Filed Pursuant to Rule 424(b)(4)

Registration No. 333-222814

ELECTRAMECCANICA VEHICLES CORP.

Issuance of up to 4,501,368 Common Shares

upon Exercise of Warrants

We previously sold

2,353,000 units (the “Units”), each unit consisting of one common share (each a “Common Share”) and two

warrants (each a “Warrant”). Each Warrant entitles the holder to purchase one common share at an exercise price of

US$4.25 per share. The Warrants will expire on August 13, 2023.

On August 13, 2018,

we completed our Units offering in gross proceeds of approximately US$10 million. On August 23, 2018, the underwriters in the Units

offering exercised an over-allotment option to purchase 705,900 Warrants at US$0.01 per Warrant for a total amount of US$7,059.

The Warrants are identical to those included in the Units issued on August 13, 2018. The aggregate net proceeds were approximately

US$9.1 million after underwriting discounts and commissions and other offering expenses.

Of the 5,411,900 Warrants

issued on August 13, 2018 and August 23, 2018, 910,532 have subsequently been exercised for gross proceeds of US$$3,869,761.

We will not receive

any proceeds from the sale of the shares underlying the Warrants, but we will receive all proceeds from the exercise of the Warrants.

We will bear all costs associated with this prospectus and the registration statement of which it forms a part. The Common Shares

and the Warrants are traded on the Nasdaq Capital Market, under the ticker symbols “SOLO” and “SOLOW”,

respectively.

The

last reported sale price of our common shares on November 26, 2019 was US$1.79 per

share.

Investing in our

common shares involves substantial risks. See “Risk Factors” beginning on page 6 of this prospectus to read about important

factors you should consider before purchasing our common shares.

Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the

adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is

December 2, 2019.

TABLE

OF CONTENTS

ABOUT THIS PROSPECTUS

We refer to Electrameccanica

Vehicles Corp. and its consolidated subsidiaries as “we”, “us”, “our”, “Company”,

“our company”, “Electrameccanica” and “our business”. This prospectus is part of a registration

statement (as amended, No. 333-222814) that we have filed with the Securities and Exchange Commission, which we refer to as the

“SEC” or the “Commission”, utilizing a registration process. It is important for you to read and consider

all of the information contained in this prospectus, including all documents incorporated herein by reference, before making a

decision whether to invest in the common stock. You should also read and consider the information contained in the exhibits filed

with our registration statement, of which this prospectus is a part, as described in “Where You Can Find More Information”

in this prospectus.

You should rely only

on the information contained in this prospectus, including the information incorporated by reference. We have not authorized anyone

to provide you with different information. We are not offering to sell or soliciting offers to buy, and will not sell, any securities

in any jurisdiction where it is unlawful. You should assume that the information contained in this prospectus, as well as documents

incorporated herein by reference,, is accurate only as of the date of this prospectus, the or the document containing that information,

as the case may be.

INDUSTRY AND MARKET DATA

This prospectus includes market and industry

data and forecasts that we have derived from independent consultant reports, publicly available information, various industry publications,

other published industry sources and our internal data and estimates. Independent consultant reports, industry publications and

other published industry sources generally indicate that the information contained therein was obtained from sources believed to

be reliable.

Our internal data and estimates are based

upon information obtained from trade and business organizations and other contacts in the markets in which we operate and our management’s

understanding of industry conditions. While we believe the market information included in this prospectus is generally reliable,

the future performance of the industry in which we operate and, as a result, our future prospects, are subject to a high degree

of risk due to a variety of factors, including those described in the section titled “Risk Factors” and elsewhere in

this prospectus.

PROSPECTUS SUMMARY

This

summary highlights selected information contained elsewhere, or incorporated by reference, in this prospectus. Because this is

only a summary, it does not contain all the information that may be important to you. You should read the entire prospectus carefully,

especially “Risk Factors,” “Risk Factors” and “Management’s Discussion and Analysis of

Financial Condition and Results of Operations” in the following documents which we incorporate by reference:

and our consolidated

financial statements and related notes and other information incorporated by reference in this prospectus, before deciding to invest

in our common shares.

Our Company

We are a development-stage

electric vehicle, or EV, manufacturing company located in Vancouver, British Columbia, Canada. Our initial product line targets

urban residents seeking to commute in an efficient, cost-effective and environmentally friendly manner.

Our first flagship

EV is the SOLO, a single person car, of which we have built 64 pre-mass production vehicles in-house as of November 4, 2019, and

approximately 50 pre-mass production vehicles with our manufacturing partner. We have used some of these pre-mass production vehicles

as prototypes and for certification purposes, have delivered some to customers and have used others as test drive models in our

showroom. We believe our schedule to mass produce EVs over the near term, combined with our 50-year history of automotive design,

manufacturing, and deliveries of motor vehicles to customers, significantly differentiates us from other early and development

stage EV companies. To support our near-term production, we have entered into a manufacturing agreement with a wholly-owned subsidiary

of Zongshen Industrial Group Co. Ltd. (“Zongshen”), an affiliate of Zongshen Power Machinery Co., Ltd., a large-scale

scientific and technical enterprise, which designs, develops, manufactures and sells a diverse range of motorcycles and motorcycle

engines in China. Zongshen has previously purchased common shares and warrants to purchase common shares from us and beneficially

owns approximately 7.3% of our common shares.

We have two other EV

candidates in an advanced stage of development, the Super SOLO, a sports car model of the SOLO, and the Tofino, an all-electric,

two-seater roadster, and have identified other vehicles that we would like to add to our candidate list such as the Cargo, a fleet

vehicle with ample storage space, and the Twinn, featuring two seats, suitable for urban families, young commuters and empty nesters.

We have devoted substantial

resources to create an affordable EV which brings significant performance and value to our customers. To this end, we envision

the SOLO carrying a manufacturer’s suggested retail price of less than $20,000 (approximately US$16,000), prior to any surcharge

to cover tariffs, and being powered by a high-performance electric rear drive motor which enables the SOLO to achieve:

|

|

·

|

a top speed of 85 mph and an attainable cruise speed of 68 mph resulting from its lightweight aerospace composite chassis;

|

|

|

·

|

acceleration from 0 mph to 60 mph in approximately eight seconds; and

|

|

|

·

|

a range of up to 100 miles generated from a lithium ion battery system that requires only three hours of charging time on a 220-volt charging station (six hours from a 110-volt outlet) that utilizes approximately 8.64 kW/h.

|

Pre-orders and expressions

of interest

As at September 30, 2019, we maintained

certain deposits from various individuals for SOLOs and Tofinos. As part of our “Match My Deposit” program, we offer

customers who have placed deposits for other electric vehicles a credit of up to $1,000 towards the purchase of a SOLO, which is

initially credited towards the buyer’s deposit. In addition, we also maintain certain expressions of interest arising

from non-binding letters of interest, including certain deposits associated with the same, from certain proposed dealers and/or

distributors for our vehicles representing their collective expressions of interest (should we choose to contract with them) for

the purchase from or the sale on our behalf of SOLOs and Tofinos.

Marketing Plan

We recognize that marketing efforts must

be focused on customer education and establishing brand presence and visibility which is expected to allow our vehicles to gain

traction and subsequently gain increases in orders. Marketing and promotional efforts must emphasize the SOLO’s image as

an efficient, clean and affordable EV for the masses to commute on a daily basis. If we can successfully promote the SOLO on these

points, we expect growth in sales and customer base to occur rapidly.

