EBay Profit Declines Amid Strategic Review -- 2nd Update

January 28 2020 - 7:22PM

Dow Jones News

By Kimberly Chin

EBay Inc. reported a decline in profit on weak sales in the

latest quarter, amid a strategic review that led the online

marketplace to shake up its leadership ranks and sell off part of

its business.

Net revenue for the e-commerce giant fell 2% from a year ago to

$2.82 billion, marking the first year-over-year quarterly decline

since eBay spun out payments company PayPal Holdings Inc. in 2015.

Still, revenue pulled slightly ahead of analysts' estimates of

$2.81 billion.

The company also gave a weaker first-quarter revenue outlook,

anticipating $2.55 billion to $2.60 billion, below analysts'

estimates of $2.64 billion. Per-share earnings are projected to be

around 50 cents to 53 cents, and 70 cents to 73 cents on an

adjusted basis.

EBay said active buyers grew by 2% to about 183 million in the

December quarter, the eighth straight quarter of gains, though

gross merchandise volume, or the amount of business transacted on

its platforms, fell 5.4% from the comparable period a year earlier

to $23.3 million.

Its shares, which closed Tuesday at $36.21, fell 5.3% in

after-hours trading.

EBay has spent much of 2019 in an operations review after a

clash with activist investors over the company's strategic

focus.

Late last year, eBay agreed to sell its ticketing business

StubHub to Geneva-based Viagogo Entertainment Inc. for $4.05

billion. EBay has owned StubHub since 2007, when it bought the

business from StubHub co-founders Eric Baker and Jeff Fluhr for

$310 million.

EBay decided to explore selling StubHub shortly after two

activist investors surfaced last year and urged it to exit from

businesses unrelated to its core marketplace. The company agreed to

sell StubHub as well as its internationally focused

classified-advertising business. It also added board members as

part of a settlement with the investors, Elliott Management Corp.

and Starboard Value LP.

As part of its deal with the investors, eBay agreed to return

more money to shareholders, beginning with its first-ever dividend

payment last year. On Tuesday, the company bumped up its quarterly

cash dividend to shareholders by 14% to 16 cents a share. Ebay also

increased its current buyback program by $5 billion, adding to the

$2.2 billion it had already authorized. The company said it

repurchased about $1 billion in shares in the fourth quarter.

Scott Schenkel, who was eBay's finance chief, assumed the reins

of the company in September after Devin Wenig resigned over

conflicts with a reshaped board of directors.

EBay was founded in 1995 -- the same year that Amazon.com

launched as an online bookstore -- and became a success story

during the dot-com heyday. However, it has struggled to match

Amazon in recent years.

Overall, the e-commerce giant's fourth-quarter profit fell 27%

from a year earlier to $556 million, or 69 cents a share. On an

adjusted basis, profit was 81 cents a share. Analysts were

expecting adjusted per-share earnings of 76 cents.

Write to Kimberly Chin at kimberly.chin@wsj.com

(END) Dow Jones Newswires

January 28, 2020 19:07 ET (00:07 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

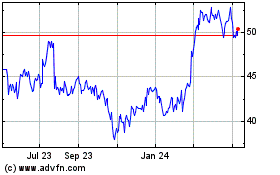

eBay (NASDAQ:EBAY)

Historical Stock Chart

From Mar 2024 to Apr 2024

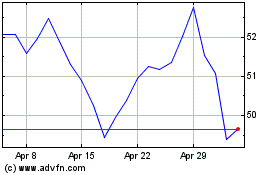

eBay (NASDAQ:EBAY)

Historical Stock Chart

From Apr 2023 to Apr 2024