ADT Inc. (NYSE: ADT), a leading provider of security, automation,

and smart home solutions serving consumer and business customers in

the United States, announced today it has acquired Defenders, its

largest independent dealer and only Authorized Premier Provider,

for a purchase price of approximately $381 million1. As part of the

transaction, Defenders founder David P. Lindsey and Jessica A.

Lindsey received approximately 16.3 million shares of ADT common

stock for 100% of their ownership in Defenders, while the remaining

$260 million of consideration was paid in cash to retire existing

Defenders debt, fund other liabilities, and pay transaction

expenses. The cash consideration was partially funded from existing

revolving credit facilities.

“We’re excited to officially join forces with the impressive

Defenders team after successfully partnering with them for nearly

22 years so that, as one company, we can create a unique and

simplified platform,” said Jim DeVries, ADT’s President and Chief

Executive Officer. “This opportunistic acquisition creates numerous

strategic, financial and operational advantages for ADT, and is

consistent with our stated goal of driving down the capital

intensity of the business as we seek to drive long-term, profitable

growth.”

Mr. DeVries continued, “Together, we will have greater marketing

efficiency through unified brand messaging, enhanced control of the

customer experience, and the ability to provide a full suite of

innovative security and home automation products, including

consumer financing, to a complementary geographic footprint. Over

time, we also expect lower subscriber acquisition costs, an

improved revenue payback period, and new account gains from the

optimization of our combined ecosystem.”

“We have built our business by partnering with ADT to sell and

install state-of-the-art security systems, helping to protect more

than 2.2 million families through our best-in-class marketing team

and expert knowledge of the industry,” said David Lindsey, Chairman

and Founder, Defenders. “Given this longstanding and productive

relationship, we are proud that this transaction will integrate us

even closer into the ADT team, and I am excited to be a significant

shareholder and see the benefits we are able to deliver to

customers as a combined company.”

“We are thrilled to join the ADT team,” said Jim Boyce,

President & CEO, Defenders. “This acquisition brings our direct

response marketing capabilities, best in class sales

expertise, and national reach to a leading provider of security,

automation, and smart home solutions. Together, we will be better

positioned to leverage the trusted ADT brand, improve the combined

company’s go-to-market operations and deliver an enhanced customer

experience.”

Strategic and Financial Benefits of

Transaction

- Enhances Customer Experience: Provides ability

to drive a unified brand message and premium customer experience to

the majority of ADT’s residential customers.

- Simplifies Operating Ecosystem: Establishes a

single party focused on the customer experience and lifetime value,

and reduces channel conflict and potential for customer

confusion.

- Improves Marketing Prowess: Leverages

Defenders’ strengths in customer acquisition to drive optimized

spend across channels and enable more effective marketing messaging

and customer segmentation.

- Increases Go to Market Efficiency:

Significantly enhances ability to bring new initiatives to a

broader customer base more quickly, including consumer financing,

DIY, and innovative equipment and service offerings.

- Drives Capital Efficiency: Results in a more

capital efficient ADT through the elimination of dealer “margin.”

Expected to be modestly beneficial to 2020 net cash provided by

operating activities and free cash flow before special items and to

create synergies to further drive net cash provided by operating

activities and free cash flow before special items in subsequent

years.

Founded in 1998 and headquartered in Indianapolis, Defenders has

approximately 2,900 team members across more than 130 field branch

locations, and has developed a best-in-class direct marketing

skillset, currently generating more than 6 billion ADT advertising

impressions annually. Through its rigorously trained and certified

technicians and its full suite of home security and automation

products, including an 85 percent interactive take rate, Defenders

currently helps more than 2.2 million families improve their lives

and safety.

Financial Advisor Citi served as the

financial advisor to Defenders.

About ADT Inc.ADT is a leading provider of

security, automation, and smart home solutions serving consumer and

business customers through more than 200 locations, 9 monitoring

centers, and the largest network of security professionals in the

United States. The Company offers many ways to help protect

customers by delivering lifestyle-driven solutions via

professionally installed, do-it-yourself, mobile, and digital-based

offerings for residential, small business, and larger commercial

customers. For more information, please visit www.adt.com or follow

on Twitter, LinkedIn, Facebook, and Instagram.

