Matinas BioPharma Holdings, Inc. (NYSE AMER: MTNB), a

clinical-stage biopharmaceutical company, today announced financial

results for the quarter ended September 30, 2019, and provided an

update on its product pipeline.

“I am extremely pleased with the progress we

made in the third quarter, positioning the Company to commence two

important studies for our lead assets, MAT9001 and MAT2203,”

commented Jerome D. Jabbour, Chief Executive Officer of Matinas.

“With respect to MAT9001, we began pre-screening patients in

September for our confirmatory head to head ENHANCE-IT study vs.

Vascepa, and remain on track to start dosing patients in early

2020. This is an exciting time for the omega-3 class as there are

multiple upcoming catalysts that could help validate the

blockbuster potential of prescription-only omega-3 therapy. We look

forward to reporting data from the ENHANCE-IT trial in the fourth

quarter of 2020, and continue to believe that MAT9001 has the

potential to become the best-in-class prescription-only omega-3

product.”

“Importantly, we have also commenced dosing in

the EnACT study of MAT2203, our oral formulation of amphotericin B,

applying our lipid nano-crystal (LNC) platform delivery technology.

Just recently the US Food and Drug Administration (FDA)

granted MAT2203 orphan drug designation for the treatment of

cryptococcosis. This designation, along with the previously

granted Qualified Infectious Disease Product Designation (QIDP)

with Fast Track status, positions MAT2203 for up to 12 years of

exclusivity, if approved. We believe MAT2203, beginning with

the EnACT trial, has the potential to provide a much-needed

solution for patients and doctors in the battle against invasive

fungal infections. We look forward to providing updates on

this study throughout 2020,” added Mr. Jabbour.

MAT9001 Program Update (next

generation, prescription-only omega-3 fatty acid-based composition

under development for treatment of cardiovascular or metabolic

conditions, including hypertriglyceridemia)

- Commenced pre-screening of patients for head-to-head

comparative study of MAT9001 and Vascepa®, and on track to initiate

enrollment in the first quarter of 2020. This study will evaluate

pharmacodynamic (PD) markers for MAT9001 and Vascepa in a 28-day

crossover study in patients with elevated triglycerides (150 – 499

mg/dL). It follows a previous study showing that, compared to

Vascepa, MAT9001 provided significantly greater reductions in PD

markers known to be associated with increased risk of

cardiovascular disease, including triglycerides, Total

cholesterol, VLDL-C, non-HDL-C, ApoC3, and PCSK9, without any

meaningful increase in LDL cholesterol. The objective of this

second study is to further validate the enhanced bioavailability

and greater potency of MAT9001 relative to Vascepa in order to best

position the drug for commercial success. The Company expects to

announce data from the study in the fourth quarter of 2020.

- On track to commence a comparative clinical bridging

bioavailability study by the end of 2019 to support 505(b)(2)

registration pathway, with expected completion in the first half of

2020.

MAT2203 and Lipid Nano-Crystal (LNC)

Technology Platform Update (intracellular delivery of

potentially life-saving medicines)

- Dosing initiated in Phase 2 EnACT (Encochleated Oral

Amphotericin for Cryptococcal Meningitis Trial) study of MAT2203

for the treatment of HIV-infected patients with cryptococcal

meningitis in October 2019. This open-label, sequential cohort

study, financially supported by the National Institutes of Health

(NIH), will utilize the Company’s LNC drug delivery technology to

orally deliver the traditionally IV-only fungicidal drug,

amphotericin B. Updates on EnACT will be provided over the course

of 2020.

- FDA granted MAT2203 orphan drug designation for the treatment

of cryptococcosis in October 2019. As previously reported, the FDA

has designated MAT2203 as a QIDP with Fast Track status for four

indications, specifically, the prevention of invasive fungal

infections due to immunosuppressive therapy, and the treatment of

invasive candidiasis, invasive aspergillus and cryptococcal

meningitis.

Third Quarter 2019 Financial Results

For the third quarter of 2019, the Company

reported a net loss attributable to common shareholders of $4.6

million, or a net loss per share of $0.03 (basic and diluted),

compared to a net loss attributable to common shareholders of $3.3

million, or a net loss per share of $0.03 (basic and diluted) for

the same period in 2018.

