Global Stocks Follow U.S. Markets Higher

December 27 2019 - 9:11AM

Dow Jones News

By Anna Hirtenstein

Global markets edged up in low-volume trading Friday, after U.S.

stocks touched new records on signs of a strong Christmas retail

season and easing trade tensions.

Stock indexes across the European continent posted gentle gains

after a mixed session in Asia. The Stoxx Europe 600 rose 0.4%.

"Today's definitely about the performance of U.S. equities,"

said James Athey, a senior investment manager at Aberdeen Standard

Investments. "We're seeing the broader equity markets playing

along, it's very difficult for European markets to ignore what's

happening in the U.S."

In premarket trading, some U.S. technology stocks rose after the

tech-heavy Nasdaq reached an all-time high and crossed 9000 for the

first time. Chip maker Advanced Micro Devices added 0.9% and

semiconductor company Qualcomm gained 1.3%. Tesla climbed 0.7%.

Hong Kong's Hang Seng Index closed 1.3% higher after a two-day

break, its strongest finish in more than five months, while Korea's

Kospi gained 0.3%. Japan's Nikkei fell 0.4%, weighed down by losses

in mining and food companies.

"The weeks entering the Christmas break were characterized by a

positive market mood and nothing has happened to change this

attitude," said Luca Cazzulani, a strategist at UniCredit. "The way

the calendar is set makes the end of this year even thinner than

usual, you have very few trading days at the turn of the year. Most

people will be taking today off, particularly in Europe."

U.S. stock futures advanced slightly after major stock indexes

hit fresh records on the back of strong holiday sales. Contracts

linked to the Dow Jones Industrial Average and the S&P 500

climbed 0.3%.

E-commerce giant Amazon said it had its best holiday season to

date, selling billions of items from its site and tens of millions

of Amazon devices.

The dollar slipped the most since Dec. 2, with the ICE Dollar

Index falling 0.4% as trade tensions continued to ease between the

U.S. and China. The currency weakened 0.5% against the euro and

0.9% against the pound.

"Broadly speaking there's a number of potential negative stories

that have gone away, such as the trade tensions, so investors are

more comfortable selling the dollar against broad risk-facing

currencies," Aberdeen's Athey said. "But the volatility is

massively exacerbated by the illiquidity in today's market."

Write to Anna Hirtenstein at anna.hirtenstein@wsj.com

(END) Dow Jones Newswires

December 27, 2019 08:56 ET (13:56 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

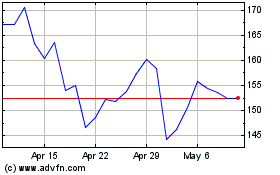

Advanced Micro Devices (NASDAQ:AMD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Advanced Micro Devices (NASDAQ:AMD)

Historical Stock Chart

From Apr 2023 to Apr 2024