A key point to the marketing plan is to

target metropolitan cities with high population density, expensive real estate, high commuter traffic load and pollution levels

which are becoming an enormous concern. Accordingly, we have opened stores in Vancouver and Los Angeles, and our management has

identified additional states in the United States that fit the aforementioned criteria and have plans to seek out suitable locations

for additional stores in California, Washington, Oregon and Southern Florida.

We plan to develop a marketing strategy

that will generate interest and media buzz based on the SOLO’s selling points. Key aspects of our marketing plan include:

|

|

●

|

Organic engagement and paid digital marketing media with engaging posts aimed to educate the public

about EVs and develop interest in our SOLO, which to date has had positive traction;

|

|

|

●

|

Earned media—we have already received press coverage from several traditional media sources

and expect these features and news stories to continue as we embark on our commercial launch;

|

|

|

●

|

Investor Relations/Press Releases — our in-house investor relations team will provide media

releases/kits for updates and news on our progress;

|

|

|

●

|

Industry shows and events—we displayed the SOLO at the Vancouver International Autoshow in

March 2017, the Consumer Electronics Show in Las Vegas in January 2018 and the Vancouver International Autoshow in March 2018 and

2019. Promotional merchandise giveaways will enhance and further solidify our branding in consumer minds. Computer stations and

payment processing software will be readily on hand at to accept SOLO reservations; and

|

|

|

●

|

First-hand experience —Test-drives and public viewings are available at our existing stores

in the Vancouver downtown core and in Los Angeles.

|

We anticipate that our marketing strategy

and tactics will evolve over time as our SOLO gains momentum and we identify appropriate channels and media that align with our

long-term objectives. In all of our efforts, we plan to focus on the features that differentiate our SOLO from the existing EVs

on the market.

Reservation system

We cannot guarantee that a significant

number of the pre-orders and expressions of interest, if any, will become binding or result in sales. We have an online reservation

system which allows a potential customer to reserve a SOLO by paying a refundable $250 deposit and a Tofino by paying a refundable

$1,000 deposit. Once reserved, the potential customer is allocated a reservation number and the reservation will be fulfilled

as the respective vehicles are produced. We have achieved our pre-order book through an online “direct sales to customers

and corporate sales” platform as well as a store and show room at our headquarters in Vancouver. We plan on expanding

this model and will be opening similar stores in key urban areas. We have recently opened our first U.S. corporate store

located in Los Angeles.

We will earn revenue once a vehicle has

been delivered to the customer who has pre-ordered their vehicle. Each order is placed in line as received and fulfilled

once the vehicle becomes available. The customer may, at any time, for any reason, cancel their order and have their deposit

returned. We do not consider any order as being secured until the vehicle has been delivered and full receipt of the remaining

balance of the vehicle purchase price has been received.

Sales strategy

Our near-term goal is to commence and expand

sales of the SOLO. We intend to achieve this goal by:

|

|

●

|

expanding the commercial production of the SOLO: we anticipate that Zongshen, our manufacturing

partner, will begin producing the SOLO for deliveries to customers in first quarter of 2020;

|

|

|

●

|

by increasing the pre-orders and expressions of interest for our EVs;

|

|

|

●

|

by having sales and services supported by local corporate stores: we will monitor all cars in real

time via telematics which provides early warning of potential maintenance issues; and

|

|

|

●

|

by expanding our product offering: in parallel with the production and sale of the SOLO, we aim

to continue the development of our other proposed products, including the Tofino, a two seater sports car in the expected price

range of $50,000 to $60,000.

|

We are

currently developing a turn-key sales program beginning from our L.A. store.

Service model

We sell our vehicles

online via our website (www.electrameccanica.com) while we develop our planned corporate owned stores in key markets. As

each store is established, any vehicles sold within such store’s designated territory will be delivered to such store to

fulfill online orders as well as such store’s orders.

We have not yet identified where we hope

to establish corporate owned stores or other distribution arrangements. The establishment of stores will depend on regional demand,

available candidates and local regulations. We are currently accepting expressions of interest and applications for stores from

individuals, and do not have any franchise or dealer agreements. Our vehicles will initially be available directly from us.

We plan to only establish and operate corporate

owned stores in those states in the United States that do not restrict or prohibit certain retail sales models by vehicle manufacturers.

Our Corporate Information

We were

incorporated on February 16, 2015 under the laws of British Columbia, Canada, and have a December 31, fiscal year end. As of

December 2, 2019, we had 37,049,374 common shares outstanding.

Our principal executive

offices are located at 102 East 1st Avenue, Vancouver, British Columbia, Canada, V5T 1A4. Our telephone number is (604) 428-7656.

Our website address is www.electrameccanica.com. Information on our website does not constitute part of this prospectus. Our registered

and records office is located at Suite 1500, 1055 West Georgia Street, P.O. Box 11117, Vancouver, British Columbia, Canada, V6E

4N7.

The Offering

|

Securities Offered

|

|

Up to 4,501,368 common shares issuable upon exercise of outstanding Warrants issued on August 13, 2018 and August 23, 2018.

|

|

|

|

|

|

Exercise Price and Term of Warrants

|

|

The Warrants have an exercise price of US$4.25 per share. The Warrants are exercisable at any time prior to August 13, 2023.

|

|

|

|

|

|

Use of Proceeds

|

|

We will not receive any proceeds from the sale of the shares underlying the Warrants, but we will receive all proceeds from the exercise of the Warrants. We plan to use those proceeds, if any, to further develop our products, for working capital and for general corporate purposes.

|

|

|

|

|

|

Risk Factors

|

|

The exercise of the Warrants and the acquisition of our common shares involve substantial risks. See “Risk Factors” beginning on page 6 of this prospectus.

|

|

|

|

|

|

|

|

|

|

Nasdaq Symbol for Common Shares

|

|

SOLO

|

|

|

|

|

|

Nasdaq Symbol for Warrants

|

|

SOLOW

|

RISK FACTORS

You

should carefully consider the risks incorporated by reference in this prospectus before making an investment decision. You

should also consider the matters discussed under “Risk Factors” in the 2018 Annual Report, the March 31 Quarterly

Report, the June 30 Quarterly Report and the September 30 Quarterly Report. Our business, financial condition and results of operations could

be materially and adversely affected by any of these risks or uncertainties. In that case, the trading price of our common

stock could decline, and you may lose all or part of your investment.

CAUTIONARY NOTE

REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus contains forward-looking statements. We intend such forward-looking statements to be covered by the safe harbor provisions

for forward-looking statements contained in Section 27A of the Securities Act of 1933, as amended (the “Securities Act”),

and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements other

than statements of historical facts contained in this prospectus, including, without limitation, statements regarding our future

results of operations and financial position, business strategy, transformation, strategic priorities and future progress, are

forward-looking statements. These statements involve known and unknown risks, uncertainties and other important factors that may

cause our actual results, performance or achievements to be materially different from any future results, performance or achievements

expressed or implied by the forward-looking statements.

In

some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,”

“expect,” “plan,” “anticipate,” “could,” “intend,” “project,”

“believe,” “estimate” or “predict” “or the negative of these terms or other similar expressions.

