FILED BY DUPONT DE NEMOURS, INC. PURSUANT TO RULE 425 UNDER THE SECURITIES

ACT OF 1933 AND DEEMED FILED PURSUANT TO RULE 14a-12 UNDER THE SECURITIES EXCHANGE ACT OF 1934 SUBJECT COMPANY: DUPONT DE NEMOURS, INC. COMMISSION FILE NO. 001-38196 IFF TO COMBINE WITH DUPONT NUTRITION & BIOSCIENCES Creates New Global

Integrated Solutions Leader December 16, 2019FILED BY DUPONT DE NEMOURS, INC. PURSUANT TO RULE 425 UNDER THE SECURITIES ACT OF 1933 AND DEEMED FILED PURSUANT TO RULE 14a-12 UNDER THE SECURITIES EXCHANGE ACT OF 1934 SUBJECT COMPANY: DUPONT DE

NEMOURS, INC. COMMISSION FILE NO. 001-38196 IFF TO COMBINE WITH DUPONT NUTRITION & BIOSCIENCES Creates New Global Integrated Solutions Leader December 16, 2019

CAUTIONARY STATEMENT Cautionary Note on Forward-Looking Statements This

communication contains “forward-looking statements” within the meaning of the federal securities laws, including Section 27A of the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”). In this context, forward-looking statements often address expected future business and financial performance and financial condition, and often contain words such as “expect,” “anticipate,” “intend,”

“plan,” “believe,” “seek,” “see,” “will,” “would,” “target,” similar expressions, and variations or negatives of these words. Forward-looking statements by their

nature address matters that are, to different degrees, uncertain, such as statements about the proposed transaction, the expected timetable for completing the proposed transaction, the benefits and synergies of the proposed transaction, future

opportunities for the combined company and products and any other statements regarding DuPont’s, IFF’s and N&Bco’s future operations, financial or operating results, capital allocation, dividend policy, debt ratio, anticipated

business levels, future earnings, planned activities, anticipated growth, market opportunities, strategies, competitions, and other expectations and targets for future periods. There are several factors which could cause actual plans and results to

differ materially from those expressed or implied in forward-looking statements. Such factors include, but are not limited to, (1) the parties’ ability to meet expectations regarding the timing, completion and accounting and tax treatments of

the proposed transaction, (2) changes in relevant tax and other laws, (3) any failure to obtain necessary regulatory approvals, approval of IFF’s shareholders, anticipated tax treatment or any required financing or to satisfy any of the other

conditions to the proposed transaction, (4) the possibility that unforeseen liabilities, future capital expenditures, revenues, expenses, earnings, synergies, economic performance, indebtedness, financial condition, losses, future prospects,

business and management strategies that could impact the value, timing or pursuit of the proposed transaction, (5) risks and costs and pursuit and/or implementation of the separation of N&Bco, including timing anticipated to complete the

separation, any changes to the configuration of businesses included in the separation if implemented, (6) risks related to indemnification of certain legacy liabilities of E. I. du Pont de Nemours and Company (“Historical EID”) in

connection with the distribution of Corteva Inc. on June 1, 2019 (the “Corteva Distribution”), (7) potential liability arising from fraudulent conveyance and similar laws in connection with DuPont’s distribution of Dow Inc. on

April 1, 2019 and/or the Corteva Distributions (the “Previous Distributions”), (8) failure to effectively manage acquisitions, divestitures, alliances, joint ventures and other portfolio changes, including meeting conditions under the

Letter Agreement entered in connection with the Corteva Distribution, related to the transfer of certain levels of assets and businesses, (9) uncertainty as to the long-term value of DuPont common stock, (10) potential inability or reduced access to

the capital markets or increased cost of borrowings, including as a result of a credit rating downgrade, (11) inherent uncertainties involved in the estimates and judgments used in the preparation of financial statements and the providing of

estimates of financial measures, in accordance with the accounting principles generally accepted in the United States of America and related standards, or on an adjusted basis, (12) the integration of IFF and its Frutarom business and/or N&Bco

being more difficult, time consuming or costly than expected, (13) the failure to achieve expected or targeted future financial and operating performance and results, (14) the possibility that IFF may be unable to achieve expected benefits,

synergies and operating efficiencies in connection with the proposed transaction within the expected time frames or at all or to successfully integrate Frutarom and N&Bco, (15) customer loss and business disruption being greater than expected

following the proposed transaction, (16) the impact of divestitures required as a condition to consummation of the proposed transaction as well as other conditional commitments, (17) legislative, regulatory and economic developments; (18) an

increase or decrease in the anticipated transaction taxes (including due to any changes to tax legislation and its impact on tax rates (and the timing of the effectiveness of any such changes)), (19) potential litigation relating to the proposed

transaction that could be instituted against DuPont, IFF or their respective directors, (20)risks associated with third party contracts containing consent and/or other provisions that may be triggered by the proposed transaction, (21)negative

effects of the announcement or the consummation of the transaction on the market price of DuPont’s and/or IFF’s common stock, (22) risks relating to the value of the IFF shares to be issued in the transaction and uncertainty as to the

long-term value of IFF’s common stock, (23)r isks relating to IFF’s ongoing investigations into improper payments made in Frutarom businesses principally operating in Russia and the Ukraine, including expenses incurred with respect to

the investigations, the cost of any remedial measures or compliance programs arising out of the investigations, legal proceedings or government investigations that may arise relating to the subject of IFF’s investigations, and the outcome of

any such legal or government investigations, such as the imposition of fines, penalties, orders, or injunctions, 2CAUTIONARY STATEMENT Cautionary Note on Forward-Looking Statements This communication contains “forward-looking statements”

within the meaning of the federal securities laws, including Section 27A of the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). In this context, forward-looking statements often

address expected future business and financial performance and financial condition, and often contain words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,”

“see,” “will,” “would,” “target,” similar expressions, and variations or negatives of these words. Forward-looking statements by their nature address matters that are, to different degrees, uncertain,

such as statements about the proposed transaction, the expected timetable for completing the proposed transaction, the benefits and synergies of the proposed transaction, future opportunities for the combined company and products and any other

statements regarding DuPont’s, IFF’s and N&Bco’s future operations, financial or operating results, capital allocation, dividend policy, debt ratio, anticipated business levels, future earnings, planned activities, anticipated

growth, market opportunities, strategies, competitions, and other expectations and targets for future periods. There are several factors which could cause actual plans and results to differ materially from those expressed or implied in

forward-looking statements. Such factors include, but are not limited to, (1) the parties’ ability to meet expectations regarding the timing, completion and accounting and tax treatments of the proposed transaction, (2) changes in relevant tax

and other laws, (3) any failure to obtain necessary regulatory approvals, approval of IFF’s shareholders, anticipated tax treatment or any required financing or to satisfy any of the other conditions to the proposed transaction, (4) the

possibility that unforeseen liabilities, future capital expenditures, revenues, expenses, earnings, synergies, economic performance, indebtedness, financial condition, losses, future prospects, business and management strategies that could impact

the value, timing or pursuit of the proposed transaction, (5) risks and costs and pursuit and/or implementation of the separation of N&Bco, including timing anticipated to complete the separation, any changes to the configuration of businesses

included in the separation if implemented, (6) risks related to indemnification of certain legacy liabilities of E. I. du Pont de Nemours and Company (“Historical EID”) in connection with the distribution of Corteva Inc. on June 1, 2019

