UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

(Rule

14a-101)

(Amendment No.2)

INFORMATION

REQUIRED IN PROXY STATEMENT

SCHEDULE

14A INFORMATION

Proxy

Statement Pursuant to Section 14(a) of The Securities Exchange Act of 1934

Filed

by the Registrant ☐

Filed

by a Party other than the Registrant ☒

Check

the appropriate box:

|

|

☒

|

Preliminary

Proxy Statement

|

|

|

☐

|

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

☐

|

Definitive Proxy

Statement

|

|

|

☐

|

Definitive Additional

Materials

|

|

|

☐

|

Soliciting Material

Under Rule 14a-12

|

|

DOCUMENT

SECURITY SYSTEMS, INC.

|

|

(Name

of Registrant as Specified in Its Charter)

|

|

|

J.

MARVIN FEIGENBAUM

BARINDER ATHWAL

BRIAN MIRMAN

|

|

(Name

of Persons(s) Filing Proxy Statement, if Other Than the Registrant)

|

Payment

of Filing Fee (Check the appropriate box):

|

|

☐

|

Fee computed

on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title

of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate

number of securities to which transaction applies:

|

|

|

(3)

|

Per

unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which

the filing fee is calculated and state how it was determined):

|

|

|

(4)

|

Proposed

maximum aggregate value of transaction:

|

|

|

☐

|

Fee

paid previously with preliminary materials:

|

|

|

☐

|

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of

its filing.

|

|

|

(1)

|

Amount previously

paid:

|

|

|

(2)

|

Form, Schedule

or Registration Statement No.:

|

Persons

who are to respond to the collection of information contained in this form are not required to respond unless the form displays

a currently valid OMB control number.

PRELIMINARY

COPY SUBJECT TO COMPLETION

DATED NOVEMBER 14, 2019

Dear

Fellow Shareholder:

J.

Marvin Feigenbaum, Barinder Athwal and Brian Mirman (collectively the “Concerned Shareholders” or “we”

or “our”) are shareholders of Document Security Systems, Inc., a New York corporation (“DSS” or the “Company”).

For the reasons set forth in the attached Proxy Statement, we believe that stockholders would benefit from the complete replacement

of the Company’s current Board of Directors (the “Board”). We are therefore seeking your support at the Company’s

upcoming 2019 annual meeting of stockholders (the “Annual Meeting”) scheduled to be held at 10:30 a.m. (Eastern Standard

Time) on Monday, December 9, 2019, at Grand Hyatt New York, 109 East 42nd Street at Grand Central Terminal, New York, New York

10017, for the following purposes:

|

|

1.

|

To

elect our slate of directors of seven (7) nominees comprised of J. Marvin Feigenbaum, David Sterling, Giles Hunt, Kerri

Rupert Schiller, Jay P. Moskowitz, Joy C. Booker and Sherman Lee (each a “Nominee” and collectively, the

“Nominees”), to serve for the ensuing year and until their respective successors are duly elected and qualified;

|

|

|

2.

|

To

ratify the appointment of Freed Maxick CPAs, P.C. as the Company’s independent registered public accounting firm for

the fiscal year ending December 31, 2019;

|

|

|

3.

|

To

approve the Company’s 2020 Equity Incentive Plan (the “2020 Incentive Plan”);

|

|

|

4.

|

To

conduct an advisory vote on executive compensation;

|

|

|

5.

|

To

conduct an advisory vote on the frequency of future advisory votes on executive compensation: and

|

|

|

|

|

|

|

6.

|

To

transact such other business as may properly come before the meeting or any adjournment thereof.

|

The

Company has nominated seven (7) candidates for election at the Annual Meeting. The enclosed Proxy Statement is soliciting proxies

to elect our seven (7) Nominees. Accordingly, the enclosed BLUE proxy card may only be voted for our Nominees and does not

confer voting power with respect to any of the Company’s director nominees. Stockholders who return the BLUE proxy card

will only be able to vote for our slate of seven (7) Nominees at the Annual Meeting. Your vote to elect our Nominees will

have the legal effect of replacing all of the Company’s incumbent directors with our Nominees.

We urge you to

carefully consider the information contained in the attached Proxy Statement and then support our efforts by signing, dating and

returning the enclosed BLUE proxy card today. The attached Proxy Statement and the enclosed BLUE proxy

card are first being mailed to stockholders of record on or about [November 15], 2019.

If you have already

voted for the Company’s candidates, you have every right to change your vote by signing, dating and returning a later dated BLUE proxy

card or by voting in person at the Annual Meeting.

If

you have any questions or require any assistance with your vote, please contact Saratoga Proxy Consulting LLC, which is assisting

us, at its address and toll-free numbers listed below.

|

|

Thank

you for your support,

|

|

|

|

|

|

/s/

J. Marvin Feigenbaum

|

|

|

J.

Marvin Feigenbaum

|

|

|

|

|

|

/s/

Barinder Athwal

|

|

|

Barinder

Athwal

|

|

|

|

|

|

/s/

Brian Mirman

|

|

|

Brian

Mirman

|

Stockholders

call toll free at (888) 368-0379

Email:

info@saratogaproxy.com

PRELIMINARY

COPY SUBJECT TO COMPLETION

DATED NOVEMBER 14, 2019

2019

ANNUAL MEETING OF STOCKHOLDERS

OF

DOCUMENT SECURITY SYSTEMS, Inc.

_________________________

PROXY STATEMENT

OF

J.

MARVIN FEIGENBAUM

BARINDER

ATHWAL

BRIAN

MIRMAN

_________________________

PLEASE SIGN, DATE AND MAIL THE ENCLOSED BLUE PROXY CARD TODAY

J.

Marvin Feigenbaum, Barinder Athwal and Brian Mirman (collectively the “Concerned Shareholders” or “we”

or “our”) are shareholders of Document Security Systems, Inc., a New York corporation (“DSS” or the “Company”).