The forward-looking statements in this prospectus are only predictions. We have based these forward-looking statements largely

on our current expectations and projections about future events and financial trends that we believe may affect our business, financial

condition and results of operations. These forward-looking statements speak only as of the date of this prospectus and are subject

to a number of important factors that could cause actual results to differ materially from those in the forward-looking statements,

including the factors described in

|

|

·

|

Part I. “Item 1A. Risk Factors” and Part II. “Item 7. Management’s Discussion

and Analysis of Financial Condition and Results of Operations” in the 2018 Annual Report;

|

|

|

·

|

Part II. “Item 1A. Risk Factors” and Part I. “Item 2. Management’s Discussion

and Analysis of Financial Condition and Results of Operations” in the March 31 Quarterly Report;

|

|

|

·

|

Part II. “Item 1A. Risk Factors” and Part I. “Item 2. Management’s Discussion

and Analysis of Financial Condition and Results of Operations” in the June 30 Quarterly Report; and

|

|

|

·

|

Part II. “Item 1A. Risk Factors” and Part I. “Item 2. Management’s Discussion

and Analysis of Financial Condition and Results of Operations” in the September 30 Quarterly Report;

|

each incorporated

by reference herein. Because forward-looking statements are inherently subject to risks and uncertainties, you should not rely

on these forward-looking statements as predictions of future events. Except as required by applicable law, we do not plan to publicly

update or revise any forward-looking statements contained herein, whether as a result of any new information, future events, changed

circumstances or otherwise.

USE

OF PROCEEDS

We will not receive

any proceeds from the sale of the shares underlying the Warrants, but we will receive all proceeds from the exercise of the Warrants.

Assuming full exercise of all of the 4,501,368 Warrants covered by this prospectus

at US$4.25 per share, we will receive gross proceeds of approximately US$19,130,814. The actual exercise of any of the Warrants,

however, is beyond our control and depends on a number of factors, including the market price of our common stock. We cannot assure

you that all, or even any, of the Warrants will be exercised.

While we have no specific

plan for the proceeds, we expect to use the net proceeds from the exercise, if any, of the Warrants described in this prospectus

to further develop our products, for working capital, and for general corporate purposes.

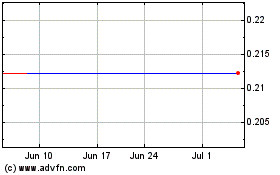

MARKET PRICE AND TRADING HISTORY

The common shares have been listed on the

Nasdaq Capital Market under the symbol “SOLO” since August 9, 2018. Our common shares were traded previously on the

OTC Market Group Inc.’s Venture Market (the “OTCQB”) under the symbol “ECCTF” since September 2017.

The following tables sets forth, for the

periods indicated, the high and low trading prices of our common shares as reported on the Nasdaq Capital Market and OTCQB prior

to the filing of this prospectus.

Common Shares (symbol: “SOLO”)

|

|

|

OTCQB

(U.S. Dollars)

|

|

|

NASDAQ

(U.S. Dollars)

|

|

|

Period

|

|

High

|

|

|

Low

|

|

|

High

|

|

|

Low

|

|

|

Quarter ended

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2017

|

|

|

8.00

|

|

|

|

1.50

|

|

|

|

|

|

|

|

|

|

|

December 31, 2017

|

|

|

15.00

|

|

|

|

10.00

|

|

|

|

|

|

|

|

|

|

|

March 31, 2018

|

|

|

10.70

|

|

|

|

9.00

|

|

|

|

|

|

|

|

|

|

|

June 30, 2018

|

|

|

9.88

|

|

|

|

4.25

|

|

|

|

|

|

|

|

|

|

|

September 30, 2018

|

|

|

|

|

|

|

|

|

|

|

6.25

|

|

|

|

2.27

|

|

|

December 31, 2018

|

|

|

|

|

|

|

|

|

|

|

7.48

|

|

|

|

0.9

|

|

|

March 31, 2019

|

|

|

|

|

|

|

|

|

|

|

6.74

|

|

|

|

1.05

|

|

|

June 30, 2019

|

|

|

|

|

|

|

|

|

|

|

3.93

|

|

|

|

2.41

|

|

|

September 30, 2019

|

|

|

|

|

|

|

|

|

|

|

2.84

|

|

|

|

1.60

|

|

|

Last Eleven Months

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

January 2019

|

|

|

|

|

|

|

|

|

|

|

1.65

|

|

|

|

1.05

|

|

|

February 2019

|

|

|

|

|

|

|

|

|

|

|

6.74

|

|

|

|

1.18

|

|

|

March 2019

|

|

|

|

|

|

|

|

|

|

|

5.15

|

|

|

|

3.12

|

|

|

April 2019

|

|

|

|

|

|

|

|

|

|

|

3.93

|

|

|

|

3.22

|

|

|

May 2019

|

|

|

|

|

|

|

|

|

|

|

3.34

|

|

|

|

2.43

|

|

|

June 2019

|

|

|

|

|

|

|

|

|

|

|

2.85

|

|

|

|

2.41

|

|

|

July 2019

|

|

|

|

|

|

|

|

|

|

|

3.25

|

|

|

|

2.30

|

|

|

August 2019

|

|

|

|

|

|

|

|

|

|

|

2.84

|

|

|

|

2.11

|

|

|

September 2019

|

|

|

|

|

|

|

|

|

|

|

2.60

|

|

|

|

2.01

|

|

|

October 2019

|

|

|

|

|

|

|

|

|

|

|

1.96

|

|

|

|

1.60

|

|

|

November 2019

|

|

|

|

|

|

|

|

|

|

|

2.25

|

|

|

|

1.73

|

|

Notes:

(1) From July, 2018 through August 7, 2018, the common shares

traded on the OTCQB. The trading history from that period has been included in this quarterly information as if such trading had

occurred on the Nasdaq Capital Market.

DIVIDEND POLICY

To date, we have not

paid any dividends on our outstanding common shares. The future payment of dividends will depend upon our financial requirements

to fund further growth, our financial condition and other factors which our Board of Directors may consider in the circumstances.

We do not contemplate paying any dividends in the immediate or foreseeable futures.

DILUTION

Our net tangible

book value as of September 30, 2019 was approximately $23,012,095, or approximately $0.6227 per share. Net tangible book

value per share represents the amount of our total tangible assets, less our total liabilities, divided by the number of

outstanding shares of common stock. Dilution in net tangible book value per share represents the difference between the

amount per share paid by the purchaser of shares of common stock upon the exercise of the Warrants and the net tangible book

value per share of common stock immediately after the exercise of the Warrants.

If all of the 4,501,368

Warrants covered by this Prospectus had been exercised on or before September 30, 2019 at an exercise price of $5.80

(US$4.25), our pro forma net tangible book value as of June 30, 2019 would have been approximately $49,114,000 or $1.1848 per

share. This represents an immediate increase in net tangible book value of $0.5620 per share to existing stockholders and an

immediate dilution in net tangible book value of $4.6139 per share to shares underlying the Warrants.

The shares outstanding

as of September 30, 2019 used to calculate the information in this section exclude:

|

|

●

|

7,676,041 shares issuable upon the exercise of stock options

outstanding on September 30, 2019; and

|

|

|

|

|

|

|

●

|

21,253,395 shares

issuable upon the exercise of warrants outstanding on September 30, 2019.

|

CURRENCY AND EXCHANGE RATES

All dollar amounts

in this prospectus are expressed in Canadian dollars unless otherwise indicated. Our accounts are maintained in Canadian dollars,

and our financial statements are prepared in accordance with International Financial Reporting Standards as issued by the International

Accounting Standards Board. All reference to “U.S. dollars”, “USD”, or to “US$” are to United

States dollars.

