Current Report Filing (8-k)

December 20 2019 - 4:06PM

Edgar (US Regulatory)

REATA PHARMACEUTICALS INC

false

0001358762

0001358762

2019-12-20

2019-12-20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 20, 2019

Reata Pharmaceuticals, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

Delaware

|

001-37785

|

11-3651945

|

|

|

(State or Other Jurisdiction

of Incorporation)

|

(Commission File Number)

|

(IRS Employer

Identification No.)

|

5320 Legacy Drive

Plano, TX 75024

(Address of Principal executive offices, including zip code)

(972) 865-2219

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Securities Exchange Act of 1934:

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange on which registered

|

|

Class A Common Stock, Par Value $0.001 Per Share

|

|

RETA

|

|

NASDAQ Global Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Item 2.03.Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Obligation of a Registrant.

On December 20, 2019, the Company exercised its option to borrow an additional $75.0 million (the “Term B Loan”) pursuant to the First Amendment to Amended and Restated Loan and Security Agreement, dated as of October 9, 2019 (the “Loan Agreement”), with Oxford Finance LLC, as the collateral agent and lender (“Oxford”), and Silicon Valley Bank, as a lender (together with Oxford, the “Lenders”). The Company is required to make a final payment of 2.00% of the Term B Loan, payable on the earliest of June 1, 2023 (the “Maturity Date”), the acceleration of the Term B Loan, or the prepayment of the Term B Loan. The Company may prepay all, but not less than all, of the borrowed amounts under the Term B Loan upon 10 days advance written notice to the Lenders, provided that the Company will be obligated to pay a prepayment fee. The prepayment fees payable by the Company for the Term B Loan are (i) 4.00% at the interest in effect on the date of prepayment of the Term B Loan if prepaid on or before the first anniversary of the funding date, (ii) 3.00% of the Term B Loan if prepaid after the first anniversary of the funding date and on or before the second anniversary of the funding date, (iii) 1.50% of the Term B Loan if prepaid after the second anniversary of the funding date and on or before the third anniversary of the funding date, and (iv) 0.00% of the Term B Loan if prepaid after the third anniversary of the funding date and prior to the Maturity Date.

Amounts drawn under the Loan Agreement bear interest at a floating per annum rate equal to the sum of (i) the greater of (x) the 30-day U.S. Dollar LIBOR rate reported in The Wall Street Journal on the last business day of the month that immediately precedes the month in which the interest will accrue, which shall not exceed 4.50%, and (y) 1.91% plus (ii) 7.79%. Notwithstanding the foregoing, the interest rate shall not be less than 9.70% nor greater than 12.29%.

Cautionary Note Regarding Forward-Looking Statements

This Current Report on Form 8-K and oral statements made with respect to information contained in this report may contain certain disclosures that contain “forward-looking statements.” You can identify forward-looking statements because they contain words such as “believes,” “will,” “may,” “aims,” “plans,” “model,” and “expects.” Forward-looking statements are based on the Company’s current expectations and assumptions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks, and changes in circumstances that may differ materially from those contemplated by the forward-looking statements, which are neither statements of historical fact nor guarantees or assurances of future performance. Important information regarding risks and other cautionary information can be found in the Company’s filings with the U.S. Securities and Exchange Commission, including its Annual Report on Form 10-K for the year ended December 31, 2018 and Quarterly Report on Form 10-Q for the quarter ended June 30, 2019, under the caption “Risk Factors.” The forward-looking statements speak only as of the date made and, other than as required by law, the Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

Item 9.01.Financial Statements and Exhibits.

|

|

|

|

|

Exhibit

Number

|

|

Description

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

Reata Pharmaceuticals, Inc.

|

|

|

|

|

|

|

Date: December 20, 2019

|

|

By:

|

/s/ Michael D. Wortley

|

|

|

|

|

Michael D. Wortley

|

|

|

|

|

Chief Legal Office

|

3

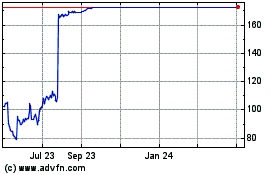

Reata Pharmaceuticals (NASDAQ:RETA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Reata Pharmaceuticals (NASDAQ:RETA)

Historical Stock Chart

From Apr 2023 to Apr 2024