We believe that the Board of Directors of the Company (the “Board”) must be meaningfully reconstituted to ensure that

the Board takes the necessary steps for the Company’s stockholders to realize the maximum value of their investments. We

have nominated a slate of highly qualified and capable candidates who are fully committed to representing the best interests of

stockholders and exploring all opportunities to unlock stockholder value. We are therefore seeking your support at the Company’s

upcoming 2019 annual meeting of stockholders scheduled to be held at 10:30 a.m. (Eastern Standard Time) on Monday, December 9,

2019, at Grand Hyatt New York, 109 East 42nd Street at Grand Central Terminal, New York, New York 10017 (including any adjournments

or postponements thereof and any meeting which may be called in lieu thereof, the “Annual Meeting”), for the following

purposes:

|

|

1.

|

To

elect our slate of directors of seven (7) nominees comprised of J. Marvin Feigenbaum, David Sterling, Giles Hunt,

Kerri Rupert Schiller, Jay P. Moskowitz, Joy C. Booker and Sherman Lee (each a “Nominee” and collectively,

the “Nominees”), to serve for the ensuing year and until their respective successors are duly elected and qualified;

|

|

|

2.

|

To

ratify the appointment of Freed Maxick CPAs, P.C. as the Company’s independent registered public accounting firm for

the fiscal year ending December 31, 2019;

|

|

|

3.

|

To

approving the Company’s 2020 Equity Incentive Plan (the “2020 Incentive Plan”);

|

|

|

4.

|

To

conduct an advisory vote on executive compensation;

|

|

|

5.

|

To

conduct an advisory vote on the frequency of future advisory votes on executive compensation: and

|

|

|

|

|

|

|

6.

|

To

transact such other business as may properly come before the meeting or any adjournment thereof.

|

This

Proxy Statement is soliciting proxies to elect only our Nominees. Accordingly, the enclosed BLUE proxy card may only be

voted for our Nominees and does not confer voting power with respect to any of the Company’s director nominees. Stockholders

who return the BLUE proxy card will only be able to vote for our seven (7) Nominees at the Annual Meeting. See “Voting

and Proxy Procedures” below for additional information. You can only vote for the Company’s director nominees by signing

and returning a proxy card provided by the Company.

The

participants in this solicitation intend to vote their shares FOR the election of the Nominees, FOR the ratification

of the appointment of Freed Maxick CPAs, P.C. as the Company’s independent registered public accounting firm for the fiscal

year ending December 31, 2019, AGAINST the approval of the Company’s 2020 Equity Incentive Plan, AGAINST the

advisory vote on executive compensation and 1 YEAR on the advisory vote on the frequency of holding future advisory votes

on executive compensation. Stockholders should understand, however, that all shares of Common Stock represented by the enclosed

BLUE proxy card will be voted at the Annual Meeting as marked.

The

Company has set the close of business on November 4, 2019 as the record date for determining stockholders entitled to notice of

and to vote at the Annual Meeting (the “Record Date”). The mailing address of the principal executive offices of the

Company is 200 Canal View Boulevard, Suite 300, Rochester, New York, 14623. Stockholders of record at the close of business on

the Record Date will be entitled to vote at the Annual Meeting. According to the Company, as of the Record Date, there were [36,180,557]

shares of Common Stock outstanding.

This

Proxy Statement and the enclosed BLUE proxy card are first being mailed to stockholders on or about [November

15], 2019.

THIS

SOLICITATION IS BEING MADE BY US AND NOT ON BEHALF OF THE BOARD OR MANAGEMENT OF THE COMPANY. WE ARE NOT AWARE OF ANY OTHER MATTERS

TO BE BROUGHT BEFORE THE ANNUAL MEETING OTHER THAN AS DESCRIBED HEREIN. SHOULD OTHER MATTERS, WHICH WE ARE NOT AWARE OF A REASONABLE

TIME BEFORE THIS SOLICITATION, BE BROUGHT BEFORE THE ANNUAL MEETING, THE PERSONS NAMED AS PROXIES IN THE ENCLOSED BLUE

PROXY CARD WILL VOTE ON SUCH MATTERS IN THEIR DISCRETION.

WE

URGE YOU TO SIGN, DATE AND RETURN THE BLUE PROXY CARD IN FAVOR OF THE ELECTION OF THE NOMINEES.

IF

YOU HAVE ALREADY SENT A PROXY CARD FURNISHED BY MANAGEMENT TO THE COMPANY, YOU MAY REVOKE THAT PROXY AND VOTE FOR THE ELECTION

OF THE NOMINEES BY SIGNING, DATING AND RETURNING THE ENCLOSED BLUE PROXY CARD. THE LATEST DATED PROXY IS THE ONLY ONE THAT

COUNTS. ANY PROXY MAY BE REVOKED AT ANY TIME PRIOR TO THE ANNUAL MEETING BY DELIVERING A WRITTEN NOTICE OF REVOCATION OR A LATER

DATED PROXY FOR THE ANNUAL MEETING OR BY VOTING IN PERSON AT THE ANNUAL MEETING.

Important

Notice Regarding the Availability of Proxy Materials for the Annual Meeting

This

Proxy Statement and our BLUE proxy card are available at [www.saratogaproxy.com/concernedshareholders]

IMPORTANT

Your

vote is important, no matter how many shares of Common Stock you own. We urge you to sign, date, and return the enclosed BLUE

proxy card today to vote FOR the election of the Nominees and in accordance with our recommendations on the other proposals on

the agenda for the Annual Meeting.

|

|

☐

|

If

your shares of Common Stock are registered in your own name, please sign and date the enclosed BLUE proxy card and

return it to the Concerned Shareholders c/o Saratoga Proxy Consulting LLC (“Saratoga Proxy”) in the enclosed envelope

today.

|

|

|

☐

|

If

your shares of Common Stock are held in a brokerage account or bank, you are considered the beneficial owner of the shares

of Common Stock, and these proxy materials, together with a BLUE voting form, are being forwarded to you by your broker

or bank. As a beneficial owner, if you wish to vote, you must instruct your broker, trustee or other representative how to

vote. Your broker cannot vote your shares of Common Stock on your behalf without your instructions.

|

|

|

☐

|

Depending

upon your broker or custodian, you may be able to vote either by toll-free telephone or by the Internet. Please refer to the

enclosed voting form for instructions on how to vote electronically. You may also vote by signing, dating and returning the

enclosed voting form.

|

Since

only your latest dated proxy card will count, we urge you not to return any proxy card you receive from the Company. Even if you

return the management proxy card marked “withhold” as a protest against the incumbent directors, it will revoke any

proxy card you may have previously sent to us. Remember, you can vote for our Nominees only on the BLUE proxy card. So

please make certain that the latest dated proxy card you return is the BLUE proxy card.

Stockholders

call toll free at (888) 368-0379

Email:

info@saratogaproxy.com

BACKGROUND

OF THIS PROXY SOLICITATION

The following is a chronology of events

leading up to this proxy solicitation.

During the first few

months of 2018, Mr. Joseph Sanders discussed with Mr. Feigenbaum the possibility of serving on the Board of DSS. Subsequently,

Mr. Sanders recommended Mr. Feigenbaum to Mr. Heng Fai Ambrose Chan, the Company’s Chairman, as a potential director candidate.

On or about July 2018,

Mr. Feigenbaum held conversations with Mr. Chan, the Company’s Chairman, regarding Mr. Feigenbaum joining

the Board of DSS or, alternatively, serving as a consultant to the Company.

