By Brent Kendall and Anne Steele

WASHINGTON -- The Justice Department is preparing to take legal

action against Live Nation Entertainment Inc. on allegations the

company has sought to strong-arm concert venues into using its

dominant Ticketmaster subsidiary, according to people familiar with

the matter.

The department believes the concert-promotion giant's conduct

has violated the merger settlement Live Nation and Ticketmaster

reached with the government in 2010, the people said. Under that

agreement, the department's antitrust division allowed the

companies to combine, but required them to abide by conditions

designed to keep consumer prices in check by preserving competition

in the music and ticketing industries.

As ticket prices have risen, critics have questioned whether the

settlement has worked as intended. It is due to expire next year,

but the Justice Department now plans to ask a judge to extend the

restrictions by several years and prohibit the alleged coercive

conduct by Live Nation, the people said.

Live Nation's chief executive has publicly denied that the

company has violated its agreement. The company and the Justice

Department have engaged in talks but haven't settled their

differences, people familiar with the matter said.

Details about the department's specific concerns couldn't

immediately be learned.

The Live Nation-Ticketmaster merger consolidated two of the most

powerful forces in the music industry. As the world's largest

concert promoter, Live Nation organizes live music events --

booking talent, securing venues, setting ticket prices and

marketing shows. It has also built a robust artist-management

business.

The merger faced opposition at the time it was announced in

2009, and the Obama-era Justice Department's decision to allow the

deal with a settlement wasn't well-received in some industry and

consumer circles. Critics who say U.S. antitrust enforcement has

been too lax have often pointed to the merger as one where the

government should have taken a harder line to protect

consumers.

In the past decade, and particularly over the last few years,

ticket prices have soared -- increasing by nearly 50% since 2009 to

$92.42 on average for the top 100 tours world-wide, according to

Pollstar.

The settlement, known as a consent decree, forbids Live Nation

from forcing venues that want to book the concert promoter's tours

to use Ticketmaster for those shows, and from retaliating when

venues choose to use a ticketing competitor instead.

The deal also required Ticketmaster to license its technology to

Anschutz Entertainment Group, the distant No. 2 concert promoter,

to build a competitive ticketing platform. That ticketing service,

AXS, has had limited success outside of AEG's own venues.

Assistant Attorney General Makan Delrahim, the Justice

Department's antitrust chief, confirmed during a September Senate

hearing that the department was investigating allegations that Live

Nation had been violating the decree.

Typically, venues ranging from nightclubs and theaters to arenas

and stadiums enter long-term contracts giving a ticketing provider

the exclusive right to sell tickets to any event they host.

Ticketmaster holds an estimated 80% of the market, according to

people in the concert industry. Over the years, Live Nation's

competitors have accused it of using its market power as a concert

promoter and artist manager to coerce venues into using

Ticketmaster or risk losing out on lucrative bookings.

While in theory advances in new technology have made it easier

for other ticketing companies to challenge Ticketmaster, in

practice few venues have defected from their longstanding contracts

with the giant, according to people in the industry. Almost 10

years since the decree was put in place, Ticketmaster has no

serious competitor.

Live Nation previously dismissed the calls for investigation as

based on a misunderstanding of the decree and ticketing-industry

dynamics. Speaking at a conference in mid-September, Live Nation

Chief Executive Michael Rapino said the decree allows the company

to make decisions that are "right for our business," and that

booking a Live Nation tour date at a venue that uses a ticketing

provider other than Ticketmaster may not make economic sense for

the company. He acknowledged that competitors have raised flags to

the Justice Department, but said the company had never been found

to engage in wrongdoing.

"We have no fear that we have any systematic issues. We're very

compliant," he said.

The company has been facing fire from Congress as well as the

Justice Department.

In August, Sens. Richard Blumenthal (D., Conn.) and Amy

Klobuchar (D., Minn.) asked DOJ to investigate the state of

competition in ticketing, focusing on the Live Nation-Ticketmaster

merger.

Last week, four House lawmakers sent a letter to the department

that expressed concerns about the merger, saying, "Our constituents

are facing significantly increased live event prices and a lack of

meaningful alternatives to purchase tickets to live events."

The signatories were Reps. Ken Buck (R., Colo.), Matt Gaetz (R.,

Fla.), Lucy McBath (D., Ga.) and James Sensenbrenner (R.,

Wis.).

The Justice Department rarely has sued companies for alleged

violations of antitrust consent decrees, but Mr. Delrahim has

publicly voiced the need for companies to abide by their

commitments. He has called for changes in decree language that

would make it easier for the department to establish violations in

court, and to force merged companies to pay the government's costs

in enforcing merger settlements.

The Live Nation decree also has arisen recently in a second

context with the Justice Department. The company has asked the DOJ

for permission to explore a transaction involving Rival, a

ticketing company launched last year by former Ticketmaster CEO

Nathan Hubbard, according to people familiar with the matter.

The decree requires Live Nation to give notice of any potential

transactions of a ticketing company so the department can

investigate the competitive effects of any such deal.

Mr. Hubbard led Ticketmaster for four years after the

merger.

Mr. Hubbard, whose efforts attracted high-profile backers

including top Silicon Valley venture-capital firm Andreessen

Horowitz and Santa Monica, Calif.-based Upfront Ventures,

envisioned fully digitizing tickets could address inefficiencies in

how live events operate, and make them safer, by connecting

identity, payment and location data.

He built the aptly named Rival to be what he hoped would be a

serious competitor in ticketing.

Write to Brent Kendall at brent.kendall@wsj.com and Anne Steele

at Anne.Steele@wsj.com

(END) Dow Jones Newswires

December 13, 2019 16:21 ET (21:21 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

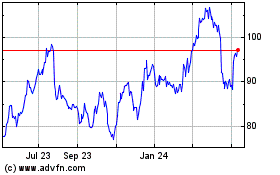

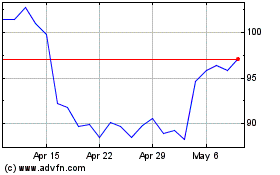

Live Nation Entertainment (NYSE:LYV)

Historical Stock Chart

From Mar 2024 to Apr 2024

Live Nation Entertainment (NYSE:LYV)

Historical Stock Chart

From Apr 2023 to Apr 2024