(the “Corteva Distribution”), (7) potential liability arising from fraudulent conveyance and similar laws in connection with DuPont’s distribution of Dow Inc. on April 1, 2019 and/or the Corteva Distributions (the “Previous

Distributions”), (8) failure to effectively manage acquisitions, divestitures, alliances, joint ventures and other portfolio changes, including meeting conditions under the Letter Agreement entered in connection with the Corteva Distribution,

related to the transfer of certain levels of assets and businesses, (9) uncertainty as to the long-term value of DuPont common stock, (10) potential inability or reduced access to the capital markets or increased cost of borrowings, including as a

result of a credit rating downgrade, (11) inherent uncertainties involved in the estimates and judgments used in the preparation of financial statements and the providing of estimates of financial measures, in accordance with the accounting

principles generally accepted in the United States of America and related standards, or on an adjusted basis, (12) the integration of IFF and its Frutarom business and/or N&Bco being more difficult, time consuming or costly than expected, (13)

the failure to achieve expected or targeted future financial and operating performance and results, (14) the possibility that IFF may be unable to achieve expected benefits, synergies and operating efficiencies in connection with the proposed

transaction within the expected time frames or at all or to successfully integrate Frutarom and N&Bco, (15) customer loss and business disruption being greater than expected following the proposed transaction, (16) the impact of divestitures

required as a condition to consummation of the proposed transaction as well as other conditional commitments, (17) legislative, regulatory and economic developments; (18) an increase or decrease in the anticipated transaction taxes (including due to

any changes to tax legislation and its impact on tax rates (and the timing of the effectiveness of any such changes)), (19) potential litigation relating to the proposed transaction that could be instituted against DuPont, IFF or their respective

directors, (20)risks associated with third party contracts containing consent and/or other provisions that may be triggered by the proposed transaction, (21)negative effects of the announcement or the consummation of the transaction on the market

price of DuPont’s and/or IFF’s common stock, (22) risks relating to the value of the IFF shares to be issued in the transaction and uncertainty as to the long-term value of IFF’s common stock, (23)r isks relating to IFF’s

ongoing investigations into improper payments made in Frutarom businesses principally operating in Russia and the Ukraine, including expenses incurred with respect to the investigations, the cost of any remedial measures or compliance programs

arising out of the investigations, legal proceedings or government investigations that may arise relating to the subject of IFF’s investigations, and the outcome of any such legal or government investigations, such as the imposition of fines,

penalties, orders, or injunctions, 2

CAUTIONARY STATEMENT (24) the impact of the failure to comply with U.S. or

foreign anti-corruption and anti-bribery laws and regulations, including with respect to IFF’s ongoing investigations into improper payments made in Frutarom businesses principally operating in Russia and the Ukraine, (25) the impact of the

outcome of legal claims, regulatory investigations and litigation, including any that may arise out of IFF’s ongoing investigations into improper payments made in Frutarom businesses principally operating in Russia and the Ukraine, (26) the

ability of N&Bco or IFF to retain and hire key personnel, (27) the risk that N&Bco, as a newly formed entity that currently has no credit rating, will not have access to the capital markets on acceptable terms, (28) the risk that N&Bco

and IFF will incur significant indebtedness in connection with the potential transaction, and the degree to which IFF will be leveraged following completion of the potential transaction may materially and adversely affect its business, financial

condition and results of operations, (29) the ability to obtain or consummate financing or refinancing related to the transaction upon acceptable terms or at all, and (30) other risks to DuPont’s, N&Bco’s and IFF’s business,

operations and results of operations including from: failure to develop and market new products and optimally manage product life cycles; ability, cost and impact on business operations, including the supply chain, of responding to changes in market

acceptance, rules, regulations and policies and failure to respond to such changes; outcome of significant litigation, environmental matters and other commitments and contingencies; failure to appropriately manage process safety and product

stewardship issues; global economic and capital market conditions, including the continued availability of capital and financing, as well as inflation, interest and currency exchange rates; changes in political conditions, including tariffs, trade

disputes and retaliatory actions; impairment of goodwill or intangible assets; the availability of and fluctuations in the cost of energy and raw materials; business or supply disruption, including in connection with the Previous Distributions;

security threats, such as acts of sabotage, terrorism or war, natural disasters and weather events and patterns which could result in a significant operational event for DuPont, N&Bco or IFF, adversely impact demand or production; ability to

discover, develop and protect new technologies and to protect and enforce DuPont’s, N&Bco’s or IFF’s intellectual property rights; unpredictability and severity of catastrophic events, including, but not limited to, acts of

terrorism or outbreak of war or hostilities, as well as management’s response to any of the aforementioned factors. These risks, as well as other risks associated with the proposed merger, will be more fully discussed in the registration

statement and merger proxy on Form S-4 to be filed by IFF and the registration statement on Form 10 to be filed by N&Bco. While the list of factors presented here is, and the list of factors to be presented in any registration statement filed in

connection with the transaction are, considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties. Unlisted factors may present significant additional obstacles to the realization

of forward looking statements. Further lists and descriptions of risks and uncertainties can be found in each of IFF’s and DuPont’s Form 10-Q for the period ended September 30, 2019 and each of IFF’s and DuPont’s respective

subsequent reports on Form 10-Q, Form 10-K and Form 8-K, the contents of which are not incorporated by reference into, nor do they form part of, this announcement. Any other risks associated with the proposed transaction will be more fully discussed

in any registration statement filed with the SEC. While the list of factors presented here is, and the list of factors that may be presented in a registration statement of IFF or N&Bco would be, considered representative, no such list should be

considered to be a complete statement of all potential risks and uncertainties. Unlisted factors may present significant additional obstacles to the realization of forward looking statements. Consequences of material differences in results as

compared with those anticipated in the forward-looking statements could include, among other things, business disruption, operational problems, financial loss, legal liability to third parties and similar risks, any of which could have a material

adverse effect on IFF’s, DuPont’s or N&Bco’s consolidated financial condition, results of operations, credit rating or liquidity. None of IFF, DuPont nor N&Bco assumes any obligation to publicly provide revisions or updates

to any forward-looking statements, whether as a result of new information, future developments or otherwise, should circumstances change, except as otherwise required by securities and other applicable laws. Participants in the Solicitation This

communication is not a solicitation of a proxy from any investor or security holder. However, DuPont, IFF and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies in connection

with the proposed transaction under the rules of the SEC. Information about the directors and executive officers of DuPont may be found in its Annual Report on Form 10-K filed with the SEC on February 11, 2019 and its definitive proxy statement

filed with the SEC on May 1, 2019. Information about the directors and executive officers of IFF may be found in its definitive proxy statement filed with the SEC on March 18, 2019. Other information regarding the participants in the proxy

solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the registration statements, prospectuses and proxy statement and other relevant materials to be filed with the SEC when

they become available. 3CAUTIONARY STATEMENT (24) the impact of the failure to comply with U.S. or foreign anti-corruption and anti-bribery laws and regulations, including with respect to IFF’s ongoing investigations into improper payments

made in Frutarom businesses principally operating in Russia and the Ukraine, (25) the impact of the outcome of legal claims, regulatory investigations and litigation, including any that may arise out of IFF’s ongoing investigations into

