California Regulators a Potential Obstacle to T-Mobile, Sprint Merger

January 26 2020 - 2:09PM

Dow Jones News

By Sarah Krouse

T-Mobile US Inc. and Sprint Corp. are waiting for a federal

judge to rule on whether they can merge, but the companies face

another hurdle even if they overcome that legal challenge: the

California Public Utilities Commission.

The state utilities overseer is the only such body that hasn't

yet blessed the $26 billion deal, and its continuing review

threatens to further delay -- or even derail -- a merger that has

dragged on for nearly two years. The state body has until July to

vote but might extend that timeline further.

Just how much power the California Public Utilities Commission

and other state bodies like it wield is unclear. Neither company is

based in California but, as nationwide wireless providers, they

have millions of customers in the state, and Sprint has a small

wireline business there. Most other state utility commissions have

approved the deal.

A spokesman for the commission said the review was continuing.

Representatives for Sprint and T-Mobile declined to comment.

Disapproval by a state public-utility commission could be enough

to stop a communications merger, consultants at NERA Economic

Consulting wrote in a 2017 paper that analyzed state reviews of 40

such transactions. The paper found that California, New York and

West Virginia historically have the most active utilities

commissions when it comes to reviewing communications mergers.

Other legal experts said that while the California commission

could demand further concessions from the carriers and delay the

deal's close, it was unlikely to scuttle the transaction. It was

more common for utilities commissions to block energy deals

involving local businesses than to block telecommunications

transactions, they said, because the latter involve wireless

service sold nationally.

"It has some leverage, but it's not endless," Samuel Weinstein,

an assistant law professor at the Cardozo School of Law at Yeshiva

University, said of the utilities commission. "What tends to come

out of these proceedings is some concessions by the merging

parties."

States typically seek remedies such as pricing guarantees or

infrastructure investments, the NERA authors found. When Frontier

Communications Corp. bought some Verizon Communications Inc.

wireline assets in 2015, for example, the California commission's

demands included requiring the company to make some price-control

commitments, invest in bringing broadband to rural areas and fund

the purchase of Wi-Fi-capable tablets.

State utilities commissions generally review communications

mergers to see if they are in the public interest and consider

factors such as what impact the deal will have on competition,

service quality and company employees.

California's public-utilities code states that no companies can

merge or acquire any public utility doing business in the state

without the commission's approval, whether or not that firm is

organized there. "Any merger, acquisition, or control without that

prior authorization shall be void and of no effect," it says.

State reviews often "impose significant and unnecessary costs in

the form of procedural burdens and delays," the NERA authors said.

One of the authors submitted an expert opinion on behalf of

T-Mobile when it sought Federal Communications Commission

approval.

The California commission, whose members are appointed by the

governor and approved by the state senate, has come under pressure

for its oversight of utility PG&E Corp., whose equipment

sparked several deadly wildfires.

The commissioner overseeing the review of the T-Mobile-Sprint

merger, Clifford Rechtschaffen, worked previously as a senior

adviser to former Gov. Jerry Brown and as special assistant

attorney general.

The public advocate's office within the Public Utilities

Commission said in a December brief that the deal in its current

form wasn't in the public interest. An administrative-law judge or

Mr. Rechtschaffen will now propose a decision that parties will

have 30 days to comment on before the commission votes on the

matter.

No date has been set for the vote, a commission spokesman

said.

State challenges have proved time-consuming for Sprint and

T-Mobile since the merger was announced in April 2018. A coalition

of state attorneys general sued to block the deal after FCC

Chairman Ajit Pai said he would support the transaction. The FCC

and the Justice Department later approved the merger after the

companies agreed to certain concessions, but most of the states

went ahead with their legal challenge.

If the companies prevail in the antitrust lawsuit and the deal

isn't approved in California, Sprint and T-Mobile could challenge

California's decision in court, which could test the power of

public-utilities commissions, legal experts said.

Write to Sarah Krouse at sarah.krouse@wsj.com

(END) Dow Jones Newswires

January 26, 2020 13:54 ET (18:54 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

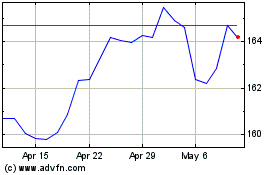

T Mobile US (NASDAQ:TMUS)

Historical Stock Chart

From Mar 2024 to Apr 2024

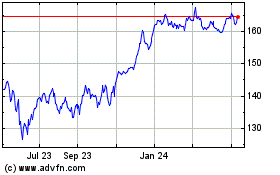

T Mobile US (NASDAQ:TMUS)

Historical Stock Chart

From Apr 2023 to Apr 2024