UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14C

INFORMATION STATEMENT

PURSUANT TO SECTION 14C OF THE

SECURITIES EXCHANGE ACT OF 1934

|

|

☒

|

Filed by the Registrant

|

☐ Filed by a Party other than the Registrant

|

Check the appropriate box::

|

|

☒

|

Preliminary Information Statement

|

|

|

☐

|

Definitive Information Statement Only

|

|

|

☐

|

Confidential, for Use of the Commission (as permitted by

Rule 14c)

|

CARDIFF LEXINGTON

CORPORATION

(Name of Registrant as

Specified in Its Charter)

________________________________________

Name of Person(s) Filing

Information Statement, if other than Registrant:

Payment of Filing Fee (Check the appropriate box):

|

☒

|

No fee required.

|

|

☐

|

Fee computed on table below per Exchange Act Rules 14C-5(g) and 0-11.

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

(3) Per

unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount of which

the filing fee is calculated and state how it was determined):

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

☐

|

Fee paid previously with preliminary materials.

|

☐

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11 (a) (2) and identify

the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number,

or the Form or Schedule and the date of its filing.

|

1)

|

Amount previously paid:

|

|

2)

|

Form, Schedule or Registration Statement No.:

|

|

3)

|

Filing Party:

|

|

4)

|

Date Filed:

|

CARDIFF LEXINGTON CORPORATION

401 Las Olas Blvd, Unit

1400

Ft. Lauderdale, Florida 33301

(844) 628-2100

Copies of correspondence

to:

Frederick C. Bauman,

Esq.

Bauman

& Associates Law Firm

6440 Sky Pointe Dr., Ste 140-149

Las Vegas, NV 89131

(702) 533-8372

NOTICE OF ACTION TAKEN

WITHOUT A STOCKHOLDER MEETING

Date of Mailing: December

2, 2019

STOCKHOLDERS OF CARDIFF LEXINGTON CORPORATION:

The

purpose of this Information Statement is to inform the holders of record, as of the close of business on December 2, 2019 (the

“Record Date”), of shares of all series of stock with voting power of Cardiff Lexington Corporation, a Florida corporation

(the “Company,” or the “Corporation”), that our Board of Directors (the “Board”) and the Holders

of a majority of each Series of Preferred Stock affected herein, as of the Record Date have giving written consent as of November

18, 2019, to approve the following (the “Corporate Actions”):

|

|

(a)

|

To authorize the Board to effectuate a reverse stock split of certain Series

of Preferred Stock as detailed herein, and

|

|

|

(b)

|

To authorize the filing of Amendment(s) to the Designation(s) of certain Series

of Preferred Stock as detailed herein.

|

On

November 12, 2019, the Board recommended to the Shareholders, and by the close of business on November 18, 2019, the Holders

of a majority of each Series of Preferred Stock affected herein consented in writing to approve the corporate actions

described above, which are described in greater detail in the Information Statement accompanying this notice. This consent

was sufficient to satisfy the stockholder approval requirement for the proposed action. The actions detailed herein will

become effective upon filing with the Florida Secretary of State, but no earlier than twenty (20) calendar days after filing

and dissemination of the Definitive Information Statement.

NO VOTE OR OTHER ACTION OF

THE COMPANY'S STOCKHOLDERS IS REQUIRED IN CONNECTION WITH THIS INFORMATION STATEMENT. WE ARE NOT ASKING YOU FOR A PROXY AND YOU

ARE REQUESTED NOT TO SEND US A PROXY.

Please read this Notice and

Information Statement carefully and in its entirety. It describes the terms of the actions taken by the stockholders.

Although you will not have

an opportunity to vote on the approval of the Corporate Actions, this Information Statement contains important information regarding

the Corporate Actions.

|

|

By Order of the Board of Directors

|

|

|

|

|

|

/s/ Alex Cunningham

|

|

|

Alex Cunningham, President / CEO

|

|

|

|

|

|

/s/ Daniel Thompson

|

|

|

Daniel Thompson, Chairman / Principal Accounting

Officer

|

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF

INFORMATION STATEMENT MATERIALS IN CONNECTION WITH THIS NOTICE OF STOCKHOLDER ACTION BY WRITTEN CONSENT:

CARDIFF LEXINGTON CORPORATION

401 Las Olas Blvd, Unit

1400

Ft. Lauderdale, Florida 33301

(844) 628-2100

THIS INFORMATION STATEMENT

IS BEING PROVIDED TO

YOU BY THE BOARD OF DIRECTORS OF THE COMPANY

WE

ARE NOT ASKING YOU FOR A PROXY AND

YOU ARE REQUESTED NOT TO SEND US A PROXY

Cardiff Lexington Corporation

401 Las Olas Blvd, Unit 1400

Ft. Lauderdale, Florida 33301

(844) 628-2100

INFORMATION STATEMENT

December

2, 2019

GENERAL INFORMATION

This Information Statement

has been filed with the Securities and Exchange Commission and is being furnished, pursuant to Section 14C of the Securities Exchange

