Newmont (NYSE: NEM, TSX: NGT) (Newmont or the Company) today

announced it successfully completed the sale of its 50 percent

stake in Kalgoorlie Consolidated Gold Mines (KCGM) to Northern Star

Resources Limited (ASX: NST) (Northern Star) receiving cash

proceeds of $800 million.

“Newmont is pleased to complete the sale of KCGM to Northern

Star and hand over the asset in good order to a well-established

gold producer with a commitment to safety, community development

and responsible environmental practices,” said Tom Palmer,

President and Chief Executive Officer. “Proceeds from the

transaction will support Newmont’s disciplined approach to capital

allocation, which includes strategically reinvesting in the

business, strengthening the Company’s investment-grade balance

sheet and returning cash to shareholders,” Palmer added.

Total proceeds from the transaction include a $25 million

payment that gives Northern Star specified exploration tenements,

transitional services support and an option to exclusively

negotiate for the purchase of Newmont’s Kalgoorlie power business

for a 120 day period. The $25 million payment will be credited

against the purchase price for the power business or $22.5 million

would be returned to Northern Star if the power business is sold to

a third party.

Combined with the previously announced agreements to sell Red

Lake in Canada for $375 million and the Company’s stake in

Continental Gold for $260 million, Newmont has met its divestiture

target of $1.0 to $1.5 billion, with more than $1.4 billion in cash

proceeds expected to be received in the first quarter of 2020. The

sale of KCGM further streamlines Newmont’s portfolio, with 12

top-tier assets located on four continents in the world’s most

favorable gold mining jurisdictions.

Following the divestiture of KCGM, the Company is updating its

2020 guidance and long-term outlook1.

- Attributable gold production2: Production guidance is

expected to be 6.4 million ounces for 2020 and between 6.2 and 6.7

million ounces longer-term through 2024.

- Gold costs applicable to sales (CAS):CAS guidance is

unchanged at $750 per ounce for 2020 and between $650 and $750 per

ounce for 2021 and 2022; CAS is expected to be between $600 and

$700 per ounce for 2023 and 2024.

- Gold all-in sustaining costs3(AISC): AISC

guidance is unchanged at $975 per ounce for 2020 and between $850

and $950 per ounce for 2021 and 2022; AISC is expected to be

between $800 and $900 per ounce for 2023 and 2024.

- Capital: Attributable sustaining capital guidance has

been lowered to $950 million for 2020 and between $0.9 to $1.1

billion longer-term through 2024.

- Consolidated expense outlook: The 2020 outlook for

general & administrative costs is unchanged at $265 million,

depreciation and amortization has been lowered to $2,125 million,

and investment in exploration and advanced projects has decreased

to $450 million. Outlook for interest expense and adjusted tax rate

remains unchanged.

_______________________________

1 Outlook guidance used in this release are considered

“forward-looking statements” and users are cautioned that actual

results may vary; refer to the cautionary statement at the end of

this release. 2 Attributable gold production outlook includes the

Company’s equity investment (40%) in Pueblo Viejo but does not

include other equity investments. 3 AISC as used in the Company’s

outlook is a non-GAAP metric – see end of this release for

information and reconciliation to CAS outlook.

Australia region:

- Australia remains a core operating region for Newmont, and the

sale of KCGM allows the Company to focus on investing in profitable

growth and long-term value creation at our world class Tanami and

Boddington complexes, in addition to Newmont’s active exploration

campaigns across the region. The following table shows the

Company’s revised production and improved cost outlook for the

Australia region over the next three years.

2020

2021

2022

Moz

1.2

1.2 - 1.4

1.3 - 1.5

CAS/oz

$700

$575 - $675

$500 - $600

AISC/oz

$900

$775 - $875

$650 - $750

Newmont has the strongest and most sustainable portfolio of

operations, projects and exploration prospects in the gold sector.

These assets allow the Company to sequence profitable projects in

its unmatched pipeline to sustain stable gold production over a

decades-long time horizon in top-tier jurisdictions around the

globe.