improper payments made in Frutarom businesses principally operating in Russia and the Ukraine, (26) the ability of N&Bco or IFF to retain and hire key personnel, (27) the risk that N&Bco, as a newly formed entity that currently has no credit

rating, will not have access to the capital markets on acceptable terms, (28) the risk that N&Bco and IFF will incur significant indebtedness in connection with the potential transaction, and the degree to which IFF will be leveraged following

completion of the potential transaction may materially and adversely affect its business, financial condition and results of operations, (29) the ability to obtain or consummate financing or refinancing related to the transaction upon acceptable

terms or at all, and (30) other risks to DuPont’s, N&Bco’s and IFF’s business, operations and results of operations including from: failure to develop and market new products and optimally manage product life cycles; ability,

cost and impact on business operations, including the supply chain, of responding to changes in market acceptance, rules, regulations and policies and failure to respond to such changes; outcome of significant litigation, environmental matters and

other commitments and contingencies; failure to appropriately manage process safety and product stewardship issues; global economic and capital market conditions, including the continued availability of capital and financing, as well as inflation,

interest and currency exchange rates; changes in political conditions, including tariffs, trade disputes and retaliatory actions; impairment of goodwill or intangible assets; the availability of and fluctuations in the cost of energy and raw

materials; business or supply disruption, including in connection with the Previous Distributions; security threats, such as acts of sabotage, terrorism or war, natural disasters and weather events and patterns which could result in a significant

operational event for DuPont, N&Bco or IFF, adversely impact demand or production; ability to discover, develop and protect new technologies and to protect and enforce DuPont’s, N&Bco’s or IFF’s intellectual property

rights; unpredictability and severity of catastrophic events, including, but not limited to, acts of terrorism or outbreak of war or hostilities, as well as management’s response to any of the aforementioned factors. These risks, as well as

other risks associated with the proposed merger, will be more fully discussed in the registration statement and merger proxy on Form S-4 to be filed by IFF and the registration statement on Form 10 to be filed by N&Bco. While the list of factors

presented here is, and the list of factors to be presented in any registration statement filed in connection with the transaction are, considered representative, no such list should be considered to be a complete statement of all potential risks and

uncertainties. Unlisted factors may present significant additional obstacles to the realization of forward looking statements. Further lists and descriptions of risks and uncertainties can be found in each of IFF’s and DuPont’s Form 10-Q

for the period ended September 30, 2019 and each of IFF’s and DuPont’s respective subsequent reports on Form 10-Q, Form 10-K and Form 8-K, the contents of which are not incorporated by reference into, nor do they form part of, this

announcement. Any other risks associated with the proposed transaction will be more fully discussed in any registration statement filed with the SEC. While the list of factors presented here is, and the list of factors that may be presented in a

registration statement of IFF or N&Bco would be, considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties. Unlisted factors may present significant additional obstacles to

the realization of forward looking statements. Consequences of material differences in results as compared with those anticipated in the forward-looking statements could include, among other things, business disruption, operational problems,

financial loss, legal liability to third parties and similar risks, any of which could have a material adverse effect on IFF’s, DuPont’s or N&Bco’s consolidated financial condition, results of operations, credit rating or

liquidity. None of IFF, DuPont nor N&Bco assumes any obligation to publicly provide revisions or updates to any forward-looking statements, whether as a result of new information, future developments or otherwise, should circumstances change,

except as otherwise required by securities and other applicable laws. Participants in the Solicitation This communication is not a solicitation of a proxy from any investor or security holder. However, DuPont, IFF and certain of their respective

directors and executive officers may be deemed to be participants in the solicitation of proxies in connection with the proposed transaction under the rules of the SEC. Information about the directors and executive officers of DuPont may be found in

its Annual Report on Form 10-K filed with the SEC on February 11, 2019 and its definitive proxy statement filed with the SEC on May 1, 2019. Information about the directors and executive officers of IFF may be found in its definitive proxy statement

filed with the SEC on March 18, 2019. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the registration

statements, prospectuses and proxy statement and other relevant materials to be filed with the SEC when they become available. 3

CAUTIONARY STATEMENT Additional Information and Where to Find It This

communication is not intended to and shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote of approval, nor shall there be any sale of

securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a

prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended (the “Securities Act”). In connection with the proposed combination of Nutrition & Biosciences, Inc. (“N&Bco”), a wholly

owned subsidiary of DuPont de Nemours, Inc. (“DuPont”), and International Flavors & Fragrances Inc. (“IFF”), which will immediately follow the proposed separation of N&Bco from DuPont (the “proposed

transaction”), N&Bco, IFF, Neptune Merger Sub I Inc. (“Merger Sub I”) and Neptune Merger Sub II LLC (“Merger Sub II”) intend to file relevant materials with the SEC, including a registration statement on Form S-4

that will include a proxy statement/prospectus relating to the proposed transaction. In addition, N&Bco expects to file a registration statement in connection with its separation from DuPont. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE

REGISTRATION STATEMENTS, PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT IFF, N&BCO, MERGER SUB I, MERGER SUB II AND THE PROPOSED TRANSACTION. A

definitive proxy statement will be sent to shareholders of IFF seeking approval of the proposed transaction. The documents relating to the proposed transaction (when they are available) can be obtained free of charge from the SEC’s website at

www.sec.gov. Free copies of these documents, once available, and each of the companies’ other filings with the SEC may also be obtained from the respective companies by contacting the investor relations department of DuPont or IFF. 4CAUTIONARY

STATEMENT Additional Information and Where to Find It This communication is not intended to and shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities or a solicitation of

any vote of approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of

securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended (the “Securities Act”). In connection with the proposed combination of Nutrition & Biosciences,

Inc. (“N&Bco”), a wholly owned subsidiary of DuPont de Nemours, Inc. (“DuPont”), and International Flavors & Fragrances Inc. (“IFF”), which will immediately follow the proposed separation of N&Bco from

DuPont (the “proposed transaction”), N&Bco, IFF, Neptune Merger Sub I Inc. (“Merger Sub I”) and Neptune Merger Sub II LLC (“Merger Sub II”) intend to file relevant materials with the SEC, including a

registration statement on Form S-4 that will include a proxy statement/prospectus relating to the proposed transaction. In addition, N&Bco expects to file a registration statement in connection with its separation from DuPont. INVESTORS AND

SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENTS, PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT IFF, N&BCO, MERGER SUB I, MERGER SUB II

AND THE PROPOSED TRANSACTION. A definitive proxy statement will be sent to shareholders of IFF seeking approval of the proposed transaction. The documents relating to the proposed transaction (when they are available) can be obtained free of charge

from the SEC’s website at www.sec.gov. Free copies of these documents, once available, and each of the companies’ other filings with the SEC may also be obtained from the respective companies by contacting the investor relations

department of DuPont or IFF. 4

TRANSACTION SUMMARY Key takeaways (1) • IFF and DuPont Nutrition and

Biosciences unit (N&B) to combine in a Reverse Morris Trust transaction valued at $26.2B Structure • Transaction value represents a multiple of ~18x 2019 estimated pro-forma EBITDA excluding synergies and a multiple of ~15x including cost

synergies (~$300 million) • DuPont shareholders to own 55.4% of the pro forma company Ownership • IFF shareholders to own 44.6% of the pro forma company • Fixed ownership ratios, not subject to change post-signing • IFF &

