Prologis Core Funds From Operations In Line With Expectations

January 22 2020 - 8:49AM

Dow Jones News

By Micah Maidenberg

Prologis Inc.'s (PLD) core funds from operations for the fourth

quarter were in line with Wall Street analysts' expectations, as

the logistics-property company said it tried to focus on boosting

lease rates within its real-estate portfolio.

The company said Wednesday its quarterly net income for common

stockholders fell to $385.5 million, or 61 cents a share, from

$596.6 million, or 94 cents a share, a year earlier.

Prologis also reported so-called core funds from operations of

84 cents a share, in line with the consensus estimate compiled by

FactSet. Core FFO, a profit metric, excludes certain items such as

gains or losses from land sales and costs related to natural

disasters.

The San Francisco-based company has exposure to a wide range of

industries via a portfolio of owned and managed properties that

stood at 797 million square feet as of last September. Big

customers that rent space from it include Amazon.com Inc. (AMZN),

FedEx Corp. (FDX) and Home Depot Inc. (HD).

The company reported its portfolio was 96.5% occupied as of the

end of the fourth quarter, one percentage point lower compared with

the same time a year ago.

Prologis said it was prioritizing rent growth over occupancy

within its buildings. Its share of net-effective rent growth was

29.5% in the quarter, compared with a 25.6% increased a year

earlier.

Total revenue for the fourth quarter increased 2.4% from the

year earlier to $826 million.

Write to Micah Maidenberg at micah.maidenberg@wsj.com

(END) Dow Jones Newswires

January 22, 2020 08:34 ET (13:34 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

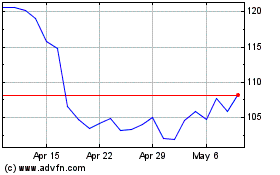

Prologis (NYSE:PLD)

Historical Stock Chart

From Mar 2024 to Apr 2024

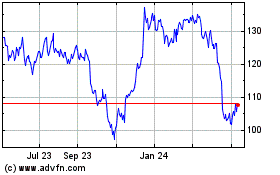

Prologis (NYSE:PLD)

Historical Stock Chart

From Apr 2023 to Apr 2024