2020 Outlooka

2020 Outlook +/- 5% ConsolidatedProduction

AttributableProduction ConsolidatedCAS

ConsolidatedAll-in SustainingCostsb

ConsolidatedSustainingCapitalExpenditures

ConsolidatedDevelopmentCapitalExpenditures

AttributableSustainingCapitalExpenditures

AttributableDevelopmentCapitalExpenditures (Koz, GEOs

Koz) (Koz, GEOs Koz) ($/oz) ($/oz)

($M) ($M) ($M) ($M) North

America

1,675

1,675

805

995

335

60

335

60

South America

1,290

1,345

790

940

135

175

100

125

Australia

1,180

1,180

700

900

185

270c

185

270c

Africa

850

850

710

870

95

70

95

70

Nevada Gold Minesd

1,375

1,375

690

880

185

45

185

45

Total Golde

6,300

6,400e

750

975

975f

625

950f

575

Total Co-products

1,105

1,105

560

880

2020 Consolidated Expense Outlook ($M) +/-5% General

& Administrative

265

Interest Expense

300

Depreciation and Amortization

2,125

Advanced Projects & Exploration

450

Adjusted Tax Rateg,h

38%-42%

Federal Tax Rateh

29%-33%

Mining Tax Rateh

8%-10%

2020 Site Outlooka as of January 2, 2020

ConsolidatedProduction AttributableProduction

ConsolidatedCAS ConsolidatedAll-in SustainingCostsb

ConsolidatedSustainingCapitalExpenditures

ConsolidatedDevelopmentCapitalExpenditures (Koz)

(Koz) ($/oz) ($/oz) ($M) ($M)

CC&V

285

285

1,000

1,175

35

Éléonore

355

355

760

915

50

10

Peñasquito

575

575

570

725

165

Porcupine

325

325

795

975

40

Musselwhite

140

140

1,460

1,930

50

50

Other North America

Cerro Negro

405

405

560

710

45

75

Yanacochai

415

215

1,105

1,260

35

100

Meriani

465

350

715

840

50

Pueblo Viejo

375

Other South America

Boddington

700

700

855

1,015

95

40

Tanami

480

480

455

685

85

225c

Other Australia

5

Ahafo

480

480

810

960

60

30

Akyem

365

365

575

695

25

10

Ahafo North

25

Other Africa

5

Nevada Gold Minesd

1,375

1,375

690

880

185

45

Corporate/Other

30

Peñasquito - Co-products (GEO)j

975

975

515

805

Boddington - Co-product (GEO)j

130

130

910

1,105

Peñasquito - Zinc (Mlbs)

425

425

Peñasquito - Lead (Mlbs)

200

200

Peñasquito - Silver (Moz)

30

30

Boddington - Copper (Mlbs)

