By Tim Higgins and Heather Somerville

LOS ANGELES-- Elon Musk unveiled the next piece of Tesla Inc.'s

electric-vehicle vision: a pickup truck with a starting price of

$39,900. But the road won't be easy.

Mr. Musk's gamble on the lucrative truck market could help him

expand the Silicon Valley car company further from a niche player

into a mainstream all-electric manufacturer. Yet as Tesla tries to

vie with U.S. auto makers that rely on pickups to fuel their profit

engines, it must contend with a history of struggling to bring out

new products.

The billionaire entrepreneur revealed the newest vehicle in the

Silicon Valley auto maker's lineup--a pickup the chief executive

has dubbed "Cybertruck"--on Thursday night outside Los Angeles.

The Cybertruck has a triangle-like appearance and features

performance capabilities that would rival or beat gasoline-powered

designs. It would come in three versions, Mr. Musk said. The

entry-level, $39,900 rear-wheel drive model would have a range of

more than 250 miles per charge. A version with a dual motor and

all-wheel drive priced at $49,900 would have a range of more than

300 miles. The top-end model will have a so-called tri-motor and

all-wheel drive and be able to drive more than 500 miles per

charge. That costs $69,900, the company said.

The company began taking orders on its website with fully

refundable deposits of $100. The company was vague about when

production would begin. It said customers could complete their

vehicle configurations as production startup nears in late 2021.

Production of the tri-motor version is expected to begin in late

2022, Tesla said.

Ahead of the event, Mr. Musk teased details suggesting the truck

will have capabilities similar to those of Ford Motor Co.'s popular

F-150 and a design inspired by the science fiction movie "Blade

Runner."

Mr. Musk, who previously likened the design to an armored

personnel carrier, on Thursday said the design's metal structure

could withstand 9 millimeter bullets and the windows would be hard

to break--though an on stage demonstration failed when a metal ball

thrown twice at the side windows left them badly damaged.

A splashy event filled with customers and fans is part of the

playbook long adopted by Tesla to generate interest in vehicles

that are often months, if not years, away. Mr. Musk, known for his

penchant for promotion, last month told analysts he views the truck

as "our best product ever."

But customers may have to wait some time before they can get

their hands on the vehicle. Tesla hasn't said when the pickup is

supposed to roll off its production line, and Mr. Musk has a record

of missing self-imposed deadlines.

Mr. Musk, about two years ago, revealed an electric semitrailer

truck and new Roadster sports car. The semitrailer was supposed to

begin production this year, but that has slipped to next year. The

Roadster also remains in development.

Earlier this year, Tesla revealed the Model Y compact

sport-utility vehicle, but that won't begin production until next

year.

The busy product pipeline presents a challenge for Tesla. The

company traditionally spent years largely focused on developing one

vehicle at a time. Now it is working on multiple designs.

The pickup truck also revives a question Tesla has faced before:

Are consumers ready for an all-electric-vehicle future?

Mr. Musk has defied conventional automotive industry wisdom

during the past 16 years by demonstrating that hundreds of

thousands of people were willing to pay a premium for electric

cars. When Tesla first revealed the Model S large sedan in 2009,

there was uncertainty over how large the market would be for an

electric car. Mr. Musk proved customers could be won over.

But the jury is out on whether pickup buyers will be lured by

environmental credentials and drawn away from models offered by

incumbents in one of the most fiercely competitive segments in the

U.S.

The pickup market has long been a tempting segment for auto

makers eyeing the success it has brought for Ford and General

Motors Co. But the success has proved challenging to replicate.

Customers of GM, Ford and Fiat Chrysler Automobiles NV's Ram

pickups have shown more brand loyalty than the typical sedan buyer.

Almost 70% of Ford truck buyers, for example, returned for their

next truck purchases, in the most recent survey of vehicle buyers

conducted by market researcher Strategic Vision. That compares with

51% of Ford car buyers doing the same. By comparison, 34% of Nissan

Motor Co. buyers bought another truck from the Japanese brand.

Tesla could be "at a major disadvantage because they would end

up competing with themselves for those that are buying on prestige,

while those who want a truck-truck--rather than a

sport-truck--would look to others to provide that type of vehicle,"

said Alexander Edwards, president of Strategic Vision.

Tesla isn't alone in betting that the time for an electric

pickup is right. Rivian, a startup based in suburban Detroit, has

been working for years on an electric truck. It plans to begin

production in 2020 of a version with a price starting at $69,000.

The company says the truck will have a range of 400 miles on a

single charge. It revealed the vehicle at the Los Angeles Auto Show

last year and has since received investments from Amazon.com Inc.

and Ford, which is also working on its own electric truck.

Rival trucks had doors that "might as well be made of tissue

paper," he said. "When you say something's 'built tough' that's

what we mean," he said in a swipe at Ford's slogan "Built Ford

Tough."

The high-end Tesla pickup would be able to tow 14,000 pounds,

Mr. Musk said. Ford offers an F-150 with a maximum tow rating of

13,200 pounds. In July, Ford showed off a prototype version of its

electric truck, currently under development, towing a train

weighing more than 1 million pounds. On Thursday night, Mr. Musk

showed a video of his truck winning a tug of war with a Ford

truck.

Earlier this week, Ford shrugged off Mr. Musk's previous claims

about the new vehicle outperforming a Ford pickup. "We've heard

that before a few times in our 42 years as America's undisputed

truck leader with Ford F-series," said Michael Levine, a Ford

spokesman.

Paying for Mr. Musk's vision has been a challenge for Tesla amid

repeated concerns about the company's small reserve of cash. Mr.

Musk bought himself some breathing room earlier this year when

Tesla raised more than $2 billion in new equity and debt and

returned the company to being cash-flow-positive in the third

quarter. Still, investors will be looking for details on how Mr.

Musk plans to pay for another product and where he expects to build

the vehicle.

Cracking the pickup segment comes with financial appeal for

Tesla.

Large trucks accounted for 36% of Ford's North America unit

sales last year, while those trucks generated 70% of the region's

profit, Barclays PLC said.

That is, in part, because auto makers are able to charge so much

more for these vehicles, with customers paying for performance

features and creature comforts. The average new vehicle sold in the

U.S. in October for $37,886. That month full-size pickups had

average transaction prices of $50,496, greater than entry-level

luxury sedans and SUVs, according to Edmunds, a website that tracks

car sales.

Write to Tim Higgins at Tim.Higgins@WSJ.com and Heather

Somerville at Heather.Somerville@wsj.com

(END) Dow Jones Newswires

November 22, 2019 00:53 ET (05:53 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

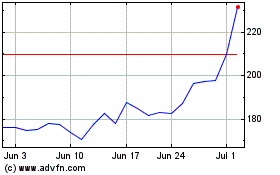

Tesla (NASDAQ:TSLA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tesla (NASDAQ:TSLA)

Historical Stock Chart

From Apr 2023 to Apr 2024