The following table

sets forth, for each period indicated, the high and low exchange rate for U.S. dollars expressed in Canadian dollars, and

the average exchange rate for the periods indicated. Averages for year-end periods are calculated by using the exchange rates on

the last day of each full month during the relevant period. These rates are based on the noon-buying rate certified for custom

purposes by the U.S. Federal Reserve Bank of New York set forth in the H.10 statistical release of the Federal Reserve Board. These

rates are provided solely for your convenience and are not necessarily the exchange rates that we used in preparation of our consolidated

financial statements, pro forma financial statements or elsewhere in this prospectus or will use in the preparation of our periodic

reports or any other information to be provided to you. We make no representation that any Canadian dollar or U.S. dollar amounts

referred to in this prospectus could have been or could be converted into U.S. dollars or Canadian dollars, as the case may be,

at any particular rate or at all.

|

|

|

Period

End

|

|

|

Period

Average

Rate

|

|

|

High Rate

|

|

|

Low

Rate

|

|

|

Year Ended

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2017

|

|

$

|

1.2517

|

|

|

$

|

1.2963

|

|

|

$

|

1.3745

|

|

|

$

|

1.2131

|

|

|

December 31, 2018

|

|

$

|

1.3644

|

|

|

$

|

1.2957

|

|

|

$

|

1.3650

|

|

|

$

|

1.2280

|

|

|

Last Six Months

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

May 2019

|

|

$

|

1.3523

|

|

|

$

|

1.3460

|

|

|

$

|

1.3533

|

|

|

$

|

1.3417

|

|

|

June 2019

|

|

$

|

1.3091

|

|

|

$

|

1.3289

|

|

|

$

|

1.3471

|

|

|

$

|

1.3091

|

|

|

July 2019

|

|

$

|

1.3143

|

|

|

$

|

1.3105

|

|

|

$

|

1.3187

|

|

|

$

|

1.3036

|

|

|

August 2019

|

|

$

|

1.3290

|

|

|

$

|

1.3273

|

|

|

$

|

1.3331

|

|

|

$

|

1.3196

|

|

|

September 2019

|

|

$

|

1.3243

|

|

|

$

|

1.3420

|

|

|

$

|

1.3332

|

|

|

$

|

1.3140

|

|

|

October 2019

|

|

$

|

1.3144

|

|

|

$

|

1.3189

|

|

|

$

|

1.3332

|

|

|

$

|

1.3063

|

|

Certain conversions from U.S. dollars into

Canadian dollars have been made for your convenience at US$1.00 = $1.3644, the noon-buying price on December 31, 2018.

DESCRIPTION OF SHARE CAPITAL

Common Shares

We are authorized

to issue an unlimited number of common shares, without par value. As of December 31, 2018, the date of the most recent

audited balance sheet included in our financial statements, there were 32,332,343 common shares issued and outstanding,

27,125,892 common shares issuable upon exercise of outstanding stock options and warrants. As of December 2, 2019, there

were 37,049,374 common shares issued and outstanding and 28,867,492 common shares issuable upon exercise of outstanding

stock options and warrants.

The holders of our

common shares are entitled to vote at all meetings of shareholders, to receive dividends if, as and when declared by the directors

and to participate pro rata in any distribution of property or assets upon our liquidation, winding-up or other dissolution.

Our common shares carry no pre-emptive rights, conversion or exchange rights, redemption, retraction, repurchase, sinking fund

or purchase fund provisions. There are no provisions requiring the holder of our common share to contribute additional capital

and no restrictions on the issuance of additional securities by us. There are no restrictions on the repurchase or redemption of

common shares by us except to the extent that any such repurchase or redemption would render us insolvent pursuant to the Business

Corporations Act (British Columbia).

Preferred Shares

We may issue our preferred

shares from time to time in one or more series. The terms of each series of preferred shares, including the number of shares, the

designation, rights, preferences, privileges, priorities, restrictions, conditions and limitations, will be determined at the time

of creation of each such series by our board of directors, without shareholder approval, provided that all preferred shares will

rank equally within their class as to dividends and distributions in the event of our dissolution, liquidation or winding-up. We

do not have any preferred shares outstanding as of the date of this prospectus.

Transfer Agent

Our stock transfer

agent and warrant agent for our securities is VStock Transfer, LLC, located at 18 Lafayette Place, Woodmere, New York, New

York, U.S.A., 11598, and its telephone number is (212) 828-8436.

LIMITATIONS ON RIGHTS OF NON-CANADIANS

Electrameccanica is incorporated pursuant

to the laws of the Province of British Columbia, Canada. There is no law or governmental decree or regulation in Canada that restricts

the export or import of capital, or affects the remittance of dividends, interest or other payments to a non-resident holder of

common shares, other than withholding tax requirements. Any such remittances to United States residents are generally subject to

withholding tax, however, no such remittances are likely in the foreseeable future. See “Canadian Federal Income Tax Considerations

For United States Residents,” below.

There is no limitation imposed by Canadian

law or by the charter or other constituent documents of our company on the right of a non-resident to hold or vote common shares

of our company. However, the Investment Canada Act (Canada) (the “Investment Act”) has rules regarding certain

acquisitions of shares by non-residents, along with other requirements under that legislation.

The following discussion summarizes the

principal features of the Investment Act for a non-resident who proposes to acquire common shares of our company. The discussion

is general only; it is not a substitute for independent legal advice from an investor’s own advisor; and it does not anticipate

statutory or regulatory amendments.

The Investment Act is a federal statute

of broad application regulating the establishment and acquisition of Canadian businesses by non-Canadians, including individuals,

governments or agencies thereof, corporations, partnerships, trusts or joint ventures (each an “entity”). Investments

by non-Canadians to acquire control over existing Canadian businesses or to establish new ones are either reviewable or notifiable

under the Investment Act. If an investment by a non-Canadian to acquire control over an existing Canadian business is reviewable

under the Investment Act, the Investment Act generally prohibits implementation of the investment unless, after review, the Minister

of Innovation, Science and Economic Development Canada (the “Minister”), is satisfied that the investment is likely

to be of net benefit to Canada.

A non-Canadian would acquire control of

our company for the purposes of the Investment Act through the acquisition of common shares if the non-Canadian acquired a majority

of the common shares of our company.

Further, the acquisition of less than a

majority but one-third or more of the common shares of our company would be presumed to be an acquisition of control of our company

unless it could be established that, on the acquisition, our company was not controlled in fact by the acquirer through the ownership

of common shares.

For a direct acquisition that would result

in an acquisition of control of our company, subject to the exception for “WTO-investors” that are controlled by persons

who are resident in World Trade Organization (“WTO”) member nations, a proposed investment would be reviewable where

the value of the acquired assets is $5 million or more, or if an order for review was made by the federal cabinet on the grounds

that the investment related to Canada’s cultural heritage or national identity, where the value of the acquired assets is

less than $5 million.

For a proposed indirect acquisition by

an investor other than a so-called WTO investor that would result in an acquisition of control of our company through the acquisition

of a non-Canadian parent entity, the investment would be reviewable where the value of the assets of the entity carrying on the

Canadian business, and of all other entities in Canada, the control of which is acquired, directly or indirectly is $50 million

or more.