Act of 1934, as amended (the “Exchange Act”), to the stockholders of Cardiff Lexington Corporation. (the “Stockholders”),

a Florida corporation (the "Company," "we" or "us"), to advise them of the corporate actions that

have been authorized by written consent of two of the Company's stockholders. These actions are being taken without notice, meetings

or votes in accordance with 2018 Florida Statutes Section 607.0704 and the Company’s Articles of Incorporation. This Information

Statement constitutes notice to the non-consenting shareholders pursuant to 2018 Florida Statutes Section 607.0704(3). This Information

Statement is being mailed to the stockholders of the Company on ___________, 2019.

On November 12, 2019, the

Board recommended to the Shareholders, and by the close of business on November 18, 2019, the Holders of a majority of each Series

of Preferred Stock affected herein consented in writing to approve the following corporate actions (the “Corporate Actions”):

|

|

1.

|

A reverse stock split of certain Series of Preferred Stock as detailed herein; and

|

|

|

2.

|

The filing of Amendment(s) to the Designation(s) of certain Preferred Stock

as detailed herein. The Amendment(s) to the Designation(s) of the Preferred Stock will amend the voting rights and conversion rights

of specified Series of Preferred Stock.

|

Accordingly, your consent is not required and

is not being solicited in connection with the approval of the matters set forth herein.

We are not aware of any substantial interest,

direct or indirect, by security holders or otherwise, that is in opposition to matters of action taken. In addition, pursuant to

the laws of the State of Florida, the actions taken by majority written consent in lieu of a special shareholder meeting do not

create appraisal or dissenters’ rights.

Our board of directors determined

to pursue shareholder action by majority written consent presented by our shares of Series A Preferred stock in an effort to reduce

the costs and management time required to hold a special meeting of shareholders and to implement the above action to our shareholders

in a timely manner.

The above actions will become effective 20 days

following the mailing to the Stockholders of the Definitive Information Statement, or as soon thereafter as is practicable, which

will be on or about

2019.

WE

ARE NOT ASKING YOU FOR A PROXY AND YOU ARE

REQUESTED NOT TO SEND A PROXY.

HOUSEHOLDING OF STOCKHOLDER

MATERIALS

In some instances, we may

deliver only one copy of this Information Statement to multiple stockholders sharing a common address. If requested by phone or

in writing, we will promptly provide a separate copy to a stockholder sharing an address with another stockholder. Requests by

phone should be directed to our President at (844) 628-2100, and requests in writing should be sent to Cardiff Lexington Corp.,

Attention President, 401 Las Olas Blvd., Unit 1400, Ft. Lauderdale, FL 33301. Stockholders sharing an address who currently receive

multiple copies and wish to receive only a single copy should contact their broker or send a signed, written request to us at the

above address.

INFORMATION ON CONSENTING

STOCKHOLDERS

As of the close of business on November 18, 2019, the

Holders of a majority of each Series of Preferred Stock affected herein consented in writing to approve the Corporate Actions.

COMMON STOCK OWNERSHIP

TABLE

The following table provides certain information

regarding the ownership of our common stock as of the date of the filing of this annual report by:

|

|

·

|

Each of our executive officers;

|

|

|

·

|

Each person known to us to own more than 5% of our outstanding common stock; and

|

|

|

·

|

All of our executive officers and directors and as a group

|

|

Title of Class

|

|

Name and Address of Beneficial Owner(4)

|

|

Amount and Nature of

Beneficial Ownership(4)

|

|

Percentage

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock

|

|

Daniel Thompson(2)(3) 401 East Las Olas Blvd.,

Unit 1400

Ft. Lauderdale, FL

|

|

57,516,351shares of common stock (direct)

|

|

4.2%(1)

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock

|

|

Alex Cunningham(2)(3) 401 East Las Olas Blvd.,

Unit 1400

Ft. Lauderdale, FL

|

|

50,512,789 shares of common stock (direct)

|

|

3.7%(1)

|

|

|

|

|

|

|

|

|

|

|

Our officers and

directors as a group

|

|

–

|

|

108,029,140 shares of common stock

|

|

7.9%(1)

|

|

___________________

|

|

(1)

|

Based on 539,169,831 common shares outstanding as of November 5, 2019.

|

|

|

(2)

|

Daniel Thompson also owns 1 share of Preferred

“A”, 720,000 shares of Preferred “B” 1 share of Preferred “C” and 97,500,000 shares of “Preferred

I”; and Alex Cunningham also owns 9,999 shares of Preferred “B,” 1 share of Preferred “C” and 97,500,000

shares of Preferred “I”, respectively.

|

|

|

(3)

|

These are the officers and directors of the Company.

