As filed with the Securities and Exchange Commission on

November 12, 2019

Registration No. 333-234277

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

AMENDMENT NO. 1

TO

FORM

S-1

REGISTRATION

STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

GROWLIFE, INC.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

|

5261

|

|

90-0821083

|

|

(State

or other jurisdiction ofincorporation or organization)

|

|

(Primary Standard IndustrialClassification Code

Number)

|

|

(I.R.S. EmployerIdentification No.)

|

5400 Carillon Point

Kirkland, WA 98033

(866) 781-5559

(Address,

including zip code, and telephone number, including area code, of

registrant's principal executive offices)

Marco Hegyi

Chief Executive Officer

GrowLife, Inc.

5400 Carillon Point

Kirkland, WA 98033

(Name,

address, including zip code, and telephone number, including area

code, of agent for service)

Copies

to:

Jessica M. Lockett, Esq.

Horwitz + Armstrong, A Professional Law Corporation

14 Orchard, Suite 200

Lake Forest, California 92630

(949) 540-6540

Approximate

date of commencement of proposed sale to public: As soon as practicable after this Registration

Statement is declared effective.

If any

of the securities being registered on this Form are to be offered

on a delayed or continuous basis pursuant to Rule 415 under

the Securities Act of 1933, check the following

box. ☒

If this

Form is filed to register additional securities for an offering

pursuant to Rule 462(b) under the Securities Act, check the

following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same

offering. ☐

If this

Form is a post-effective amendment filed pursuant to

Rule 462(c) under the Securities Act, check the following box

and list the Securities Act registration statement number of the

earlier effective registration statement for the same

offering. ☐

If this

Form is a post-effective amendment filed pursuant to

Rule 462(d) under the Securities Act, check the following box

and list the Securities Act registration statement number of the

earlier effective registration statement for the same

offering. ☐

Indicate

by check mark whether the registrant is a large accelerated filer,

an accelerated filer, a non-accelerated filer, or a smaller

reporting company. See the definitions of "large accelerated

filer," "accelerated filer" and "smaller reporting company" in

Rule 12b-2 of the Exchange Act.

|

Large

accelerated filer

|

☐

|

Accelerated

filer

|

☐

|

|

|

|

|

|

|

Non-accelerated

filer

|

☐

|

Smaller

reporting company

|

☒

|

|

Emerging

growth company

|

☐

|

|

|

CALCULATION OF REGISTRATION FEE

Title of Each

Class

of Securities to

be

Registered

(1)

|

|

Amount to

be

Registered

(2)

|

Proposed Maximum

Offering Price Per Share (3)

|

Proposed

MaximumAggregate Offering Price

|

Amount of

Registration Fee (4)

|

|

Common stock, par

value $0.0001 per share

|

|

625,000,000

Shares

|

$0.004

|

$2,500,000

|

$324.50

|

|

|

(1)

|

This

Registration Statement covers a direct public offering by the

Company of up to 625,000,000 shares of our common

stock.

|

|

|

(2)

|

This

Registration Statement includes an indeterminate number of

additional shares of common stock issuable for no additional

consideration pursuant to any stock dividend, stock split,

recapitalization or other similar transaction effected without the

receipt of consideration, which results in an increase in the

number of outstanding shares of our common stock. In the event of a

stock split, stock dividend or similar transaction involving our

common stock, in order to prevent dilution, the number of shares

registered shall be automatically increased to cover the additional

shares in accordance with Rule 416(b) under the Securities Act of

1933, as amended (the “Securities Act”).

|

|

|

(3)

|

Estimated

solely for purposes of calculating the registration fee pursuant to

Rule 457(a) under the Securities Act, using the approximate closing

price as reported on the OTC on October 18, 2019, which was $0.004

per share.

|

|

|

|

|

|

|

(4)

|

$303.00 has been previously paid to

the commission via a withdrawn registration statement filed on

September 4, 2019 (file number

333-233618).

|

The registrant hereby amends this registration statement on such

date or dates as may be necessary to delay its effective date until

the registrant shall file a further amendment which specifically

states that this registration statement shall thereafter become

effective in accordance with section 8(a) of the Securities Act of

1933 or until the registration statement shall become effective on

such date as the commission, acting pursuant to said section 8(a),

may determine.

The information in this prospectus is not complete and may be

changed. These securities may not be sold (except pursuant to a

transaction exempt from the registration requirements of the

Securities Act) until this registration statement filed with the

Securities and Exchange Commission is declared effective. This

prospectus is not an offer to sell these securities and it is not

soliciting an offer to buy these securities in any state where the

offer or sale is not permitted.

Subject to completion, dated ____________.

THE

INFORMATION IN THIS PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED.

THESE SECURITIES MAY NOT BE SOLD UNTIL THE REGISTRATION STATEMENT

FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IS

EFFECTIVE. THIS PROSPECTUS IS NOT AN OFFER TO SELL THESE

SECURITIES AND IT IS NOT SOLICITING AN OFFER TO BUY THESE

SECURITIES IN ANY STATE WHERE THE OFFER OR SALE IS NOT

PERMITTED.

PRELIMINARY PROSPECTUS

GrowLife, Inc.

625,000,000 Shares of Common Stock

$0.004 per share

We are

offering for sale up to 625,000,000 shares of our common stock (the

“Shares”) with an offering price of $0.004 per Share

(the “Offering”) . This Offering shall be conducted by

the Company in a direct offering. Should all Shares being offered

by the Company hereunder be sold, the Company would receive an

aggregate of $2,500,000 at an offering price of $0.004 per Share.