Investor Relations:Jason Smith

- ADTinvestorrelations@adt.comTel: 888-238-8525

Media Inquiries:Paul Wiseman –

ADTpaulwiseman@adt.comTel: 561-356-6388

NON-GAAP MEASURESTo provide

investors with additional information in connection with our

results as determined in accordance with generally accepted

accounting principles in the United States (“GAAP”), we disclose

Free Cash Flow and Free Cash Flow before special items as non-GAAP

measures. These measures are not financial measures calculated in

accordance with GAAP and should not be considered as a substitute

for net income, operating income, cash flows, or any other measure

calculated in accordance with GAAP, and may not be comparable to

similarly titled measures reported by other companies.

Free Cash FlowWe believe that

the presentation of Free Cash Flow is appropriate to provide

additional information to investors about our ability to repay

debt, make other investments, and pay dividends.

We define Free Cash Flow as cash flows from

operating activities less cash outlays related to capital

expenditures. We define capital expenditures to include purchases

of property, plant, and equipment; subscriber system asset

additions; and accounts purchased through our network of authorized

dealers or third parties outside of our authorized dealer network.

These items are subtracted from cash flows from operating

activities because they represent long-term investments that are

required for normal business activities.

Free Cash Flow adjusts for cash items that are

ultimately within management’s discretion to direct, and therefore,

may imply that there is less or more cash that is available than

the most comparable GAAP measure. Free Cash Flow is not intended to

represent residual cash flow for discretionary expenditures since

debt repayment requirements and other non-discretionary

expenditures are not deducted. These limitations are best addressed

by using Free Cash Flow in combination with the cash flows as

calculated in accordance with GAAP.

Free Cash Flow before special

itemsWe define Free Cash Flow before special items as Free

Cash Flow adjusted for payments related to (i) financing and

consent fees, (ii) restructuring and integration, (iii) integration

related capital expenditures, (iv) radio conversion costs, and (v)

other payments or receipts that may mask the operating results or

business trends of the Company. As a result, subject to the

limitations described below, Free Cash Flow before special items is

a useful measure of our cash available to repay debt, make other

investments, and pay dividends.

Free Cash Flow before special items adjusts for

cash items that are ultimately within management’s discretion to

direct, and therefore, may imply that there is less or more cash

that is available than the most comparable GAAP measure. Free Cash

Flow before special items is not intended to represent residual

cash flow for discretionary expenditures since debt repayment

requirements and other non-discretionary expenditures are not

deducted. These limitations are best addressed by using Free Cash

Flow before special items in combination with the GAAP cash flow

numbers.

FORWARD-LOOKING STATEMENTSADT

has made statements in this press release and other reports,

filings, and other public written and verbal announcements that are

forward-looking and therefore subject to risks and uncertainties.

All statements, other than statements of historical fact, included

in this document are, or could be, “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act

of 1995 and are made in reliance on the safe harbor protections

provided thereunder. These forward-looking statements relate

to anticipated financial performance, management’s plans and

objectives for future operations, business prospects, outcome of

regulatory proceedings, market conditions and other matters. Any

forward-looking statement made in this press release speaks only as

of the date on which it is made. ADT undertakes no obligation to

publicly update or revise any forward-looking statement, whether as

a result of new information, future developments or otherwise.

Forward-looking statements can be identified by various words such

as “expects,” “intends,” “will,” “anticipates,” “believes,”

“confident,” “continue,” “propose,” “seeks,” “could,” “may,”

“should,” “estimates,” “forecasts,” “might,” “goals,” “objectives,”

“targets,” “planned,” “projects,” and similar expressions. These

forward-looking statements are based on management’s current

beliefs and assumptions and on information currently available to

management. ADT cautions that these statements are subject to risks

and uncertainties, many of which are outside of ADT’s control, and

could cause future events or results to be materially different

from those stated or implied in this document, including among

others, risk factors that are described in the Company’s Annual

Report on Form 10-K and other filings with the Securities and

Exchange Commission, including the sections entitled “Risk Factors”

and “Management’s Discussion and Analysis of Financial Condition

and Results of Operations” contained therein.

___________________________

1 Based on ADT’s closing stock price of $7.45 on January 3,

2020.

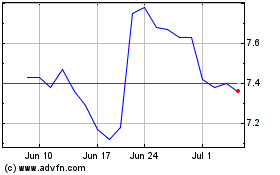

ADT (NYSE:ADT)

Historical Stock Chart

From Mar 2024 to Apr 2024

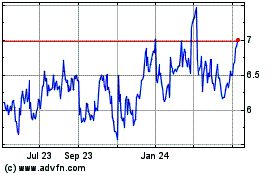

ADT (NYSE:ADT)

Historical Stock Chart

From Apr 2023 to Apr 2024