DuPont Nutrition & Biosciences would have more than $11B of pro forma 2019 sales and $2.6B of pro forma EBITDA, Financial Impact more than doubling the size of IFF • Expected pro forma net leverage of 4.0x Net Debt to EBITDA supporting a

$7.3B special cash payment • Fully committed bridge financing for the transaction Capital Structure & • Commitment to maintaining investment grade rating; reduce leverage <3.0x Net Debt to EBITDA by the end of 2 years post close

Financing • Commitment to maintaining quarterly dividend policy with no share repurchases until deleveraging targets are achieved • Substantially all of the debt of the combined company will be pari passu • Andreas Fibig, Chairman

and Chief Executive Officer of IFF, to lead combined company Governance & • 7 current IFF directors and 6 DuPont director appointees until the Annual Meeting in 2022, when there will be 6 directors from each company, including

DuPont’s Executive Chairman who will become Lead Independent Director on June 1, 2021 Leadership • Experienced management teams with strong integration roadmap & capabilities • IFF shareholder vote requires majority approval

(>50%) of votes cast; no shareholder vote for DuPont Closing • IFF’s largest shareholder has agreed to vote in favor of the transaction • Targeted to close by end of Q1 2021, subject to customary closing conditions and

regulatory authority approvals Notes: 1. Based on IFF’s share price as of December 13, 2019 5TRANSACTION SUMMARY Key takeaways (1) • IFF and DuPont Nutrition and Biosciences unit (N&B) to combine in a Reverse Morris Trust transaction

valued at $26.2B Structure • Transaction value represents a multiple of ~18x 2019 estimated pro-forma EBITDA excluding synergies and a multiple of ~15x including cost synergies (~$300 million) • DuPont shareholders to own 55.4% of the

pro forma company Ownership • IFF shareholders to own 44.6% of the pro forma company • Fixed ownership ratios, not subject to change post-signing • IFF & DuPont Nutrition & Biosciences would have more than $11B of pro forma

2019 sales and $2.6B of pro forma EBITDA, Financial Impact more than doubling the size of IFF • Expected pro forma net leverage of 4.0x Net Debt to EBITDA supporting a $7.3B special cash payment • Fully committed bridge financing for the

transaction Capital Structure & • Commitment to maintaining investment grade rating; reduce leverage <3.0x Net Debt to EBITDA by the end of 2 years post close Financing • Commitment to maintaining quarterly dividend policy with no

share repurchases until deleveraging targets are achieved • Substantially all of the debt of the combined company will be pari passu • Andreas Fibig, Chairman and Chief Executive Officer of IFF, to lead combined company Governance &

• 7 current IFF directors and 6 DuPont director appointees until the Annual Meeting in 2022, when there will be 6 directors from each company, including DuPont’s Executive Chairman who will become Lead Independent Director on June 1,

2021 Leadership • Experienced management teams with strong integration roadmap & capabilities • IFF shareholder vote requires majority approval (>50%) of votes cast; no shareholder vote for DuPont Closing • IFF’s

largest shareholder has agreed to vote in favor of the transaction • Targeted to close by end of Q1 2021, subject to customary closing conditions and regulatory authority approvals Notes: 1. Based on IFF’s share price as of December 13,

2019 5

A POWERFUL COMBINATION Redefining the value-add ingredients industry

Combined Company IFF DuPont N&B Broader • Leading value-added ingredients and • A global leader in taste and scent Set of Ingredients and Solutions solutions provider • Leading Natural capabilities • #1 or 2 positions in

cultures, enzymes Deeper and probiotics • Creative and R&D-led organization Innovation and R&D Platform • Customer-led innovation and R&D • Broadest customer base with 60% of Shared focused organization sales to local

& regional customers Focus on Consumer-Oriented End Markets (45% in Emerging Markets) • Deep customer relationships across food, nutrition, pharma and HPC >$11B • Well positioned in fast-growing $2.6B customers Pro Forma 2019

adjacencies (i.e., Food Protection, Pro Forma 2019 Revenue • Extensive global sales & applications EBITDA Inclusions, Health ingredients, capability Cosmetic Actives) $550M+ • Deep commitment to sustainability • Deep commitment

to sustainability 2018 Pro Forma and product stewardship R&D Spend 6A POWERFUL COMBINATION Redefining the value-add ingredients industry Combined Company IFF DuPont N&B Broader • Leading value-added ingredients and • A global

leader in taste and scent Set of Ingredients and Solutions solutions provider • Leading Natural capabilities • #1 or 2 positions in cultures, enzymes Deeper and probiotics • Creative and R&D-led organization Innovation and

R&D Platform • Customer-led innovation and R&D • Broadest customer base with 60% of Shared focused organization sales to local & regional customers Focus on Consumer-Oriented End Markets (45% in Emerging Markets) • Deep

customer relationships across food, nutrition, pharma and HPC >$11B • Well positioned in fast-growing $2.6B customers Pro Forma 2019 adjacencies (i.e., Food Protection, Pro Forma 2019 Revenue • Extensive global sales &

applications EBITDA Inclusions, Health ingredients, capability Cosmetic Actives) $550M+ • Deep commitment to sustainability • Deep commitment to sustainability 2018 Pro Forma and product stewardship R&D Spend 6

INDUSTRY LEADING FINANCIAL PROFILE Strong platform for enhanced growth and

margin expansion RANKING OF PEERS BY 2018 REVENUE (PRE-SYNERGIES) In USD Billions 11 7 6 6 4 (1) (2) IFF + N&B Peer 1 Peer 2 Peer 3 Peer 4 RANKING OF PEERS BY 2018 EBITDA MARGIN Includes ~$300m of cost synergies 26% 23% 20% 20% 14% 23%

(Pre-Synergies) (1)(3) (4) (4) (2) IFF + N&B Peer 1 Peer 2 Peer 3 Peer 4 Source: Company information, Factset, FX converted at average 2018 rate 1. IFF 2018 sales are pro forma for the acquisition of Frut 2. Peer 3 Pro forma sales and EBITDA

based on latest 2018E broker consensus adjusted for a recent acquisition 3. EBITDA includes run-rate cost synergies 4. Financials reflect only nutrition portions of portfolios 7INDUSTRY LEADING FINANCIAL PROFILE Strong platform for enhanced growth

and margin expansion RANKING OF PEERS BY 2018 REVENUE (PRE-SYNERGIES) In USD Billions 11 7 6 6 4 (1) (2) IFF + N&B Peer 1 Peer 2 Peer 3 Peer 4 RANKING OF PEERS BY 2018 EBITDA MARGIN Includes ~$300m of cost synergies 26% 23% 20% 20% 14% 23%

(Pre-Synergies) (1)(3) (4) (4) (2) IFF + N&B Peer 1 Peer 2 Peer 3 Peer 4 Source: Company information, Factset, FX converted at average 2018 rate 1. IFF 2018 sales are pro forma for the acquisition of Frut 2. Peer 3 Pro forma sales and EBITDA

based on latest 2018E broker consensus adjusted for a recent acquisition 3. EBITDA includes run-rate cost synergies 4. Financials reflect only nutrition portions of portfolios 7