There is no minimum number of Shares that must be sold by us for

the Offering to proceed, and we will retain the proceeds from

the sale of any of the offered Shares. The Offering is being

conducted on a self-underwritten, best efforts basis, which means

our officers and directors will attempt to sell the

Shares. This Prospectus will permit our officers and directors

to sell the Shares directly to the public, with no commission or

other remuneration payable to them for any Shares they may

sell. The Offering will terminate twelve months (12) months

from the date that the registration statement relating to the

Shares is declared effective, unless earlier fully subscribed or

terminated by the Company. In offering the securities on our

behalf, our Officers and Directors will rely on the safe harbor

from broker-dealer registration set out in Rule 3a4-1 under the

Securities and Exchange of 1934.

As of October 18, 2019, the Company had 3,858,188,075 shares of

Common Stock outstanding. Our securities are not listed on any

national securities exchange. Our common stock is presently quoted

for trading on the OTC Market under the symbol "PHOT”.

On October 18, 2019, the last reported sales price for our Common

Stock was $0.004 per share. We intend to use these funds for

general working capital, debt

reduction and other corporate purposes.

Our auditor has expressed substantial doubt about our ability to

continue as a going concern. As discussed in the Notes to the

financial statements, the Company has suffered losses and has

experienced negative cash flows from operations, which raises

substantial doubt about the Company's ability to continue as a

going concern.

This prospectus covers the primary direct public offering by the

Company of 625,000,000 shares of common stock.

THE

PURCHASE OF THE SECURITIES OFFERED THROUGH THIS PROSPECTUS INVOLVES

A HIGH DEGREE OF RISK. YOU SHOULD CAREFULLY READ THIS ENTIRE

PROSPECTUS, INCLUDING THE SECTION ENTITLED “RISK

FACTORS” BEGINNING ON PAGE 4 HEREOF BEFORE BUYING ANY SHARES

OF GROWLIFE’S COMMON STOCK.

NEITHER

THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES

COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR

DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY

REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

No dealer, salesperson or any other person is authorized to give

any information or make any representations in connection with this

offering other than those contained in this prospectus and, if

given or made, the information or representations must not be

relied upon as having been authorized by us. This prospectus does

not constitute an offer to sell or a solicitation of an offer to

buy any security other than the securities offered by this

prospectus, or an offer to sell or a solicitation of an offer to

buy any securities by anyone in any jurisdiction in which the offer

or solicitation is not authorized or is unlawful.

The date of this prospectus is _____________.

TABLE OF CONTENTS

|

|

Page

|

|

|

1

|

|

|

3

|

|

|

4

|

|

|

14

|

|

|

14

|

|

|

16

|

|

|

16

|

|

|

17

|

|

|

17

|

|

|

21

|

|

|

23

|

|

|

23

|

|

|

23

|

|

|

30

|

|

|

37

|

|

|

46

|

|

|

47

|

|

|

56

|

|

|

56

|

|

|

56

|

|

|

57

|

|

|

F-1

|

You

should rely only on the information contained in this prospectus

and any applicable prospectus supplement. We have not authorized

anyone to provide you with different or additional information. If

anyone provides you with different or inconsistent information, you

should not rely on it. The information contained in this prospectus

is accurate only as of the date of this prospectus, regardless of

the time of delivery of this prospectus or any sale of securities

described in this prospectus. This prospectus is not an offer to

sell these securities and it is not soliciting an offer to buy

these securities in any jurisdiction where the offer or sale is not

permitted. You should assume that the information appearing in this

prospectus or any prospectus supplement, as well as information we

have previously filed with the Securities and Exchange Commission,

is accurate as of the date on the front of those documents only.

Our business, financial condition, results of operations and

prospects may have changed since those dates.

For

investors outside the United States: neither we nor the

underwriters have done anything that would permit this offering or

possession or distribution of this prospectus or any free writing

prospectus we may provide to you in connection with this offering

in any jurisdiction where action for that purpose is required,

other than in the United States. You are required to inform

yourselves about and to observe any restrictions relating to this

offering and the distribution of this prospectus and any such free

writing prospectus outside of the United States.

Unless

otherwise indicated, information contained in this prospectus

concerning our industry and the markets in which we operate,

including our general expectations and market position, market

opportunity and market share, is based on information from our own

management estimates and research, as well as from industry and

general publications and research, surveys and studies conducted by

third parties. Management estimates are derived from publicly

available information, our knowledge of our industry and

assumptions based on such information and knowledge, which we

believe to be reasonable. Our management estimates have not been

verified by any independent source, and we have not independently

verified any third-party information. In addition, assumptions and

estimates of our and our industry's future performance are

necessarily subject to a high degree of uncertainty and risk due to

a variety of factors, including those described in "Risk Factors".

These and other factors could cause our future performance to

differ materially from our assumptions and estimates. See "Special

Note Regarding Forward-Looking Statements".

GrowLife,

Inc. is our trademark that is used in this prospectus. This

prospectus also includes trademarks, tradenames and service marks

that are the property of other organizations. Solely for

convenience, trademarks and tradenames referred to in this

prospectus appear without the ® and ™ symbols, but those

references are not intended to indicate, in any way, that we will

not assert, to the fullest extent under applicable law, our rights

or that the applicable owner will not assert its rights, to these

trademarks and tradenames.

This summary highlights information contained elsewhere in this

prospectus. This summary does not contain all of the information

you should consider before investing in our common stock. You

should read this entire prospectus carefully, especially the "Risk

Factors" section of this prospectus and our financial statements

and the related notes appearing at the end of this prospectus,

before making an investment decision.

As used in this prospectus, unless the context otherwise requires,

references to "we," "us," "our," "our company" and "GrowLife" refer

to GrowLife, Inc. and its consolidated

subsidiaries.

