Lowe's to Close 34 Stores in Canada -- WSJ

November 21 2019 - 3:02AM

Dow Jones News

By Dave Sebastian

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (November 21, 2019).

Lowe's Cos. reported another quarter of soft sales but raised

its adjusted full-year earnings targets and said it would trim its

store fleet in Canada as part of the home-improvement chain's

broader turnaround.

The company said Wednesday that it is closing 34 Canadian stores

early next year as part of its wide-ranging efforts to simplify and

improve its business. The company said it also plans to reduce the

number of banners it operates under in that country.

The Canadian restructuring is the latest of President and Chief

Executive Marvin Ellison's cost-cutting measures since he took the

helm last summer. Mr. Ellison was most recently chief executive of

the struggling department-store chain J.C. Penney Co. and was

previously a senior executive for Home Depot Inc.

In the past year, Mr. Ellison has closed other underperforming

stores and tried to improve the company's supply chain, customer

experience and merchandising.

The latest round of closures include 26 Rona stores, six Lowe's

and two Reno-Depot locations, the retailer said. The stores are

expected to close by Feb. 19.

The company booked a $53 million noncash charge related to the

Canadian strategic review in the third quarter.

Lowe's reported third-quarter earnings of $1.36 a share, up from

78 cents a share in the year-ago period and more than the $1.34 a

share that analysts polled by FactSet had expected. Adjusted

earnings were $1.41 a share, ahead of the $1.35 a share analysts

were anticipating.

Sales, however, declined 0.2% to $17.39 billion and missed the

consensus estimate of $17.69 billion.

The Mooresville, N.C., company lowered its full-year earnings

expectations, but raised them on an adjusted basis, as it

anticipates additional charges in the fourth quarter related to the

restructuring.

Shares of Lowe's were up 3.9% Wednesday.

Lowe's said sales at stores that have been open for more than 13

months were up 2.2% in the quarter, compared with rival Home

Depot's same-store sales growth of 3.6%. Lowe's sales growth in

recent years has lagged behind Home Depot, but during the first

quarter, Lowe's sales growth outpaced Home Depot for the first time

since 2016.

Comparable sales in the U.S. home-improvement business were up

3% in the third quarter.

The company attributed the growth in the U.S. to improved

customer experience, better merchandise category performance and

the continued growth of its business with professionals.

The company is now eyeing how it might expand the professional

business further. This quarter it rolled out a loyalty program for

its professional customers that it plans to take national in the

first half of 2020. The program, with the help of a customer

relationship management program, should allow it to be more

strategic with its marketing.

In the latest quarter, online sales in the U.S. grew 3%, adding

no real benefit to sales, Mr. Ellison said, adding that the

industry standard is closer to 20% growth. It is in the midst of a

major overhaul, including moving its website to the cloud in the

first half of 2020, Mr. Ellison said.

On a call with investors, Mr. Ellison said the company

underestimated the complexity of rebuilding its online

business.

"It's not difficult to grow dot-com sales. It's difficult to do

it correctly," he said. "Rather than having a bunch of

nonproductive promotions and other couponing events, we shut that

down and we basically said, 'How do we structure this business in

the right way?' "

In addition to the complexities of a turnaround, Mr. Ellison

said the company this year has faced other uncertainties such as

U.S. tariffs on trading partners.

"Overall, I feel great," Mr. Ellison said. "I think that we have

identified most of the surprises because we spent a lot of time

really digging into the areas of the business that carry the most

financial risk and the most financial benefit."

Write to Dave Sebastian at dave.sebastian@wsj.com

(END) Dow Jones Newswires

November 21, 2019 02:47 ET (07:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

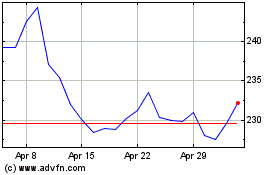

Lowes Companies (NYSE:LOW)

Historical Stock Chart

From Mar 2024 to Apr 2024

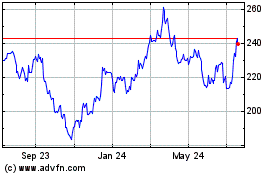

Lowes Companies (NYSE:LOW)

Historical Stock Chart

From Apr 2023 to Apr 2024