In the case of a direct acquisition by

or from a “WTO investor”, the threshold is significantly higher. An investment in common shares of our company by a

WTO investor would be reviewable only if it was an investment to acquire control of the company and the enterprise value of the

assets of the company was equal to or greater than a specified amount, which is published by the Minister after its determination

for any particular year. This amount is $1.045 billion for 2019 (unless the investor is a “trade agreement investor”,

which includes investors controlled by one or more persons who are national to a country that is a party to one of a list of certain

free trade agreements, in which case the amount is $1.568 billion); each January 1, both thresholds are adjusted by a GDP (Gross

Domestic Product) based index.

The higher WTO threshold for direct investments

and the exemption for indirect investments do not apply where the relevant Canadian business is carrying on a “cultural business”.

The acquisition of a Canadian business that is a “cultural business” is subject to lower review thresholds under the

Investment Act because of the perceived sensitivity of the cultural sector.

In 2009, amendments were enacted to the

Investment Act concerning investments that may be considered injurious to national security. If the Minister has reasonable grounds

to believe that an investment by a non-Canadian “could be injurious to national security,” the Minister of Industry

may send the non-Canadian a notice indicating that an order for review of the investment may be made. The review of an investment

on the grounds of national security may occur whether or not an investment is otherwise subject to review on the basis of net benefit

to Canada or otherwise subject to notification under the Investment Act.

Certain transactions, except those to which

the national security provisions of the Investment Act may apply, relating to common shares of our company are exempt from the

Investment Act, including

|

|

(a)

|

the acquisition of our common shares by a person in the ordinary course of that person’s business as a trader or dealer in securities;

|

|

|

(b)

|

the acquisition of control of our company in connection with the realization of security granted for a loan or other financial assistance and not for a purpose related to the provisions on the Investment Act, if the acquisition is subject to approval under certain Canadian legislation; and

|

|

|

(c)

|

the acquisition of control of our company by reason of an amalgamation, merger, consolidation or corporate reorganization following which the ultimate direct or indirect control in fact of our company, through the ownership of common shares, remained unchanged.

|

MATERIAL INCOME TAX INFORMATION

Certain Canadian Federal Income Tax

Considerations For United States Residents

The following is a

summary of certain Canadian federal income tax considerations generally applicable to the holding and disposition of our common

shares acquired by a holder who, at all relevant times, (a) for the purposes of the Income Tax Act (Canada) (the “Tax

Act”) (i) is not resident, or deemed to be resident, in Canada, (ii) deals at arm’s length with us and the placement

agents, and is not affiliated with us or the placement agents, (iii) holds our common shares as capital property, (iv) does not

use or hold the common shares in the course of carrying on, or otherwise in connection with, a business carried on or deemed to

be carried on in Canada and (v) is not a “registered non-resident insurer” or “authorized foreign bank”

(each as defined in the Tax Act), or other holder of special status, and (b) for the purposes of the Canada-U.S. Tax Convention

(the “Tax Treaty”), is a resident of the United States, has never been a resident of Canada, does not have and has

not had, at any time, a permanent establishment or fixed base in Canada, and who otherwise qualifies for the full benefits of the

Tax Treaty. Holders who meet all the criteria in clauses (a) and (b) above are referred to herein as “U.S. Holders”,

and this summary only addresses such U.S. Holders.

This summary does not

deal with special situations, such as the particular circumstances of traders or dealers, tax exempt entities, insurers or financial

institutions, or other holders of special status or in special circumstances. Such holders, and all other holders who do not meet

the criteria in clauses (a) and (b) above, should consult their own tax advisors. The summary also does not address the holding,

exercise or other disposition of warrants or other securities, and addresses only the holding and disposition of our common shares

by a U.S. Holder as discussed herein.

This summary is based

on the current provisions of the Tax Act, the regulations thereunder in force at the date hereof (“Regulations”),

the current provisions of the Tax Treaty, and our understanding of the administrative and assessing practices of the Canada Revenue

Agency published in writing prior to the date hereof. This summary takes into account all specific proposals to amend the Tax Act

and Regulations publicly announced by or on behalf of the Minister of Finance (Canada) prior to the date hereof (the “Proposed

Amendments”) and assumes that such Proposed Amendments will be enacted in the form proposed. However, such Proposed Amendments

might not be enacted in the form proposed, or at all, and no assurance in this regard can be given. This summary does not otherwise

take into account or anticipate any changes in law or administrative or assessing practices, whether by legislative, governmental

or judicial decision or action, nor does it take into account tax laws of any province or territory of Canada or of any other jurisdiction

outside Canada, which may differ significantly from those discussed in this summary.

For the purposes of

the Tax Act, all amounts relating to the acquisition, holding or disposition of our common shares must generally be expressed in

Canadian dollars. Amounts denominated in United States currency generally must be converted into Canadian dollars using the rate

of exchange that is acceptable to the Canada Revenue Agency.

This summary is of

a general nature only and is not intended to be, nor should it be construed to be, legal or tax advice to any particular U.S. Holder,

and no representation with respect to the Canadian federal income tax consequences to any particular U.S. Holder or prospective

U.S. Holder is made. This summary is not exhaustive of all Canadian federal income tax considerations. Accordingly, all prospective

purchasers (including U.S. Holders as defined above) should consult with their own tax advisors for advice with respect to their

own particular circumstances.

Withholding Tax on Dividends

Amounts paid or credited

or deemed to be paid or credited as, on account or in lieu of payment of, or in satisfaction of, dividends on our common shares

to a U.S. Holder will be subject to Canadian withholding tax. Under the Tax Treaty, the rate of Canadian withholding tax on dividends

paid or credited by us to a U.S. Holder that beneficially owns such dividends and substantiates eligibility for the benefits of

the Tax Treaty is generally 15% (unless the beneficial owner is a company that owns at least 10% of our voting stock at that time,

in which case the rate of Canadian withholding tax is generally reduced to 5%).

Dispositions

A U.S. Holder will

not be subject to tax under the Tax Act on a capital gain realized on a disposition or deemed disposition of a common share, unless

the common share is “taxable Canadian property” to the U.S. Holder for purposes of the Tax Act and the U.S. Holder

is not entitled to relief under the Tax Treaty.

Provided the common shares are listed on

a “designated stock exchange” as defined in the Tax Act (which currently includes Nasdaq) at the time of disposition,

the common shares generally will not constitute “taxable Canadian property” of a U.S. Holder at that time unless, at

any time during the 60 month period immediately preceding the disposition, the following two conditions are met: (i) the U.S. Holder,

persons with whom the U.S. Holder did not deal at arm’s length, partnerships in which the U.S. Holder or such non-arm’s

length person holds a membership interest (either directly or indirectly through one or more partnerships), or the U.S. Holder

together with all such persons, owned 25% or more of the issued shares of any class or series of shares of our company; and (ii)

more than 50% of the fair market value of the shares of the company was derived directly or indirectly from one or any combination

of real or immovable property situated in Canada, Canadian resource properties (as defined in the Tax Act), timber resource properties

(as defined in the Tax Act) or options in respect of, or interests in, or for civil law rights in, property described in any of

the foregoing whether or not the property exists. Notwithstanding the foregoing, in certain other circumstances set out in the

Tax Act, common shares could also be deemed to be “taxable Canadian property”.