The Company and Our Business

GrowLife,

Inc. (“GrowLife” or the “Company”) is

incorporated under the laws of the State of Delaware and is

headquartered in Kirkland, Washington. We were founded in 2012 with

the Closing of the Agreement and Plan of Merger with SGT Merger

Corporation.

Toward

the end of 2018, we announced the majority acquisition of a company

called EZ-CLONE Enterprises. EZ-CLONE was and is known as an

industry-leading supplier of commercial-grade cloning and

propagation equipment. This was a part of the Company’s

strategic positioning plan to make ourselves the industry leaders

in plant cloning, and more specifically, as the leader in cloning

of hemp plants that are being grown for CBD extraction. Hemp

production was recently legalized in the US, creating a completely

new market opportunity where countless farmers are switching their

operations to hemp. Some conservative reports estimate that more

than 500 million hemp plants will be planted in 2019, with most

farmers looking to grow hemp to provide raw materials to the

exploding CBD market. Unfortunately, a lot of hemp growers do not

understand the intricacies of growing hemp, especially for CBD

extraction. Not all hemp plants can be used to create CBD products.

Plants need to be rich in CBD, not THC, be the correct gender, and

be healthy and large enough to process. In order to achieve this,

the only way to start plants is by using genetically modified and

feminized seeds or through cloning.

Our

revenue in the last quarter ended June 30, 2019 was $2.2 million

and our first half of the year totaled $4.4 million. In comparison

we generated $4.6 million ALL of last year. If you add the

uncounted over $500,000 of unshipped orders we received last

quarter, that brings us to about $5 million for just the first half

of this year, well outpacing all of last year.

For

more information see “Description of our

Business.”

Financing Requirements

The company needs to raise capital in the amount of $2,500,000 to

fully execute on its business plans. The $2,500,000 would be

utilized for general working capital to increase inventory,

complete the acquisition of EZ-Clone, and further develop our CBD

plant cloning operations. The Company has not secured the financing

necessary to execute on its business plan as stated above. If the

Company cannot raise the full amount of capital necessary, then it

will take longer than expected for the Company to implement its

growth plan.

Risks That We Face

Our

business is subject to a number of risks of which you should be

aware before making an investment decision. We are exposed to various risks related to our

business and financial position (specifically our need for

additional financing), this offering, our common stock and our

recent reverse stock split. These risks are discussed more

fully in the "Risk Factors" section of this prospectus beginning on

page 4.

Going Concern

Our auditor has expressed substantial doubt about our ability to

continue as a going concern. As discussed in Note 2 to the

financial statements, the Company has suffered losses and has

experienced negative cash flows from operations, which raises

substantial doubt about the Company's ability to continue as a

going concern. Management's plans in regard to those matters are

also described in Note 2 to the financial statements. The financial

statements do not include any adjustments that might result from

the outcome of this uncertainty.

Our Direct Public Offering

We are offering for sale up to a maximum of 625,000,000 shares of

our Common Stock directly to the public. There is no underwriter

involved in this offering. We are offering the shares without any

underwriting discounts or commissions. The purchase price is $0.004

per share. The expenses associated with this offering are estimated

to be $10,000. As of October 18, 2019 the Company

had 3,858,188,075 shares of Common Stock outstanding. Our

securities are not listed on any national securities exchange. Our

common stock is presently quoted for trading on the OTC Markets

under the symbol "PHOT". On October 18, 2019 the last sales price

of our common stock as reported was $0.004 per

share.

Our Corporate Information

Our

principal executive offices are located at 5400 Carillon Point,

Kirkland, WA 98033. Our telephone number is (866) 781-5559. Our

principal website address is located at www.growlifeinc.com. The

information contained on, or that can be accessed through, our

website is not incorporated into and is not a part of this

prospectus. We have included our website address in this prospectus

solely as an inactive textual reference.

|

Issuer:

|

|

GrowLife,

Inc.

|

|

Securities

offered:

|

|

Up to

625,000,000 of shares of our common stock. Our Common Stock is

described in further detail in the section of this prospectus

titled "DESCRIPTION OF SECURITIES

|

|

Offering Price per

share:

|

|

$0.004

|

|

Common

stock outstanding before the offering (1):

|

|

3,858,188,075

shares

|

|

Shares

of Common Stock being offered:

|

|

625,000,000

|

|

Net

Proceeds to the Company; Use of proceeds

|

|

The

Company is offering a maximum of 625,000,000 shares of Common Stock

at an offering price of $0.004 per Share for net proceeds to the

Company of $2,500,000. The full subscription price will be payable

at the time of subscription and accordingly, funds received from

subscribers in this Offering will be released to the Company when

subscriptions are received and accepted.

No

assurance can be given that the net proceeds from the total number

of shares offered hereby or any lesser net amount will be

sufficient to accomplish our goals. If proceeds from this offering

are insufficient, we may be required to seek additional capital. No

assurance can be given that we will be able to obtain such

additional capital, or even if available, that such additional

capital will be available on terms acceptable to us.

See

"Use of Proceeds" beginning on page 14. We will use the proceeds

from these sales for general working capital, debt reduction, and

other corporate purposes.

|

|

Risk

Factors

|

|

You

should read the "Risk Factors" section starting on page 4 of this

prospectus for a discussion of factors to consider carefully before

deciding to invest in shares of our common stock.

|

|

Symbol

|

|

PHOT

|

(1)

The number of shares of our common

stock outstanding before this offering is based

on 3,858,188,075 shares of our common stock outstanding as

of October 18, 2019, and excludes:

●

________ shares of our common stock issuable upon the exercise

of stock options outstanding as of October __, 2019 at a

weighted-average exercise price of $0.____ per

share;

●

___________ shares of our common stock issuable upon the

exercise of warrants outstanding as of October __, 2019 (at a

weighted-average exercise price of $0.___ per share. These

warrants will expire between ________, ______ and _________,

________;

●

____________ shares of common stock to be issued for the conversion of Convertible Notes

Payables as of October __, 2019 with expiration dates

between __________ and ___________ at conversion

prices of $0.___ per share;

●

__________ additional shares of our common stock available for

future issuance under our 2017 Amended Stock Incentive

Plan;

●

__________ shares of our common stock issuable upon the conversion

of convertible promissory notes; and,

●up to

625,000,000 shares of our common stock pursuant to this

Registration Statement.

