable series of Notes set forth in the table above (with

respect to each series of Notes, the “Early Tender Premium” and,

together with the applicable Tender Offer Consideration, the “Total

Consideration”). Holders of Notes validly tendered (and, with

respect to the 3.375% Notes only, any consents that have been

validly delivered) after the Early Tender Time, but before the

Expiration Time, and accepted for purchase pursuant to the Tender

Offers will receive the applicable Tender Offer Consideration, but

not the Early Tender Premium.

In addition to the Tender Offer Consideration or the Total

Consideration, as applicable, all holders of Notes accepted for

purchase pursuant to the Tender Offers will, on the Early

Settlement Date or the Final Settlement Date (each as defined

below), as applicable, also receive accrued and unpaid interest on

those Notes from the last interest payment date with respect to

those Notes to, but not including, the Early Settlement Date or the

Final Settlement Date, as applicable.

Subject to compliance with applicable law, the Company may (i)

extend or otherwise amend the Early Tender Time or the Expiration

Time with respect to any Tender Offer and, with respect to the

3.375% Notes only, the Consent Solicitation or (ii) increase or

decrease the Aggregate Maximum Principal Amount and/or any

Waterfall Series Tender Cap, or add a tender cap for the 3.375%

Notes, in each case without extending the Withdrawal Deadline for

such Tender Offer or the Consent Solicitation or otherwise

reinstating withdrawal or revocation rights of Holders for such

Tender Offer or the Consent Solicitation. In addition, the Early

Tender Time with respect to a Tender Offer and, with respect to the

3.375% Notes only, the Consent Solicitation can be extended

independently of the Early Tender Time or Withdrawal Deadline with

respect to any other Tender Offer (provided; however, that, with

respect to the 3.375% Notes only, any extension of the Early Tender

Time or the Withdrawal Deadline will result in a corresponding

extension for the Consent Solicitation). There can be no assurance

that the Company will change the Aggregate Maximum Principal

Amount, the Waterfall Series Tender Caps, or add a tender cap for

the 3.375% Notes. If the Company changes the Aggregate Maximum

Principal Amount, any Waterfall Series Tender Cap, or adds a tender

cap for the 3.375% Notes, it does not expect to extend the

Withdrawal Deadline, subject to applicable law.

The Company reserves the right, in its sole discretion, at any

point following the Early Tender Time and before the Expiration

Time, to accept for purchase any Notes validly tendered (and, with

respect to the 3.375% Notes only, any consents that have been

validly delivered) at or prior to the Early Tender Time (the date

of such acceptance and purchase, the “Early Settlement Date”),

subject to the Aggregate Maximum Principal Amount, the Acceptance

Priority Levels, the Waterfall Series Tender Caps (with respect to

the Waterfall Notes only), and proration as described herein. The

Early Settlement Date will be determined at the Company’s option

and is currently expected to occur on February 26, 2020, assuming

the conditions to the Tender Offers and, with respect to the 3.375%

Notes only, the Consent Solicitation have been either satisfied or

waived by the Company at or prior to the Early Settlement Date. The

Company has no obligation to elect to have an Early Settlement

Date. Irrespective of whether the Company chooses to exercise the

Company’s option to have an Early Settlement Date, it will purchase

any remaining Notes that have been validly tendered (and, with

respect to the 3.375% Notes only, consents that have been validly

delivered) at or prior to the Expiration Time and accepted for

purchase, subject to all conditions to the Tender Offers and, with

respect to the 3.375% Notes only, the Consent Solicitation having

been either satisfied or waived by the Company, promptly following

the Expiration Time (the date of such acceptance and purchase, the

“Final Settlement Date”; the Final Settlement Date and the Early

Settlement Date each being a “Settlement Date”), subject to the

Aggregate Maximum Principal Amount, the Acceptance Priority Levels,

the Waterfall Series Tender Caps (with respect to the Waterfall

Notes only), and proration as described herein. The Final

Settlement Date is expected to occur on the second business day

following the Expiration Time, assuming the conditions to the

Tender Offers and, with respect to the 3.375% Notes only, the

Consent Solicitation have been either satisfied or waived by the

Company at or prior to the Expiration Time and the Aggregate

Maximum Principal Amount is not purchased on the Early Settlement

Date.

Subject to the Aggregate Maximum Principal Amount, the Waterfall

Series Tender Caps (with respect to the Waterfall Notes only), and

proration as described herein, all Notes validly tendered at or

before the Early Tender Time having a higher Acceptance Priority

Level will be accepted before any Notes validly tendered at or

before the Early Tender Time having a lower Acceptance Priority

Level are accepted, and all Notes validly tendered after the Early

Tender Time having a higher Acceptance Priority Level will be

accepted before any Notes validly tendered after the Early Tender

Time having a lower Acceptance Priority Level are accepted in the

Tender Offers. Accordingly, subject to the Waterfall Series Tender

Caps (with respect to the Waterfall Notes only), all validly

tendered Notes with an Acceptance Priority Level 1 will be accepted

before any validly tendered Notes with an Acceptance Priority Level

2, and so on, until the Aggregate Maximum Principal Amount is

allocated. Once all Notes validly tendered in a certain Acceptance

Priority Level have been accepted, Notes from the next Acceptance

Priority Level may begin to be accepted. If the remaining portion

of the Aggregate Maximum Principal Amount and the Waterfall Series

Tender Caps (with respect to the Waterfall Notes only), as

applicable, is adequate to purchase some but not all of the

aggregate principal amount of Notes validly tendered within the

next Acceptance Priority Level, Notes validly tendered in that

Acceptance Priority Level will be accepted on a pro rata basis,

based on the aggregate principal amount of Notes validly tendered

with respect to that Acceptance Priority Level, and no Notes with a

lower Acceptance Priority Level will be accepted.