TRANSACTION BENEFITS ALL STAKEHOLDERS Strong Corporate Competitive

Governance and thorough • Andreas Fibig to serve as Chairman & CEO process leading • Balanced board with equal to the selection Significant value composition from IFF and DuPont; Breen as Lead of IFF creation opportunities

Independent Director • Compelling growth profile benefitting • Experienced senior leadership stakeholders and attractive value team with representation from creation for shareholders over the both companies Advances short, medium and

long term DuPont strategy • Will deliver ~$300 million in run-rate cost synergies and ~$400 million in of active portfolio run-rate growth synergies management • Creates the industry’s to unlock broadest technology portfolio

shareholder value 8TRANSACTION BENEFITS ALL STAKEHOLDERS Strong Corporate Competitive Governance and thorough • Andreas Fibig to serve as Chairman & CEO process leading • Balanced board with equal to the selection Significant value

composition from IFF and DuPont; Breen as Lead of IFF creation opportunities Independent Director • Compelling growth profile benefitting • Experienced senior leadership stakeholders and attractive value team with representation from

creation for shareholders over the both companies Advances short, medium and long term DuPont strategy • Will deliver ~$300 million in run-rate cost synergies and ~$400 million in of active portfolio run-rate growth synergies management

• Creates the industry’s to unlock broadest technology portfolio shareholder value 8

DUPONT N&B SNAPSHOT Leader in Food Science and Biotechnology Strong

Financial Profile Diversified Revenue by Geography (2018A) ~$6B ~24% 30% 37% 2019 Estimated 2019 Estimated Operating EBITDA 23% (1) Sales (1)(2) Margin 10% #1 across active Food & Beverage segments #1 in Probiotics Global Scale 10,000+ 70+

10,000+ 30+ employees manufacturing sites technology and innovation centers customers (1) 2019 Estimated Sales and 2019 Estimated Operating EBITDA Margin based on mid-point of full-year segment guidance provided on October 31, 2019. (2) Operating

EBITDA is on a pro forma basis and is defined as earnings (i.e. income (loss) from continuing operations before income taxes) before interest, depreciation, amortization, nonoperating pension / OPEB benefits / charges, 9 and foreign exchange gains /

losses, excluding the impact of costs historically allocated to the materials science and agriculture businesses that did not meet the criteria to be recorded as discontinued operations and excluding significant items.DUPONT N&B SNAPSHOT Leader

in Food Science and Biotechnology Strong Financial Profile Diversified Revenue by Geography (2018A) ~$6B ~24% 30% 37% 2019 Estimated 2019 Estimated Operating EBITDA 23% (1) Sales (1)(2) Margin 10% #1 across active Food & Beverage segments #1 in

Probiotics Global Scale 10,000+ 70+ 10,000+ 30+ employees manufacturing sites technology and innovation centers customers (1) 2019 Estimated Sales and 2019 Estimated Operating EBITDA Margin based on mid-point of full-year segment guidance provided

on October 31, 2019. (2) Operating EBITDA is on a pro forma basis and is defined as earnings (i.e. income (loss) from continuing operations before income taxes) before interest, depreciation, amortization, nonoperating pension / OPEB benefits /

charges, 9 and foreign exchange gains / losses, excluding the impact of costs historically allocated to the materials science and agriculture businesses that did not meet the criteria to be recorded as discontinued operations and excluding

significant items.

DUPONT N&B BUSINESS OVERVIEW Innovation-driven portfolio of

high-value, specialty ingredient businesses Nutrition & Biosciences Portfolio Health & Biosciences Food & Beverage Pharma Solutions 39% 48% 13% Business World-leading bioscience innovator serving Broadest portfolio of natural and

plant-based Global leader of functional cellulosic polymers Overview attractive markets with sustainable and high- specialty food ingredients & seaweed derived excipients for pharma & performance solutions dietary supplements

•Probiotics, HMO, Fibers •Animal Feed Enzymes • Functional Solutions • Controlled and immediate release & Nutrition (probiotics) • Protein Solutions • API (Alginates) •Cultures, Food Enzymes Product

• Emulsifiers & Sweeteners and Protection •Biorefinery Enzymes Segments •Home & Personal •Microbial Control Care Enzymes End Markets Served Food & Beverage Dietary Home & Animal Pharma Excipients (Specialty

Food Ingredients) Supplements Personal Care Nutrition Based on DuPont N&B’s 2019 estimated portfolio. 10DUPONT N&B BUSINESS OVERVIEW Innovation-driven portfolio of high-value, specialty ingredient businesses Nutrition & Biosciences

Portfolio Health & Biosciences Food & Beverage Pharma Solutions 39% 48% 13% Business World-leading bioscience innovator serving Broadest portfolio of natural and plant-based Global leader of functional cellulosic polymers Overview attractive

markets with sustainable and high- specialty food ingredients & seaweed derived excipients for pharma & performance solutions dietary supplements •Probiotics, HMO, Fibers •Animal Feed Enzymes • Functional Solutions •

Controlled and immediate release & Nutrition (probiotics) • Protein Solutions • API (Alginates) •Cultures, Food Enzymes Product • Emulsifiers & Sweeteners and Protection •Biorefinery Enzymes Segments •Home

& Personal •Microbial Control Care Enzymes End Markets Served Food & Beverage Dietary Home & Animal Pharma Excipients (Specialty Food Ingredients) Supplements Personal Care Nutrition Based on DuPont N&B’s 2019 estimated

portfolio. 10

IFF SNAPSHOT Global leader in natural taste, scent and nutrition Strong

Financial Profile Diversified Revenue by Geography (2018A) ~$5B ~22% 41% 23% 2019 Estimated 2019 Estimated 22% Sales EBITDA Margin 14% #2 Flavors and Fragrances player Global Scale 60% ~20% 8% 110+ 39,000+ annual R&D spend as manufacturing sales

from fast growing small & sales from faster growing customers percent of sales facilities mid-sized customers adjacencies 11IFF SNAPSHOT Global leader in natural taste, scent and nutrition Strong Financial Profile Diversified Revenue by

Geography (2018A) ~$5B ~22% 41% 23% 2019 Estimated 2019 Estimated 22% Sales EBITDA Margin 14% #2 Flavors and Fragrances player Global Scale 60% ~20% 8% 110+ 39,000+ annual R&D spend as manufacturing sales from fast growing small & sales from

faster growing customers percent of sales facilities mid-sized customers adjacencies 11

IFF BUSINESS OVERVIEW Global leader in natural taste, scent and nutrition

IFF Portfolio Scent Taste Nutrition & Ingredients 37% 57% 6% Business Range of natural & synthetic fragrance Range of flavor compounds and natural Suite of natural product offerings Overview compounds & ingredients, and cosmetic taste

solutions for Food & Beverage industry serving fast-growing small, mid-sized actives for Home & Personal Care products & private label customers • Fine Fragrance • Flavor Compounds • Natural Health Ingredients •

Consumer Fragrance • Savory Solutions • Natural Food Protection Product • Cosmetic Active Ingredients • Inclusions • Natural Colors Segments • Fragrance Ingredients • Flavor Ingredients End Markets Served

Food & Beverage Home, Beauty & Dietary Pharma Personal Care Supplements Based on IFF’s 2019 estimated portfolio. 12IFF BUSINESS OVERVIEW Global leader in natural taste, scent and nutrition IFF Portfolio Scent Taste Nutrition &

