Investors Parse Mixed Signals Ahead of Retail Earnings

November 18 2019 - 4:54PM

Dow Jones News

By Paul Vigna

Retail earnings are in the spotlight this week, and some

analysts are confident that they will exceed expectations -- adding

to what's already been a strong year for the sector.

This week brings earnings reports from Home Depot Inc. and

Kohl's Corp. on Tuesday; Target Corp. on Wednesday; Macy's Inc. and

Nordstrom Inc. on Thursday; and others. Analysts, noting last

week's rosy report from Walmart Inc., and the government's October

retail-sales report, expect other retailers will outperform as

well.

"October retail sales showed acceleration," Nomura Instinet

analyst Michael Baker wrote in a note. In fact, he said, over the

last three full months the Commerce Department's numbers were the

best since the second quarter of 2018.

So far this year, investors have bought that narrative. The

S&P 500's consumer-staples and consumer-discretionary sectors

are both up about 22% in 2019, just short of the broader index's

25% gain. Target, Tiffany & Co., Best Buy Co., Home Depot and

Walmart are all up at least 25%.

But if Walmart is any indication, future share-price gains may

be harder to come by. Its shares initially jumped after its

earnings report, but fell thereafter. On Monday, they closed at

$120.25, a hair under Wednesday's $120.98 close just ahead of the

report. Walmart beat earnings expectations, but its 2.5% sales

increase was slightly under expectations.

There are also big decliners in retail this year. Kohl's is down

12%, Nordstrom has lost 19%, and Macy's is the worst performer in

the consumer discretionary sector, down 44%.

The question for investors at this point is which group -- the

big gainers or the big decliners -- better reflects the

economy.

Andrew Zatlin, who operates SouthBay Research in San Mateo,

Calif., sees signs consumer spending is faltering. Mr. Zatlin

maintains a measure he calls his "vice index," which tracks

spending on discretionary items including alcohol, gambling and

diamond sales.

He tracks state revenue boards to get a sense of how much people

are spending on gambling. In Detroit, Maryland, Connecticut,

Atlantic City and Pennsylvania, he has found, gambling revenue is

flat. Even Las Vegas is seeing no growth, he wrote in a note to

clients.

Another trend he examines is diamond sales, particularly what

size diamonds are selling best. If smaller diamonds aren't selling,

he says, that's a sign consumers are struggling. PriceScope, an

industry site that publishes diamond prices, says prices for

diamonds have been falling -- and those of one karat or less have

fallen sharply.

Prices "have absolutely collapsed the last few months," Mr.

Zatlin said, a sign that lower- and middle-income households are

cutting down or holding off on discretionary spending.

A worrying sign on a broader level is the monthly report on

freight shipments published by Cass Information Systems, which

showed an 11th consecutive monthly decline in October. The report

shows demand is down across all modes of transportation, both

domestically and internationally.

That report should be looked at as a leading indicator because

retailers must order goods before they can sell them. If they are

ordering less -- and that's what the Cass report ultimately shows

-- then they are going to be selling less down the line.

Write to Paul Vigna at paul.vigna@wsj.com

(END) Dow Jones Newswires

November 18, 2019 16:39 ET (21:39 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

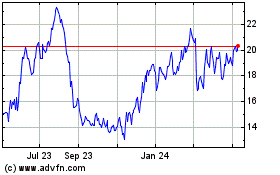

Nordstrom (NYSE:JWN)

Historical Stock Chart

From Mar 2024 to Apr 2024

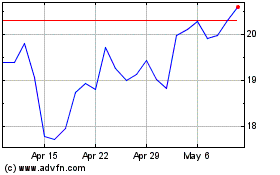

Nordstrom (NYSE:JWN)

Historical Stock Chart

From Apr 2023 to Apr 2024