Notwithstanding the foregoing, even if the Tender Offers are not

fully subscribed as of the Early Tender Time, subject to the

Aggregate Maximum Principal Amount and the Waterfall Series Tender

Caps (with respect to the Waterfall Notes only), Notes validly

tendered at or before the Early Tender Time will be accepted for

purchase in priority to other Notes validly tendered after the

Early Tender Time, even if such Notes validly tendered after the

Early Tender Time have a higher Acceptance Priority Level than

Notes validly tendered prior to the Early Tender Time. In addition,

if the aggregate principal amount of Notes validly tendered at or

before the Early Tender Time exceeds the Aggregate Maximum

Principal Amount, the Company will not accept for purchase any

Notes tendered after the Early Tender Time. If the aggregate

principal amount of any series of Waterfall Notes validly tendered

at or before the Early Tender Time exceeds the applicable Waterfall

Series Tender Cap, the Company will not accept for purchase any

Notes of such series tendered after the Early Tender Time.

Any Holder who tenders 3.375% Notes pursuant to the 3.375% Notes

Tender Offer must also concurrently deliver a consent to the

Proposed Amendments pursuant to the Consent Solicitation. Holders

who validly tender their 3.375% Notes pursuant to the 3.375% Notes

Tender Offer with respect to the 3.375% Notes, will be deemed to

have delivered their consents for the 3.375% Notes pursuant to the

Consent Solicitation by virtue of such tender. Holders may not

deliver consents with respect to the 3.375% Notes without also

tendering their 3.375% Notes in the 3.375% Notes Tender Offer. A

Holder may not revoke a consent with respect to the 3.375% Notes

without withdrawing the previously tendered 3.375% Notes to which

such consent relates. A valid withdrawal of tendered Notes prior to

the Withdrawal Deadline will constitute the concurrent valid

revocation of such Holder’s related consent.

Acceptance for tenders of any series of Notes may be subject to

proration as to such series if the aggregate principal amount of

the Notes of such series would cause the Aggregate Maximum

Principal Amount to be exceeded. Acceptance for tenders of any

series of Waterfall Notes may also be subject to proration if the

aggregate principal amount of such series of Waterfall Notes

exceeds the applicable Waterfall Series Tender Cap. If the Tender

Offers are fully subscribed as of the Early Tender Time, Holders

who validly tender Notes after the Early Tender Time will not have

any of their Notes accepted for purchase.

The Tender Offers are not conditioned upon a minimum amount of

Notes of any series, or a minimum amount of Notes of all series,

being tendered, or upon obtaining the Requisite Consents (as

defined below). The adoption of the Proposed Amendments with

respect to the Indenture Documents and the 3.375% Notes is,

however, conditioned upon, among other things, obtaining consents

of Holders of a majority in aggregate principal amount of the

outstanding 3.375% Notes to the Proposed Amendments (the “Requisite

Consents”) with respect to the Indenture Documents and such Notes.

In the event of any proration of the 3.375% Notes, any delivered

Consents will be null and void and the Requisite Consents will be

deemed not to have been obtained with respect to such Notes.

MUFG Securities Americas Inc., Citigroup Global Markets Inc. and

J.P. Morgan Securities LLC are serving as the Lead Dealer Managers

in connection with the Tender Offers and the Lead Solicitation

Agents in connection with the Consent Solicitation and SunTrust

Robinson Humphrey, Inc., Goldman Sachs & Co. LLC, Citizens

Capital Markets, Inc., RBC Capital Markets, LLC and Siebert

Williams Shank & Co., LLC are serving as the Co-Dealer Managers

in the Tender Offers and Co-Solicitation Agents in the Consent

Solicitation. Global Bondholder Services Corporation has been

retained to serve as both the depositary and the information agent

for the Tender Offers and the Consent Solicitation. Persons with

questions regarding the Tender Offers or the Consent Solicitation

should contact MUFG Securities Americas Inc. at (877) 744-4532

(toll-free) or (212) 405-7481 (collect); Citigroup Global Markets

Inc. at (800) 558-3745 (toll-free) or (212) 723-6106 (collect); or

J.P. Morgan Securities LLC at (866) 834-4666 (toll-free) or (212)

834-8553 (collect). Requests for copies of the Offer to Purchase

and Consent Solicitation Statement and other related materials

should be directed to Global Bondholder Services Corporation by

calling (banks and brokers collect) (212) 430-3774 or (all others

toll-free) (866) 470-3700 or by email at contact@gbsc-usa.com.