55

55

a2020 outlook projections used in this presentation are

considered forward-looking statements and represent management’s

good faith estimates or expectations of future production results

as of January 2, 2019. Outlook is based upon certain assumptions,

including, but not limited to, metal prices, oil prices, certain

exchange rates and other assumptions. For example, 2020 Outlook

assumes $1,200/oz Au, $16/oz Ag, $2.75/lb Cu, $1.20/lb Zn, $0.95/lb

Pb, $0.75 USD/AUD exchange rate, $0.77 USD/CAD exchange rate and

$60/barrel WTI; AISC and CAS estimates do not include inflation,

for the remainder of the year. Production, CAS, AISC and capital

estimates exclude projects that have not yet been approved. The

potential impact on inventory valuation as a result of lower

prices, input costs, and project decisions are not included as part

of this Outlook. Assumptions used for purposes of Outlook may prove

to be incorrect and actual results may differ from those

anticipated, including variation beyond a +/-5% range. Outlook

cannot be guaranteed. As such, investors are cautioned not to place

undue reliance upon Outlook and forward-looking statements as there

can be no assurance that the plans, assumptions or expectations

upon which they are placed will occur. Amounts may not recalculate

to totals due to rounding. See cautionary at the end of this

release. bAll-in sustaining costs or AISC as used in the Company’s

Outlook is a non-GAAP metric; see below for further information and

reconciliation to consolidated 2020 CAS outlook. cIncludes finance

lease payments related to the Tanami Power Project paid over a 10

year term beginning in 2019. dRepresents the ownership interest in

the Nevada Gold Mines (NGM) joint venture. NGM is owned 38.5% by

Newmont Goldcorp and owned 61.5% and operated by Barrick. The

Company accounts for its interest in NGM using the proportionate

consolidation method, thereby recognizing its pro-rata share of the

assets, liabilities and operations of NGM. eAttributable gold

production outlook includes the Company’s equity investment (40%)

in Pueblo Viejo with ~375Koz in 2020; does not include the

Company’s other equity investments. fTotal sustaining capital

includes ~$30 million of corporate and other spend. gThe adjusted

tax rate excludes certain items such as tax valuation allowance

adjustments. hAssuming average prices of $1,400 per ounce for gold,

$16 per ounce for silver, $2.75 per pound for copper, $0.95 per

pound for lead, and $1.20 per pound for zinc and achievement of

current production and sales volumes and cost estimates, we

estimate our consolidated adjusted effective tax rate related to

continuing operations for 2020 will be between 38%-42%.

iConsolidated production for Yanacocha and Merian is presented on a

total production basis for the mine site; attributable production

represents a 51.35% interest for Yanacocha and a 75% interest for

Merian. jGold equivalent ounces (GEO) is calculated as pounds or

ounces produced multiplied by the ratio of the other metal’s price

to the gold price, using Gold ($1,200/oz.), Copper ($2.75/lb.),

Silver ($16/oz.), Lead ($0.95/lb.), and Zinc ($1.20/lb.)

pricing.

Longer-term Outlook

Outlook 2020E (+/- 5%) 2021E

2022E 2023E 2024E Attributable Production

(koz)

6,400

6,200 - 6,700

6,200 - 6,700

6,200 - 6,700

6,200 - 6,700

Attributable Co-products (GEOs Koz)

1,105

1,000 - 1,200

1,100 - 1,300

1,300 - 1,500

1,300 - 1,500

Consolidated Gold CAS ($/oz)

750

650 - 750

650 - 750

600 - 700

600 - 700

Consolidated Gold All-in Sustaining Costs ($/oz)

975

850 - 950

850 - 950

800 - 900

800 - 900

Attributable Sustaining Capital Expenditures ($M)

950

900 - 1,100

900 - 1,100

900 - 1,100

900 - 1,100

Attributable Development Capital Expenditures ($M)

575

500 - 600

300 - 400

100 - 200

0 - 100

Consolidated Sustaining Capital Expenditures ($M)

975

900 - 1,100

900 - 1,100

900 - 1,100

900 - 1,100

Consolidated Development Capital Expenditures ($M)

625

500 - 600

300 - 400

100 - 200

0 - 100

The estimates in the table above are considered “forward-looking

statements” within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended, which are intended to be covered by the safe

harbor created by such sections and other applicable laws.

In developing this outlook, Newmont management applied a number

of hypothetical assumptions in respect of a number of future

matters that impact outlook. For example, longer-term Outlook

assumes $1,200/oz Au, $16/oz Ag, $2.75/lb Cu, $1.20/lb Zn, $0.95/lb

Pb, $0.75 USD/AUD exchange rate, $0.77 USD/CAD exchange rate and

$60/barrel WTI. There can be no assurance that such assumptions are

correct, that such projects will be approved or that outlook will

be achieved.

