Current Report Filing (8-k)

December 18 2019 - 6:03AM

Edgar (US Regulatory)

0001164727

false

0001164727

2019-12-15

2019-12-16

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

December 16, 2019

Newmont Goldcorp Corporation

(Exact name of Registrant as Specified

in Its Charter)

Delaware

(State or Other Jurisdiction of Incorporation)

001-31240

(Commission File Number)

84-1611629

(I.R.S. Employer Identification No.)

6363 South Fiddlers Green Circle, Greenwood Village, Colorado 80111

(Address of principal executive offices)

(zip code)

(303) 863-7414

(Registrant’s telephone number, including

area code)

Not Applicable

(Former Name or Former Address, if Changed

Since Last Report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instructions A.2. below):

|

|

¨

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

¨

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

¨

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

¨

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered or to be registered pursuant to Section 12(b) of

the Act.

|

Title of each class

|

|

Trading

Symbol

|

|

Name of each exchange on which registered

|

|

Common stock, par value $1.60 per share

|

|

NEM

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth

company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.01. Entry Into a Material Definitive Agreements.

On December 17, 2019 (AWST), Newmont Goldcorp

Australia Pty Ltd (“NGA”), a subsidiary of Newmont Goldcorp Corporation (“Newmont”), entered into the KCGM

Share Sale Deed with Northern Star Resources Limited (“NST”) in respect of the sale of all of the shares in Kalgoorlie

Lake View Pty Ltd (“KLV”) (“Share Sale Deed”). KLV holds a 50% interest in the Kalgoorlie Consolidated

Gold Mines Joint Venture (“KCGM JV”). The KCGM JV owns and operates the Super Pit gold mine in Kalgoorlie-Boulder,

Western Australia.

The Share Sale Deed provides for the payment

by NST of USD$800 million in cash for Newmont’s interests in KCGM, comprised of (i) a completion payment of USD$775 million

in consideration of the acquisition of all of the shares in KLV, with customary adjustments for working capital and pre-completion

cash call payments made by KLV, and (ii) a fee of USD$25 million (“Option Fee”) for an option to acquire the Newmont

power business through the purchase of all of the shares in GMK Investments Pty Ltd (“GMK”) (the “Option”).

The Option terms include: an exclusive option

period, commencing immediately after completion of the Share Sale Deed for a period of no more than 120 days (“Option Period”);

a right for NST to undertake due diligence of the power business during the Option Period; an obligation on NST to deliver to NGA

a purchase proposal for the shares in GMK which contains proposed cash price, terms and timing of payment and other material terms;

and good faith negotiations with respect to the fair market value of the power business before expiry of the Option Period. If

NST and NGA enter into a binding agreement during the Option Period, the Option Fee will be deemed to form part of the purchase

price; and if, after the expiry of the Option Period, NGA sells its shares in GMK to a bona fide third party then NGA must refund

the Option Fee less USD$2.5 million in recognition of the value of the exploration tenements transferred and costs of transitional

services for the six month transitional period.

Completion of the transaction is scheduled

to occur on January 2, 2020 and is conditional on approval from the Western Australian Minister for Finance, Aboriginal Affairs

and Lands, which approval has been received. The Share Sale Deed also provides certain limited rights to terminate the Share Sale

Deed if there is a material adverse change in the gold operations of the KCGM JV prior to completion and in certain other events.

The foregoing description of the Share Sale

Deed is qualified in its entirety by reference to the complete text thereof, which is filed herewith as Exhibit 10.1 and incorporated

by reference herein.

ITEM 9.01. FINANCIAL STATEMENTS AND EXHIBITS.

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities

and Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

By:

|

/s/ Logan Hennessey

|

|

|

|

Name:

|

Logan Hennessey

|

|

|

|

Title:

|

Vice President, Associate General Counsel and Corporate Secretary

|

|

|

|

|

|

|

Dated: December 17, 2019

|

|

|

|

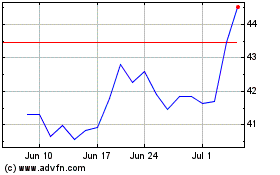

Newmont (NYSE:NEM)

Historical Stock Chart

From Mar 2024 to Apr 2024

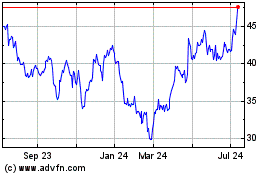

Newmont (NYSE:NEM)

Historical Stock Chart

From Apr 2023 to Apr 2024