Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

November 25 2019 - 3:09PM

Edgar (US Regulatory)

|

|

|

|

|

|

|

Filed Pursuant to Rule 433

Registration Statement No. 333-229539

November 25, 2019

|

Final Term Sheet

€850,000,000 0.250% Notes due 2024

€800,000,000 0.750% Notes due 2029

€750,000,000 1.000% Notes due 2031

|

|

|

|

|

|

|

|

|

Issuer:

|

|

Stryker Corporation

|

|

|

|

|

|

|

|

|

|

|

2024 Notes

|

|

2029 Notes

|

|

2031 Notes

|

|

|

|

|

|

|

Security Type:

|

|

0.250% Notes due 2024

|

|

0.750% Notes due 2029

|

|

1.000% Notes due 2031

|

|

|

|

|

|

|

Principal Amount:

|

|

€850,000,000

|

|

€800,000,000

|

|

€750,000,000

|

|

|

|

|

|

|

Maturity Date:

|

|

December 3, 2024

|

|

March 1, 2029

|

|

December 3, 2031

|

|

|

|

|

|

|

Interest Payment Dates:

|

|

Each December 3,

commencing

December 3, 2020

|

|

Each March 1,

commencing

March 1, 2021

|

|

Each December 3,

commencing

December 3,

2020

|

|

|

|

|

|

|

Day Count Convention:

|

|

Actual/Actual (ICMA)

|

|

Actual/Actual (ICMA)

|

|

Actual/Actual (ICMA)

|

|

|

|

|

|

|

Coupon (Interest Rate):

|

|

0.250% per year

|

|

0.750% per year

|

|

1.000% per year

|

|

|

|

|

|

|

Benchmark German Government Security:

|

|

OBL 0.000% due October 2024

|

|

DBR 0.250% due February 2029

|

|

DBR 0.000% due August 2029

|

|

|

|

|

|

|

Benchmark German Government Security Price/Yield:

|

|

102.880%; -0.579%

|

|

106.005%; -0.388%

|

|

103.480%; -0.351%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Spread to Benchmark German Government Security:

|

|

+90.3 bps

|

|

+115.5 bps

|

|

+142.5 bps

|

|

|

|

|

|

|

Yield to Maturity:

|

|

0.324%

|

|

0.767%

|

|

1.074%

|

|

|

|

|

|

|

Mid-Swap Yield:

|

|

-0.226%

|

|

0.017%

|

|

0.174%

|

|

|

|

|

|

|

Spread to Mid-Swap Yield:

|

|

+55 bps

|

|

+75 bps

|

|

+90 bps

|

|

|

|

|

|

|

Price to Public:

|

|

99.634%

|

|

99.848%

|

|

99.171%

|

|

|

|

|

|

|

Optional Redemption Provisions:

|

|

|

|

|

|

|

|

|

|

|

|

|

Make-Whole Call:

|

|

Comparable Government Bond Rate + 15 bps

|

|

Comparable Government Bond Rate + 20 bps

|

|

Comparable Government Bond Rate + 25 bps

|

|

|

|

|

|

|

Par Call:

|

|

On or after November 3, 2024, at par

|

|

On or after December 1, 2028, at par

|

|

On or after September 3, 2031, at par

|

|

|

|

|

|

|

CUSIP/ISIN:

|

|

863667AV3 /

XS2087622069

|

|

863667AW1 /

XS2087639626

|

|

863667AX9 /

XS2087643651

|

|

|

|

|

|

|

Common Code:

|

|

208762206

|

|

208763962

|

|

208764365

|

|

|

|

|

Special Mandatory Redemption:

|

|

In the event that the Issuer does not consummate the tender offer in connection with acquisition of Wright Medical Group N.V. on or prior to February 4, 2021 or at

any time prior to such date, the Issuer notifies the trustee in writing that the Purchase Agreement has been terminated, the Issuer will be required to redeem each series of notes (other than the 2029 Notes) in whole and not in part at a special

mandatory redemption price equal to 101% of the aggregate principal amount of such series of notes, plus accrued and unpaid interest, if any, to, but excluding, the special mandatory redemption date.

|

|

|

|

|

Expected Ratings*:

|

|

Baa1 (stable) (Moody’s) / A- (stable) (Standard & Poor’s)

|

|

|

|

|

Trade Date:

|

|

November 25, 2019

|

|

|

|

|

|

|

|

|

|

|

|

|

Settlement Date**:

|

|

December 3, 2019 (T+5)

|

|

|

|

|

Joint Book-Running Managers:

|

|

Barclays Bank PLC

BNP Paribas

Goldman Sachs & Co. LLC

Morgan Stanley & Co. International plc

|

|

|

|

|

Senior Co-Managers:

|

|

Citigroup Global Markets Limited

Merrill Lynch International

Wells Fargo Securities International Limited

|

|

|

|

|

Co-Managers:

|

|

Citizens Capital Markets, Inc.

HSBC Securities (USA) Inc.

Mizuho International plc

MUFG Securities EMEA plc

PNC Capital Markets LLC

Siebert Williams Shank & Co., LLC

U.S. Bancorp Investments, Inc.

|

|

*

|

Ratings may be changed, suspended or withdrawn at any time and are not a recommendation to buy, hold or sell any security. No report of any

rating agency is being incorporated by reference herein.

|

|

**

|

It is expected that delivery of the notes will be made against payment therefor on or about December 3, 2019, which is the fifth U.S.

business day following the date of the pricing of the notes. Under Rule 15c6-1 under the Securities Exchange Act of 1934, as amended, trades in the secondary market generally are required to settle in two

business days unless the parties to that trade expressly agree otherwise. Accordingly, purchasers who wish to trade the notes prior to the second business day preceding the settlement date will be required, by virtue of the fact that the notes

initially will settle in T+5, to specify an alternative settlement cycle at the time of any such trade to prevent failed settlement and should consult their own advisors.

|

Manufacturer target market (MiFID II product governance) is eligible counterparties and professional clients only (all distribution channels). No PRIIPs key information document has been prepared as the

Notes are not available to retail investors in the EEA.

The issuer has filed a registration statement (including a prospectus) with the

SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this

offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by

calling Barclays Bank PLC toll free at 1-888-603-5847, BNP Paribas toll-free at 1-800-854-5674, Goldman Sachs & Co. LLC toll-free at

1-866-471-2526 or Morgan Stanley & Co. International plc toll-free at 1-866-718-1649.

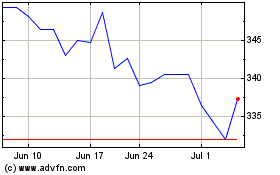

Stryker (NYSE:SYK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Stryker (NYSE:SYK)

Historical Stock Chart

From Apr 2023 to Apr 2024