By Jared S. Hopkins and Dave Sebastian

New drugs powered Pfizer Inc.'s fourth-quarter sales, a sign the

drugmaker's effort to remake itself as a smaller company relying on

its own laboratories for growth is starting to emerge.

Sales of the New York-based company's patent-protected medicines

rose 7% to $10.5 billion. Among the products notching big gains

were blood-thinner Eliquis, which posted a 21% increase in

quarterly sales to $1.1 billion, and breast-cancer therapy Ibrance,

whose sales increased 13% to $1.3 billion. Newly approved

rare-disease drug Vyndaqel topped analyst expectations with $213

million in sales.

The company recorded a net loss of $337 million, or 6 cents a

share, compared with a loss of $394 million, or 7 cents a share, a

year earlier. Excluding one-time items, the company reported

earnings of 55 cents a share, missing the 58 cents a share analysts

were expecting.

Shares in Pfizer were down 5.2% on Tuesday afternoon. Analysts

attributed the stock's decline to the earnings miss and a sales

forecast that investors hoped would be higher.

Pfizer, one of the world's biggest drugmakers by sales, is

trying to turn into a smaller but faster-growing drugmaker focused

more on novel, patent-protected medicines for diseases such as

cancer with bigger sales-growth upside.

To further the overhaul, Pfizer agreed last July to combine its

Upjohn off-patent drugs business with Mylan NV. The deal, which

would create a company called Viatris, is expected to close in the

middle of this year.

If its strategy pays off, Pfizer could see sales rise faster

than they have in years. Yet the plan is risky, especially without

the safety net that the steady cash flow from off-patent drugs

provided.

Many experimental therapies don't make it to market, and their

development requires heavy investment. Pfizer spent $2.8 billion on

research and development in the fourth quarter, up 15% from the

same period a year earlier.

"I'm very, very pleased with the way things are evolving," Chief

Executive Albert Bourla said in an interview. "We have taken steps

-- very deliberate steps -- to transform Pfizer."

For 2020, Pfizer targets adjusted earnings of $2.82 to $2.92 a

share on revenue of $48.5 billion to $50.5 billion. Reflecting

Upjohn's coming combination with Mylan, Pfizer forecasts adjusted

earnings of $2.25 a share to $2.35 a share on revenue of $40.7

billion to $42.3 billion. Pfizer said it doesn't plan to make any

share repurchases this year.

Overall, the drugmaker on Tuesday posted $12.7 billion in

fourth-quarter sales, off 9.3% from $14 billion a year earlier.

The drop occurred in part because of the absence of revenue from

the consumer health-care business, which was combined with

GlaxoSmithKline PLC's in a joint venture last August.

It was also tied to a sales decline of nearly one-third in

Pfizer's Upjohn segment. Pain pill Lyrica began to face generic

competition last year, and sales fell 67% to $433 million for the

quarter.

Chief Financial Officer Frank D'Amelio said during a conference

call Pfizer is negotiating with Mylan for it to also take on two

additional Pfizer subsidiaries when the merger closes: one that

manufactures auto-injector products such as EpiPen, and a

partnership with Mylan that makes generic drugs for the Japanese

market.

The segments posted combined sales of nearly $600 million last

year.

After the deal closes, Pfizer will be more dependent on its

pipeline of experimental therapies. This year, the company expects

to announce results from as many as five late-stage studies and to

begin as many as 10 late-stage studies.

Pfizer has targeted 2022 for U.S. approval of 15 new drugs or

indications that have the potential to generate $1 billion in

annual sales.

The company said Tuesday that this year it hopes to start

late-stage studies testing its gene therapies for blood disease

hemophilia, and Duchenne muscular dystrophy, a disease that weakens

muscles and organ function.

Mr. Bourla identified gene therapies as a Pfizer priority. "They

are very, very crucial for us," he said. "We believe they are the

future of science right now."

He added that the company continues to look for small and

midsize deals for drugs in mid-to-late-stage development to

complement its laboratory deals, but anything larger could be

destructive to its strategy.

Pfizer executives said they also expect growth from biosimilars,

lower-price copies of branded biologic drugs. Sales of Pfizer's

biosimilars totaled $911 million last year, up 19%. Pfizer in

recent weeks brought to market two cancer biosimilars, with plans

to launch another next month.

Write to Jared S. Hopkins at jared.hopkins@wsj.com and Dave

Sebastian at dave.sebastian@wsj.com

(END) Dow Jones Newswires

January 28, 2020 15:20 ET (20:20 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

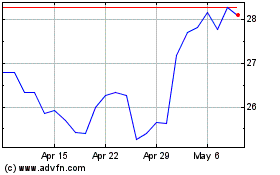

Pfizer (NYSE:PFE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Pfizer (NYSE:PFE)

Historical Stock Chart

From Apr 2023 to Apr 2024