By Anna Isaac and Caitlin Ostroff

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (January 10, 2020).

A New Year's Eve ransomware attack on foreign-currency exchange

company Travelex has disrupted cash deliveries from its global

network of vaults to major international banks.

Banks in the U.K., including units owned by Barclays PLC, Lloyds

Banking Group PLC, as well as Westpac Banking Corp. in Australia

said Thursday they were unable to take orders from customers in

branches that rely on Travelex to supply cash in foreign

currencies. The banks' online retail foreign-currency exchange

services, which are outsourced to Travelex, were also shut off.

Travelex's internal networks and consumer-facing websites and ap

p have been offline since the attack, after the company shut down

its computer systems to stop a ransomware virus that infiltrated

its networks.

A Travelex spokeswoman confirmed that the outage has limited the

service its wholesale operations provided to other

institutions.

Representatives for Barclays, Lloyds and Westpac all confirmed

the disruptions were because of the Travelex outage.

Travelex, a unit of U.K.-listed payments conglomerate Finablr

PLC, is best known for its global network of retail

foreign-exchange kiosks that target customers passing through

international airports. Those operations have been hobbled by the

attacks, with agents resorting to manual operations, writing

handwritten receipts. Travelex has told customers of its prepaid

currency debit cards, popular with overseas travelers, to access

account information by phone or through alternate websites.

A lesser known, but important, part of Travelex's operations is

its business helping other financial institutions manage their

supply of foreign bank notes.

Underpinning this business is a network of high-security vaults

in 14 countries including the U.S., with a vault in Louisville,

Ky., the U.K., Australia, Japan and China. It uses these vaults to

supply cash notes to wholesale clients including banks, central

banks, travel agencies, hotels and casinos, according to a company

bond prospectus from 2017 and a separate business brochure that

appeared to be posted on a company website in September 2019.

Travelex's central-bank clients have included the Central Bank

of Nigeria, where it was responsible for the distribution of U.S.

dollars in Lagos, according to the bond prospectus. A spokesman for

the Central Bank of Nigeria declined to comment.

The business brochure describes Travelex's work with Malaysia's

central bank, where it has provided foreign currencies and

consulted with it to stop traffickers illegally transporting bank

notes into the country. Bank Negara Malaysia representatives didn't

immediately respond to requests to comment.

In a statement this week, Travelex said that the software virus

is a ransomware known as Sodinokibi, also commonly referred to as

REvil. It said the attack froze access to its data by locking it up

in encrypted form.

Ransomware is a technique used to extort money by infecting

systems and then shutting off access to data and processing

capabilities. Money is demanded by the attackers in exchange for

regaining access or to prevent data breaches. A string of such

attacks have hampered operations at companies and governments in

the past year.

Successful ransomware attacks, in which victims pay money to

release their data, appears to have encouraged more attacks and

demands for bigger ransoms. In June 2019, the city of Riviera Beach

in South Florida paid nearly $600,000 to hackers who paralyzed the

city's computer systems.

Lawrence Abrams, a New York-based security researcher, said he

had contact with the group behind Sodinokibi on Tuesday, which

claims to have hacked Travelex.

Mr. Abrams said the group implied to him that it is in

negotiations with Travelex for it to pay a $3 million ransom and

that the company had until early next week before they released the

data publicly. He said the group told him they have stolen 5

gigabytes of data, including dates of birth, social security

numbers and credit-card numbers, and that it deleted all data

backup.

A Travelex statement issued Tuesday said that there was "no

evidence to date that any data has been exfiltrated" or taken off

the network. "There is no evidence that structured personal

customer data has been encrypted," the company said. Structured

data usually refers to information that can be easily analyzed,

such as data in a spreadsheet or database.

Mr. Abrams said the hacking group might be bluffing to pressure

the company into paying the ransom.

"Ransomware is very public. They want to leverage this fear

factor," he said. He said that the group he communicated with also

declined to provide Mr. Abrams with a screenshot proving their

possession of customer data.

The Travelex spokeswoman declined to comment about whether it is

interacting with the attackers or what ransom demand has been

made.

"There is an ongoing investigation. We have taken advice from a

number of experts," she said. London's Metropolitan Police are

spearheading a criminal investigation. The company has also hired

cybersecurity experts to conduct forensic analysis of the

attack.

Write to Anna Isaac at anna.isaac@wsj.com and Caitlin Ostroff at

caitlin.ostroff@wsj.com

(END) Dow Jones Newswires

January 10, 2020 02:47 ET (07:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

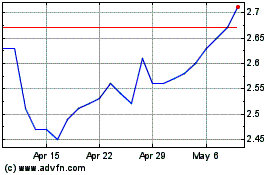

Lloyds Banking (NYSE:LYG)

Historical Stock Chart

From Mar 2024 to Apr 2024

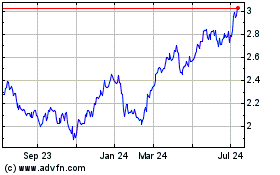

Lloyds Banking (NYSE:LYG)

Historical Stock Chart

From Apr 2023 to Apr 2024