On July 24, 2018, Mr.

Feigenbaum returned a completed Directors and Executive Officers questionnaire to DSS’s general counsel at the time (Jeffrey

D’Angelo), yet Mr. Feigenbaum was ultimately not appointed to the Board. Nevertheless, contacts continued into early August

through subsequent telephone conversations with Mr. Chan. Ultimately, on or about August 2018, Mr. Feigenbaum declined an

invitation to join the Company as a consultant.

On or about August

9-11 2018, Mr. Chan and Mr. Feigenbaum communicated by text message regarding other ventures operated by Mr. Chan and ideas to

increase their value. Mr. Chan discussed with Mr. Feigenbaum the possibility of Mr. Feigenbaum becoming involved with other ventures

of Mr. Chan unrelated to the Company. The other ventures related to developing “Nutraceuticals” or health food alternatives

and assisting Mr. Chan with renaming a virtual bank that Mr. Chan was then considering purchasing. Following this exchange, Mr.

Feigenbaum determined not to pursue involvement with any other Mr. Chan’s other ventures.

On or about early May

2019, Mr. Feigenbaum and Mr. Chan discussed possible avenues as to increase shareholder value. In these discussions, Mr. Feigenbaum

made some concrete proposals to Mr. Chan. Mr. Sanders was present at these meetings. Mr. Feigenbaum discussed with Mr. Chan the

need for the Company to be more pro-active in raising awareness of the Company in the market. Mr. Feigenbaum told Mr. Chan that

the Company was not sufficiently proactive in initiating meetings with market participants and gaining appropriate market coverage

of the Company. In addition, Mr. Feigenbaum recommended to Mr. Chan that management needed to undertake a thorough analysis of

the various lines of business that it is involved in and to identify and focus on the more promising lines of business. Thereafter,

there was no further contact between Mr. Feigenbaum and Mr. Chan.

Seeing the significant

opportunities for DSS, Mr. Feigenbaum subsequently sought out significant minority stockholders of DSS, such as Dr. Athwal and

Dr. Mirman in an effort to seek to replace the Board of DSS with a Board that would align itself with the interests of all of the

Company’s stockholders.

On October 24, 2019,

Dr. Athwal delivered by electronic-mail a written demand of the Company, after the required five day notice period, to examine

certain records related to the purpose of the Concerned Shareholders’ solicitation, to communicate with the Company’s

stockholders in connection with the election of directors at the Annual Meeting, as well as of the Concerned Shareholders’

intention to nominate individuals for election as an alternative slate to the nominees recommended by the Board.

On October 25, 2019, the Company filed a

Current Report on Form 8-K with the SEC to announce that the Annual Meeting would be held on December 9, 2019, at a time and location

to be determined, and that any notices to nominate candidates for election as directors at the Annual Meeting must be delivered

to the principal executive offices of the Company, at 200 Canal View Boulevard, Suite 300, Rochester, NY 14623, by November 4,

2019.

On October 28, 2019,

in accordance with the Company’s By-Laws, Dr. Athwal requested a directors and officers questionnaire and form of written

representation and agreement which nominees are required to deliver in order for the Board and its Nominating and Corporate Governance

Committee to properly consider them.

On October 30, 2019,

we issued a press release, including a letter to fellow shareholders of DSS, which was filed on Form DFAN14 with the SEC.

On October 31, 2019, the Company provided

the directors’ and officers’ questionnaire and written representation and agreement.

On November 1, we filed

a Schedule 13D with the SEC to report ownership of approximately 1,671,462 shares of issued and outstanding common stock of the

Company, which at the time was approximately 5.6% of the outstanding shares of the Company’s common stock.

On November 1, 2019,

the Company announced that it had sold 6,000,000 shares to its chairman and largest shareholder, in a private placement transaction

(the “Private Placement”) which closed immediately and increased his beneficial ownership to 31.77% of the Company’s

issued and outstanding voting shares.

On November 4, 2019,

we issued a press release, including a letter to fellow shareholders of DSS, which was filed a Form DFAN14A with the SEC on November

5, 2019, regarding the Private Placement and questioning the timing and need for the issuance of shares.

On November 4, 2019,

Dr, Athwal submitted to the Company our notice of nomination of directors.

On November 4, 2019,

the Company filed a preliminary proxy statement with the SEC.

On November 5, 2019, we filed a preliminary

proxy statement with the SEC.

On November 6, 2019,

after not having received a response to the first notice provided on October 24, 2019, we provided a second notice of Dr. Athwal’s

written demand to receive copies of information regarding the Company’s shareholders.

On November 8, 2019,

we were informed by the Company that the Company had made available to them the proper records at the Company’s offices in

Rochester, NY.

On November 12, 2019,

the Company filed an amended preliminary proxy statement with the SEC.

On November 12, 2019, we filed this amended

preliminary proxy statement with the SEC.

REASONS

FOR THE SOLICITATION

We

believe that DSS has the potential to unlock significant value for all of its stockholders. However, to realize its potential,

DSS needs a Board and a senior management team with proven operational experience. We are here to communicate our vision on what

can be accomplished and the tremendous opportunity that is in front of stockholders.

Poor

Operational Performance: We believe that as a consequence of poor operational execution, DSS’ share price has declined

67% since October 2018 and has undergone an overall decline of 85% over the last five years1. We believe that the Company

needs to address the factors contributing to this consistent underperformance.

Accordingly,

we constructed a slate of director candidates that have diverse and complementary skill sets and the experience spanning the areas

of operations, manufacturing, financial, technology, marketing, banking, risk management that, in the aggregate, possess the expertise

gravely needed at DSS. Our director nominees will be prepared to drive DSS forward and act solely in the best interests of all

stockholders. We believe this level of change is appropriate in light of the dismal operational results and substantial shareholder

value destruction DSS has experienced over the past several years.

|

|

1

|

Simply

Wall St., S. (2019). Those

Who Purchased Document Security Systems (NYSEMKT:DSS) Shares Five Years Ago Have A 85%

Loss To Show For It. [online] Yahoo Finance.

|

Dilution

of Stockholder Value. In June 2019, management closed on a registered stock offering at a price per share of less than 50%

of the then market price of DSS shares. Mr. Chan, the Chairman of the Board of Directors of DSS, purchased approximately

10% of the offering at this deeply discounted price. As of May 31, 2019, the stock price closed at $1.00 and on June 6, 2019,

following the disclosure of the registered offering at per share price of $0.50, the DSS stock closed at approximately $0.46 per

share. Since then, the stock price has only declined and recently hit an all-time low closing price of under $0.30 per share.

