Altria Deal for Stake In Juul Is Stuck In Antitrust Review -- WSJ

January 18 2020 - 3:02AM

Dow Jones News

By Jennifer Maloney and John D. McKinnon

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (January 18, 2020).

Altria Inc.'s investment in e-cigarette startup Juul Labs Inc.

remains in limbo more than a year after the deal was made, as

federal antitrust officials continue to probe the Marlboro maker's

control of shelf space in stores, according to people familiar with

the matter.

Altria, the largest U.S. tobacco company, paid $12.8 billion for

a 35% stake in the e-cigarette market leader in December 2018. Two

weeks before announcing the deal, Altria closed its e-cigarette

business. As part of the tie-up, Altria agreed to put Juul coupons

on cigarette packs, send Juul promotions to its mailing list of

cigarette smokers and give Juul the shelf space that Altria's

MarkTen e-cigarettes had occupied. Juul has since taken some of

that shelf space.

Juul has come under increasing regulatory and financial pressure

since the investment as it has been blamed for a surge in underage

vaping in the U.S. Juul voluntarily halted sales of its sweet and

fruity-flavored refill pods, which are popular among teenagers, and

has said it is working to repair its damaged relationship with

regulators.

As part of the Federal Trade Commission review, Altria and Juul

in October agreed not to complete some aspects of the deal until at

least early January, pending signoff from the agency, but that date

passed last week without an approval. The agency is still

conducting depositions, some of the people familiar with the matter

said.

Until the review is complete, Altria can't convert its nonvoting

shares to voting shares, appoint representatives to Juul's board or

count Juul's earnings toward its own earnings.

FTC staffers are looking at Altria's acquisition of additional

retail shelf space in convenience stores and other outlets for its

e-cigarette products even as it planned to wind down that business

and take a stake in Juul, according to one of the people familiar

with the matter.

Big tobacco companies traditionally haven't paid retailers for

shelf space for their cigarettes. But Reynolds American Inc., the

second-largest U.S. tobacco company, began paying retailers in 2013

to secure shelf space for its Vuse e-cigarettes. As the e-cigarette

market boomed with competitors vying for space, Altria followed,

spending about $100 million on the effort in 2018, people familiar

with the matter said. Altria offered retailers cash and display

fixtures in exchange for a commitment that its e-cigarettes would

occupy prime shelf space for at least two years.

In the antitrust review, the FTC also has sought information

from Altria on its role in the September resignation of Juul Chief

Executive Kevin Burns and the appointment of his successor, Altria

executive K.C. Crosthwaite, according to Altria.

The Juul investment has been problematic for the tobacco

company. In October, Altria took a $4.5 billion write-down on the

company and now holds its stake at a price that values the startup

at roughly $24 billion, down from its $38 billion valuation when

Altria made its investment in 2018.

The FTC could seek to force changes to the deal to resolve any

antitrust concerns, or it could try to block the transaction

outright. Most antitrust concerns are resolved through settlements

instead of litigation.

The FTC is conducting a separate investigation into whether Juul

used influencers and other marketing to appeal to minors. That

probe predates the antitrust review. Several attorneys general are

investigating Juul, and the e-cigarette maker is the subject of a

criminal probe being conducted jointly by federal prosecutors in

California and the Food and Drug Administration, according to

people familiar with the matter.

Write to Jennifer Maloney at jennifer.maloney@wsj.com and John

D. McKinnon at john.mckinnon@wsj.com

(END) Dow Jones Newswires

January 18, 2020 02:47 ET (07:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

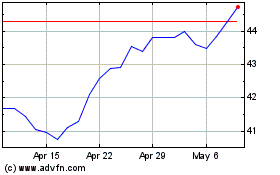

Altria (NYSE:MO)

Historical Stock Chart

From Mar 2024 to Apr 2024

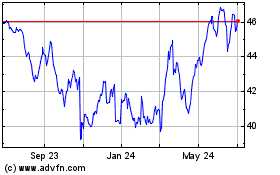

Altria (NYSE:MO)

Historical Stock Chart

From Apr 2023 to Apr 2024