Ingredients 37% 57% 6% Business Range of natural & synthetic fragrance Range of flavor compounds and natural Suite of natural product offerings Overview compounds & ingredients, and cosmetic taste solutions for Food & Beverage industry

serving fast-growing small, mid-sized actives for Home & Personal Care products & private label customers • Fine Fragrance • Flavor Compounds • Natural Health Ingredients • Consumer Fragrance • Savory Solutions

• Natural Food Protection Product • Cosmetic Active Ingredients • Inclusions • Natural Colors Segments • Fragrance Ingredients • Flavor Ingredients End Markets Served Food & Beverage Home, Beauty & Dietary

Pharma Personal Care Supplements Based on IFF’s 2019 estimated portfolio. 12

REDEFINING THE INDUSTRY TOGETHER Leading positions in Food & Beverage,

Home & Personal Care, Health & Wellness A clear Shared Compelling Powerful Strength in leader focus value R&D shared in the categories on consumer- proposition platform cultures where we oriented end- to customers with clear path led by

science compete markets in line with to deliver and creativity consumer differentiated demand offering 13REDEFINING THE INDUSTRY TOGETHER Leading positions in Food & Beverage, Home & Personal Care, Health & Wellness A clear Shared

Compelling Powerful Strength in leader focus value R&D shared in the categories on consumer- proposition platform cultures where we oriented end- to customers with clear path led by science compete markets in line with to deliver and creativity

consumer differentiated demand offering 13

LEADER ACROSS ATTRACTIVE MARKETS Breadth of capability & exposure

establishes strong competitive position Category Leader Position IFF + Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 DuPont N&B ✔ Participates in the category (1) Functional Solutions✔✔ Emulsifiers & Lecithin✔ (2)

Sweeteners✔ (2) Plant Protein✔ Cultures✔ Probiotics✔✔ Enzymes✔✔✔ (1) Animal Nutrition✔✔✔✔ Excipients✔ (1) Nutraceuticals✔✔✔✔

Flavors✔✔ Fragrances✔ (1) Cosmetic Ingredients✔✔✔✔ Evolving Customer Base Demands More Integrations Solutions from Their Suppliers Source: Company information 14 1. Functional solutions, Animal

Nutrition, Nutraceuticals and Cosmetic Ingredients are widely defined categories with limited traditional “leadership” 2. In relevant segments Flavor & Health & Food & Beverage Pharma Fragrance BioscienceLEADER ACROSS

ATTRACTIVE MARKETS Breadth of capability & exposure establishes strong competitive position Category Leader Position IFF + Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 DuPont N&B ✔ Participates in the category (1) Functional

Solutions✔✔ Emulsifiers & Lecithin✔ (2) Sweeteners✔ (2) Plant Protein✔ Cultures✔ Probiotics✔✔ Enzymes✔✔✔ (1) Animal Nutrition✔✔✔✔

Excipients✔ (1) Nutraceuticals✔✔✔✔ Flavors✔✔ Fragrances✔ (1) Cosmetic Ingredients✔✔✔✔ Evolving Customer Base Demands More Integrations Solutions from Their Suppliers

Source: Company information 14 1. Functional solutions, Animal Nutrition, Nutraceuticals and Cosmetic Ingredients are widely defined categories with limited traditional “leadership” 2. In relevant segments Flavor & Health & Food

& Beverage Pharma Fragrance Bioscience

HIGHLY COMPELLING POSITION WITH CUSTOMERS Clear path to become a partner

of choice Strong Representation Across All Customer Sets Customer Type Global Multinational New & Emerging Brands; Regional Leaders Champions Private Label • Industry-leading innovation • In-depth consumer insights • End-to-end

partner from idea to Combined capabilities • Strong presence in nearly all creation Company • Experience with high-growth markets • Reliability of scale player segments Value • R&D portfolio for world-class product

• Global reach and industry leading • Speed-to-market development Proposition expertise • Efficiencies in development • Proven go-to-market model Focused on natural, Fast growing, focused on Growing need for integrated

health, clean label, and traceability nutritional and healthy solutions Powerful Trends Partnering for growth & innovation Partnering for scale and global Partnering for rapid growth expansion and global expansion 15HIGHLY COMPELLING POSITION

WITH CUSTOMERS Clear path to become a partner of choice Strong Representation Across All Customer Sets Customer Type Global Multinational New & Emerging Brands; Regional Leaders Champions Private Label • Industry-leading innovation •

In-depth consumer insights • End-to-end partner from idea to Combined capabilities • Strong presence in nearly all creation Company • Experience with high-growth markets • Reliability of scale player segments Value •

R&D portfolio for world-class product • Global reach and industry leading • Speed-to-market development Proposition expertise • Efficiencies in development • Proven go-to-market model Focused on natural, Fast growing,

focused on Growing need for integrated health, clean label, and traceability nutritional and healthy solutions Powerful Trends Partnering for growth & innovation Partnering for scale and global Partnering for rapid growth expansion and global

expansion 15

TECHNOLOGY & INNOVATION Expanded capabilities through R&D and

innovation platforms Focused Technology & Innovation Platforms Demand Across Shared End Markets 50+ NATURALS DELIVERY MODULATION & BEYOND SYSTEMS Research, Creative & Application Centers 30+ Human Clinical Trials In Flight FOOD SCIENCE

PHARMA EXCIPIENTS BIOTECHNOLOGY & APPLICATION SCIENCE 100s Flavorists, Scent Design Managers and Perfumers, Chefs 3,000+ ACTIVE HEALTH & INGREDIENTS COSMETICS NUTRITION Scientists, Engineers, Technologists & Application >12K Total

Patents Granted & Filed REGULATORY AFFAIRS PROCESS ADVANCED & PRODUCT TECHNOLOGY ANALYTICAL SCIENCE STEWARDSHIP 40+ Strategic University Partnerships C H E M I S T RY & M AT E R I A L S C I E N C E 6 S U S TAI N A B I L I T Y Master

Perfumers 16TECHNOLOGY & INNOVATION Expanded capabilities through R&D and innovation platforms Focused Technology & Innovation Platforms Demand Across Shared End Markets 50+ NATURALS DELIVERY MODULATION & BEYOND SYSTEMS Research,

Creative & Application Centers 30+ Human Clinical Trials In Flight FOOD SCIENCE PHARMA EXCIPIENTS BIOTECHNOLOGY & APPLICATION SCIENCE 100s Flavorists, Scent Design Managers and Perfumers, Chefs 3,000+ ACTIVE HEALTH & INGREDIENTS

COSMETICS NUTRITION Scientists, Engineers, Technologists & Application >12K Total Patents Granted & Filed REGULATORY AFFAIRS PROCESS ADVANCED & PRODUCT TECHNOLOGY ANALYTICAL SCIENCE STEWARDSHIP 40+ Strategic University Partnerships C

H E M I S T RY & M AT E R I A L S C I E N C E 6 S U S TAI N A B I L I T Y Master Perfumers 16

DIFFERENTIATED SOLUTIONS: A CLEAR ADVANTAGE Complementary capabilities and

expertise in shared end-markets Demand Across Shared End-Markets Illustrative Product Examples IFF Product Offering DuPont N&B Product Offering Food & Texturants (Mouth feel) Beverage Binders (“Glue” ingredients together)