|

|

|

(4)

|

For purposes of this table, “beneficial ownership” is determined

in accordance with Rule 13d-3 under the Securities Exchange Act of 1934, pursuant to which a person or group of persons is deemed

to have beneficial ownership of any common shares that such person or group has the right to acquire within 60 days after November

12, 2019. For purposes of computing the percentage of outstanding common shares held by each person or group of persons named above,

any shares that such person or group has the right to acquire within 60 days after November 12, 2019 are deemed outstanding but

are not deemed to be outstanding for purposes of computing the percentage ownership of any other person or group.

|

PROPOSAL NUMBER ONE: APPROVAL

OF A REVERSE STOCK SPLIT ON CERTAIN SERIES OF PREFERRED STOCK

GENERAL

On

November 12, 2019, the Board recommended to the Shareholders, and by the close of business on November 18, 2019, the Holders of

a majority of each Series of Preferred Stock affected herein approved by written consent to approve a resolution to effectuate

a reverse stock split (the “Reverse Stock Split”) on the Series specified in the chart below, and in the ratios as

described in Table 1 below:

|

SERIES

|

|

REVERSE/ FORWARD RATIO

|

|

|

B

|

|

1.6:1

|

|

|

|

D

|

|

1.6:1

|

|

|

|

D1

|

|

1.6:1

|

|

|

|

E

|

|

1.6:1

|

|

|

|

E1

|

|

1.6:1

|

|

|

|

F

|

|

1.6:1

|

|

|

|

F1

|

|

1.6:1

|

|

|

|

G

|

|

57.1:1

|

|

|

|

G1

|

|

57.1:1

|

|

|

|

H

|

|

22.1:1

|

|

|

|

H1

|

|

22.1:1

|

|

|

|

L

|

|

307.7:1

|

|

PLEASE

NOTE THAT THE REVERSE STOCK SPLIT WILL NOT CHANGE YOUR PROPORTIONATE EQUITY INTEREST IN THE COMPANY, EXCEPT AS MAY RESULT FROM

THE ISSUANCE OR CANCELLATION OF SHARES PURSUANT TO THE FRACTIONAL SHARES.

PLEASE

NOTE THAT THE REVERSE STOCK SPLIT WILL NOT HAVE ANY EFFECT ON THE NUMBER OF AUTHORIZED SHARES.

MATERIAL EFFECTS OF

THE REVERSE STOCK SPLIT

When a company engages

in a reverse stock split, it substitutes one share of stock for a predetermined amount of shares of stock. It does not increase

the market capitalization of the company. Under this reverse stock split each share of Preferred Stock will be automatically converted

at the rate as described in Table 1. To avoid the issuance of fractional shares of Preferred Stock, the Company will issue an additional

share to all holders of fractional shares.

The Reverse Stock

Split will affect all of our stockholders of Preferred Stock Series B, D, D1, E, E1, F, F1, G, G1, H, H1, and L and will not

affect any stockholder's percentage ownership interests in the Company or proportionate voting power, except to the extent

that the Reverse Stock Split results in any of our stockholders owning a fractional share. All stockholders holding a

fractional share shall be issued an additional share. The principal effect of the Reverse Stock Split will be that the number

of shares of Preferred Stock issued and outstanding will be reduced. The Reverse Stock Split will not affect the shares of

any Series of Preferred Stock of the Company that are not specifically detailed in Table 1 above. The number of authorized

shares of Preferred Stock will not be affected.

Due to the fact that we

are not decreasing the number of Authorized Preferred Stock of the Company in conjunction with the Reverse Stock Split, it will

have many of the same effects as an increase in authorized preferred stock. We are not undergoing a Reverse Stock Split in order

to construct or enable any anti-takeover defense or mechanism on behalf of the Company. While it is possible that management could

use the additional common shares to resist or frustrate a third-party transaction providing an above-market premium that is favored

by a majority of the independent stockholders, we have no intent or plan to employ the additional unissued authorized shares as

an anti-takeover device.

FRACTIONAL SHARES

We

will not issue fractional certificates for post- Reverse Stock Split shares in connection with the Reverse Stock Split. Instead,

an additional share shall be issued to all holders of a fractional share. To the extent any holders of pre- Reverse Stock Split

shares are entitled to fractional shares as a result of the Reverse Stock Split, the Company will issue an additional share to

all holders of fractional shares.

STOCKHOLDERS SHOULD NOT DESTROY

ANY STOCK CERTIFICATE AND SHOULD NOT SUBMIT ANY CERTIFICATES WITHOUT BEING ASKED TO DO SO.

FEDERAL INCOME TAX

CONSEQUENCES

The following discussion

is a summary of certain United States federal income tax consequences of the Reverse Stock Split to us and stockholders of our

common stock. It does not purport to be a complete discussion of all of the possible federal income tax consequences of the Reverse

Stock Split and is included for general information only. This discussion is based on laws, regulations, rulings and decisions

in effect on the date hereof, all of which are subject to change (possibly with retroactive effect) and to differing interpretations.