Investing in our common stock is highly

speculative and involves a high degree of

risk. You should carefully consider the risks and uncertainties

described below, together with all of the other information

contained in this prospectus, including our financial statements

and the related notes appearing at the end of this prospectus,

before deciding to invest in our common stock. If any of the

following risks actually occur, our business, prospects, operating

results and financial condition could suffer materially, the

trading price of our common stock could decline and you could lose

all or part of your investment. There are

certain inherent risks which will have an effect on the

Company’s development in the future and the most significant risks

and uncertainties known and identified by our management are

described below.

Risks Related to Our Business

There are certain inherent risks which will have an effect on the

Company’s development in the future and the most

significant risks and uncertainties known and identified by our

management are described below.

Risks Associated with Securities Purchase Agreement with Chicago

Venture.

The

Securities Purchase Agreement with Chicago Venture will terminate

if we file protection from its creditors, a Registration Statement

on Form S-1 is not effective, and our market capitalization or the

trading volume of our common stock does not reach certain levels.

If terminated, we will be unable to draw down all or substantially

all of our Chicago Venture Notes.

Our

ability to require Chicago Venture to fund the Chicago Venture Note

is at our discretion, subject to certain limitations. Chicago

Venture is obligated to fund if each of the following conditions

are met; (i) the average and median daily dollar volumes of our

common stock for the twenty (20) and sixty (60) trading days

immediately preceding the funding date are greater than $100,000;

(ii) our market capitalization on the funding date is greater than

$17,000,000; (iii) we are not in default with respect to share

delivery obligations under the note as of the funding date; and

(iv) we are current in our reporting obligations.

There

is no guarantee that we will be able to meet the foregoing

conditions or any other conditions under the Securities Purchase

Agreement and/or Chicago Venture Note or that we will be able to

draw down any portion of the amounts available under the Securities

Purchase Agreement and/or Chicago Venture Note.

If we

not able to draw down all due under the Securities Purchase

Agreement or if the Securities Purchase Agreement is terminated, we

may be forced to curtail the scope of our operations or alter our

business plan if other financing is not available to

us.

Our common stock.

On

October 17, 2017, we were informed by Alpine Securities Corporation

(“Alpine”) that Alpine has demonstrated compliance with

the Financial Industry Regulatory Authority (“FINRA”)

Rule 6432 and Rule 15c2-11 under the Securities Exchange Act of

1934. We filed an amended application with the OTC Markets to list

the Company’s common stock on the OTCQB and begin to trade on

this market as of March 20, 2018. As

of March 4, 2019, we began to trade on the OTC Markets

Pink

Sheet because our bid

price had closed below $0.01 for more than 30 consecutive calendar

days.

This

action had a material adverse effect on our business, financial

condition and results of operations. If we are unable to obtain

additional financing when it is needed, we will need to restructure

our operations, and divest all or a portion of our

business.

We have been involved in Legal Proceedings.

We have

been involved in certain disputes and legal proceedings as

discussed in the section title “Legal Proceedings”

within our Form 10-Q for the quarter year ended June 30, 2019. In

addition, as a public company, we are also potentially susceptible

to litigation, such as claims asserting violations of securities

laws. Any such claims, with or without merit, if not resolved,

could be time-consuming and result in costly litigation. There can

be no assurance that an adverse result in any future proceeding

would not have a potentially material adverse on our business,

results of operations or financial condition.

We may engage in acquisitions, mergers, strategic alliances, joint

ventures and divestures that could result in final results that are

different than expected.

In the normal course of business, we engage in discussions relating

to possible acquisitions, equity investments, mergers, strategic

alliances, joint ventures and divestitures. Such transactions are

accompanied by a number of risks, including the use of significant

amounts of cash, potentially dilutive issuances of equity

securities, incurrence of

debt on potentially unfavorable terms as well as impairment

expenses related to goodwill and amortization expenses related to

other intangible assets, the possibility that we may pay too much

cash or issue too many of our shares as the purchase price for an

acquisition relative to the economic benefits that we ultimately

derive from such acquisition, and various potential difficulties

involved in integrating acquired businesses into our

operations.

From time to time, we have also engaged in discussions with

candidates regarding the potential acquisitions of our product

lines, technologies and businesses. If a divestiture such as this

does occur, we cannot be certain that our business, operating

results and financial condition will not be materially and

adversely affected. A successful divestiture depends on various

factors, including our ability to effectively transfer liabilities,

contracts, facilities and employees to any purchaser; identify and

separate the intellectual property to be divested from the

intellectual property that we wish to retain; reduce fixed costs

previously associated with the divested assets or business; and

collect the proceeds from any divestitures.

If we do not realize the expected benefits of any acquisition or

divestiture transaction, our financial position, results of

operations, cash flows and stock price could be negatively

impacted.

Our proposed business is dependent on laws pertaining to the

marijuana industry.

Continued

development of the marijuana industry is dependent upon continued

legislative authorization of the use and cultivation of marijuana

at the state level. Any number of factors could slow or

halt progress in this area. Further, progress, while

encouraging, is not assured. While there may be ample

public support for legislative action, numerous factors impact

the legislative process. Any one of these factors could

slow or halt use of marijuana, which would negatively impact our

proposed business.