Research and development (R&D) activities

for the third quarter of 2019 were $2.7 million, compared to $1.4

million for the same period in 2018. The increase in R&D was

due primarily to higher manufacturing process development, clinical

development and overhead costs, specifically around the development

of MAT9001.

General and administrative (G&A) expenses

for the third quarter of 2019 were $1.9 million, compared to $1.6

million in the same period in 2018. The increase in G&A was due

primarily to increased employee compensation expense.

Cash and cash equivalents at September 30, 2019

were approximately $32.7 million, compared to $12.4 million at

December 31, 2018. This increase includes net proceeds of $30.1

million from the Company’s public offering of its common stock

completed in March 2019. Based on Management’s current projections

the Company believes that cash on hand is sufficient to fund

operations into the first quarter of 2021.

*VASCEPA® is a registered trademark of the

Amarin group of companies. Conference Call and

Webcast Details

The Company will host a live conference call and

webcast to discuss these results on Wednesday, November 13, 2019 at

8:00 a.m. ET.

To participate in the call, please dial (877)

407-5976 (domestic) or (412) 902-0031 (international). The live

webcast will be available on the Events page of the Investors

section of the Company’s website (www.matinasbiopharma.com) and

archived for 60 days.

About Matinas BioPharma

Matinas BioPharma is a clinical-stage

biopharmaceutical company focused on development of its lead

product candidate, MAT9001, for the treatment of cardiovascular and

metabolic conditions. MAT9001 is a prescription-only omega-3 fatty

acid-based composition, comprised primarily of EPA and DPA, under

development for hypertriglyceridemia, that was specifically

designed to overcome the shortcomings seen from other agents in the

omega-3 class. Company leadership has a deep history and knowledge

of cardiovascular drug development and is supported by a

world-class team of scientific advisors.

In addition, the Company is developing MAT2203,

an oral, encochleated formulation of amphotericin B, to treat

serious invasive fungal infections. The drug is based on Matinas’

proprietary lipid nano-crystal (LNC) platform technology which can

help solve complex challenges relating to the safe and effective

delivery of potent medicines, potentially making them more

targeted, less toxic and orally bioavailable.

Forward Looking Statements

This release contains "forward-looking

statements" within the meaning of the Private Securities Litigation

Reform Act of 1995, including those relating to the Company's

anticipated capital and liquidity needs, strategic focus and the

future development of its product candidates, including MAT9001 and

MAT2203, the anticipated timing of regulatory submissions, the

anticipated timing of clinical studies, the anticipated timing of

regulatory interactions, the Company’s ability to identify and

pursue development and partnership opportunities for its products

or platform delivery technology on favorable terms, if at all, and

the ability to obtain required regulatory approval and other

statements that are predictive in nature, that depend upon or refer

to future events or conditions. All statements other than

statements of historical fact are statements that could be

forward-looking statements. Forward-looking statements include

words such as "expects," "anticipates," "intends," "plans,"

"could," "believes," "estimates" and similar expressions. These

statements involve known and unknown risks, uncertainties and other

factors which may cause actual results to be materially different

from any future results expressed or implied by the forward-looking

statements. Forward-looking statements are subject to a number of

risks and uncertainties, including, but not limited to, our ability

to obtain additional capital to meet our liquidity needs on

acceptable terms, or at all, including the additional capital which

will be necessary to complete the clinical trials of our product

candidates; our ability to successfully complete research and

further development and commercialization of our product

candidates; the uncertainties inherent in clinical testing; the

timing, cost and uncertainty of obtaining regulatory approvals; our

ability to protect the Company's intellectual property; the loss of

any executive officers or key personnel or consultants;

competition; changes in the regulatory landscape or the imposition

of regulations that affect the Company's products; and the other

factors listed under "Risk Factors" in our filings with the SEC,

including Forms 10-K, 10-Q and 8-K. Investors are cautioned not to

place undue reliance on such forward-looking statements, which

speak only as of the date of this release. Except as may be

required by law, the Company does not undertake any obligation to

release publicly any revisions to such forward-looking statements

to reflect events or circumstances after the date hereof or to

reflect the occurrence of unanticipated events. Matinas BioPharma's

product candidates are all in a development stage and are not

available for sale or use.