This discussion only applies to stockholders that are U.S. persons as defined in the Internal Revenue Code of 1986, as amended,

and does not describe all of the tax consequences that may be relevant to a stockholder in light of his particular circumstances

or to stockholders subject to special rules (such as dealers in securities, financial institutions, insurance companies, tax-exempt

organizations, foreign individuals and entities, and persons who acquired their common stock as compensation). In addition, this

summary is limited to stockholders that hold their common stock as capital assets. This discussion also does not address any tax

consequences arising under the laws of any state, local or foreign jurisdiction or alternative minimum tax consequences. The tax

treatment of each stockholder may vary depending upon the particular facts and circumstances of such stockholder.

We have not sought and will

not seek an opinion of counsel or a ruling from the Internal Revenue Service regarding the federal income tax consequences of the

Reverse Stock Split. We believe, however, that because the Reverse Stock Split is not part of a plan to periodically increase or

decrease any stockholder’s proportionate interest in the assets or earnings and profits of our company, the Reverse Stock

Split should have the federal income tax effects described below:

|

|

§

|

The exchange of pre-split shares for post-split shares should not result in

recognition of gain or loss for federal income tax purposes.

|

|

|

§

|

The stockholder’s aggregate tax basis in the post-split shares would

equal that stockholder’s aggregate tax basis in the pre-split shares.

|

|

|

§

|

The stockholder’s holding period for the post-split shares will include

such stockholder’s holding period for the pre-split shares.

|

|

|

§

|

Provided that a stockholder held the pre-split shares as a capital asset, the

post-split shares received in exchange therefor would also be held as a capital asset.

|

We believe that our Company

should not recognize gain or loss as a result of the Reverse Stock Split. Our view regarding the tax consequences of the Reverse

Stock Split is not binding on the Internal Revenue Service or the courts. We urge all stockholders to consult their own tax advisers

to determine the particular federal, state, local and foreign tax consequences to each of them of the Reverse Stock Split.

TO

ENSURE COMPLIANCE WITH TREASURY DEPARTMENT CIRCULAR 230, STOCKHOLDERS ARE HEREBY NOTIFIED THAT: (A) ANY DISCUSSION OF FEDERAL TAX

ISSUES IN THIS INFORMATION STATEMENT IS NOT INTENDED OR WRITTEN TO BE RELIED UPON, AND CANNOT BE RELIED UPON BY STOCKHOLDERS FOR

THE PURPOSE OF AVOIDING PENALTIES THAT MAY BE IMPOSED ON STOCKHOLDERS UNDER THE INTERNAL REVENUE CODE; (B) SUCH DISCUSSION IS INCLUDED

HEREIN BY THE COMPANY IN CONNECTION WITH THE PROMOTION OR MARKETING (WITHIN THE MEANING OF CIRCULAR 230) BY THE COMPANY OF THE

TRANSACTIONS OR MATTERS ADDRESSED HEREIN; AND (C) STOCKHOLDERS SHOULD SEEK ADVICE BASED ON THEIR PARTICULAR CIRCUMSTANCES FROM

AN INDEPENDENT TAX ADVISOR.

PROPOSAL NUMBER TWO:TO

FILE WITH THE STATE OF FLORIDA AMENDMENT(S) TO THE DESIGNATION(S) OF CERTAIN SERIES OF PREFERRED STOCK

On November 12, 2019, the

Board recommended to the Shareholders, and by the close of business on November 18, 2019, the Holders of a majority of each Series

of Preferred Stock affected herein approved by written consent to approve a resolution in favor of the filing of Amendment(s) to

the Designation(s) of certain shares of Preferred Stock, attached hereto as Exhibit A. The Amendment(s) will affect only the Conversion

Rights of the shares, and the Voting Rights of the shares, as detailed below:

|

|

a.

|

Holders of the Series B, D, D1, E, E1, F, F1, G, G1, H, H1, I, J, J1, L, L1, M, and P Preferred Stock shall have

Conversion Rights that are affected by the closing common share market price on the date of conversion as reported on such national

exchange where the Company’s common stock is traded:

|

|

|

|

i.

|

If the closing market price is less than $4 per share one (1) share of the respective Series of Preferred

Stock described in this Section 4(a) shall convert into an amount of common stock equal to: two (2) times the Stated Value, as

defined herein, divided by the closing market price as reported on such national exchange where the Company’s common stock

is traded on the date of conversion.

|

|

|

|

|

For Example. If the closing price of the common stock as reported on such national exchange where the Company’s

common stock is traded is $1.00 and the Stated Value is $4.00, one (1) preferred share would convert into eight (8) shares of common

stock.

|

|

|

|

|

|

|

|

|

ii.

|

If the closing market price is equal to or greater than $4 per share one (1) share of the respective Series

of Preferred Stock described in this Section 4(a) shall convert into two (2) shares of common stock.