U.S. Holders who may

hold common shares as “taxable Canadian property” should consult their own tax advisors with respect to the application

of Canadian capital gains taxation, any potential relief under the Tax Treaty, and special compliance procedures under the Tax

Act, none of which is described in this summary.

Certain Material United States Federal

Income Tax Considerations

The following is a

general summary of certain material U.S. federal income tax considerations applicable to a U.S. Holder (as defined below) arising

from the acquisition, ownership and disposition of our securities. This summary applies only to U.S. Holders that acquire securities

offered by this prospectus and does not apply to any subsequent U.S. Holder of our common shares.

This summary is for

general information purposes only and does not purport to be a complete analysis or listing of all potential U.S. federal income

tax considerations that may apply to a U.S. Holder as a result of the acquisition, ownership and disposition of our common shares.

In addition, this summary does not take into account the individual facts and circumstances of any particular U.S. Holder that

may affect the U.S. federal income tax consequences to such U.S. Holder, including specific tax consequences to a U.S. Holder under

an applicable tax treaty. Accordingly, this summary is not intended to be, and should not be construed as, legal or U.S. federal

income tax advice with respect to any particular U.S. Holder. In addition, this summary does not address the U.S. federal alternative

minimum, net investment income, U.S. federal estate and gift, U.S. Medicare contribution, U.S. state and local, or non-U.S. tax

consequences of the acquisition, ownership or disposition of our common shares. Except as specifically set forth below, this summary

does not discuss applicable tax reporting requirements. Each U.S. Holder should consult its own tax advisor regarding all

U.S. federal, U.S. state and local and non-U.S. tax consequences of the acquisition, ownership and disposition of our common shares.

No opinion from U.S.

legal counsel or ruling from the Internal Revenue Service (the “IRS”) has been requested, or will be obtained, regarding

the U.S. federal income tax consequences of the acquisition, ownership or disposition of our common shares. This summary is not

binding on the IRS, and the IRS is not precluded from taking a position that is different from, or contrary to, any position taken

in this summary. In addition, because the authorities upon which this summary is based are subject to various interpretations,

the IRS and the U.S. courts could disagree with one or more of the positions taken in this summary.

Scope of This Disclosure

Authorities

This summary is based

on the Internal Revenue Code of 1986, as amended (the “Code”), Treasury Regulations (whether final, temporary, or proposed),

published rulings of the IRS, published administrative positions of the IRS, the Convention Between Canada and the United States

of America with Respect to Taxes on Income and on Capital, signed September 26, 1980, as amended (the “Canada-U.S. Tax Convention”),

and U.S. court decisions that are applicable and, in each case, as in effect and available, as of the date hereof. Any of the authorities

on which this summary is based could be changed in a material and adverse manner at any time, and any such change could be applied

on a retroactive or prospective basis, which could affect the U.S. federal income tax considerations described in this summary.

This summary does not discuss the potential effects, whether adverse or beneficial, of any proposed legislation that, if enacted,

could be applied on a retroactive or prospective basis.

U.S. Holders

For purposes of this

summary, the term “U.S. Holder” means a beneficial owner of our common shares that is for U.S. federal income tax purposes:

|

|

•

|

an individual who is a citizen or resident of the U.S.;

|

|

|

•

|

a corporation (or other entity taxable as a corporation for U.S. federal income tax purposes) created or organized in or under the laws of the U.S., any state thereof or the District of Columbia;

|

|

|

•

|

an estate, the income of which is subject to U.S. federal income taxation regardless of its source; or

|

|

|

•

|

a trust that (a) is subject to the primary supervision of a court within the U.S. and the control of one or more U.S. persons for all substantial decisions or (b) has a valid election in effect under applicable Treasury Regulations to be treated as a U.S. person.

|

Transactions Not Addressed

This summary does not

address the tax consequences of transactions effected prior or subsequent to, or concurrently with, any purchase of common shares

pursuant to this prospectus (whether or not any such transactions are undertaken in connection with the purchase of common shares

pursuant to this prospectus).

U.S. Holders Subject to Special U.S.

Federal Income Tax Rules Not Addressed

This summary does not

address the U.S. federal income tax considerations of the acquisition, ownership or disposition of our securities by U.S. Holders

that are subject to special provisions under the Code, including, but not limited to, the following: (a) tax-exempt organizations,

qualified retirement plans, individual retirement accounts, or other tax-deferred accounts; (b) financial institutions, underwriters,

insurance companies, real estate investment trusts, or regulated investment companies; (c) broker-dealers, dealers, or traders

in securities or currencies that elect to apply a “mark-to-market” accounting method; (d) U.S. Holders that have

a “functional currency” other than the U.S. dollar; (e) U.S. Holders that own our securities as part of a straddle,

hedging transaction, conversion transaction, constructive sale, or other arrangement involving more than one position; (f) U.S.

Holders that acquire our securities in connection with the exercise of employee stock options or otherwise as compensation for

services; (g) U.S. Holders that hold our securities other than as a capital asset within the meaning of Section 1221 of the Code

(generally, property held for investment purposes); and (h) U.S. Holders that own directly, indirectly, or by attribution, 10%

or more, by voting power, of our outstanding stock. This summary also does not address the U.S. federal income tax considerations

applicable to U.S. Holders who are: (a) U.S. expatriates or former long-term residents of the U.S.; (b) persons that have been,

are, or will be a resident or deemed to be a resident in Canada for purposes of the Income Tax Act (Canada); (c) persons that use

or hold, will use or hold, or that are or will be deemed to use or hold our securities in connection with carrying on a business

in Canada; (d) persons whose securities in our company constitute “taxable Canadian property” under the Income Tax

Act (Canada); or (e) persons that have a permanent establishment in Canada for purposes of the Canada-U.S. Tax Convention. U.S.

Holders that are subject to special provisions under the Code, including U.S. Holders described immediately above, should consult

their own tax advisors regarding all U.S. federal, U.S. state and local, and non-U.S. tax consequences (including the potential

application and operation of any income tax treaties) relating to the acquisition, ownership or disposition of our common shares.

If an entity or arrangement

that is classified as a partnership (or other “pass-through” entity) for U.S. federal income tax purposes holds

our common shares, the U.S. federal income tax consequences to such partnership and the partners (or other owners) of such partnership

of the acquisition, ownership or disposition of our common shares generally will depend on the activities of the partnership and

the status of such partners (or other owners). This summary does not address the U.S. federal income tax considerations for

any such partner or partnership (or other “pass-through” entity or its owners). Owners of entities and arrangements

that are classified as partnerships (or other “pass-through” entities) for U.S. federal income tax purposes should

consult their own tax advisors regarding the U.S. federal income tax consequences of the acquisition, ownership or disposition

of our common shares.

Acquisition of Our Securities

A U.S. Holder generally

will not recognize gain or loss upon the acquisition of our securities for cash pursuant to this prospectus. A U.S. Holder’s

holding period for such common shares will begin on the day after the acquisition.

Ownership and Disposition of Our Common

Shares

Distributions on Our Common Shares

Subject to the “passive

foreign investment company” (“PFIC”) rules discussed below (see “Tax Consequences if the Company is a PFIC”),

a U.S. Holder that receives a distribution, including a constructive distribution, with respect to our common shares will be required

to include the amount of such distribution in gross income as a dividend (without reduction for any Canadian income tax withheld

from such distribution) to the extent of the current or accumulated “earnings and profits” of the Company, as computed

for U.S. federal income tax purposes. To the extent that a distribution exceeds the current and accumulated “earnings and

profits” of the Company, such distribution will be treated first as a tax-free return of capital to the extent of a U.S.