| |

|

|

|

Matinas BioPharma Holdings Inc. |

|

Condensed Consolidated Balance Sheets |

| |

| |

|

September 30, 2019 |

|

|

December 31, 2018 |

|

| |

|

(Unaudited) |

|

|

(Audited) |

|

|

ASSETS: |

|

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

32,664,782 |

|

|

$ |

12,446,838 |

|

|

Restricted cash |

|

|

200,000 |

|

|

|

100,000 |

|

|

Prepaid expenses |

|

|

1,386,130 |

|

|

|

538,646 |

|

|

Total current assets |

|

|

34,250,912 |

|

|

|

13,085,484 |

|

| |

|

|

|

|

|

|

|

|

| Non-current assets: |

|

|

|

|

|

|

|

|

|

Leasehold improvements and equipment - net |

|

|

1,806,304 |

|

|

|

2,042,893 |

|

|

Operating lease right-of-use assets - net |

|

|

3,877,069 |

|

|

|

- |

|

|

Finance lease right-of-use assets - net |

|

|

141,972 |

|

|

|

- |

|

|

In-process research and development |

|

|

3,017,377 |

|

|

|

3,017,377 |

|

|

Goodwill |

|

|

1,336,488 |

|

|

|

1,336,488 |

|

|

Restricted cash - security deposits |

|

|

386,000 |

|

|

|

461,000 |

|

|

Total non-current assets |

|

|

10,565,210 |

|

|

|

6,857,758 |

|

|

Total assets |

|

$ |

44,816,122 |

|

|

$ |

19,943,242 |

|

| |

|

|

|

|

|

|

|

|

| LIABILITIES AND

STOCKHOLDERS’ EQUITY: |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

685,802 |

|

|

$ |

295,652 |

|

|

Note payable |

|

|

- |

|

|

|

199,842 |

|

|

Accrued expenses |

|

|

1,462,767 |

|

|

|

1,086,868 |

|

|

Stock dividends payable |

|

|

- |

|

|

|

1,174,286 |

|

|

Operating lease liabilities - current |

|

|

407,026 |

|

|

|

- |

|

|

Financing lease liabilities - current |

|

|

66,743 |

|

|

|

83,245 |

|

|

Total current liabilities |

|

|

2,622,338 |

|

|

|

2,839,893 |

|

| |

|

|

|

|

|

|

|

|

| Non-current liabilities: |

|

|

|

|

|

|

|

|

|

Deferred tax liability |

|

|

341,265 |

|

|

|

341,265 |

|

|

Operating lease liabilities - net of current portion |

|

|

3,809,442 |

|

|

|

- |

|

|

Financing lease liabilities - net of current portion |

|

|

62,331 |

|

|

|

107,656 |

|

|

Deferred rent liability |

|

|

- |

|

|

|

512,704 |

|

|

Total non-current liabilities |

|

|

4,213,038 |

|

|

|

961,625 |

|

|

Total liabilities |

|

|

6,835,376 |

|

|

|

3,801,518 |

|

| |

|

|

|

|

|

|

|

|

| Stockholders’ equity: |

|

|

|

|

|

|

|

|

|

Series A Convertible preferred stock, stated value $5.00 per share,

1,600,000 shares authorized as of September 30, 2019 and December

31, 2018; 0 and 1,467,858 shares issued and outstanding as of

September 30, 2019 and December 31, 2018, respectively (liquidation

preference - $0 at September 30, 2019) |

|

|

- |

|

|

|

5,583,686 |

|

| |

|

|

|

|

|

|

|

|

|

Series B Convertible preferred stock, stated value $1,000 per

share, 8,000 shares authorized as of September 30, 2019 and

December 31, 2018; 4,620 and 4,819 shares issued and outstanding as

of September 30, 2019 and December 31, 2018; (liquidation

preference - $4,620,000 at September 30, 2019) |

|

|

4,023,251 |

|

|

|

4,196,547 |

|

| |

|

|

|

|

|

|

|

|

|

Common stock par value $0.0001 per share, 250,000,000 shares

authorized at September 30, 2019 and December 31, 2018; 162,720,274