Currently,

thirty three states and the District of Columbia allow its citizens

to use medical cannabis. Additionally, ten states and

the District of Columbia have legalized cannabis for adult

use. The state laws are in conflict with the federal

Controlled Substances Act, which makes marijuana use and possession

illegal on a national level. The Obama administration previously

effectively stated that it is not an efficient use of resources to

direct law federal law enforcement agencies to prosecute those

lawfully abiding by state-designated laws allowing the use and

distribution of medical marijuana. The Trump

administration position is unknown. However, there is no

guarantee that the Trump administration will not change current

policy regarding the low-priority enforcement of federal

laws. Additionally, any new administration that follows

could change this policy and decide to enforce the federal laws

strongly. Any such change in the federal

government’s enforcement of current federal laws could cause

significant financial damage to us and its

shareholders.

Further,

while we do not harvest, distribute or sell marijuana, by supplying

products to growers of marijuana, we could be deemed to be

participating in marijuana cultivation, which remains illegal under

federal law, and exposes us to potential criminal liability, with

the additional risk that our business could be subject to civil

forfeiture proceedings.

The marijuana industry faces strong opposition.

It is

believed by many that large, well-funded businesses may have a

strong economic opposition to the marijuana industry. We

believe that the pharmaceutical industry clearly does not want to

cede control of any product that could generate significant

revenue. For example, medical marijuana will likely

adversely impact the existing market for the current

“marijuana pill” sold by mainstream pharmaceutical

companies. Further, the medical marijuana industry could

face a material threat from the pharmaceutical industry, should

marijuana displace other drugs or encroach upon the pharmaceutical

industry’s products. The pharmaceutical industry

is well funded with a strong and experienced lobby that eclipses

the funding of the medical marijuana movement. Any

inroads the pharmaceutical industry could make in halting or

impeding the marijuana industry harm our business, prospects,

results of operation and financial condition.

Marijuana remains illegal under Federal

law.

Marijuana

is a Schedule-I controlled substance and is illegal under federal

law. Even in those states in which the use of marijuana

has been legalized, its use remains a violation of federal

law. Since federal law criminalizing the use of

marijuana preempts state laws that legalize its use, strict

enforcement of federal law regarding marijuana would harm our

business, prospects, results of operation and financial

condition.

Raising additional capital to implement our business plan and pay

our debts will cause dilution to our existing stockholders, require

us to restructure our operations, and divest all or a portion of

our business.

We need

additional financing to implement our business plan and to service

our ongoing operations and pay our current debts. There can be no

assurance that we will be able to secure any needed funding, or

that if such funding is available, the terms or conditions would be

acceptable to us.

If we

raise additional capital through borrowing or other debt financing,

we may incur substantial interest expense. Sales of additional

equity securities will dilute on a pro rata basis the percentage

ownership of all holders of common stock. When we raise more equity

capital in the future, it will result in substantial dilution to

our current stockholders.

If we

are unable to obtain additional financing when it is needed, we

will need to restructure our operations, and divest all or a

portion of our business.

Closing of bank and merchant processing accounts could have a

material adverse effect on our business, financial condition and/or

results of operations.

As a

result of the regulatory environment, we have experienced the

closing of several of our bank and merchant processing accounts

since March 2014. We have been able to open other bank accounts.

However, we may have other banking accounts closed. These factors

impact management and could have a material adverse effect on our

business, financial condition and/or results of

operations.

Federal regulation and enforcement may adversely affect the

implementation of medical marijuana laws and regulations may

negatively impact our revenues and

profits.

Currently,

there are thirty three states plus the District of Columbia that

have laws and/or regulation that recognize in one form or another

legitimate medical uses for cannabis and consumer use of cannabis

in connection with medical treatment. Many other states are

considering legislation to similar effect. As of the date of this

writing, the policy and regulations of the Federal government and

its agencies is that cannabis has no medical benefit and a range of

activities including cultivation and use of cannabis for personal

use is prohibited on the basis of federal law and may or may not be

permitted on the basis of state law. Active enforcement of the

current federal regulatory position on cannabis on a regional or

national basis may directly and adversely affect the willingness of

customers of GrowLife to invest in or buy products from GrowLife

that may be used in connection with cannabis. Active enforcement of

the current federal regulatory position on cannabis may thus

indirectly and adversely affect revenues and profits of the

GrowLife companies.

Our history of net losses has raised substantial doubt regarding

our ability to continue as a going concern. If we do not continue

as a going concern, investors could lose their entire

investment.

Our

history of net losses has raised substantial doubt about our

ability to continue as a going concern, and as a result, our

independent registered public accounting firm included an

explanatory paragraph in its report on our financial statements as

of and for the years ended December 31, 2018 and 2017 with

respect to this uncertainty. Accordingly, our ability to continue

as a going concern will require us to seek alternative financing to

fund our operations. This going concern opinion could materially

limit our ability to raise additional funds through the issuance of

new debt or equity securities or otherwise. Future reports on our

financial statements may include an explanatory paragraph with

respect to our ability to continue as a going concern.

We have a history of operating losses and there can be no assurance

that we can again achieve or maintain profitability.

We have

experienced net losses since inception. As of June 30, 2019, we had

an accumulated deficit of $145.2 million. There can be no assurance

that we will achieve or maintain profitability.

We are subject to corporate governance and internal control

reporting requirements, and our costs related to compliance with,

or our failure to comply with existing and future requirements,

could adversely affect our business.