|

|

|

|

|

For Example. If the closing price of the common stock as reported on such national exchange where the Company’s

common stock is traded is $5.00 one (1) preferred share would convert into two (2) shares of common stock.

|

|

|

b.

|

Holders of the Series C Preferred Stock shall have Conversion Rights such

that upon Conversion each one (1) share of Series C Preferred Stock shall convert into one hundred thousand (100,000) shares of

the Common Stock. In the event that the Company should up list to a national exchange as defined by the U.S. Securities and Exchange

Commission , each share of Series C Preferred Stock shall automatically be redeemed by the Company in exchange for a total of Fifty

Thousand Dollars ($50,000.00) worth of the Common Stock, valued at the time of redemption.

|

|

|

c.

|

Holders if the Series K and K1 Preferred Stock shall have Conversion Rights

such that upon Conversion each one (1) share of Series K and K1 Preferred Stock shall convert into 1.25 shares of the Common Stock.

|

SECURITY OWNERSHIP OF CERTAIN

BENEFICIAL OWNERS AND MANAGEMENT

On November 12, 2019, the Board recommended to

the Shareholders, and by the close of business on November 18, 2019, the Holders of a majority of each Series of Preferred

Stock affected herein, consented in writing to approve the Corporate Actions.

For purposes of this

Information Statement “beneficial ownership” is determined in accordance with Rule 13d-3 under the Securities

Exchange Act of 1934, pursuant to which a person or group of persons is deemed to have “beneficial ownership” of

any common shares that such person or group has the right to acquire within 60 days after November 18, 2019. For purposes of

computing the percentage of outstanding common shares held by each person or group of persons named above, any shares that

such person or group has the right to acquire within 60 days after November 18, 2019 are deemed outstanding but are not

deemed to be outstanding for purposes of computing the percentage ownership of any other person or group.

NO VOTE OR OTHER ACTION OF THE COMPANY'S STOCKHOLDERS

IS REQUIRED IN CONNECTION WITH THIS INFORMATION STATEMENT. WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND

US A PROXY.

There are no

stockholder dissenters' or appraisal rights in connection with any of the matters discussed in this Information Statement.

Please read this Notice and Information Statement carefully and in its entirety. It describes the terms of the actions taken

by the stockholders. Although you will not have an opportunity to vote on the approval of the Articles of Amendment, this

Information Statement contains important information about the Articles of Amendment.

IMPORTANT NOTICE REGARDING THE AVAILABILITY

OF INFORMATION STATEMENT MATERIALS IN CONNECTION WITH THIS NOTICE OF STOCKHOLDER ACTION BY WRITTEN CONSENT:

The Information Statement is available at: www.cardifflexington.com

|

|

By Order of the Board of Directors

|

|

|

/s/ Daniel Thompson

|

|

|

Daniel Thompson, Chairman and Director

|

|

|

|

|

|

Date:

November 18, 2019

|

EXHIBIT A

CARDIFF LEXINGTON CORPORATION.

AMENDED CERTIFICATE OF

DESIGNATION OF PREFERENCES,

RIGHTS AND LIMITATIONS

OF

CERTAIN SERIES OF PREFERRED

STOCK

DESIGNATION OF THE SERIES

B, C, D, D1, E, E1, F, F1, G, G1, H, H1, I, J, J1, L, L1, M, P PREFERRED STOCK

Section 1. Designation,

Amount, and Par Value. The designation of such series of the Preferred Stock shall be the Series B, C, D, D1, E, E1, F, F1,

G, G1, H, H1, I, J, J1, L, L1, M, or P Preferred Stock, no par value per share, with a Stated Value of $4.00 per share (collectively,

the "Preferred Stock"). The Preferred Stock shall rank senior to the Company's common stock, par value $0.0001 per share

(the "Common Stock"), and to all other classes and series of equity securities of the Company which by their terms do

not rank senior to the Series of Preferred Stock ("Junior Stock"). The Preferred Stock shall be subordinate to and rank

junior to all indebtedness of the Company now or hereafter outstanding.

Section 2. Voting Rights.

The Preferred Stock of the Company shall have the Voting Rights as described below:

|

|

a.

|

Holders of the Series B, C, D, E, F, G, H, J, K, L, M, and P Preferred Stock shall have one (1) vote per

share on any matter on which the holders of the Common Stock are entitled to vote.

|

|

|

b.

|

Holders of the Series I Preferred Stock shall have five (5) votes per share

on any matter on which the holders of the Common Stock are entitled to vote.

|

|

|

c.

|

Holders of the Series D1, E1, F1, G1, H1, J1, K1, and L1 Preferred Stock

shall have no voting rights on any matter.

|

Section 3.

