Maersk Will Restrain Costs, Expand Logistics Services on Weak Shipping Outlook

November 15 2019 - 4:07PM

Dow Jones News

By Costas Paris and Dominic Chopping

A.P. Moeller-Maersk AS is stepping back from buying new vessels

as the Danish shipping giant focuses on controlling costs and

targets its growth efforts to inland logistics rather than

oceangoing trade.

"We are focused on our costs," Chief Executive Søren Skou said

Friday, as the Danish company posted better-than-expected earnings

for the third quarter despite declining revenue. "We have a strict

focus on capacity and network capacity."

That includes stepping back from an arms race that has seen

several container lines in Asia and Europe order megaships with

significantly more capacity per vessel than the biggest ships

operated by Maersk Line, the company's main container shipping

unit.

Mr. Skou said in an interview that Maersk instead will focus its

capital spending and strategic planning on efforts to build up its

business beyond port-to-port ocean transport, expanding its

logistics services business that provides more profitable long-term

growth potential.

"We need to grow in acquisitions on land warehouses and customs

house clearing services," Mr. Skou said. "We have invested around

$1 billion already on the land side supply chain and we are looking

to put in hundreds of millions more over the next year."

The effort has been three years in the making, but revenue from

the what Maersk calls its Logistics & Services unit totaled

$1.6 billion in the last quarter, a fraction of the $7.3 billion

that came from shipping. Gross profit growth from Logistics and

Services improved to 13.4% in the quarter.

Mr. Skou said he wants half of the company's income to come from

nonocean services over the next three years.

Maersk has around 70,000 customers at sea, with clients ranging

from U.S. retail chains and car makers to furniture suppliers,

electronics companies and clothing importers.

But less than a quarter of those customers use the company to

move their goods from ports to warehouses and distribution centers,

and its logistics infrastructure -- around 100 inland

cargo-handling locations around the world -- is small compared with

global logistics providers. Switzerland's Kuehne + Nagel

International AG, Deutsche Post AG's DHL Supply Chain of Germany

and Switzerland-based Ceva Logistics -- a subsidiary of French

shipping competitor CMA CGM SA -- each have hundreds of warehouses

globally.

The company wouldn't say how long it will stay away from the

ship-buying market.

Finance chief Carolina Dybeck Happe said in an investor call

that "there are no intentions now to invest in any large

vessels."

"We will, of course, at some point, need to replenish our fleet

to maintain our competitive network," she said. But "new vessel

orderings in the years to come will be to maintain the

competitiveness," rather than to gain more market share in

shipping.

Maersk, which moves around 20% of all containers, reported a net

profit of $520 million in the quarter ending Sept. 30, up from $396

million a year earlier, compared with average analyst expectations

of $359 million. Net profit attributable to shareholders totaled

$506 million.

That came as overall revenue slipped 1% to $10.06 billion.

Business at the company's main shipping unit was flat as a 2.1%

rise in volumes was offset by a 3.6% decline in average freight

rates from a year ago.

Maersk expects box growth at around 2% this year, less than half

the 4.5% recorded in 2018. The overall industry container fleet

will grow by 4%, according to data by Braemar ACM Shipbroking in

London.

The carrier estimates uncertainty from global trade skirmishes,

including the U.S.-China trade war, likely reduced container trade

by 0.5%-1.0% this year.

"Volume growth of 1.5% in the third quarter, which is

traditionally the busy quarter leading into the Christmas trade, is

a sign that the world is not spinning as fast as it has done for

many years," Mr. Skou said.

Write to Costas Paris at costas.paris@wsj.com and Dominic

Chopping at dominic.chopping@wsj.com

(END) Dow Jones Newswires

November 15, 2019 15:52 ET (20:52 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

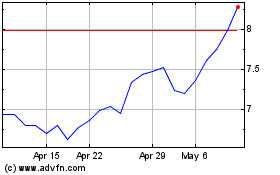

AP Moller Maersk AS (PK) (USOTC:AMKBY)

Historical Stock Chart

From Mar 2024 to Apr 2024

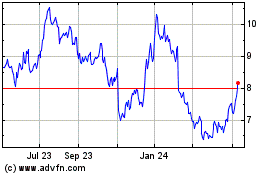

AP Moller Maersk AS (PK) (USOTC:AMKBY)

Historical Stock Chart

From Apr 2023 to Apr 2024