For a more discussion of risks and other factors that might

impact future looking statements, see the Company’s Quarterly

Report on Form 10-Q for the quarter ended September 30 2019,

available on the SEC website or www.newmontgoldcorp.com, including

without limitation the risk factors under the heading “We may not

realize the anticipated benefits of the Newmont Goldcorp

Transaction and the integration of Goldcorp and Newmont may not

occur as planned”, “To the extent we are unable to control all

activities of any joint ventures or joint operations in which we

hold an interest, the success of such operations will be beyond our

control” and other descriptions in the “Risk Factors” section.

A reconciliation has not been provided for longer-term AISC

outlook in reliance on Item 10(e)(1)(i)(B) of Regulation S-K

because such reconciliation is not available without unreasonable

efforts.

Non-GAAP Financial Measures

Non-GAAP financial measures are intended to provide additional

information only and do not have any standard meaning prescribed by

U.S. generally accepted accounting principles (“GAAP”). These

measures should not be considered in isolation or as a substitute

for measures of performance prepared in accordance with GAAP.

Costs applicable to sales per ounce/gold equivalent

ounce

Costs applicable to sales per ounce/gold equivalent ounce are

non-GAAP financial measures. These measures are calculated by

dividing the costs applicable to sales of gold and other metals by

gold ounces or gold equivalent ounces sold, respectively. These

measures are calculated for the periods presented on a consolidated

basis. Costs applicable to sales per ounce/gold equivalent ounce

statistics are intended to provide additional information only and

do not have any standardized meaning prescribed by GAAP and should

not be considered in isolation or as a substitute for measures of

performance prepared in accordance with GAAP. The measures are not

necessarily indicative of operating profit or cash flow from

operations as determined under GAAP. Other companies may calculate

these measures differently.

All-In Sustaining Costs

Newmont has developed a metric that expands on GAAP measures,

such as cost of goods sold, and non-GAAP measures, such as Costs

applicable to sales per ounce, to provide visibility into the

economics of our mining operations related to expenditures,

operating performance and the ability to generate cash flow from

our continuing operations.

Current GAAP measures used in the mining industry, such as cost

of goods sold, do not capture all of the expenditures incurred to

discover, develop and sustain production. Therefore, we believe

that all-in sustaining costs is a non-GAAP measure that provides

additional information to management, investors and analysts that

aid in the understanding of the economics of our operations and

performance compared to other producers and provides investors

visibility by better defining the total costs associated with

production.

All-in sustaining cost (“AISC”) amounts are intended to provide

additional information only and do not have any standardized

meaning prescribed by GAAP and should not be considered in

isolation or as a substitute for measures of performance prepared

in accordance with GAAP. The measures are not necessarily

indicative of operating profit or cash flow from operations as

determined under GAAP. Other companies may calculate these measures

differently as a result of differences in the underlying accounting

principles, policies applied and in accounting frameworks such as

in International Financial Reporting Standards (“IFRS”), or by

reflecting the benefit from selling non-gold metals as a reduction

to AISC. Differences may also arise related to definitional

differences of sustaining versus development (i.e. non-sustaining)

activities based upon each company’s internal policies.

The following disclosure provides information regarding the

adjustments made in determining the all-in sustaining costs

measure:

Costs applicable to sales. Includes all direct and indirect

costs related to current production incurred to execute the current

mine plan. We exclude certain exceptional or unusual amounts from

Costs applicable to sales (“CAS”), such as significant revisions to

recovery amounts. CAS includes by-product credits from certain

metals obtained during the process of extracting and processing the

primary ore-body. CAS is accounted for on an accrual basis and

excludes Depreciation and amortization and Reclamation and

remediation, which is consistent with our presentation of CAS on

the Condensed Consolidated Statements of Operations for the period

ended September 30, 2019. In determining AISC, only the CAS

associated with producing and selling an ounce of gold is included

in the measure. Therefore, the amount of gold CAS included in AISC

is derived from the CAS presented in the Company’s Condensed

Consolidated Statements of Operations less the amount of CAS

attributable to the production of other metals. The other metals’

CAS at the Peñasquito, Boddington, and Phoenix mines is disclosed

in Note 5 to the Condensed Consolidated Financial Statements. The

allocation of CAS between gold and other metals is based upon the

relative sales value of gold and other metals produced during the

period.