Liquidation. Upon any liquidation, dissolution or winding-up of the Corporation, whether voluntary or involuntary (a

"Liquidation"), the Holders shall be entitled to receive out of the assets of the Company whether such assets are

capital or surplus, for each share of Preferred Stock an amount equal to the Holder's pro rata share of the assets and funds

of the Corporation to be distributed, less any amount distributed to the Holders of the Preferred Stock, assuming their

conversion of Preferred Stock to Common Stock and if the assets of the Company shall be insufficient to pay in full such

amounts, then the entire assets to be distributed to the Holders shall be distributed among the Holders ratably in accordance

with the respective amounts that would be payable on such shares if all amounts payable thereon were paid in full.

Section 4. Conversion.

Holders of Preferred Stock shall have the following rights with respect to the conversion of the Preferred Stock into shares

of Common Stock:

|

|

a.

|

Holders of the Series B, D, D1, E, E1, F, F1, G, G1, H, H1, I, J, J1, L, L1, M, and P Preferred Stock shall have

Conversion Rights that are affected by the closing common share market price on the date of conversion as reported on such national

exchange where the Company’s common stock is traded:

|

|

|

|

i.

|

If the closing market price is less than $4 per share one (1) share of the respective Series of Preferred

Stock described in this Section 4(a) shall convert into an amount of common stock equal to: two (2) times the Stated Value, as

defined herein, divided by the closing market price as reported on such national exchange where the Company’s common stock

is traded on the date of conversion.

|

|

|

|

|

For Example. If the closing price of the common stock as reported on such national exchange where the Company’s

common stock is traded is $1.00 and the Stated Value is $4.00, one (1) preferred share would convert into eight (8) shares of common

stock.

|

|

|

|

|

|

|

|

|

ii.

|

If the closing market price is equal to or greater than $4 per share one (1) share of the respective Series

of Preferred Stock described in this Section 4(a) shall convert into two (2) shares of common stock.

|

|

|

|

|

For Example. If the closing price of the common stock as reported on such national exchange where the Company’s

common stock is traded is $5.00 one (1) preferred share would convert into two (2) shares of common stock.

|

|

|

b.

|

Holders of the Series C Preferred Stock shall have Conversion Rights such

that upon Conversion each one (1) share of Series C Preferred Stock shall convert into one hundred thousand (100,000) shares of

the Common Stock. In the event that the Company should up list to a national exchange as defined by the U.S. Securities and Exchange

Commission , each share of Series C Preferred Stock shall automatically be redeemed by the Company in exchange for a total of Fifty

Thousand Dollars ($50,000.00) worth of the Common Stock, valued at the time of redemption.

|

|

|

c.

|

Holders if the Series K and K1 Preferred Stock shall have Conversion Rights

such that upon Conversion each one (1) share of Series K and K1 Preferred Stock shall convert into 1.25 shares of the Common Stock.

|

|

|

d.

|

Mechanics of Conversion

|

|

|

i.

|

Delivery of Certificate Upon Conversion. Not later than three Trading Days

after each Conversion Date (the “Share Delivery Date”), the Corporation shall deliver to the Holder (A) a certificate

or certificates which, after the Effective Date, representing the number of shares of Common Stock being acquired upon the conversion

of shares of each respective Series of Preferred Stock as described above, and (B) a bank check in the amount of accrued and unpaid

dividends (if the Corporation has elected or is required to pay accrued dividends in cash). If in the case of any Notice of Conversion

such certificate or certificates are not delivered to or as directed by the applicable Holder by the third Trading Day after the

Conversion Date, the Holder shall be entitled to elect by written notice to the Corporation at any time on or before its receipt

of such certificate or certificates thereafter, to rescind such conversion, in which event the Corporation shall immediately return

the certificates representing the shares of Preferred Stock tendered for conversion.

|

|

|

ii.

|

Obligation Absolute. The Corporation’s obligations

to issue and deliver the Conversion Shares upon conversion of Preferred Stock in accordance with the terms hereof are absolute

and unconditional, irrespective of any action or inaction by the Holder to enforce the same, any waiver or consent with respect

to any provision hereof, the recovery of any judgment against any Person or any action to enforce the same, or any setoff, counterclaim,

recoupment, limitation or termination, or any breach or alleged breach by the Holder or any other Person of any obligation to

the Corporation or any violation or alleged violation of law by the Holder or any other person, and irrespective of any other

circumstance which might otherwise limit such obligation of the Corporation to the Holder in connection with the issuance of such

Conversion Shares.

|

|

|

iii.

|

Transfer Taxes. The issuance of certificates for shares

of the Common Stock on conversion of the Preferred Stock shall be made without charge to the Holders thereof for any documentary

stamp or similar taxes that may be payable in respect of the issue or delivery of such certificate, provided that the Corporation

shall not be required to pay any tax that may be payable in respect of any transfer involved in the issuance and delivery of any

such certificate upon conversion in a name other than that of the Holder of such shares of Preferred Stock so converted and the

