By Gunjan Banerji

The Dow Jones Industrial Average crossed 28000 for the first

time Friday, notching a new record as fading recession fears

extended the decadelong bull-market rally.

A furious rise in the final minutes of the trading session

thrust the Dow above its latest milestone, re-energizing a stock

market that appeared listless in recent days.

Investors drove the Dow up 222.93 points, or 0.8%, to 28004.89

-- its 11th record close of 2019 -- as they cheered trade

developments and a rosier economic outlook. The blue-chip gauge has

logged four straight weeks of gains.

The S&P 500 and technology-heavy Nasdaq Composite also

closed at records, extending their weekly winning streaks to six

and seven, respectively.

This week's optimism was spurred, in part, by White House

economic adviser Lawrence Kudlow who indicated progress toward a

potential trade deal with China and Federal Reserve Chairman Jerome

Powell who noted strength in the economy. A better-than-feared

corporate earnings season has also helped fend off fears of a

downturn that had weighed on markets in recent months.

Meanwhile, fresh data Friday showed U.S. retail sales rebounded

in October, rising 0.3% after a drop the previous month. Those

figures bolstered confidence in the U.S. consumer, a key engine of

domestic growth, and followed a strong earnings report from

Walmart. The retail giant on Thursday reported another increase in

sales, marking a five-year streak of quarterly sales gains.

Those developments reignited investor enthusiasm about the final

stretch of 2019, particularly in light of the Federal Reserve's

three interest-rate cuts this year. Many investors had previously

been wary of a redo of 2018, when an autumn selloff erased a rally

that had been months in the making.

Now, many predict the recent rally to continue.

"Ever so slowly...you get increasing confirmation that this

slowdown has stabilized," said Joseph Amato, chief investment

officer at Neuberger Berman. "All these things have come together

to build a little bit more confidence in risk assets."

The Dow's climb above 28000 marked its first thousand-point

milestone since July. Much of those gains -- 434 points -- were

powered by Apple whose shares have advanced 32% since mid-July.

That was followed by Microsoft, which added 78 points.

In Friday's session, the biggest winners were shares of

health-care companies including UnitedHealth Group and Pfizer. A

far-reaching plan released by the Trump administration showed that

hospitals and insurers would be forced to disclose secret,

negotiated rates for the first time.

The S&P 500 finished the week 0.9% higher. Its six

consecutive weeks of gains are the longest such stretch in two

years. The Nasdaq Composite advanced 0.8% this week.

Strong retail earnings like those from Walmart have spurred

optimism that a strong holiday season could be ahead. Shares of

J.C. Penney rose 6.4% Friday after the retailer boosted its

financial outlook for the year and reported better-than-expected

third-quarter results.

Investors have also been encouraged by a rebound in

government-bond yields, particularly in the U.S. The growing

positive gap between 10-year yields and two-year yields has helped

ease fears about a potential recession.

"Much of this rally over the past 30 days is the reassessment of

the recession risk that was increasingly priced into the market,"

said Bob Browne, chief investment officer of Northern Trust Corp.

"We would expect this momentum to continue going into the end of

the year."

The string of records for stocks comes as broader markets have

been in a lull. In one sign of how sleepy trading has been, the Dow

finished unchanged earlier this week for only the third time since

2000.

The S&P 500, meanwhile, hadn't moved up or down more than

0.5% for nine consecutive trading days through Thursday, the

longest streak since October 2018, according to Dow Jones Market

Data.

This is partially driven by mixed signals of progress between

the U.S. and China that have left investors in a lurch, analysts

said.

"I think the uncertainty is still elevated," said Justin

Onuekwusi, head of retail multiasset funds at Legal & General

Investment Management. "Just because you see an improvement doesn't

mean it's gone away," he said.

Though stock investors appeared elated, caution was evident in

traditionally safer investments this week, as investors also

scooped up haven assets like Treasurys and gold. The yield on the

10-year Treasury note fell to 1.833%, its biggest one-week yield

decline in a month. Gold prices edged higher.

Some analysts said big risks have receded lately, rather than

positive news emerging to help drive stocks higher.

For example, though retail sales didn't disappoint, the data

stood in contrast to U.S. factory production, which fell in

October. Mr. Powell told lawmakers Thursday that the U.S.-China

trade conflict has weighed on domestic manufacturing activity.

Elsewhere, Hong Kong's Hang Seng Index was flat Friday but ended

the week down 4.8%, its worst week since early August, after

antigovernment protests in the Chinese territory turned more

violent with some of the worst clashes in six months of unrest. The

Shanghai Composite Index ended the week down 2.5%.

Paul J. Davies and Caitlin Ostroff contributed to this

article.

Write to Gunjan Banerji at Gunjan.Banerji@wsj.com

(END) Dow Jones Newswires

November 15, 2019 17:41 ET (22:41 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

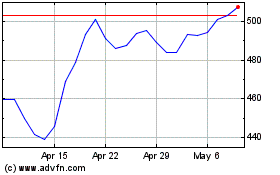

UnitedHealth (NYSE:UNH)

Historical Stock Chart

From Mar 2024 to Apr 2024

UnitedHealth (NYSE:UNH)

Historical Stock Chart

From Apr 2023 to Apr 2024