Holder’s tax basis in our common shares and thereafter as gain from the sale or exchange of such common shares (see “Sale

or Other Taxable Disposition of Our Common Shares” below). However, the Company may not maintain calculations of earnings

and profits in accordance with U.S. federal income tax principles, and each U.S. Holder should therefore assume that any distribution

by the Company with respect to our common shares will constitute a dividend. Dividends received on our common shares generally

will not be eligible for the “dividends received deduction” available to U.S. corporate shareholders receiving dividends

from U.S. corporations. If the Company is eligible for the benefits of the Canada-U.S. Tax Convention or our common shares is readily

tradable on an established securities market in the U.S., dividends paid by the Company to non-corporate U.S. Holders generally

will be eligible for the preferential tax rates applicable to long-term capital gains, provided certain holding period and other

conditions are satisfied, including that the Company not be classified as a PFIC in the tax year of distribution or in the preceding

tax year. The dividend rules are complex, and each U.S. Holder should consult its own tax advisor regarding the application

of such rules.

Sale or Other Taxable Disposition

of Our Common Shares

Subject to the PFIC

rules discussed below, upon the sale or other taxable disposition of our common shares, a U.S. Holder generally will recognize

capital gain or loss in an amount equal to the difference between the amount of cash plus the fair market value of any property

received and such U.S. Holder’s tax basis in the common shares sold or otherwise disposed of. Such capital gain or loss

will be long-term capital gain or loss if, at the time of the sale or other taxable disposition, the U.S. Holder’s holding

period for such security is more than one year. Preferential tax rates apply to long-term capital gains of non-corporate U.S. Holders.

There are currently no preferential tax rates for long-term capital gains of a U.S. Holder that is a corporation. Deductions for

capital losses are subject to significant limitations under the Code.

PFIC Status of the Company

If the Company is or

becomes a PFIC, the preceding sections of this summary may not describe the U.S. federal income tax consequences to U.S. Holders

of the ownership and disposition of our common shares. The U.S. federal income tax consequences of owning and disposing of our

common shares if the Company is or becomes a PFIC are described below under the heading “Tax Consequences if the Company

is a PFIC.”

A non-U.S. corporation

is a PFIC for each tax year in which (i) 75% or more of its gross income is passive income (as defined for U.S. federal income

tax purposes) (the “income test”) or (ii) on average for such tax year, 50% or more (by value) of its assets either

produces or is held for the production of passive income (the “asset test”). For purposes of the PFIC provisions, “gross

income” generally includes sales revenues less cost of goods sold, plus income from investments and from incidental or outside

operations or sources, and “passive income” generally includes dividends, interest, certain rents and royalties, and

certain gains from commodities or securities transactions. In determining whether or not it is a PFIC, a non-U.S. corporation is

required to take into account its pro rata portion of the income and assets of each corporation in which it owns, directly or indirectly,

at least a 25% interest (by value). If certain conditions are met, a start-up non-U.S. corporation is not a PFIC in the first year

that it has gross income, but could be a PFIC in one or more earlier years in which it has no gross income but satisfies the asset

test.

Under certain attribution

and indirect ownership rules, if the Company is a PFIC, U.S. Holders will generally be deemed to own their proportionate shares

of the Company’s direct or indirect equity interest in any company that is also a PFIC (a “Subsidiary PFIC”).

The Company does not

know if it currently is a PFIC or was a PFIC in a prior year and, based on current business plans and financial projections, does

not know if it will be a PFIC in subsequent tax years. The determination of PFIC status is inherently factual, is subject to a

number of uncertainties, and can be determined only annually after the close of the tax year in question. Additionally, the analysis

depends, in part, on the application of complex U.S. federal income tax rules, which are subject to differing interpretations.

We might be determined to be a PFIC for the current tax year or any prior or future tax year, and no opinion of legal counsel or

ruling from the IRS concerning the status of the Company as a PFIC has been obtained or will be requested. U.S. Holders should

consult their own U.S. tax advisors regarding the PFIC status of the Company.

Tax Consequences if the Company is

a PFIC

If the Company is

a PFIC for any tax year during which a U.S. Holder owns our common shares, special rules may increase such U.S. Holder’s

U.S. federal income tax liability with respect to the ownership and disposition of such common shares. If the Company meets the

income test or the asset test for any tax year during which a U.S. Holder owns our common shares, the Company will be treated

as a PFIC with respect to such U.S. Holder for that tax year and for all subsequent tax years, regardless of whether the Company

meets the income test or the asset test for such subsequent tax years, unless the U.S. Holder elects to recognize any unrealized

gain in such common shares or makes a timely and effective QEF Election or, if applicable, Mark-to-Market Election.

Under the default PFIC rules:

|

|

•

|

any gain realized on the

sale or other disposition (including dispositions and certain other events that would not otherwise be treated as taxable events)

of our common shares (including an indirect disposition of the stock of any Subsidiary PFIC) and any “excess distribution”

(defined as a distribution to the extent it, together with all other distributions received in the relevant tax year, exceeds

125% of the average annual distribution received during the preceding three years) received on our common shares or with respect

to the stock of a Subsidiary PFIC will be allocated ratably to each day of such U.S. Holder’s holding period for our common

shares;

|

|

|

•

|

the amount allocated to

the current tax year and any year prior to the first year in which the Company was a PFIC will be taxed as ordinary income in

the current year;

|

|

|

•

|

the amount allocated to

each of the other tax years (the “Prior PFIC Years”) will be subject to tax at the highest ordinary income tax rate

in effect for the applicable class of taxpayer for that year;

|

|

|

•

|

an interest charge will

be imposed with respect to the resulting tax attributable to each Prior PFIC Year, which interest charge is not deductible by

non-corporate U.S. Holders; and

|

|

|

•

|

any loss realized on the

disposition of our common shares generally will not be recognized.

|

A U.S. Holder that

makes a timely and effective “mark-to-market” election under Section 1296 of the Code (a “Mark-to-Market Election”)

or a timely and effective election to treat the Company and each Subsidiary PFIC as a “qualified electing fund” (a

“QEF”) under Section 1295 of the Code (a “QEF Election”) may generally mitigate or avoid the PFIC consequences

described above with respect to our common shares.

If a U.S. Holder makes

a timely and effective QEF Election, the U.S. Holder must include currently in gross income each year its pro rata share of the

Company’s ordinary income and net capital gains, regardless of whether such income and gains are actually distributed. Thus,

a U.S. Holder could have a tax liability with respect to such ordinary income or gains without a corresponding receipt of cash

from the Company. If the Company is a QEF with respect to a U.S. Holder, the U.S. Holder’s basis in our common shares will

be increased to reflect the amount of the taxed but undistributed income. Distributions of income that had previously been taxed

will result in a corresponding reduction of basis in our common shares and will not be taxed again as a distribution to a U.S.