Reclamation costs. Includes accretion expense related to

Reclamation liabilities and the amortization of the related Asset

Retirement Cost (“ARC”) for the Company’s operating properties.

Accretion related to the Reclamation liabilities and the

amortization of the ARC assets for reclamation does not reflect

annual cash outflows but are calculated in accordance with GAAP.

The accretion and amortization reflect the periodic costs of

reclamation associated with current production and are therefore

included in the measure. The allocation of these costs to gold and

other metals is determined using the same allocation used in the

allocation of CAS between gold and other metals.

Advanced projects, research and development and exploration.

Includes incurred expenses related to projects that are designed to

sustain current production and exploration. We note that as current

resources are depleted, exploration and advanced projects are

necessary for us to replace the depleting reserves or enhance the

recovery and processing of the current reserves to sustain

production at existing operations. As these costs relate to

sustaining our production, and are considered a continuing cost of

a mining company, these costs are included in the AISC measure.

These costs are derived from the Advanced projects, research and

development and Exploration amounts presented in the Condensed

Consolidated Statements of Operations less incurred expenses

related to the development of new operations, or related to major

projects at existing operations where these projects will

materially benefit the operation in the future. The allocation of

these costs to gold and other metals is determined using the same

allocation used in the allocation of CAS between gold and other

metals.

General and administrative. Includes costs related to

administrative tasks not directly related to current production,

but rather related to support our corporate structure and fulfill

our obligations to operate as a public company. Including these

expenses in the AISC metric provides visibility of the impact that

general and administrative activities have on current operations

and profitability on a per ounce basis.

Other expense, net. We exclude certain exceptional or unusual

expenses from Other expense, net, such as restructuring, as these

are not indicative to sustaining our current operations.

Furthermore, this adjustment to Other expense, net is also

consistent with the nature of the adjustments made to Net income

(loss) attributable to Newmont stockholders as disclosed in the

Company’s non-GAAP financial measure Adjusted net income (loss).

The allocation of these costs to gold and other metals is

determined using the same allocation used in the allocation of CAS

between gold and other metals.

Treatment and refining costs. Includes costs paid to smelters

for treatment and refining of our concentrates to produce the

salable metal. These costs are presented net as a reduction of

Sales on our Condensed Consolidated Statements of Operations. The

allocation of these costs to gold and other metals is determined

using the same allocation used in the allocation of CAS between

gold and other metals.

Sustaining capital and finance lease payments. We determined

sustaining capital and finance lease payments as those capital

expenditures and finance lease payments that are necessary to

maintain current production and execute the current mine plan.

Sustaining finance lease payments are included beginning in 2019 in

connection with the adoption of ASC 842. Refer to Note 2 in the

Condensed Consolidated Financial Statements for further details. We

determined development (i.e. non-sustaining) capital expenditures

and finance lease payments to be those payments used to develop new

operations or related to projects at existing operations where

those projects will materially benefit the operation. The

classification of sustaining and development capital projects and

finance leases is based on a systematic review of our project

portfolio in light of the nature of each project. Sustaining

capital and finance lease payments are relevant to the AISC metric

as these are needed to maintain the Company’s current operations

and provide improved transparency related to our ability to finance

these expenditures from current operations. The allocation of these

costs to gold and other metals is determined using the same

allocation used in the allocation of CAS between gold and other

metals.

A reconciliation of the 2020 Gold AISC outlook to the 2020 Gold

CAS outlook, 2020 Co-product AISC outlook to the 2020 Co-product

CAS outlook are provided below. The estimates in the table below

are considered “forward-looking statements” within the meaning of

Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended, which are

intended to be covered by the safe harbor created by such sections

and other applicable laws.