Plant-Based Protein (Nutritional component) Better Emulsifiers (Bun yield) Plant- System Blends (Dairy-free cheese) Based Flavor & Seasonings (Taste) Health & Burger Taste Modulation (Bitterness & salt reduction) Wellness Delivery

Systems (Flavor performance) Natural Antioxidants (Food protection) Natural Color & Grill Mark (For appearance & clean label) Home & Enzymes (Fluidity, Stain removal, Malodor) Better Cold Personal Care Microbial Control (Antimicrobial

& shelf-life) Water Fragrance (Scent & odor coverage) Laundry Detergent Encapsulation (Fit-for-purpose delivery and performance) Accelerates speed to market with enhanced outcomes 17DIFFERENTIATED SOLUTIONS: A CLEAR ADVANTAGE Complementary

capabilities and expertise in shared end-markets Demand Across Shared End-Markets Illustrative Product Examples IFF Product Offering DuPont N&B Product Offering Food & Texturants (Mouth feel) Beverage Binders (“Glue” ingredients

together) Plant-Based Protein (Nutritional component) Better Emulsifiers (Bun yield) Plant- System Blends (Dairy-free cheese) Based Flavor & Seasonings (Taste) Health & Burger Taste Modulation (Bitterness & salt reduction) Wellness

Delivery Systems (Flavor performance) Natural Antioxidants (Food protection) Natural Color & Grill Mark (For appearance & clean label) Home & Enzymes (Fluidity, Stain removal, Malodor) Better Cold Personal Care Microbial Control

(Antimicrobial & shelf-life) Water Fragrance (Scent & odor coverage) Laundry Detergent Encapsulation (Fit-for-purpose delivery and performance) Accelerates speed to market with enhanced outcomes 17

A NEW GLOBAL LEADER Differentiated product portfolio and balanced

geographic footprint PRO FORMA PORTFOLIO– 2018A SALES PRO FORMA GEOGRAPHIC SPLIT – 2018A SALES Nutrition Greater Food & Taste Asia 3% Beverage 22% 26% EMEA 26% 35% Pro 2018 Forma Sales Latin 13% America 7% 17% Pharma Solutions Scent

21% 30% Health & North America Bioscience Source: Company information 1. IFF 2018 sales are pro forma for the acquisition of Frutarom, PF revenue split by region calculated by applying 2017 IFF geographical sales split to IFF 2018 standalone

revenue figures and 2018PF Frutarom geographical split to Frutarom standalone 2018 figures 18A NEW GLOBAL LEADER Differentiated product portfolio and balanced geographic footprint PRO FORMA PORTFOLIO– 2018A SALES PRO FORMA GEOGRAPHIC SPLIT

– 2018A SALES Nutrition Greater Food & Taste Asia 3% Beverage 22% 26% EMEA 26% 35% Pro 2018 Forma Sales Latin 13% America 7% 17% Pharma Solutions Scent 21% 30% Health & North America Bioscience Source: Company information 1. IFF 2018

sales are pro forma for the acquisition of Frutarom, PF revenue split by region calculated by applying 2017 IFF geographical sales split to IFF 2018 standalone revenue figures and 2018PF Frutarom geographical split to Frutarom standalone 2018

figures 18

SIGNIFICANT SYNERGY OPPORTUNITIES Combination provides strong value

creation Cost Synergies Revenue Synergies LEVERAGE DIRECT TO CONSUMER ~10% MANUFACTURING DISTRIBUTION MODEL ~10% EFFICIENCIES ACCELERATE DUPONT N&B SOLUTIONS ~25% WITH TASTE STREAMLINING OVERHEAD ~40% LEVERAGE IFF CUSTOMER BASE FOR ~25% DUPONT

N&B CAPABILITIES PROCUREMENT ~50% CROSS-SELL COMPLEMENTARY ~40% PRODUCTS & SOLUTIONS Total Year 3 ~$400M Total Year 3 ~$300M (1) EBITDA Impact ~$175M (2) Cost to Achieve Year 3 Synergy Target: ~$355M Notes: 1. Excludes c. $30M of opex

reinvestment 19 2. Excludes $40M of capex synergiesSIGNIFICANT SYNERGY OPPORTUNITIES Combination provides strong value creation Cost Synergies Revenue Synergies LEVERAGE DIRECT TO CONSUMER ~10% MANUFACTURING DISTRIBUTION MODEL ~10% EFFICIENCIES

ACCELERATE DUPONT N&B SOLUTIONS ~25% WITH TASTE STREAMLINING OVERHEAD ~40% LEVERAGE IFF CUSTOMER BASE FOR ~25% DUPONT N&B CAPABILITIES PROCUREMENT ~50% CROSS-SELL COMPLEMENTARY ~40% PRODUCTS & SOLUTIONS Total Year 3 ~$400M Total Year 3

~$300M (1) EBITDA Impact ~$175M (2) Cost to Achieve Year 3 Synergy Target: ~$355M Notes: 1. Excludes c. $30M of opex reinvestment 19 2. Excludes $40M of capex synergies

PRO FORMA CAPITAL STRUCTURE • Pro forma leverage of •

Commitment to maintaining approximately 4.0x net investment grade credit debt / adjusted EBITDA at rating close • Targeting deleveraging • Commitment to current <3.0x by year two post- dividend policy transaction close 20PRO FORMA

CAPITAL STRUCTURE • Pro forma leverage of • Commitment to maintaining approximately 4.0x net investment grade credit debt / adjusted EBITDA at rating close • Targeting deleveraging • Commitment to current <3.0x by year two

post- dividend policy transaction close 20

LONG-TERM OUTLOOK Compelling upside driven by base plans and synergies 1

Mid single-digit topline growth 2 Significant margin enhancement 3 High single-digit EBITDA growth 4 Highly cash generative business 21 Financial TargetsLONG-TERM OUTLOOK Compelling upside driven by base plans and synergies 1 Mid single-digit

topline growth 2 Significant margin enhancement 3 High single-digit EBITDA growth 4 Highly cash generative business 21 Financial Targets

IFF & DUPONT N&B INTEGRATION Shared experience in integration

execution with ample time for planning TIMING ALIGNMENT WITH SHARED CULTURE AND FRUTAROM INTEGRATION FOCUS ON INTEGRATION H1 2020: Q3 2020: Q4 2020: Disciplined process-oriented companies Procurement Business 90% Sites Savings Integration

Consolidated Completed Completed Full year for joint planning process FRUTAROM DUPONT N&B Both teams bring depth of experience INTEGRATION Plan to establish integration team with Q1 2020: Start DuPont Q1 2021: Day 1 2021+: Ongoing leaders from

both organizations N&B Integration Execution Integration Milestones Planning Leverage strengths from each company 22IFF & DUPONT N&B INTEGRATION Shared experience in integration execution with ample time for planning TIMING ALIGNMENT

WITH SHARED CULTURE AND FRUTAROM INTEGRATION FOCUS ON INTEGRATION H1 2020: Q3 2020: Q4 2020: Disciplined process-oriented companies Procurement Business 90% Sites Savings Integration Consolidated Completed Completed Full year for joint planning

process FRUTAROM DUPONT N&B Both teams bring depth of experience INTEGRATION Plan to establish integration team with Q1 2020: Start DuPont Q1 2021: Day 1 2021+: Ongoing leaders from both organizations N&B Integration Execution Integration