Holder. Taxable gains on the disposition of our common shares by a U.S. Holder that has made a timely and effective QEF Election

are generally capital gains. A U.S. Holder must make a QEF Election for the Company and each Subsidiary PFIC if it wishes to have

this treatment. To make a QEF Election, a U.S. Holder will need to have an annual information statement from the Company setting

forth the ordinary income and net capital gains for the year. U.S. Holders should be aware that we might not satisfy the recordkeeping

requirements that apply to a QEF or supply U.S. Holders with information such U.S. Holders require to report under the QEF rules

in the event that the Company is a PFIC for any tax year.

In general, a U.S.

Holder must make a QEF Election on or before the due date for filing its income tax return for the first year to which the QEF

Election applies. Under applicable Treasury Regulations, a U.S. Holder will be permitted to make retroactive elections in

particular circumstances, including if it had a reasonable belief that the Company was not a PFIC and filed a protective election.

If a U.S. Holder owns PFIC stock indirectly through another PFIC, separate QEF Elections must be made for the PFIC in which the

U.S. Holder is a direct shareholder and the Subsidiary PFIC for the QEF rules to apply to both PFICs. Each U.S. Holder should consult

its own tax advisor regarding the availability and desirability of, and procedure for, making a timely and effective QEF Election

for the Company and any Subsidiary PFIC.

A Mark-to-Market Election

may be made with respect to stock in a PFIC if such stock is “regularly traded” on a “qualified exchange or

other market” (within the meaning of the Code and the applicable Treasury Regulations). A class of stock that is traded

on one or more qualified exchanges or other markets is considered to be “regularly traded” for any calendar year during

which such class of stock is traded in other than de minimis quantities on at least 15 days during each calendar quarter. If our

common shares are considered to be “regularly traded” within this meaning, then a U.S. Holder generally will be eligible

to make a Mark-to-Market Election with respect to such security but not with respect to a Subsidiary PFIC. Our common shares are

listed or posted for trading on a stock quotation system and therefore considered to be “regularly traded” for this

purpose.

When these securities

become “regularly traded,” a U.S. Holder that makes a timely and effective Mark-to-Market Election with respect to

such securities generally will be required to recognize as ordinary income in each tax year in which the Company is a PFIC an amount

equal to the excess, if any, of the fair market value of such stock as of the close of such taxable year over the U.S. Holder’s

adjusted tax basis in such stock as of the close of such taxable year. A U.S. Holder’s adjusted tax basis in our securities

generally will be increased by the amount of ordinary income recognized with respect to such stock. If the U.S. Holder’s

adjusted tax basis in our securities as of the close of a tax year exceeds the fair market value of such stock as of the close

of such taxable year, the U.S. Holder generally will recognize an ordinary loss, but only to the extent of net mark-to-market income

recognized with respect to such stock for all prior taxable years. A U.S. Holder’s adjusted tax basis in our securities generally

will be decreased by the amount of ordinary loss recognized with respect to such stock. Any gain recognized upon a disposition

of our common shares generally will be treated as ordinary income, and any loss recognized upon a disposition generally will be

treated as ordinary loss to the extent of the net mark-to-market income recognized for all prior taxable years. Any loss recognized

in excess thereof will be taxed as a capital loss. Capital losses are subject to significant limitations under the Code. Each U.S.

Holder should consult its own tax advisor regarding the availability and desirability of, and procedure for, making a timely and

effective Mark-to-Market Election with respect to our common shares.

Foreign Tax Credit

A U.S. Holder that

pays (whether directly or through withholding) Canadian income tax in connection with the ownership or disposition of our common

shares may be entitled, at the election of such U.S. Holder, to receive either a deduction or a credit for such Canadian income

tax paid. Generally, a credit will reduce a U.S. Holder’s U.S. federal income tax liability on a dollar-for-dollar basis,

whereas a deduction will reduce a U.S. Holder’s income subject to U.S. federal income tax. This election is made on a year-by-year

basis and applies to all creditable foreign taxes paid (whether directly or through withholding) by a U.S. Holder during a year.

Complex limitations

apply to the foreign tax credit, including the general limitation that the credit cannot exceed the proportionate share of a U.S.

Holder’s U.S. federal income tax liability that such U.S. Holder’s “foreign source” taxable income

bears to such U.S. Holder’s worldwide taxable income. In applying this limitation, a U.S. Holder’s various items of

income and deduction must be classified, under complex rules, as either “foreign source” or “U.S. source.”

Generally, dividends paid by a non-U.S. corporation should be treated as foreign source for this purpose, and gains recognized

on the sale of securities of a non-U.S. corporation by a U.S. Holder should be treated as U.S. source for this purpose, except

as otherwise provided in an applicable income tax treaty, and if an election is properly made under the Code. However, the amount

of a distribution with respect to our common shares that is treated as a “dividend” may be lower for U.S. federal income

tax purposes than it is for Canadian federal income tax purposes, resulting in a reduced foreign tax credit allowance to a U.S.

Holder. In addition, this limitation is calculated separately with respect to specific categories of income. The foreign tax credit

rules are complex, and each U.S. Holder should consult its own U.S. tax advisor regarding the foreign tax credit rules.

Special rules apply

to the amount of foreign tax credit that a U.S. Holder may claim on a distribution, including a constructive distribution, from

a PFIC. Subject to such special rules, non-U.S. taxes paid with respect to any distribution in respect of stock in a PFIC are generally

eligible for the foreign tax credit. The rules relating to distributions by a PFIC and their eligibility for the foreign tax credit

are complicated, and a U.S. Holder should consult its own tax advisor regarding their application to the U.S. Holder.

Receipt of Foreign Currency

The amount of any distribution

or proceeds paid in Canadian dollars to a U.S. Holder in connection with the ownership, sale or other taxable disposition of our

common shares, will be included in the gross income of a U.S. Holder as translated into U.S. dollars calculated by reference to

the exchange rate prevailing on the date of actual or constructive receipt of the payment, regardless of whether the Canadian dollars

are converted into U.S. dollars at that time. If the Canadian dollars received are not converted into U.S. dollars on the date

of receipt, a U.S. Holder will have a basis in the Canadian dollars equal to their U.S. dollar value on the date of receipt. Any

U.S. Holder who receives payment in Canadian dollars and engages in a subsequent conversion or other disposition of the Canadian

dollars may have a foreign currency exchange gain or loss that would be treated as ordinary income or loss, and generally will

be U.S. source income or loss for foreign tax credit purposes. Different rules apply to U.S. Holders who use the accrual method

with respect to foreign currency. Each U.S. Holder should consult its own U.S. tax advisor regarding the U.S. federal income tax

consequences of receiving, owning, and disposing of Canadian dollars.

Information Reporting; Backup Withholding

Under U.S. federal

income tax law, certain categories of U.S. Holders must file information returns with respect to their investment in, or involvement

in, a non-U.S. corporation. For example, U.S. return disclosure obligations (and related penalties) are imposed on individuals

who are U.S. Holders that hold certain specified foreign financial assets in excess of certain threshold amounts. The definition

of “specified foreign financial assets” includes not only financial accounts maintained in non-U.S. financial

institutions, but also, if held for investment and not in an account maintained by certain financial institutions, any stock or

security issued by a non-U.S. person, any financial instrument or contract that has an issuer or counterparty other than a U.S.

person and any interest in a non-U.S. entity. A U.S. Holder may be subject to these reporting requirements unless such U.S. Holder’s

shares of our common shares are held in an account at certain financial institutions. Penalties for failure to file certain of

these information returns are substantial. U.S. Holders should consult with their own tax advisors regarding the requirements of