Current Report Filing (8-k)

November 15 2019 - 12:03PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report: November 11, 2019

(Date of earliest event reported)

Enservco Corporation

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

001-36335

|

|

84-0811316

|

|

(State or other jurisdiction of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

999 18th Street, Suite 1925N

Denver, Colorado 80202

(Address of principal executive offices) (Zip Code)

(303) 333-3678

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $.005 par value per share

|

ENSV

|

NYSE

|

Item 1.01. Entry into a Material Definitive Agreement.

On November 11, 2019, the Company entered into an amended and restated subordinated loan agreement (the “Amended and Restated Subordinated Loan Agreement”) with the Company’s largest stockholder, Cross River Partners, L.P. (“Cross River”), documenting the Company’s obligations to Cross River with respect to a new subordinated loan to the Company in the amount of $500,000. In connection with the Amended and Restated Subordinated Loan Agreement, the Company delivered a subordinated promissory note to Cross River in the amount of $500,000 (the “Note” and together with the Amended and Restated Subordinated Loan Agreement, the “Subordinated Loan Documents”). The Note has a maturity date of June 28, 2022 (the “Maturity Date”) and bears interest at a fixed rate of 10.0% per annum. The Company must begin making quarterly payments of accrued interest under the Note on April 1, 2020, and will continue making such interest only payments until the Company’s obligations have been satisfied. On the Maturity Date, all amounts outstanding under the Note will become due and payable. The Company has the right to prepay the outstanding balance of all principal and interest of the Note, in whole, subject to a prepayment penalty equal to the total interest that would have been due and payable on the next two quarterly payments following such prepayment.

A subordinated loan agreement dated June 28, 2017 (the “Original Subordinated Loan Agreement”) provided for borrowings in an aggregate principal amount of up to $2,500,000. Once repaid or prepaid, the amounts borrowed pursuant to the Original Subordinated Loan Agreement may not be reborrowed. The Original Subordinated Loan Agreement and the Amended and Restated Subordinated Loan Agreement contain customary representations and warranties of both the Company and Cross River. In addition, the Amended and Restated Subordinated Loan Agreement incorporates by reference certain affirmative and negative covenants contained in the that certain Loan and Security Agreement between the Company and East West Bank, a California state-charted banking corporation (the “Bank”) dated as of August 10, 2017, as amended by the First Amendment to Loan and Security Agreement dated as of November 20, 2017, the Second Amendment to Loan and Security Agreement dated as of October 26, 2018 and the Third Amendment to Loan and Security Agreement dated as of August 12, 2019 (the “Senior Credit Agreement”). The Amended and Restated Subordinated Loan Agreement also permits the Company to issue debt that is senior, pari passu, or junior to the Company’s obligations under the Amended and Restated Subordinated Loan Agreement.

The Amended and Restated Subordinated Loan Agreement also provides that, in the event the Company issues subordinated debt to one or more lenders that includes pricing terms that are more advantageous to those lenders than the comparable terms of the Amended and Restated Subordinated Loan Agreement are to Cross River, the Company and Cross River will amend the Amended and Restated Subordinated Loan Agreement to reflect such more advantageous terms to Cross River. In the event that an agreement governing the Company’s issuance of such subordinated debt also includes material terms that are more advantageous to the Company than those contained in the Amended and Restated Subordinated Loan Agreement, the Company and Cross River will include such more advantageous terms in any such amendment to the Amended and Restated Subordinated Loan Agreement.

In connection with the Amended and Restated Subordinated Loan Agreement, the Company issued Cross River a five-year warrant (the “Warrant”) to buy an aggregate of 625,000 shares of the Company’s common stock at an exercise price of $0.20 per share.

The descriptions of the Amended and Restated Subordinated Loan Agreement, the Note, and the Warrant set forth above do not purport to be fully and complete and are qualified in their entirety by reference to the Amended and Restated Subordinated Loan Agreement, the Note, and the Warrant, copies of which are attached as exhibits hereto.

Item 2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

See Item 1.01 above for a discussion of the Company’s obligations pursuant to the Subordinated Loan Documents.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

The following exhibits are furnished with this Current Report on Form 8-K:

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

ENSERVCO CORPORATION

|

|

|

|

|

|

Date: November 15, 2019

|

By:

|

/s/ Ian Dickinson

|

|

|

|

Ian Dickinson

|

|

|

|

Chief Executive Officer

|

EXHIBIT INDEX

4

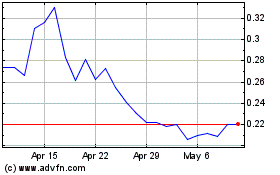

ENSERVCO (AMEX:ENSV)

Historical Stock Chart

From Mar 2024 to Apr 2024

ENSERVCO (AMEX:ENSV)

Historical Stock Chart

From Apr 2023 to Apr 2024