Additionally,

on November 1, 2019, the Board approved a private placement to Mr. Chan, the Chairman of the Board, of six (6)

million shares of Common Stock at a premium to a very low share price. The private placement was made despite management’s

assessment, in its quarterly report on Form 10-Q for the quarter ended June 30, 2019, which was issued in August 2019 following

the above referenced registered offering, that it had enough cash resources through 2020. We quote verbatim management’s

representation to this effect:

“We

believe that our $5.7 million in aggregate cash and equivalents and restricted cash as of June 30, 2019 will allow us to fund

our current and planned operations through 2020. However, we may seek additional capital through the sale of debt or equity securities,

if necessary, especially in conjunction with opportunistic acquisitions or licensing arrangements. Based on this, we have concluded

that substantial doubt of our ability to continue as a going concern has been alleviated.”

To

paraphrase, management and the Board approved a private placement of nearly 20% of the Company’s outstanding stock to Mr.

Chan, the Company’s chairman, at a nominal premium to a per share price of approximately $0.27 when there was no operational

need for this capital raise, based on Management’s statements. Furthermore, the closing of the private placement on November

1, 2019, one business day before the scheduled record date of November 4 for this Annual Meeting, is troubling.

We

also note the DSS Board’s apparent abdication of its fiduciary duty to DSS and lack of concern for the perception of DSS

in the public market in approving the issuance of these shares while DSS is in a “Blackout Period” in the weeks preceding

its required filing of DSS’ third quarter report on Form 10-Q due by November 14, 2019. With the value of the shares on

the market not reflecting the results of the third quarter, but with the Company and Mr. Chan each being aware of those results,

the price per share paid by Mr. Chan and the premium are not meaningful. While the issuance at this time may be consistent with

applicable securities law, we believe that it certainly does not comply with good corporate governance practice for a publicly

traded company.

Absence

of Appropriate Corporate Governance and Controls: The approval by the Board of the private placements noted above is deeply

troubling to us as it reflects, we believe, an insufficient regard by the Board of the interests of DSS and, by its extension,

to the DSS shareholders generally.

Equally

troubling is the resignation in the past few months of six independent directors, two of whom were appointed only in May 2019.

THERE

IS A BETTER WAY FORWARD

Our

Nominees Possess the Qualifications and Experience We Believe Is Necessary to Maximize Stockholder Value and Realize the Company’s

True Potential

We

have nominated a slate of seven (7) highly qualified director candidates for election to the Board at the Annual Meeting. The

Nominees were carefully selected for their extensive skill sets in areas directly relevant to DSS’ business, its current

challenges, and importantly, its opportunities for growth. The Nominees collectively bring decades of experience, financial acumen,

leadership skills, and a strong commitment to represent the best interests of all stockholders.

We

believe that a newly elected slate of directors who are not appointed or supported by existing management and the Company’s

major stockholder can take a fresh look at the Company’s many questionable transactions with related parties that have been

consistently approved by the Company’s Audit Committee and Board and ensure that the Company acts in the best interests

of all of the Company’s stockholders.

We believe that the

Company has several poorly performing lines of business that are costly to the overall business of the Company, in particular considering

the Company’s relatively low market cap. These lines of business have insignificant sales or growth potential but draw relatively

large and unjustified investment of resources and do not directly connect to the Company’s core businesses. In order to turn

around the Company’s business and make the Company profitable, we believe that a thorough review of all the Company’s

disparate lines of business is required to identify the more promising lines of business that have the best growth opportunities

and on which management can focus. This will invariably require selling off or closing the less promising assets/or lines of business

and focusing on the ones that have greater potential.

We believe that a corporate

restructuring of non-essential and non-profitable businesses and focusing on the existing promising lines as well as considering

leveraging asset sales to explore new business possibilities is necessary in order to create the conditions needed for a turn around..

Our board candidates include experienced executives, financial professionals and technology experts who are able to collectively

analyze and make a determination regarding these matters.

PROPOSAL

ONE

ELECTION

OF DIRECTORS

The

Board is currently composed of eight (8) directors of whom seven (7) are standing for reelection, each with terms expiring at

the Company’s next annual meeting. We are seeking your support at the Annual Meeting to elect our slate of seven (7) Nominees

in opposition to the Company’s director nominees. Your vote to elect our Nominees will have the legal effect of replacing

the incumbent directors with the Nominees. If all seven (7) Nominees are elected, such Nominees will replace all of

the members of the Board.

THE

NOMINEES

The

following information sets forth the name, age, business address, present principal occupation, and employment and material occupations,

positions, offices, or employments for the past five (5) years of each of the Nominees. The specific experience, qualifications,

attributes and skills that led us to conclude that the Nominees should serve as directors of the Company is set forth above in

the section entitled “Background of this Proxy Solicitation” and “Reasons for the Solicitation” and below.

This information has been furnished to us by the Nominees. All of the Nominees are citizens of the United States of America.

J.

Marvin Feigenbaum, age 69, serves, since October 2014, as the Chief Executive Officer of Group

F Holdings LLC, which provides general business consulting services and has historically invested in financially distressed companies.

From 2002 until September 2014, Mr. Feigenbaum served, as chief executive officer of a privately-held technology company. From

June 1994 through March 2005, he was chief executive officer and Chairman of the Board of SPO Global Inc. (f/k/a United Diagnostic

Inc.), a publicly traded company. From October 2003 to January 2004, he served as interim chief executive officer of Amedia Networks,

Inc. (f/k/a TTR Technologies, Inc.), then a publicly traded company. In addition, from 1982 to 1987, Mr. Feigenbaum served as

chief executive officer of Temco Home Healthcare Products Inc., which was then a publicly-traded company.

We

believe that Mr. Feigenbaum’s years of experience as CEO of private and publicly-traded companies, including planning and

implementing corporate objectives and maximized shareholder values, opening new markets, developing new product lines and creating

partnerships with other companies, as well as his deep knowledge of DSS’ industry and DSS, make him well qualified to serve

on the Board of Directors of the Company.

David

Sterling, age 63, has been the Chief Executive Officer of Sterling & Sterling LLC

d/b/a SterlingRisk for the past 40 years. SterlingRisk is one of the largest national insurance brokers and a leading provider

of risk management services, comprised of more than 200 professions in eight regional offices across the United States. Mr. Sterling

routinely lectures on insurance and taught at the American Management Association. Mr. Sterling received a BA degree in Finance

from Hofstra University.

We

believe that Mr. Sterling’s 40 years of experience leading and managing one of the largest insurance brokers makes him well

qualified to serve on the Board of Directors of the Company.