We must

comply with corporate governance requirements under the

Sarbanes-Oxley Act of 2002 and the Dodd–Frank Wall Street

Reform and Consumer Protection Act of 2010, as well as additional

rules and regulations currently in place and that may be

subsequently adopted by the SEC and the Public Company Accounting

Oversight Board. These laws, rules, and regulations continue to

evolve and may become increasingly stringent in the future. We are

required to include management’s report on internal controls

as part of our annual report pursuant to Section 404 of the

Sarbanes-Oxley Act. We strive to continuously evaluate and improve

our control structure to help ensure that we comply with Section

404 of the Sarbanes-Oxley Act. The financial cost of compliance

with these laws, rules, and regulations is expected to remain

substantial.

We

cannot assure you that we will be able to fully comply with these

laws, rules, and regulations that address corporate governance,

internal control reporting, and similar matters. Failure to comply

with these laws, rules and regulations could materially adversely

affect our reputation, financial condition, and the value of our

securities.

Our inability or failure to effectively manage our growth could

harm our business and materially and adversely affect our operating

results and financial condition.

Our

strategy envisions growing our business. We plan to expand our

product, sales, administrative and marketing organizations. Any

growth in or expansion of our business is likely to continue to

place a strain on our management and administrative resources,

infrastructure and systems. As with other growing businesses, we

expect that we will need to further refine and expand our business

development capabilities, our systems and processes and our access

to financing sources. We also will need to hire, train, supervise

and manage new and retain contributing employees. These processes

are time consuming and expensive, will increase management

responsibilities and will divert management attention. We cannot

assure you that we will be able to:

|

|

●

|

expand

our products effectively or efficiently or in a timely

manner;

|

|

|

●

|

allocate

our human resources optimally;

|

|

|

●

|

meet

our capital needs;

|

|

|

●

|

identify

and hire qualified employees or retain valued employees;

or

|

|

|

●

|

incorporate

effectively the components of any business or product line that we

may acquire in our effort to achieve growth.

|

Our

operating results may fluctuate significantly based on customer

acceptance of our products. As a result, period-to-period

comparisons of our results of operations are unlikely to provide a

good indication of our future performance. Management expects that

we will experience substantial variations in our net sales and

operating results from quarter to quarter due to customer

acceptance of our products. If customers don’t accept our

products, our sales and revenues will decline, resulting in a

reduction in our operating income.

Customer

interest for our products could also be impacted by the timing of

our introduction of new products. If our competitors introduce new

products around the same time that we issue new products, and if

such competing products are superior to our own, customers’

desire for our products could decrease, resulting in a decrease in

our sales and revenues. To the extent that we introduce new

products and customers decide not to migrate to our new products

from our older products, our revenues could be negatively impacted

due to the loss of revenue from those customers. In the event that

our newer products do not sell as well as our older products, we

could also experience a reduction in our revenues and operating

income.

If we do not successfully generate additional products and

services, or if such products and services are developed but not

successfully commercialized, we could lose revenue

opportunities.

Our

future success depends, in part, on our ability to expand our

product and service offerings. To that end we have engaged in the

process of identifying new product opportunities to provide

additional products and related services to our customers. The

process of identifying and commercializing new products is complex

and uncertain, and if we fail to accurately predict

customers’ changing needs and emerging technological trends

our business could be harmed. We may have to commit significant

resources to commercializing new products before knowing whether

our investments will result in products the market will accept.

Furthermore, we may not execute successfully on commercializing

those products because of errors in product planning or timing,

technical hurdles that we fail to overcome in a timely fashion, or

a lack of appropriate resources. This could result in competitors

providing those solutions before we do and a reduction in net sales

and earnings.

The

success of new products depends on several factors, including

proper new product definition, timely completion and introduction

of these products, differentiation of new products from those of

our competitors, and market acceptance of these products. There can

be no assurance that we will successfully identify new product

opportunities, develop and bring new products to market in a timely

manner, or achieve market acceptance of our products or that

products and technologies developed by others will not render our

products or technologies obsolete or noncompetitive.

Our future success depends on our ability to grow and expand our

customer base. Our failure to achieve such growth or

expansion could materially harm our business.

To

date, our revenue growth has been derived primarily from the sale

of our products and through the purchase of existing businesses.

Our success and the planned growth and expansion of our business

depend on us achieving greater and broader acceptance of our

products and expanding our customer base. There can be no assurance

that customers will purchase our products or that we will continue

to expand our customer base. If we are unable to effectively market

or expand our product offerings, we will be unable to grow and

expand our business or implement our business strategy. This could

materially impair our ability to increase sales and revenue and

materially and adversely affect our margins, which could harm our

business and cause our stock price to decline.

If we

incur substantial liability from litigation, complaints, or

enforcement actions resulting from misconduct by our distributors,

our financial condition could suffer. We will require that our

distributors comply with applicable law and with our policies and

procedures. Although we will use various means to address

misconduct by our distributors, including maintaining these

policies and procedures to govern the conduct of our distributors

and conducting training seminars, it will still be difficult to

detect and correct all instances of misconduct. Violations of

applicable law or our policies and procedures by our distributors

could lead to litigation, formal or informal complaints,

enforcement actions, and inquiries by various federal, state, or

foreign regulatory authorities against us and/or our distributors.

and could consume considerable amounts of financial and other

corporate resources, which could have a negative impact on our

sales, revenue, profitability and growth prospects. As we are

currently in the process of implementing our direct sales

distributor program, we have not been, and are not currently,

subject to any material litigation, complaint or enforcement action

regarding distributor misconduct by any federal, state or foreign

regulatory authority.

Our

future manufacturers could fail to fulfill our orders for products,

which would disrupt our business, increase our costs, harm our

reputation and potentially cause us to lose our

market.