Corporation shall not be required to issue or deliver such certificates unless or until the person or persons requesting the issuance

thereof shall have paid to the Corporation the amount of such tax or shall have established to the satisfaction

of the Corporation that such tax has been paid.

|

|

|

e.

|

Stock Dividends and Stock Splits. If the Corporation,

at any time while the Preferred Stock is outstanding: (A) shall pay a stock dividend or otherwise make a distribution or distributions

on shares of its Common Stock or any other equity or equity equivalent securities payable in shares of Common Stock (which, for

avoidance of doubt, shall not include any shares of Common Stock issued by the Corporation pursuant to this Series B Preferred

Stock), (B) subdivide outstanding shares of Common Stock into a larger number of shares, (C) combine (including by way of reverse

stock split) outstanding shares of Common Stock into a smaller number of shares, or (D) issue by reclassification of shares of

the Common Stock any shares of capital stock of the Corporation, then the Conversion Price shall be multiplied by a fraction of

which the numerator shall be the number of shares of Common Stock (excluding treasury shares, if any) outstanding before such

event and of which the denominator shall be the number of shares of Common Stock outstanding after such event. Any adjustment

made pursuant to this Section shall become effective immediately after the record date for the determination of stockholders entitled

to receive such dividend or distribution and shall become effective immediately after the effective date in the case of a subdivision,

combination or reclassification.

|

|

|

f.

|

Pro Rata Distributions. If the Corporation, at any

time while Preferred Stock is outstanding, shall distribute to all holders of Common Stock (and not to Holders) evidences of its

indebtedness or assets or rights or warrants to subscribe for or purchase any security, then in each such case the Conversion

Price shall be determined by multiplying such Conversion Price in effect immediately prior to the record date fixed for determination

of stockholders entitled to receive such distribution by a fraction of which the denominator shall be the VWAP determined as of

the record date mentioned above, and of which the numerator shall be such VWAP on such record date less the then fair market value

at such record date of the portion of such assets or evidence of indebtedness so distributed applicable to one outstanding share

of the Common Stock as determined by the Board of Directors in good faith. In either case the adjustments shall be described in

a statement provided to the Holders of the portion of assets or evidences of indebtedness so distributed or such subscription

rights applicable to one share of Common Stock. Such adjustment shall be made whenever any such distribution is made and shall

become effective immediately after the record date mentioned above.

|

|

|

g.

|

Calculations. All calculations under this Section

shall be made to the nearest cent or the nearest 1/100th of a share, as the case may be. The number of shares of Common Stock

outstanding at any given time shall not include shares owned or held by or for the account of the Corporation, and the description

of any such shares of Common Stock shall be considered on issue or sale of Common Stock. For purposes of this Section 6, the number

of shares of Common Stock deemed to be issued and outstanding as of a given date shall be the sum of the number of shares of Common

Stock (excluding treasury shares, if any) issued and outstanding.

|

|

|

h.

|

Notice to Holders; Adjustment to Conversion Price.

Whenever the Conversion Price is adjusted pursuant to any of this Section, the Corporation shall promptly mail to each Holder

a notice setting forth the Conversion Price after such adjustment and setting forth a brief statement of the facts requiring such

adjustment.

|

Section 5. Dividends. Currently, no dividend

has been declared or paid on the Preferred Stock.

Section 6. Warrants. Holders

of the Series B, D, D1, E, E1, F, F1, G, G1, H, H1, I, J, J1, L, L1, M, and P Preferred Stock shall have

options (Warrants) to purchase up to a like amount of shares currently holding at the strike price of $4 per share. Holders of

the Series C preferred stock shall have options (Warrants) to purchase 12,500 shares of Common Stock at the strike price of $4

per share.

Section 7. Miscellaneous.

|

|

a)

|

Notices. Any and all notices or other communications of deliveries

to be provided by the Holder hereunder, including, without limitation, any Notice of Conversion, shall be in writing and delivered

personally, sent by facsimile to the Company, sent by a nationally recognized overnight courier service, addressed to the Corporation,

Attn: Chief Executive Officer or such other address or facsimile number as the Corporation may specify for such purposes by notice

to the Holders delivered in accordance with this Section. Any and all notices or other communications or deliveries to be provided

by the Corporation hereunder shall be in writing and delivered personally, by facsimile, sent by a nationally recognized overnight

courier service addressed to each Holder at the facsimile telephone number or address of such Holder appearing on the books of

the Corporation, or if no such facsimile telephone number or address appears, at the principal place of business of the Holder.

Any notice or other communication or deliveries hereunder shall be deemed given and effective on the earliest of (i) the date of

transmission, if such notice or communication is delivered via facsimile at the facsimile telephone number specified in this Section

prior to 5:30p.m. (eastern standard

time), (ii) the date after the date of transmission, if such notice or communication is delivered via facsimile at the facsimile

telephone number specified in this Section later than 5:30 p.m. (eastern standard time) on any date and earlier than 11:59 p.m.