Giles Hunt,

age 64, age 64, has been, for over 30 years, an independent investor and has, through a career spanning over 30 years, advised

clients on acquisitions and capital raising efforts. Mr. Hunt has been the CEO at Lanikai Financial from January 2008 to the present

day. In this capacity, he conducted competitive analyses, primary and secondary research, and presented recommendation on business

and product lines for a private equity firm. Additionally, he performed cost and profitability analysis for business. Prior to

that, Mr. Hunt served as chief operating officer and chief financial officer of Privee Capital Management Hawaii from March 2001

to December 2007. Mr. Hunt was the Founder and chief executive officer of Business Loan Marketing Corporation from November 1999

to January 2001. Mr. Hunt received his BA from Hamilton College; a JD degree from the University of Pennsylvania and an MBA from

the Wharton School of Business.

We

believe that Mr. Hunt’s business and investing experience of over 30 years in international financial markets will assist

the Board in assessing various opportunities for the Company.

Kerri Ruppert Schiller,

age 60, has served as a financial executive for more than 30 years. During this period, Ms. Schiller has also had oversight of

IT and technology in multiple healthcare settings. Since 1998, she has been associated with Children’s HealthCare of California,

a children’s healthcare system including two children’s hospitals located in Southern California, where she currently

serves as Executive Vice President and Chief Financial Officer (since September 2017) and previously from 1998 as Senior

Vice President and Chief Financial Officer. Prior to that, she was associated with Comprehensive Care Operations, a national for-profit

corporation (NYSE-American) engaged in the ownership, operation, and management of in-hospital programs as well as HMO activities

in multiple states, where she held progressive positions with last served as Senior Vice President and Chief Financial Officer.

Ms. Schiller currently also serves as the Chair of the Board for the California State University, Fullerton Philanthropic Foundation.

Ms. Schiller received a BA with an emphasis in accounting from California State University, Fullerton

We

believe that Ms. Schiller’s experience in senior management of large organizations, financial and accounting experience

qualifies her to serve on the Board of Directors of the Company.

Jay

P. Moskowitz, age 75, is the COO, International Operations of Neogrid, SA, a Brazilian software development company, a position

he has held since January 2016. NeoGrid is an industry leader providing digital B2B supply chain management solutions. From 2009

to December 2015, he was CEO of Neosys International, a consulting company emphasizing technologies that support the optimization

of supply chain performance and synchronization between each link in the chain. Prior thereto he held various senior positions

in management and consulting roles, including CEO of a global management consulting company. Mr. Moskowitz received a B.A. from

Hunter College, an M.A. from University of Pennsylvania, and an M.A. and Ph.D from the University of Rochester.

We

believe that Mr. Moskowitz’s vast experience in the management and in particular his focus on supply chain technology, qualifies

him to serve on the Board.

Joy C. Booker,

age 48, is the Senior Vice President of Client Relations at PineBridge Investment, a multi-asset class investment management firm

with over $85 billion in assets, a position she has held since September 2011. Ms. Booker is responsible for business development,

client on-boarding, account management, client communication and overall service delivery for a range of client types. Prior to

that time, she held various senior positions in investment management roles, including Deputy Chief of Staff in the Office of

the CEO of Mercer (from July 2010 to September 2011), a Consultant for Women’s World Banking (from December 2009 to March

2010) and Vice President of the Institutional Sales and Marketing division of Madison Square Investors at New York Life Investment

Management & Insurance Company (from April 2004 to June 2009). Ms. Booker served as Corporate Vice President for New York

Life for the period from August 1998 to March 2004. From 1994 to 1998, Ms. Booker was affiliated with Price Waterhouse, Deloitte

& Touche as team lead and ultimately the manager of large-scale e-commerce projects primarily within financial services industry.

Ms. Booker received a B.S. in Computer Science from Binghamton University and an MBA from Columbia University School of Business.

We

believe that Ms. Booker’s varied financial and investment management experience qualifies her to serve on the Board and

on the audit committee.

Sherman

Lee, age 60, has been, since October 2010, an Engineering Design Consultant for FMJ Storage, Inc., which designs high reliability

NAND and NOR flash based storage products for the Industrial and military storage markets. In addition he served as VP of Engineering

at Montana Systems, Inc. from June 2014 to November 2018. He also served as CTO of 248 SolidState from December 2006 to March

2010. Prior, thereto, Mr. Lee served in various engineering positions. Mr. Lee received his B.Sc. in Computer Science and Electrical

Engineering with honors from the University of California.

We

believe that Mr. Lee’s varied technical knowledge and experience in computer systems, which includes hardware, software

and integrated circuit design, qualifies him to serve on the Board.

The

principal business address of Mr. Feigenbaum is 124 W. 60th Street, Suite 33L, New York, NY 10023.

As

of the date hereof, Mr. Feigenbaum directly beneficially owns 5,000 shares of Common Stock. Such shares of Common Stock were purchased

on October 15, 2019 in a market transaction using personal funds.

As

of the date hereof, none of the other Nominees directly or indirectly own, beneficially or of record, any securities of the Company

and have not entered into any transactions in securities of the Company during the past two years.

The

participants in this solicitation who are named in the section entitled “Additional Participant Information” are collectively

referred to as the “Group” herein.

Each

of J. Marvin Feigenbaum, Barinder Athwal and Brian Mirman have entered into an informal agreement pursuant to which they have

agreed to support the candidacy of the Nominees.

Other

than as stated herein, there are no arrangements or understandings between the members of the Group or any other person or persons

pursuant to which the nomination of the Nominees described herein is to be made, other than the consent by the Nominees to be

named in this Proxy Statement and to serve as a director of the Company if elected as such at the Annual Meeting. Other than as

stated herein, none of the Nominees is a party adverse to the Company or any of its subsidiaries or has a material interest adverse

to the Company or any of its subsidiaries in any material pending legal proceeding.

WE

URGE YOU TO VOTE “FOR” THE ELECTION OF THE NOMINEES ON THE ENCLOSED BLUE PROXY CARD.

PROPOSAL

TWO

RATIFICATION

OF THE APPOINTMENT OF FREED MAXICK CPAs, P.C. AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL

YEAR ENDING DECEMBER 31, 2019

As

discussed in further detail in the Company’s proxy statement, the Board has appointed Freed Maxick CPAs, P.C as the Company’s

independent registered public accounting firm for the fiscal year ending December 31, 2019, and stockholders are being asked to

ratify such appointment at the Annual Meeting.

As

disclosed in the Company’s proxy statement, to ratify the appointment of Freed Maxick CPAs, P.C to be the Company’s

independent registered public accounting firm for the year ending December 31, 2019, the affirmative vote of a majority of the

votes cast at the Annual Meeting on this proposal is required.

WE

MAKE NO RECOMMENDATION WITH RESPECT TO THIS PROPOSAL AND INTEND TO VOTE OUR SHARES “FOR” THIS PROPOSAL.

