Naspers Expects 1st Half EPS to Fall Against Tough Comparative -- Update

November 18 2019 - 11:00AM

Dow Jones News

(Adds Prosus statement)

By Adria Calatayud

Naspers Ltd. (NPN.JO) said Monday that it expects first-half

earnings per share to fall sharply, as its year-earlier results

received a one-off boost from the sale of its stake in India's

Flipkart Ltd.

The South Africa-based investor--which owns a major stake in

China's Tencent Holdings Ltd. (0700.HK) through its

Amsterdam-listed arm Prosus NV (PRX.AE)--said it expects EPS for

the half year to Sept. 30 to fall by 31%-38%. This would result in

EPS for the half year of between $4.87 and $5.42 compared with

$7.82 for the same period of fiscal 2019, Naspers said.

The company said it will book a $600 million gain on disposal of

its interest in MakeMyTrip Ltd. as well as a fair-value gain of

$400 million on investments held by Tencent.

Core headline EPS--the company's preferred earnings metric,

which excludes non-operational items--are expected to grow by up to

3% on year, Naspers said. The company said it expects core headline

EPS of between $3.80 and $3.91 for the first half compared with

$3.80 a year earlier.

Separately on Monday, Prosus said it expected first-half EPS to

fall by 4.4%-13% to between $1.48 and $1.63. Core headline EPS is

forecast to rise by between 11% and 17% and come in at a range of

between $1.02 and $1.08. Prosus said it is a subsidiary of Naspers,

and its financial results almost completely account for Naspers's

results.

Write to Adria Calatayud at adria.calatayud@dowjones.com

(END) Dow Jones Newswires

November 18, 2019 10:45 ET (15:45 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

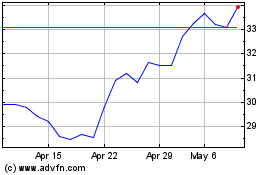

Prosus NV (EU:PRX)

Historical Stock Chart

From Mar 2024 to Apr 2024

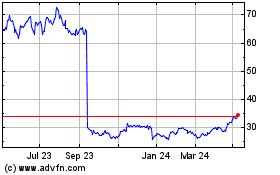

Prosus NV (EU:PRX)

Historical Stock Chart

From Apr 2023 to Apr 2024