We may

depend on contract manufacturers in the future to produce our

products. These manufacturers could fail to produce products to our

specifications or in a workmanlike manner and may not deliver the

units on a timely basis. Our manufacturers may also have to obtain

inventories of the necessary parts and tools for production. Any

change in manufacturers to resolve production issues could disrupt

our ability to fulfill orders. Any change in manufacturers to

resolve production issues could also disrupt our business due to

delays in finding new manufacturers, providing specifications and

testing initial production. Such disruptions in our business and/or

delays in fulfilling orders would harm our reputation and would

potentially cause us to lose our market.

Our inability to effectively protect our intellectual property

would adversely affect our ability to compete effectively, our

revenue, our financial condition and our results of

operations.

We may

be unable to obtain intellectual property rights to effectively

protect our business. Our ability to compete effectively may be

affected by the nature and breadth of our intellectual property

rights. While we intend to defend against any threats to our

intellectual property rights, there can be no assurance that any

such actions will adequately protect our interests. If we are

unable to secure intellectual property rights to effectively

protect our technology, our revenue and earnings, financial

condition, and/or results of operations would be adversely

affected.

We may

also rely on nondisclosure and non-competition agreements to

protect portions of our technology. There can be no assurance that

these agreements will not be breached, that we will have adequate

remedies for any breach, that third parties will not otherwise gain

access to our trade secrets or proprietary knowledge, or that third

parties will not independently develop the technology.

We do

not warrant any opinion as to non-infringement of any patent,

trademark, or copyright by us or any of our affiliates, providers,

or distributors. Nor do we warrant any opinion as to invalidity of

any third-party patent or unpatentability of any third-party

pending patent application.

Our industry is highly competitive and we have less capital and

resources than many of our competitors, which may give them an

advantage in developing and marketing products similar to ours or

make our products obsolete.

We are

involved in a highly competitive industry where we may compete with

numerous other companies who offer alternative methods or

approaches, may have far greater resources, more experience, and

personnel perhaps more qualified than we do. Such resources may

give our competitors an advantage in developing and marketing

products similar to ours or products that make our products

obsolete. There can be no assurance that we will be able to

successfully compete against these other entities.

Transfers of our securities may be restricted by virtue of state

securities “blue sky” laws, which prohibit trading

absent compliance with individual state laws. These restrictions

may make it difficult or impossible to sell shares in those

states.

Transfers

of our common stock may be restricted under the securities or

securities regulations laws promulgated by various states and

foreign jurisdictions, commonly referred to as "blue sky" laws.

Absent compliance with such individual state laws, our common stock

may not be traded in such jurisdictions. Because the securities

held by many of our stockholders have not been registered for

resale under the blue sky laws of any state, the holders of such

shares and persons who desire to purchase them should be aware that

there may be significant state blue sky law restrictions upon the

ability of investors to sell the securities and of purchasers to

purchase the securities. These restrictions may prohibit the

secondary trading of our common stock. Investors should consider

the secondary market for our securities to be a limited

one.

We are dependent on key personnel.

Our

success depends to a significant degree upon the continued

contributions of key management and other personnel, some of whom

could be difficult to replace. We do not maintain key man life

insurance covering our officers. Our success will depend on the

performance of our officers and key management and other personnel,

our ability to retain and motivate our officers, our ability to

integrate new officers and key management and other personnel into

our operations, and the ability of all personnel to work together

effectively as a team. Our failure to retain and recruit

officers and other key personnel could have a material adverse

effect on our business, financial condition and results of

operations.

We have limited insurance.

We have

limited directors’ and officers’ liability insurance

and limited commercial liability insurance policies. Any

significant claims would have a material adverse effect on our

business, financial condition and results of

operations.

Risks Related to our Common Stock

An investment in our shares is highly speculative.

The shares of our common stock are highly speculative in nature,

involve a high degree of risk and should be purchased only by

persons who can afford to lose the entire amount invested in the

common stock. Before purchasing any of the shares of common stock,

you should carefully consider the risk factors contained herein

relating to our business and prospects. If any of the risks

presented herein actually occur, our business, financial condition

or operating results could be materially adversely affected. In

such case, the trading price of our common stock could decline, and

you may lose all or part of your investment.

The market price of our Common Stock may fluctuate significantly in

the future.

We expect that the market price of our Common Stock may fluctuate

in response to one or more of the following factors, many of which

are beyond our control:

|

|

●

|

competitive

pricing pressures;

|

|

|

|

|

|

|

●

|

our

ability to market our services on a cost-effective and timely

basis;

|

|

|

|

|

|

|

●

|

changing

conditions in the market;

|

|

|

|

|

|

|

●

|

changes

in market valuations of similar companies;

|

|

|

|

|

|

|

●

|

stock

market price and volume fluctuations generally;

|

|

|

|

|

|

|

●

|

regulatory

developments;

|

|

|

|

|

|

|

●

|

fluctuations

in our quarterly or annual operating results;

|

|

|

|

|

|

|

●

|

additions

or departures of key personnel; and

|

|

|

|

|

|

|

●

|

future

sales of our Common Stock or other securities.

|

The price at which you purchase shares of our Common Stock may not

be indicative of the price that will prevail in the trading market.

Shareholders may experience wide fluctuations in the market price

of our securities. These fluctuations may have a negative effect on

the market price of our securities and may prevent a shareholder

from obtaining a market price equal to the purchase price such

shareholder paid when the shareholder attempts to sell our

securities in the open market. In these situations, the shareholder

may be required either to sell our securities at a market price,

which is lower than the purchase price the shareholder paid, or to

hold our securities for a longer period than planned. An inactive

or low trading market may also impair our ability to raise capital

by selling shares of capital stock. You may be unable to sell your

shares of Common Stock at or above your purchase price, which may

result in substantial losses to you and which may include the

complete loss of your investment. Any of the risks described above

could adversely affect our sales and profitability and the price of

our Common Stock.