PROPOSAL

THREE

APPROVAL

OF THE COMPANY’S 2020 EQUITY INCENTIVE PLAN

As

discussed in further detail in the Company’s proxy statement, the Board has approved the Company’s 2020 Equity Incentive

Plan (the “2020 Incentive Plan”), subject to shareholder approval.

As

disclosed in the Company’s proxy statement, to ratify the 2020 Incentive Plan, the affirmative vote of a majority of the

votes cast at the Annual Meeting on this proposal is required.

WE

MAKE NO RECOMMENDATION WITH RESPECT TO THIS PROPOSAL AND INTEND TO VOTE OUR SHARES “AGAINST” THIS PROPOSAL.

PROPOSAL

FOUR

ADVISORY

VOTE ON THE COMPENSATION OF THE COMPANY’S NAMED EXECUTIVE OFFICERS

As

discussed in further detail in the Company’s proxy statement, in accordance with the requirements of Section 14A of the

Exchange Act and the related rules of the SEC, the Company is providing stockholders with the opportunity to cast an annual advisory

vote to approve the compensation of its named executive officers as disclosed pursuant to the SEC’s compensation disclosure

rules (a “say-on-pay proposal”). Accordingly, the Company is asking stockholders to vote for the following resolution:

“RESOLVED,

that the stockholders of Document Security Systems, Inc. approve all of the compensation of the Company’s executive officers

who are named in the Summary Compensation Table of the Company’s 2019 Proxy Statement, as such compensation is disclosed

in the Company’s 2019 Proxy Statement pursuant to Item 402 of Regulation S-K, which disclosure includes the Proxy Statement’s

Summary Compensation Table and other executive compensation tables and related narrative disclosures..”

According

to the Company’s proxy statement, this vote is advisory and therefore not binding on the Company, the Compensation and Management

Resources Committee or the Board. The Company has further disclosed that the Board and the Compensation and Management Resources

Committee value the opinions expressed by stockholders in their votes on this proposal and will consider the outcome of the vote

when making future compensation decisions regarding named executive officers.

WE

MAKE NO RECOMMENDATION WITH RESPECT TO THIS PROPOSAL AND INTEND TO VOTE OUR SHARES “AGAINST” THIS PROPOSAL.

PROPOSAL

FIVE

ADVISORY

VOTE ON FREQUENCY OF SAY-ON-PAY VOTES

As

discussed in further detail in the Company’s proxy statement, the Company is providing stockholders with the opportunity

to cast an advisory vote on how often the Company should include a say-on-pay proposal in its proxy materials for future annual

stockholder meetings or any special stockholder meeting for which it must include executive compensation information in the proxy

statement for that meeting (a “say-on-pay frequency proposal”). Under this Proposal Five, stockholders may vote to

have the say-on-pay vote every year, every two years, or every three years.

The

Company has disclosed in its proxy statement, that as an advisory vote, this proposal is not binding on the Company or the Board.

However, the Board values the opinions expressed by stockholders in their votes on this proposal and will consider the outcome

of the vote when making future decisions regarding the frequency of conducting a say-on-pay vote.

As

disclosed in the Company’s proxy statement, a plurality of the votes cast for Proposal No. 3 will determine the stockholders’

preferred frequency for holding an advisory vote on executive compensation. This means that the option for holding an advisory

vote every 1 year, 2 years, or 3 years receiving the greatest number of votes will be considered the preferred frequency of the

stockholders.

We

believe that conducting the advisory vote on executive compensation every year is appropriate for the Company because it provides

stockholders the opportunity to provide frequent feedback on the Company’s overall compensation philosophy, design and implementation.

WE

RECOMMEND A VOTE FOR “1 YEAR” ON THE ADVISORY VOTE ON THE FREQUENCY OF THE EXECUTIVE COMPENSATION VOTE AND INTEND

TO VOTE OUR SHARES FOR “1 YEAR” ON THIS PROPOSAL.

VOTING

AND PROXY PROCEDURES

Only

stockholders of record on the Record Date will be entitled to notice of and to vote at the Annual Meeting. Stockholders who sell

shares of Common Stock before the Record Date (or acquire them without voting rights after the Record Date) may not vote such

shares of Common Stock. Stockholders of record on the Record Date will retain their voting rights in connection with the Annual

Meeting even if they sell such shares of Common Stock after the Record Date. Based on publicly available information, we believe

that the only outstanding class of securities of the Company entitled to vote at the Annual Meeting is the shares of Common Stock.

Shares

of Common Stock represented by properly executed BLUE proxy cards will be voted at the Annual Meeting as marked and, in

the absence of specific instructions, will be voted FOR the election of the Nominees to the Board, FOR the appointment

of Freed Maxick CPAs, P.C. as the Company’s independent registered public accounting firm for the fiscal year ending December

31, 2019. AGAINST the approval of the 2020 Incentive Plan, AGAINST the advisory vote on executive compensation and

1 YEAR on the advisory vote on the frequency of holding future advisory votes on executive compensation.

According

to the Company’s proxy statement for the Annual Meeting, the current Board intends to nominate seven (7) candidates for

election as directors at the Annual Meeting. This Proxy Statement is soliciting proxies to elect only our Nominees. Accordingly,

the enclosed BLUE proxy card may only be voted for the Nominees and does not confer voting power with respect to the Company’s

nominees.

QUORUM;

BROKER NON-VOTES; DISCRETIONARY VOTING

A

quorum is the minimum number of shares of Common Stock that must be represented at a duly called meeting in person or by proxy

in order to legally conduct business at the meeting. The presence, in person or by proxy (regardless of whether the proxy has

authority to vote on all matters), of the holders of not less than fifty percent (50%) of the shares entitled to vote at the Annual

Meeting will constitute a quorum for the transaction of business.

Abstentions

are counted as present and entitled to vote for purposes of determining a quorum. Shares represented by “broker non-votes”

also are counted as present and entitled to vote for purposes of determining a quorum. However, if you hold your shares in street

name and do not provide voting instructions to your broker, your shares will not be voted on any proposal on which your broker

does not have discretionary authority to vote (a “broker non-vote”). Under applicable rules, your broker will not

have discretionary authority to vote your shares at the Annual Meeting on any of the proposals.

If

you are a stockholder of record, you must deliver your vote by mail or attend the Annual Meeting in person and vote in order to

be counted in the determination of a quorum.

If

you are a beneficial owner, your broker will vote your shares pursuant to your instructions, and those shares will count in the

determination of a quorum. Brokers do not have discretionary authority to vote on any of the proposals at the Annual Meeting.

Accordingly, unless you vote via proxy card or provide instructions to your broker, your shares of Common Stock will count for

purposes of attaining a quorum, but will not be voted on those proposals.