and 113,287,670 issued and outstanding as of September 30, 2019 and

December 31, 2018, respectively |

|

|

16,271 |

|

|

|

11,329 |

|

| |

|

|

|

|

|

|

|

|

|

Additional paid-in capital |

|

|

112,745,948 |

|

|

|

72,294,921 |

|

|

Accumulated deficit |

|

|

(78,804,724 |

) |

|

|

(65,944,759 |

) |

|

Total stockholders’ equity |

|

|

37,980,746 |

|

|

|

16,141,724 |

|

|

Total liabilities and stockholders’ equity |

|

$ |

44,816,122 |

|

|

$ |

19,943,242 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Matinas BioPharma Holdings, Inc. |

|

Condensed Consolidated Statements of

Operations |

|

Unaudited |

| |

| |

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

| |

|

2019 |

|

|

2018 |

|

|

2019 |

|

|

2018 |

|

|

Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contract research revenue |

|

$ |

- |

|

|

|

- |

|

|

$ |

89,812 |

|

|

|

119,750 |

|

| Costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

|

2,671,365 |

|

|

|

1,379,525 |

|

|

|

7,814,842 |

|

|

|

5,095,110 |

|

|

General and administrative |

|

|

1,889,892 |

|

|

|

1,574,712 |

|

|

|

5,460,023 |

|

|

|

5,504,559 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total costs and expenses |

|

|

4,561,257 |

|

|

|

2,954,237 |

|

|

|

13,274,865 |

|

|

|

10,599,669 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss from operations |

|

|

(4,561,257 |

) |

|

|

(2,954,237 |

) |

|

|

(13,185,053 |

) |

|

|

(10,479,919 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sale of New Jersey net operating loss |

|

|

- |

|

|

|

- |

|

|

|

1,007,082 |

|

|

|

- |

|

|

Other income, net |

|

|

156,872 |

|

|

|

18,660 |

|

|

|

378,151 |

|

|

|

23,304 |

|

| Net loss |

|

$ |

(4,404,385 |

) |

|

|

(2,935,577 |

) |

|

$ |

(11,799,820 |

) |

|

|

(10,456,615 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Preferred stock series A

accumulated dividends |

|

|

(45,041 |

) |

|

|

(146,786 |

) |

|

|

(338,613 |

) |

|

|

(440,857 |

) |

| Preferred stock series B

accumulated dividends |

|

|

(115,500 |

) |

|

|

(175,075 |

) |

|

|

(349,500 |

) |

|

|

(196,924 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss attributable to

common shareholders |

|

$ |

(4,564,926 |

) |

|

|

(3,257,438 |

) |

|

$ |

(12,487,933 |

) |

|

|

(11,094,396 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss available for common

shareholders per share - basic and diluted |

|

$ |

(0.03 |

) |

|

|

(0.03 |

) |

|

$ |

(0.09 |

) |

|

|

(0.12 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average common shares

outstanding - basic and diluted |

|

|

156,889,602 |

|

|

|

94,697,049 |

|

|

|

139,265,178 |

|

|

|

94,098,372 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investor and Media Contacts

Peter

VozzoWestwicke443-213-0505peter.vozzo@westwicke.com

Ian CooneyDirector – Investor Relations & Corporate

DevelopmentMatinas Biopharma, Inc.(415)

722-4563icooney@matinasbiopharma.com

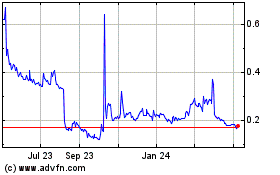

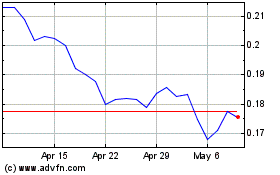

Matinas Biopharma (AMEX:MTNB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Matinas Biopharma (AMEX:MTNB)

Historical Stock Chart

From Apr 2023 to Apr 2024