None of the Company, its officers, the dealer managers, the

solicitation agents, the depositary, the information agent or the

trustees with respect to the Notes, or any of the Company’s or

their respective affiliates, makes any recommendation that holders

tender or refrain from tendering all or any portion of the

principal amount of their Notes, and no one has been authorized by

any of them to make such a recommendation. Holders must make their

own decision as to whether to tender their Notes, deliver their

consents and, if so, the principal amount of Notes to which action

is to be taken. The Tender Offers and the Consent Solicitation are

made only by the Offer to Purchase and Consent Solicitation

Statement. This press release is neither an offer to purchase nor a

solicitation of an offer to sell any notes in the Tender Offers.

The Tender Offers and the Consent Solicitation are not being made

to holders of Notes in any jurisdiction in which the making or

acceptance thereof would not be in compliance with the securities,

blue sky or other laws of such jurisdiction. In any jurisdiction in

which the Tender Offers or the Consent Solicitation are required to

be made by a licensed broker or dealer, the Tender Offers and the

Consent Solicitation will be deemed to be made on behalf of the

Company by the dealer managers, solicitation agents or one or more

registered brokers or dealers that are licensed under the laws of

such jurisdiction.

The Company and its affiliates may from time to time, after

completion of the Tender Offers and the Consent Solicitation,

purchase additional Notes or other debt securities in the open

market, in privately negotiated transactions, through tender

offers, exchange offers or otherwise, or the Company may redeem the

Notes or other debt securities pursuant to their terms. Any future

purchases, exchanges or redemptions may be on the same terms or on

terms that are more or less favorable to Holders of Notes than the

terms of the Tender Offers. Any future purchases, exchanges or

redemptions by the Company and its affiliates will depend on

various factors existing at that time. There can be no assurance as

to which, if any, of these alternatives (or combinations thereof)

the Company and its affiliates may choose to pursue in the

future.

This press release is for informational purposes only and is

neither an offer to purchase nor a solicitation of an offer to sell

the Notes. The Tender Offers are being made solely by means of the

Offer to Purchase and Consent Solicitation Statement. The Tender

Offers are void in all jurisdictions where they are prohibited. In

those jurisdictions where the securities, blue sky or other laws

require the Tender Offers to be made by a licensed broker or

dealer, the Tender Offers will be deemed to be made on behalf of

the Company by the dealer managers or one or more registered

brokers or dealers licensed under the laws of such

jurisdictions.

About Pitney Bowes

Pitney Bowes (NYSE:PBI) is a global technology company providing

commerce solutions that power billions of transactions. Clients

around the world, including 90 percent of the Fortune 500, rely on

the accuracy and precision delivered by Pitney Bowes solutions,

analytics, and APIs in the areas of ecommerce fulfillment, shipping

and returns; cross-border ecommerce; office mailing and shipping;

presort services; and financing. For nearly 100 years Pitney Bowes

has been innovating and delivering technologies that remove the

complexity of getting commerce transactions precisely right. For

additional information visit Pitney Bowes, the Craftsmen of

Commerce, at www.pitneybowes.com.

Forward Looking Statements

This press release includes

“forward-looking statements” about the Company’s intention to

purchase the Notes and solicit consents in the Offer to Purchase

and Consent Solicitation Statement. Any forward-looking statements

contained in this press release may change based on various

factors. These forward-looking statements are based on current

expectations and assumptions that are subject to risks and

uncertainties and actual results could differ materially. Words

such as “estimate,” “target,” “project,” “plan,” “believe,”

“expect,” “anticipate,” “intend” and similar expressions may

identify such forward-looking statements.

Although the Company believes

that the expectations reflected in its forward-looking statements

are reasonable, actual results could differ materially from those

projected or assumed in any of its forward-looking statements. The

Company’s future financial condition and results of operations, as

well as any forward-looking statements, are subject to change and

to inherent risks and uncertainties, such as those disclosed or

incorporated by reference in the Company’s filings with the SEC.

Please see Item 1A. under the caption “Risk Factors” in the

Company’s 2018 Annual Report on Form 10-K, as updated from time to

time in subsequently filed Quarterly Reports on Form 10-Q, and

other public filings, as they may be amended from time to time. The

Company undertakes no obligation to publicly update or revise any

forward-looking statements in this press release, whether as a

result of new information, future events or otherwise, except as

required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200210005436/en/

Bill Hughes Chief Communications Officer Pitney Bowes

203-351-6785 William.hughes@pb.com Adam David Investor Relations

Pitney Bowes 203-351-7175 Adam.David@pb.com

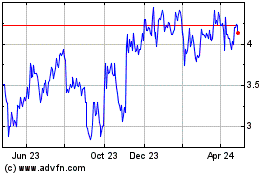

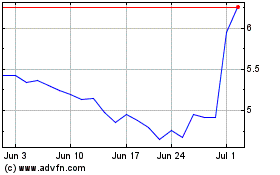

Pitney Bowes (NYSE:PBI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Pitney Bowes (NYSE:PBI)

Historical Stock Chart

From Apr 2023 to Apr 2024