2020 Outlook - Gold 7,8 Outlook Estimate

(in millions, except ounces and per ounce)

Cost Applicable to Sales 1,2

4,725

Reclamation Costs 3

110

Advance Project and Exploration 4

175

General and Administrative 5

240

Other Expense

10

Treatment and Refining Costs

35

Sustaining Capital 6

855

Sustaining Finance Lease Payments

30

All-in Sustaining Costs

6,150

Ounces (000) Sold 9

6,300

All-in Sustaining Costs per Oz

$975

(1)

Excludes Depreciation and amortization and Reclamation and

remediation.

(2)

Includes stockpile and leach pad inventory adjustments.

(3)

Reclamation costs include operating accretion and amortization of

asset retirement costs.

(4)

Advanced Project and Exploration excludes non-sustaining advanced

projects and exploration.

(5)

Includes stock based compensation.

(6)

Excludes development capital expenditures, capitalized interest and

change in accrued capital.

(7)

The reconciliation is provided for illustrative purposes in order

to better describe management’s estimates of the components of the

calculation. Estimates for each component of the forward-looking

All-in sustaining costs per ounce are independently calculated and,

as a result, the total All-in sustaining costs and the All-in

sustaining costs per ounce may not sum to the component ranges.

While a reconciliation to the most directly comparable GAAP measure

has been provided for 2020 AISC Gold and Co-Product Outlook on a

consolidated basis, a reconciliation has not been provided on an

individual site or project basis in reliance on Item 10(e)(1)(i)(B)

of Regulation S-K because such reconciliation is not available

without unreasonable efforts.

(8)

All values are presented on a consolidated basis for combined

Newmont Goldcorp.

(9)

Consolidated production for Yanacocha and Merian is presented on a

total production basis for the mine site and excludes production

from Pueblo Viejo.

2020 Outlook - Co-Product 7,8 Outlook

Estimate (in millions, except GEO and per GEO)

Cost Applicable to Sales 1,2

620

Reclamation Costs 3

10

Advance Project and Exploration 4

10

General and Administrative 5

25

Other Expense

-

Treatment and Refining Costs

160

Sustaining Capital 6

120

Sustaining Finance Lease Payments

20

All-in Sustaining Costs

975

Co-Product GEO (000) Sold 9

1,105

All-in Sustaining Costs per Co Product GEO

$880

(1)

Excludes Depreciation and amortization and Reclamation and

remediation.

(2)

Includes stockpile and leach pad inventory adjustments.

(3)

Reclamation costs include operating accretion and amortization of

asset retirement costs.

(4)

Advanced Project and Exploration excludes non-sustaining advanced

projects and exploration.

(5)

Includes stock based compensation.

(6)

Excludes development capital expenditures, capitalized interest and

change in accrued capital.

(7)

The reconciliation is provided for illustrative purposes in order

to better describe management’s estimates of the components of the

calculation. Estimates for each component of the forward-looking

All-in sustaining costs per ounce are independently calculated and,

as a result, the total All-in sustaining costs and the All-in

sustaining costs per ounce may not sum to the component ranges.

While a reconciliation to the most directly comparable GAAP measure

has been provided for 2020 AISC Gold and Co-Product Outlook on a

consolidated basis, a reconciliation has not been provided on an

individual site or project basis in reliance on Item 10(e)(1)(i)(B)

of Regulation S-K because such reconciliation is not available

without unreasonable efforts.

(8)

All values are presented on a consolidated basis for combined

Newmont Goldcorp.

(9)

Co-Product GEO are all non gold co-products (Peñasquito silver,

zinc, lead, and Boddington copper).

About Newmont

Newmont is the world’s leading gold company and a producer of

copper, silver, zinc and lead. The Company’s world-class portfolio

of assets, prospects and talent is anchored in favorable mining

jurisdictions in North America, South America, Australia and

Africa. Newmont is the only gold producer listed in the S&P 500

Index and is widely recognized for its principled environmental,

social and governance practices. The Company is an industry leader

in value creation, supported by robust safety standards, superior

execution and technical proficiency. Newmont was founded in 1921

and has been publicly traded since 1925.

