Current Report Filing (8-k)

January 06 2020 - 6:55AM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): January 3, 2020

TIPTREE INC.

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

|

|

|

|

Maryland

|

|

001-33549

|

|

38-3754322

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

|

|

299 Park Avenue, 13th Floor

New York, New York

|

|

10171

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.001 per share

|

TIPT

|

Nasdaq Capital Market

|

Registrant’s telephone number, including area code: (212) 446-1400

Former Address: 780 Third Avenue, 21st Floor, New York, New York, 10017

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

|

|

|

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

|

|

|

|

|

|

|

|

Item 2.01

|

Completion of Acquisition or Disposition of Assets.

|

On January 3, 2020, Tiptree Warranty Holdings, LLC. (“Buyer”), a subsidiary of Tiptree Inc. (“Tiptree”) completed the acquisition (the “Acquisition”) of all of the outstanding equity interests of Accelerated Service Enterprise LLC, SAC Holdings Inc., Dealer Motor Services, Inc., Independent Dealer Group, Inc., Ownershield, Inc., Freedom Insurance Company, Ltd. (“Freedom”), SAC Admin, Inc., SAC Insurance Company, Inc., Smart AutoCare, Inc. and Smart AutoCare Administration Solutions, Inc. (together the “Target Entities”) pursuant to the Equity Interest Purchase Agreement, dated as of December 16, 2019 (the “Purchase Agreement”) between Buyer and Peter Masi (“Masi”). After closing, Masi will remain the Chief Executive Officer of the Target Entities.

At the closing of the Acquisition, pursuant to the Purchase Agreement, Buyer paid Masi $110.7 million in cash, $8.25 million of which was deposited into an escrow account for 18 months to satisfy indemnity claims, if any. Simultaneously, pursuant to the Purchase Agreement, Freedom terminated reinsurance agreements with affiliates of Masi and caused such affiliates to pay $102.2 million in cash to Freedom. The Purchase Agreement also provides for an earn-out of up to $50 million in cash based on the Target Entities achieving certain specified performance metrics measured on the third and fifth anniversary of closing and an additional earn-out of up to $30 million payable in cash or Tiptree common stock based on the Target Entities achieving other specified performance metrics measured on the fourth and fifth anniversary of closing. In addition, the purchase price will be subject to a true up following the fifth anniversary of the closing based on the adequacy of certain reserves for contracts written by the Target Entities prior to closing, offset by certain earnings from business written after the closing.

The foregoing description of the Purchase Agreement does not purport to be complete and is qualified in its entirety by reference to the Purchase Agreement, which was filed as Exhibit 10.1 to the Current Report on Form 8-K filed by Tiptree with the U.S. Securities and Exchange Commission on December 17, 2019, and is incorporated into this Current Report by reference.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TIPTREE INC.

|

|

|

|

|

|

|

Date:

|

January 6, 2020

|

By:

|

/s/ Jonathan Ilany

|

|

|

|

|

Name: Jonathan Ilany

|

|

|

|

|

Title: Chief Executive Officer

|

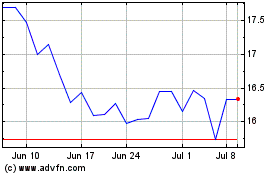

Tiptree (NASDAQ:TIPT)

Historical Stock Chart

From Mar 2024 to Apr 2024

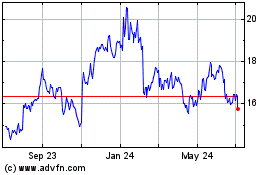

Tiptree (NASDAQ:TIPT)

Historical Stock Chart

From Apr 2023 to Apr 2024