Milestones Planning Leverage strengths from each company 22

A POWERFUL COMBINATION Redefining the value-add ingredients industry

Combined Company IFF DuPont N&B Broader • Leading value-added ingredients and • A global leader in taste and scent Set of Ingredients and Solutions solutions provider • Leading Natural capabilities • #1 or 2 positions in

cultures, enzymes Deeper and probiotics • Creative and R&D led organization Innovation and R&D Platform • Customer-led innovation and R&D • Broadest customer base with 60% of Shared focused organization sales to local

& regional customers Focus on Consumer-Oriented End Markets (45% in Emerging Markets) • Deep customer relationships across food, nutrition, pharma and HPC >$11B • Well positioned in fast-growing $2.6B customers Pro Forma 2019

adjacencies (i.e., Food Protection, Pro Forma 2019 Revenue • Extensive global sales & applications EBITDA Inclusions, Health ingredients, capability Cosmetic Actives) $550M+ • Deep commitment to sustainability • Deep commitment

to sustainability 2018 Pro Forma and product stewardship R&D Spend 23A POWERFUL COMBINATION Redefining the value-add ingredients industry Combined Company IFF DuPont N&B Broader • Leading value-added ingredients and • A global

leader in taste and scent Set of Ingredients and Solutions solutions provider • Leading Natural capabilities • #1 or 2 positions in cultures, enzymes Deeper and probiotics • Creative and R&D led organization Innovation and

R&D Platform • Customer-led innovation and R&D • Broadest customer base with 60% of Shared focused organization sales to local & regional customers Focus on Consumer-Oriented End Markets (45% in Emerging Markets) • Deep

customer relationships across food, nutrition, pharma and HPC >$11B • Well positioned in fast-growing $2.6B customers Pro Forma 2019 adjacencies (i.e., Food Protection, Pro Forma 2019 Revenue • Extensive global sales &

applications EBITDA Inclusions, Health ingredients, capability Cosmetic Actives) $550M+ • Deep commitment to sustainability • Deep commitment to sustainability 2018 Pro Forma and product stewardship R&D Spend 23

IFF TO COMBINE WITH DUPONT NUTRITION & BIOSCIENCES Creates New Global

Integrated Solutions Leader December 16, 2019IFF TO COMBINE WITH DUPONT NUTRITION & BIOSCIENCES Creates New Global Integrated Solutions Leader December 16, 2019

APPENDIX: DUPONT FY2019 GUIDANCE R E AF F I R M S F Y 1 9 E P R O F O R M

A AD J U S T E D E P S * O F $ 3 . 7 7 T O $ 3 . 8 2 Comments ➢ Macro-related weakness includes $0.39 ($0.49) impact of demand-driven softness, $4.05 2018 primarily in the T&I segment, as Discrete $3.80 ($0.17) $0.02 well as higher costs

on lower Items(1) 2019 production volumes. Discrete Items(2) ➢ FY19 gains of ~$0.25 associated with customer settlements, licensing income and sales of the Solution OLED technology and DuPont Sustainable Solutions not Synergies & Pricing

gains net Currency Other FY18 FY19E Other Cost of macro-related Headwinds expected to repeat in 2020. Pro forma Pro forma Savings, net weakness (*) (*)(3) Adj. EPS Adj. EPS of Inflation (organic growth) (1) FY18 Pro forma Adjusted EPS(*) includes

discrete items of $0.29; ~$0.23 from customer settlements associated with the Hemlock Semiconductor JV, ~$0.03 associated with the sale of the Solutions OLED technology and ~$0.03 associated with a licensing arrangement. Discrete items are included

in pro forma adjusted EPS given either their recurring nature to ongoing company performance or individually being below a threshold to be considered a significant item. (2) FY19E Pro forma Adjusted EPS(*) includes discrete items of $0.25; ~$0.11

from 2019 customer settlements associated with the Hemlock Semiconductor JV, ~$0.08 associated with the sale of the Solutions OLED technology, ~$0.03 associated with a licensing arrangement and ~$0.03 associated with the sale of the DuPont

Sustainable Solutions business. Discrete items are included in pro forma adjusted EPS given either their recurring nature to ongoing company performance or individually being below a threshold to be considered a significant item. (3) FY19E pro forma

adjusted EPS of $3.80 is the mid-point of the range of $3.77 - $3.82. * Adjusted EPS is on a pro forma basis and is a non-gaap measure. Refer to the Reconciliation of Adjusted Earnings Per Share Outlook included in DuPont’s third quarter

earnings announcement released on October 31, 2019 25 which can be found on the Investors section of our website.APPENDIX: DUPONT FY2019 GUIDANCE R E AF F I R M S F Y 1 9 E P R O F O R M A AD J U S T E D E P S * O F $ 3 . 7 7 T O $ 3 . 8 2 Comments

➢ Macro-related weakness includes $0.39 ($0.49) impact of demand-driven softness, $4.05 2018 primarily in the T&I segment, as Discrete $3.80 ($0.17) $0.02 well as higher costs on lower Items(1) 2019 production volumes. Discrete Items(2)

➢ FY19 gains of ~$0.25 associated with customer settlements, licensing income and sales of the Solution OLED technology and DuPont Sustainable Solutions not Synergies & Pricing gains net Currency Other FY18 FY19E Other Cost of

macro-related Headwinds expected to repeat in 2020. Pro forma Pro forma Savings, net weakness (*) (*)(3) Adj. EPS Adj. EPS of Inflation (organic growth) (1) FY18 Pro forma Adjusted EPS(*) includes discrete items of $0.29; ~$0.23 from customer

settlements associated with the Hemlock Semiconductor JV, ~$0.03 associated with the sale of the Solutions OLED technology and ~$0.03 associated with a licensing arrangement. Discrete items are included in pro forma adjusted EPS given either their

recurring nature to ongoing company performance or individually being below a threshold to be considered a significant item. (2) FY19E Pro forma Adjusted EPS(*) includes discrete items of $0.25; ~$0.11 from 2019 customer settlements associated with

the Hemlock Semiconductor JV, ~$0.08 associated with the sale of the Solutions OLED technology, ~$0.03 associated with a licensing arrangement and ~$0.03 associated with the sale of the DuPont Sustainable Solutions business. Discrete items are

included in pro forma adjusted EPS given either their recurring nature to ongoing company performance or individually being below a threshold to be considered a significant item. (3) FY19E pro forma adjusted EPS of $3.80 is the mid-point of the

range of $3.77 - $3.82. * Adjusted EPS is on a pro forma basis and is a non-gaap measure. Refer to the Reconciliation of Adjusted Earnings Per Share Outlook included in DuPont’s third quarter earnings announcement released on October 31, 2019

25 which can be found on the Investors section of our website.

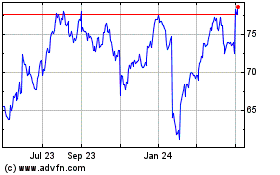

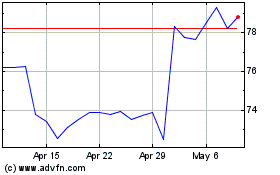

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

From Mar 2024 to Apr 2024

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

From Apr 2023 to Apr 2024