Cautionary Statement Regarding Forward Looking Statements,

Including Outlook:

This news release contains “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, which are intended to be covered by the safe harbor

created by such sections and other applicable laws. Where a

forward-looking statement expresses or implies an expectation or

belief as to future events or results, such expectation or belief

is expressed in good faith and believed to have a reasonable basis.

However, such statements are subject to risks, uncertainties and

other factors, which could cause actual results to differ

materially from future results expressed, projected or implied by

the forward-looking statements. Forward-looking statements often

address our expected future business and financial performance and

financial condition; and often contain words such as “anticipate,”

“intend,” “plan,” “will,” “would,” “estimate,” “expect,” “believe,”

“target,” “indicative,” “preliminary,” or “potential.”

Forward-looking statements in this news release may include,

without limitation, (i) expectations regarding the use of proceeds;

(ii) expectations regarding the sale of the power business and

related proceeds; (iii) expectations regarding investment-grade

balance sheet strength and future return of cash to shareholders;

(iv) expectations regarding the closing of the Red Lake and

Continental Gold sales; and (v) expectations of the Company’s 2020

guidance and long-term outlook, including, without limitation,

estimates of future production and sales, future costs applicable

to sales and all-in sustaining costs, future expenses, sustaining

capital and development capital, and other financial outlook and

assumptions. Estimates or expectations of future events or results

are based upon certain assumptions, which may prove to be

incorrect. Such assumptions, include, but are not limited to: (i)

there being no significant change to geotechnical, metallurgical,

hydrological and other physical conditions; (ii) permitting,

development, operations and expansion of operations and projects

being consistent with current expectations and mine plans,

including, without limitation, receipt of export approvals; (iii)

political developments in any jurisdiction in which the Company

operates being consistent with expectations; (iv) certain exchange

rate assumptions; (v) certain price assumptions for gold, copper,

silver, zinc, lead and oil; (vi) prices for key supplies being

approximately consistent with assumed levels; (vii) the accuracy of

current mineral reserve and mineralized material estimates; and

(viii) other planning assumptions. In addition, risks that could

cause results to differ from forward-looking statements may include

the inherent uncertainty associated with financial or other

projections, unanticipated difficulties or expenditures relating to

the Goldcorp integration and NGM joint venture, unanticipated

delays to closings of the Red Lake and Continental sales, and

unexpected developments in connection with the sale of the power

business. For a more detailed discussion of risks and other factors

that might impact future looking statements, see the Company’s

Quarterly Report on Form 10-Q for the quarter ended June 30, 2019

under the heading “Risk Factors”, filed with the U.S. Securities

and Exchange Commission (the “SEC”) and available on the SEC

website or www.newmontgoldcorp.com, as well as the Company’s other

SEC filings, including the most recent Quarterly Report on Form

10-Q for the quarter ended September 30, 2019. The Company does not

undertake any obligation to release publicly revisions to any

“forward-looking statement,” including, without limitation,

outlook, to reflect events or circumstances after the date of this

news release, or to reflect the occurrence of unanticipated events,

except as may be required under applicable securities laws.

Investors should not assume that any lack of update to a previously

issued “forward-looking statement” constitutes a reaffirmation of

that statement. Continued reliance on “forward-looking statements”

is at investors’ own risk.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200102005543/en/

Media Contact Omar Jabara

303.837.5114 omar.jabara@newmont.com

Investor Contact Jessica Largent

303.837.5484 jessica.largent@newmont.com

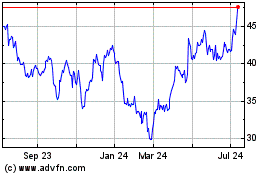

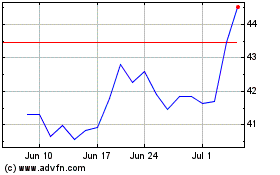

Newmont (NYSE:NEM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Newmont (NYSE:NEM)

Historical Stock Chart

From Apr 2023 to Apr 2024