REQUIRED FOR APPROVAL

Proposal

One: Election of Directors ─ The Company has adopted a plurality vote standard for contested director elections. As

a result of our nomination of the Nominees, the director election at the Annual Meeting will be contested, so the seven (7) nominees

for director receiving the highest vote totals will be elected as directors of the Company. With respect to the election of directors,

only votes cast “FOR” a nominee will be counted. Proxy cards specifying that votes should be withheld with respect

to one or more nominees will result in those nominees receiving fewer votes but will not count as a vote against the nominees,

and therefore, a “WITHHOLD” vote will have no effect on the outcome of the election of directors. Neither an abstention

nor a broker non-vote will count as a vote cast “FOR” or “AGAINST” a director nominee. Therefore, abstentions

and broker non-votes will have no direct effect on the outcome of the election of directors.

Proposal

Two: Ratification of the Appointment of Accounting Firm ─ According to the Company’s proxy statement, assuming

that a quorum is present, the ratification of Freed Maxick CPAs, P.C. as the Company’s Independent Registered Public Accounting

Firm requires the affirmative vote of a majority of the votes cast at the Annual Meeting.

The Company has indicated that abstentions and broker non-votes will have no effect on this proposal.

Proposal

Three: Approval of the 2020 Incentive Plan ─ According to the Company’s proxy statement, assuming that a quorum

is present, the approval of the 2020 Incentive Plan requires the affirmative vote of a majority of the votes cast at the Annual

Meeting. The Company has indicated that abstentions and broker non-votes will have

no effect on this proposal.

Proposal

Four: Advisory Vote on Executive Compensation ─ According to the Company’s proxy statement, although the vote

is non-binding, assuming that a quorum is present, the affirmative vote of a majority of the votes cast is required to approve

the advisory vote on the Company’s executive compensation. The Company has indicated that abstentions and broker non-votes

will have no effect on the proposal.

Proposal

Five: Advisory Vote on the Frequency of Holding Future Advisory Votes on Executive Compensation ─ According to the Company’s

proxy statement, although the vote is non-binding, assuming that a quorum is present, the advisory vote on the frequency of the

advisory vote on executive compensation will be determined by a plurality of the votes cast. Stockholders may vote “1 YEAR,”

“2 YEARS,” “3 YEARS” or “ABSTAIN” with respect to the advisory vote on the frequency of advisory

votes on executive compensation. The Company has indicated that abstentions and broker non-votes will have no effect on the proposal.

Under applicable New York law, none of the holders of Common Stock are entitled to appraisal rights in

connection with any matter to be acted on at the Annual Meeting. If you sign and submit your BLUE proxy card without

specifying how you would like your shares voted, your shares will be voted in accordance with the manner in which we intend to

vote our shares as specified herein and in accordance with the discretion of the persons named on the BLUE proxy

card with respect to any other matters that may be voted upon at the Annual Meeting.

REVOCATION

OF PROXIES

Stockholders

of the Company may revoke their proxies at any time prior to exercise by attending the Annual Meeting and voting in person (although

attendance at the Annual Meeting will not in and of itself constitute revocation of a proxy) or by delivering a written notice

of revocation. The delivery of a subsequently dated proxy which is properly completed will constitute a revocation of any earlier

proxy. The revocation may be delivered to the Concerned Shareholders in care of Saratoga Proxy Consulting, LLC at the address

set forth on the back cover of this Proxy Statement. Although a revocation is effective if delivered to the Company, we request

that either the original or photostatic copies of all revocations be mailed to us in care of Saratoga Proxy at the address set

forth on the back cover of this Proxy Statement so that we will be aware of all revocations and can more accurately determine

if and when proxies have been received from the holders of record on the Record Date of a majority of the outstanding shares of

Common Stock. Additionally, Saratoga Proxy may use this information to contact stockholders who have revoked their proxies in

order to solicit later dated proxies for the election of the Nominees.

IF

YOU WISH TO VOTE FOR THE ELECTION OF THE NOMINEES TO THE BOARD, PLEASE SIGN, DATE AND RETURN PROMPTLY THE ENCLOSED BLUE PROXY

CARD IN THE POSTAGE-PAID ENVELOPE PROVIDED.

SOLICITATION

OF PROXIES

The

solicitation of proxies pursuant to this Proxy Statement is being made by the participants. Proxies may be solicited by mail,

facsimile, telephone, Internet, in person and by advertisements.

The

Concerned Shareholders entered into an agreement with Saratoga Proxy for solicitation and advisory services in connection

with this solicitation, for which Saratoga Proxy will receive a fee not to exceed $[50,000], together with reimbursement for

its reasonable out-of-pocket expenses, and will be indemnified against certain liabilities and expenses, including certain

liabilities under the federal securities laws. Saratoga Proxy will solicit proxies from individuals, brokers, banks, bank

nominees and other institutional holders. The Concerned Shareholders have requested banks, brokerage houses and other

custodians, nominees and fiduciaries to forward all solicitation materials to the beneficial owners of the shares of Common

Stock they hold of record. The Concerned Shareholders will reimburse these record holders for their reasonable out-of-pocket

expenses in so doing. It is anticipated that Saratoga Proxy will employ approximately fifteen (15) persons to solicit the

Company’s stockholders for the Annual Meeting. The entire expense of soliciting proxies is being borne by the Concerned

Shareholders. Costs of this solicitation of proxies are currently estimated to be approximately [$105,000]. Mr. Feigenbaum

estimates that through the date hereof, his expenses in connection with this solicitation are approximately $[40,000]. The

Concerned Shareholders intend to seek reimbursement from the Company of all expenses incurred in connection with the

solicitation of proxies for the election of the Nominees to the Board at the Annual Meeting. If such reimbursement is

approved by the Board, the Concerned Shareholders not intend to submit the question of such reimbursement to a vote of

security holders of the Company.

ADDITIONAL

PARTICIPANT INFORMATION

The

participants in this solicitation are Mr. Feigenbaum, Dr. Athwal, Dr. Mirman and the Nominees.

Each

participant in this solicitation is a member of a “group” with the other participants for the purposes of Section

13(d)(3) of the Exchange Act. The Group may be deemed to beneficially own the shares of Common Stock owned in the aggregate by

all of the participants in this solicitation as disclosed herein. Each participant in this solicitation disclaims beneficial ownership

of the shares of Common Stock he or it does not directly own.

The

principal occupation of Mr. Feigenbaum is serving as a private investor. The principal occupation of Dr. Athwal is practicing

physician. The principal business of Dr. Mirman is a practicing dentist.

