Current Report Filing (8-k)

December 20 2019 - 5:34PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): December 17, 2019

PACIFIC

VENTURES GROUP, INC.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

|

000-54584

|

|

75-2100622

|

(State

or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S.

Employer

Identification No.)

|

117

West 9th Street, Suite 316

Los

Angeles, CA 90015

(Address

of principal executive offices) (Zip Code)

(310)

392-5606

(Registrant’s

telephone number, including area code)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section

12(b) of the Act: None

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company [ ]

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

1.01

Entry into a Material Definitive Agreement

In

connection with the acquisition of the assets of Seaport Meat Company, as further described in Item 2.01, below, Pacific Ventures

Group Inc. (the “Company”) entered into a series of agreements with TCA Global Credit Master Fund LP and its affiliates.

The

Company entered into 2 Senior Secured Redeemable Debentures with TCA Special Situations Credit Strategies ICAV, an Irish collective

asset vehicle, each in the amount of $1,500,000 (One Million Five Hundred Thousand Dollars). The debentures carry an interest

rate equal to Sixteen and One Half Percent (16.5%) per annum simple interest that is due and payable on June 30, 2020.

The Debentures are secured by all of the assets the Company including the newly acquired assets of Seaport Meat Company.

The

Company also entered into an Exchange Agreement with TCA Global Credit Master Fund, LP whereby the Company exchanged $2,500,000

in investment banking fees owing to TCA Global for 9,990 Common Units and 10,000 Series A Preferred Units of Seaport Group

Enterprises LLC, the Company’s subsidiary.

In

conjunction with the acquisition of the assets of Seaport Meat Company, as further described in Item 2.01, below, Pacific Ventures

Group Inc. (the “Company”) entered into a promissory note (the “Note”) with the PNC Inc., the seller of

the assets for $850,000. The Note accrues interest at the rate of 7% per annum and is payable in 3 installments over 18 months.

The

description of the agreements set forth above does not purport to be complete and is qualified in its entirety by reference to

the text of the agreements filed as exhibits hereto and incorporated herein by reference.

Item

2.01 Completion of Acquisition or Disposition of Assets.

Pacific

Ventures Group Inc. (the “Company”) completed the acquisition of the assets of Seaport Meat Company from PNC Inc.

(the “Seller”) on December 17, 2019. Pursuant to the Asset Purchase Agreement as Amended, the purchase price is as

follows:

|

|

●

|

$1,500,000

payment made at closing

|

|

|

●

|

$660,000

inventory payment made at closing

|

|

|

●

|

$850,000

note payable to the Seller

|

|

|

●

|

$1,900,000

payable to the Seller 90 days from the closing

|

|

|

●

|

A

number of common shares of the Company equal to 2.5% of the issued and outstanding shares of the Company on the date of issuance

to Seller with in fifteen (15) business days of the completion of the audit of the Company’s financial statements, including

the assets acquired, for the year ended December 31, 2019.

|

The

assets acquired consist of properties and rights that belong to the Seaport Meat Company that are used in or pertain to the

business and all necessary to operating the business as its currently being operated.

Item

3.02 Unregistered Sales of Equity Securities.

Concurrently

with the transactions described in Items 1.01 and 2.01, the Company entered into an Exchange Agreement with TCA Global Credit

Master Fund, LP whereby the Company exchanged $2,500,000 in investment banking fees owing to TCA Global for 9,990 Common

Units and 10,000 Series A Preferred Units of Seaport Group Enterprises LLC, the Company’s subsidiary.

Item

7.01 Regulation FD Disclosure.

On

December 18, 2019, the Company issued a press release announcing it had closed on its previously announced acquisition of the

assets of Seaport Meat Company. A copy of the press release is filed and attached hereto as Exhibit 99.1.

The

information in this Item 7.01 of this Current Report on Form 8-K and the related Exhibit 99.1 attached hereto shall not be deemed

“filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

or otherwise subject to the liabilities of that Section, or incorporated by reference in any filing under the Securities Act of

1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

PACIFIC

VENTURES GROUP, INC.

|

|

|

|

|

|

Dated:

December 18, 2019

|

By:

|

/s/

Shannon Masjedi

|

|

|

Name:

Title:

|

Shannon

Masjedi President, Chief Executive Officer and Interim Chief Financial Officer

|

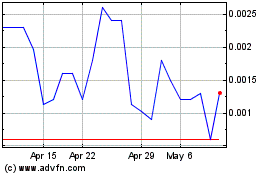

Pacific Ventures (PK) (USOTC:PACV)

Historical Stock Chart

From Mar 2024 to Apr 2024

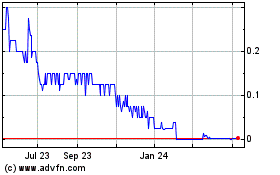

Pacific Ventures (PK) (USOTC:PACV)

Historical Stock Chart

From Apr 2023 to Apr 2024