Weak U.S. Demand Weighs on Tiffany -- WSJ

December 06 2019 - 3:02AM

Dow Jones News

By Robert Barba and Charity L. Scott

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (December 6, 2019).

Tiffany & Co. reported flat quarterly sales as softness in

the U.S. market offset growth in mainland China, highlighting the

challenges LVMH Moët Hennessy Louis Vuitton SE faces once it takes

over the famed American jeweler.

Tiffany reported $1.01 billion in world-wide net sales in the

third quarter, unchanged from a year earlier. Analysts polled by

FactSet were expecting $1.04 billion. Accounting for currency

fluctuations, net sales rose 1%. The company said Thursday net

sales in the Americas declined 4% in the period, citing lower

spending by foreign tourists. In mainland China, Tiffany reported

more than 10% growth. Late last month, Tiffany agreed to sell

itself to LVMH for roughly $16.2 billion. The European luxury

conglomerate is betting it can breathe life into a brand that has

struggled with weak demand at home and abroad.

"LVMH has bought a solid brand that will nicely complement its

existing portfolio," Neil Saunders, managing director of GlobalData

Retail, wrote in a research note. "However, it paid full price for

a business that still needs a lot of work to reach its potential."

He said he doesn't expect the holiday season to be particularly

bright for Tiffany either, pointing to data that shows shoppers

eschewing jewelry in favor of more practical gifts.

Tiffany said its quarterly profit declined to $78.4 million, or

65 cents a share, from $94.9 million, or 77 cents a share, a year

earlier. Analysts were expecting earnings of 87 cents a share.

Also Thursday, Signet Jewelers Ltd. reported

better-than-expected results for its fiscal third quarter and

boosted its annual guidance, sending shares of the mall-based chain

higher. Its stock closed up over 7% at $17.89.

The company, which owns brands such as Kay Jewelers, Zales and

Jared, has lost about two-thirds of its market value over the past

12 months. Last year it said it would close more than 200 stores

and open new ones outside of shopping centers, in a bid to blunt

the effects of declining foot traffic at malls.

Signet reported a loss of $43.7 million, compared with a loss of

$38.1 million a year ago. Revenue was $1.19 billion, roughly flat

from a year earlier. Same-store sales rose 2.1% in the quarter.

Analysts expected a 1.5% decline.

The company said it expects its same-store sales to be down 1.7%

to 1% in fiscal 2020. It had previously forecast same-store sales

to drop 2.5% to 1.5%.

Write to Robert Barba at Robert.Barba@wsj.com

(END) Dow Jones Newswires

December 06, 2019 02:47 ET (07:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

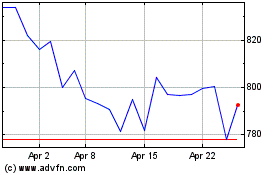

Lvmh Moet Hennessy Louis... (EU:MC)

Historical Stock Chart

From Mar 2024 to Apr 2024

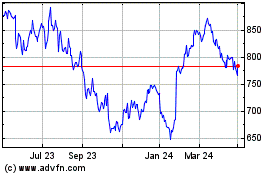

Lvmh Moet Hennessy Louis... (EU:MC)

Historical Stock Chart

From Apr 2023 to Apr 2024