The

principal business address of Mr. Feigenbaum is 124 W. 60th Street, Suite 33L, New York, NY 10023. The principal

business address of Dr. Athwal is 14 Mule Road, Suite 1, Toms River, NJ 08755. The principal business address of Dr. Mirman

is 2627 Hylan Blvd #D, Staten Island, NY 10306.

Except

as set forth in this Proxy Statement (including the Schedules hereto), (i) during the past ten (10) years, no participant in this

solicitation has been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors); (ii) no participant

in this solicitation directly or indirectly beneficially owns any securities of the Company; (iii) no participant in this solicitation

owns any securities of the Company which are owned of record but not beneficially; (iv) no participant in this solicitation has

purchased or sold any securities of the Company during the past two (2) years; (v) no part of the purchase price or market value

of the securities of the Company owned by any participant in this solicitation is represented by funds borrowed or otherwise obtained

for the purpose of acquiring or holding such securities; (vi) no participant in this solicitation is, or within the past year

was, a party to any contract, arrangements or understandings with any person with respect to any securities of the Company, including,

but not limited to, joint ventures, loan or option arrangements, puts or calls, guarantees against loss or guarantees of profit,

division of losses or profits, or the giving or withholding of proxies; (vii) no associate of any participant in this solicitation

owns beneficially, directly or indirectly, any securities of the Company; (viii) no participant in this solicitation owns beneficially,

directly or indirectly, any securities of any parent or subsidiary of the Company; (ix) no participant in this solicitation or

any of his or its associates was a party to any transaction, or series of similar transactions, since the beginning of the Company’s

last fiscal year, or is a party to any currently proposed transaction, or series of similar transactions, to which the Company

or any of its subsidiaries was or is to be a party, in which the amount involved exceeds $120,000; (x) no participant in this

solicitation or any of his or its associates has any arrangement or understanding with any person with respect to any future employment

by the Company or its affiliates, or with respect to any future transactions to which the Company or any of its affiliates will

or may be a party; and (xi) no participant in this solicitation has a substantial interest, direct or indirect, by securities

holdings or otherwise in any matter to be acted on at the Annual Meeting.

Except

as otherwise set forth in this Proxy Statement, there are no material proceedings to which any participant in this solicitation

or any of his or its associates is a party adverse to the Company or any of its subsidiaries or has a material interest adverse

to the Company or any of its subsidiaries. With respect to each of the Nominees, none of the events enumerated in Item 401(f)(1)-(8)

of Regulation S-K of the Exchange Act occurred during the past ten (10) years.

OTHER

MATTERS AND ADDITIONAL INFORMATION

We

are unaware of any other matters to be considered at the Annual Meeting. However, should other matters, which we are not aware

of a reasonable time before this solicitation, be brought before the Annual Meeting, the persons named as proxies on the enclosed

BLUE proxy card will vote on such matters in their discretion.

STOCKHOLDER

PROPOSALS

According

to the Company’s proxy statement, proposals of stockholders intended to be presented at the 2020 annual meeting of stockholders

(the “2020 Annual Meeting”) pursuant to Rule 14a-8 promulgated under the Exchange Act must be received by the Company

at its principal executive offices, Attention: Corporate Secretary, not less than 120 days before the anniversary of the date

the Company’s proxy statement is released to stockholders, unless the date of the 2020 Annual Meeting is more than 30 days

before or after December 9, 2020, in which case the proposal must be received a reasonable time before the Company begins to print

and mail its proxy materials.

For

any proposal or director nomination that is not submitted for inclusion in the Company’s proxy statement for the 2020 Annual

Meeting pursuant to the process set forth above, but is instead sought to be presented directly at the 2020 Annual Meeting, stockholders

are advised to review the Company’s Amended and Restated Bylaws as they contain requirements with respect to advance notice

of stockholder proposals and director nominations.

The

information set forth above regarding the procedures for submitting stockholder proposals for consideration at the 2020 Annual

Meeting is based on information contained in the Company’s proxy statement and the Company’s Fifth Amended and Restated

Bylaws. The incorporation of this information in this Proxy Statement should not be construed as an admission by us that such

procedures are legal, valid or binding.

ADDITIONAL

INFORMATION

WE

HAVE OMITTED FROM THIS PROXY STATEMENT CERTAIN DISCLOSURE REQUIRED BY APPLICABLE LAW THAT IS INCLUDED IN THE COMPANY’S PROXY

STATEMENT RELATING TO THE 2019 ANNUAL MEETING BASED ON RELIANCE ON RULE 14A-5(C). THIS DISCLOSURE INCLUDES, AMONG OTHER THINGS,

CURRENT BIOGRAPHICAL INFORMATION ON THE COMPANY’S DIRECTORS, INFORMATION CONCERNING EXECUTIVE COMPENSATION, SECTION 16(A)

BENEFICIAL OWNERSHIP REPORTING COMPLIANCE OF THE COMPANY’S DIRECTORS, RELATED PERSON TRANSACTIONS AND GENERAL INFORMATION

CONCERNING THE COMPANY’S ADMINISTRATION AND INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM.

The

information concerning the Company contained in this Proxy Statement and the Schedules attached hereto has been taken from, or

is based upon, publicly available information.

J.

Marvin Feigenbaum

Barinder

Athwal

Brian

Mirman

[November 15], 2019

IMPORTANT

Tell

your Board what you think! Your vote is important. No matter how many shares of Common Stock you own, please give the Concerned

Stockholders your proxy FOR the election of the Nominees by taking three steps:

|

|

●

|

SIGNING

the enclosed BLUE proxy card,

|

|

|

●

|

DATING

the enclosed BLUE proxy card, and

|

|

|

●

|

MAILING

the enclosed BLUE proxy card TODAY in the envelope provided (no postage is required

if mailed in the United States).

|

If

any of your shares of Common Stock are held in the name of a brokerage firm, bank, bank nominee or other institution, only it

can vote such shares of Common Stock and only upon receipt of your specific instructions. Depending upon your broker or custodian,

you may be able to vote either by toll-free telephone or by the Internet. Please refer to the enclosed voting form for instructions

on how to vote electronically. You may also vote by signing, dating and returning the enclosed BLUE voting form.

If

you have any questions or require any additional information concerning this Proxy Statement, please contact Saratoga Proxy Consulting

LLC at the address set forth below.

Stockholders

call toll free at (888) 368-0379

Email:

info@saratogaproxy.com

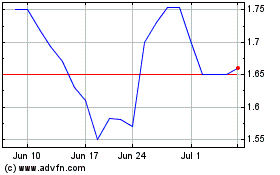

DSS (AMEX:DSS)

Historical Stock Chart

From Mar 2024 to Apr 2024

DSS (AMEX:DSS)

Historical Stock Chart

From Apr 2023 to Apr 2024