Bank of England: All Seven Large UK Banks Pass Stress Tests

December 16 2019 - 12:53PM

Dow Jones News

By Paul Hannon

The U.K.'s banking system has enough high-quality capital to

withstand a crisis more severe than the one they faced in 2008 and

2009, the Bank of England said Monday.

Announcing the results of its annual stress tests, the BOE also

said that each of the seven banks that were scrutinized also

passed, although it said investors should note they did so only by

cutting their dividend and bonus payments.

The annual tests were introduced in the wake of the global

financial crisis, and are designed to find out whether banks have

enough capital to take large losses without cutting back on their

own lending. Banks that fail the test are required to add fresh

capital.

The seven banks tested were Barclays PLC (BARC.LN), HSBC

Holdings PLC (HSBA.LN), Lloyds Banking Group PLC (LLOY.LN),

Nationwide Building Society, Royal Bank of Scotland Group PLC

(RBS.LN), Santander U.K. Group Holdings PLC and Standard Chartered

PLC (STAN.LN).

"The U.K. banking system would be resilient to deep simultaneous

recessions in the U.K. and global economies, combined with large

falls in asset prices and...misconduct costs," the BOE said.

The BOE said that U.K. banks entered the stress tests with

common equity Tier 1 capital that was three times higher than

before the global crisis, at 14.5% of risk-weighted assets. Even

after the losses they faced under the stress scenarios, U.K. banks

still had twice as much such capital as they did before the crisis,

at 9.3% of risk-weighted assets.

The BOE said the stress tests also indicated that U.K. banks

could withstand a disorderly departure from the European Union, a

scenario that has become less likely since elections Thursday gave

U.K. Prime Minister Boris Johnson a large majority in

parliament.

The BOE's Financial Policy Committee also said it had "tweaked"

its capital requirements for U.K. banks. From late 2020, U.K. banks

will be required to have a countercyclical capital buffer

equivalent to 2% of their risk-weighted assets, up from 1% now.

The buffer is designed to build up capital during periods of

economic growth and expanding credit that can be drawn on during

downturns. The BOE said that if it were to cut the buffer to zero

from that level during a downturn, banks would be able to take

GBP23 billion in losses without having to restrict their

lending.

The BOE said it will also "consult" on an offsetting reduction

in minimum capital requirements for banks, leaving their combined

loss-absorbing capacity "broadly unchanged."

Write to Paul Hannon at paul.hannon@wsj.com

(END) Dow Jones Newswires

December 16, 2019 12:38 ET (17:38 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

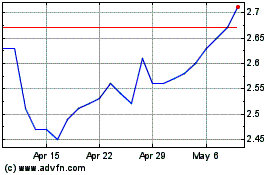

Lloyds Banking (NYSE:LYG)

Historical Stock Chart

From Mar 2024 to Apr 2024

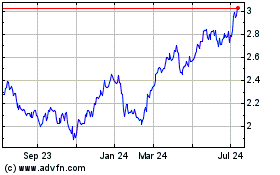

Lloyds Banking (NYSE:LYG)

Historical Stock Chart

From Apr 2023 to Apr 2024