Cisco Projects Reduced Revenue in Current Quarter

November 13 2019 - 5:44PM

Dow Jones News

By Maria Armental

Cisco Systems Inc., the networking-equipment giant, projected

the first quarterly revenue decline in more than two years, blaming

what it called a pause in customer spending.

The company, considered a proxy for corporate high-tech hardware

demand, expects revenue to fall 3% to 5% this quarter. Analysts

polled by FactSet were expecting revenue to increase about 2.4% to

$12.75 billion.

The company expects adjusted earnings between 75 cents and 77

cents a share. Analysts projected 79 cents a share.

Shares fell 5% to $46.09 in after-hours trading.

On Wednesday, Cisco reported first-quarter profit fell 18% to

$2.93 billion, or 68 cents a share. On an adjusted basis, profit

rose to 84 cents a share from 75 cents a share a year earlier.

Cisco forecast 64 cents to 69 cents a share, or 80 cents to 82

cents a share as adjusted. Analysts surveyed by FactSet projected

69 cents a share, or 81 cents a share as adjusted.

Revenue, meanwhile, rose 0.7% to $13.16 billion, beating

analysts' projections and at the low end of Cisco's projection of

flat to up 2%.

Cisco said it still expects to wrap up during the second half of

the current business year the acquisition of Acacia Communications

Inc. The deal requires approval in China.

Write to Maria Armental at maria.armental@wsj.com

(END) Dow Jones Newswires

November 13, 2019 17:29 ET (22:29 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

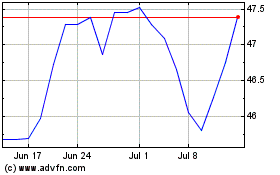

Cisco Systems (NASDAQ:CSCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cisco Systems (NASDAQ:CSCO)

Historical Stock Chart

From Apr 2023 to Apr 2024