(eastern standard time) on such date,(iii) the second Business Day following the date of mailing, if sent by nationally recognized

overnight courier service, or (iv) upon actual receipt by the party to whom such notice is required to be given. "Business

Day" shall mean a day which is not a (i) Saturday, (ii) Sunday or (iii) a national holiday observed in the United States.

|

|

|

b)

|

Lost or Mutilated Preferred Stock Certificate. If a Holder's Preferred

Stock certificate shall be mutilated, lost, stolen or destroyed, the Corporation shall execute and deliver, in exchange and substitution

for and upon cancellation of a mutilated certificate, or in lieu of or in substitution for a lost, stolen or destroyed certificate,

a new certificate for the shares of Preferred Stock so mutilated, lost, stolen or destroyed but only upon receipt of evidence of

such loss, theft or destruction of such certificate, and of the ownership hereof, and indemnity, if requested, all reasonably satisfactory

to the Corporation.

|

|

|

c)

|

Governing Law. All questions concerning the construction, validity,

enforcement, and interpretation of this Certificate of Designation shall be governed by and construed and enforced in accordance

with the internal laws of Florida, without regard to the principles of conflicts of law thereof. Each party agrees that all legal

proceedings concerning the interpretations, enforcement, and defense of the transactions by this Amended Certificate of Designation

(whether brought against a party hereto or its respective affiliates, directors, officers, shareholders, employees, or agents)

shall be commenced in the state and federal courts sitting in Florida (the "Florida Courts"). Each party hereto hereby

irrevocably submits to the exclusive jurisdiction of the Florida Courts for the adjudication of any dispute hereunder or in connection

herewith or with any transaction contemplated hereby or discussed herein, and hereby irrevocably waives, and agrees not to assert

in any suit, action or proceeding, any claim that it is not personally subject to the jurisdiction of any such court, or such Florida

Courts are improper or inconvenient venue for such proceeding. Each party hereby irrevocably waives personal service of process

and consents to process being served in any such suit, action or proceeding by mailing a copy thereof via registered or certified

mail or overnight delivery (with evidence of delivery) to such party at the address in effect for notices to it under this Certificate

of Designation and agrees that such service shall constitute good and sufficient service of process and notice thereof. Nothing

contained herein shall be deemed to limit in any way any right to serve process in any manner permitted by law. Each party hereto

hereby irrevocably waives, to the fullest extent permitted by applicable law, any and all right to trial by jury in any

legal proceeding arising out of or relating to this Certificate of Designation or the transactions contemplated hereby. If either

party shall commence an action or proceeding to enforce any provisions of this Certificate of Designation, then the prevailing

party in such action or proceeding shall be reimbursed by the other party for its attorneys' fees and other costs and expenses

incurred with the investigation, preparation and prosecution of such action or proceeding.

|

|

|

d)

|

Waiver. Any waiver by the Corporation or the Holder of a breach of

any provision of this Amended Certificate of Designation shall not operate as or be construed to be a waiver of any other breach

of such provision or of any breach of any other provision of this Amended Certificate of Designation. The failure of the Corporation

or the Holder to insist upon strict adherence to any term of this Amended Certificate of Designation on one or more occasions shall

not be considered a waiver or deprive that party of the right thereafter to insist upon strict adherence to that term or any other

term of this Amended Certificate of Designation. Any waiver must be in writing.

|

|

|

e)

|

Severability. If any provision of this Amended Certificate of Designation

is invalid, illegal, or unenforceable, the balance of this Amended Certificate of Designation shall remain in effect, and if any

provision is inapplicable to any person or circumstance, it shall nevertheless remain applicable to all other persons and circumstances.

If it shall be found that any interest or other amount deemed interest due hereunder violates applicable laws governing usury,

the applicable rate of interest due hereunder shall automatically be lowered to equal the maximum permitted rate of interest.

|

|

|

f)

|

Next Business Day. Whenever any obligation hereunder shall be due

on a day other than a Business Day, such payment shall be made on the next succeeding Business Day.

|

|

|

g)

|

Headings. The headings contained herein are for convenience only,

do not constitute a part of this Amended Certificate of Designation and shall not be deemed to limit or affect any of the provisions

thereof.

|

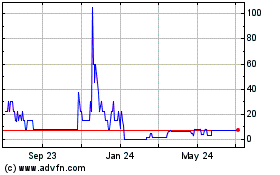

Cardiff Lexington (PK) (USOTC:CDIX)

Historical Stock Chart

From Mar 2024 to Apr 2024

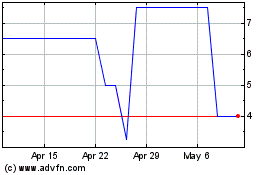

Cardiff Lexington (PK) (USOTC:CDIX)

Historical Stock Chart

From Apr 2023 to Apr 2024