Chicago Venture could have significant influence over matters

submitted to stockholders for approval.

Chicago Venture, Iliad and St. George

As a

result of funding from Chicago Venture, Iliad and St. George as

previously detailed, they exercise significant control over

us.

If

these persons were to choose to act together, they would be able to

significantly influence all matters submitted to our stockholders

for approval, as well as our officers, directors, management and

affairs. For example, these persons, if they choose to act

together, could significantly influence the election of directors

and approval of any merger, consolidation or sale of all or

substantially all of our assets. This concentration of voting power

could delay or prevent an acquisition of us on terms that other

stockholders may desire.

Trading in our stock is limited by the SEC’s penny stock

regulations.

Our

stock is categorized as a penny stock The SEC has adopted Rule

15g-9 which generally defines "penny stock" to be any equity

security that has a market price (as defined) less than US$ 5.00

per share or an exercise price of less than US $5.00 per share,

subject to certain exclusions (e.g., net tangible assets in excess

of $2,000,000 or average revenue of at least $6,000,000 for the

last three years). The penny stock rules impose additional sales

practice requirements on broker-dealers who sell to persons other

than established customers and accredited investors. The penny

stock rules require a broker-dealer, prior to a transaction in a

penny stock not otherwise exempt from the rules, to deliver a

standardized risk disclosure document in a form prepared by the

SEC, which provides information about penny stocks and the nature

and level of risks in the penny stock market. The broker-dealer

also must provide the customer with current bid and offer

quotations for the penny stock, the compensation of the

broker-dealer and its salesperson in the transaction, and monthly

account statements showing the market value of each penny stock

held in the customer's account. The bid and offer quotations, and

the broker-dealer and salesperson compensation information, must be

given to the customer orally or in writing prior to effecting the

transaction and must be given to the customer in writing before or

with the customer's confirmation. In addition, the penny stock

rules require that prior to a transaction in a penny stock not

otherwise exempt from these rules, the broker-dealer must make a

special written determination that the penny stock is a suitable

investment for the purchaser and receive the purchaser's written

agreement to the transaction. Finally, broker-dealers may not

handle penny stocks under $0.10 per share.

These

disclosure requirements reduce the level of trading activity in the

secondary market for the stock that is subject to these penny stock

rules. Consequently, these penny stock rules would affect the

ability of broker-dealers to trade our securities if we become

subject to them in the future. The penny stock rules also could

discourage investor interest in and limit the marketability of our

common stock to future investors, resulting in limited ability for

investors to sell their shares.

FINRA sales practice requirements may also limit a

shareholder’s ability to buy and sell our stock.

In

addition to the “penny stock” rules described above,

FINRA has adopted rules that require that in recommending an

investment to a customer, a broker-dealer must have reasonable

grounds for believing that the investment is suitable for that

customer. Prior to recommending speculative low priced securities

to their non-institutional customers, broker-dealers must make

reasonable efforts to obtain information about the customer’s

financial status, tax status, investment objectives and other

information. Under interpretations of these rules, FINRA believes

that there is a high probability that speculative low priced

securities will not be suitable for at least some customers. The

FINRA requirements make it more difficult for broker-dealers to

recommend that their customers buy our common stock, which may

limit your ability to buy and sell our stock and have an adverse

effect on the market for our shares.

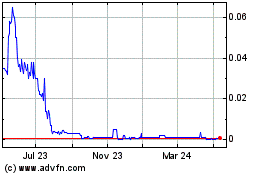

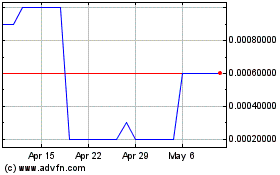

The market price of our common stock may be volatile.

The

market price of our common stock has been and is likely in the

future to be volatile. Our common stock price may fluctuate in

response to factors such as:

|

●

|

Halting of trading by the SEC or FINRA.

|

|

|

|

|

●

|

Announcements

by us regarding liquidity, legal proceedings, significant

acquisitions, equity investments and divestitures, strategic

relationships, addition or loss of significant customers and

contracts, capital expenditure commitments, loan, note payable and

agreement defaults, loss of our subsidiaries and impairment of

assets,

|

|

|

|

|

●

|

Issuance

of convertible or equity securities for general or merger and

acquisition purposes,

|

|

|

|

|

●

|

Issuance

or repayment of debt, accounts payable or convertible debt for

general or merger and acquisition purposes,

|

|

|

|

|

●

|

Sale of

a significant number of shares of our common stock by

shareholders,

|

|

|

|

|

●

|

General

market and economic conditions,

|

|

●

|

Quarterly

variations in our operating results,

|

|

|

|

|

●

|

Investor

relation activities,

|

|

|

|

|

●

|

Announcements

of technological innovations,

|

|

|

|

|

●

|

New

product introductions by us or our competitors,

|

|

|

|

|

●

|

Competitive

activities, and

|

|

|

|

|

●

|

Additions

or departures of key personnel.

|

These

broad market and industry factors may have a material adverse

effect on the market price of our common stock, regardless of our

actual operating performance. These factors could have a material

adverse effect on our business, financial condition, and/or results

of operations.

The sale of a significant number of our shares of common stock

could depress the price of our common stock.

Sales

or issuances of a large number of shares of common stock in the

public market or the perception that sales may occur could cause

the market price of our common stock to decline. As of June 30,

2019, there were approximately 3.76 billion shares of our common stock

issued and outstanding. In addition, as of June 30,

2019, there are also (i) stock option grants outstanding for the

purchase of 82.5 million common

shares at a $0.010 average exercise price; (ii) warrants for the

purchase of 362.8 million

common shares at a $0.023 average exercise price; and (iii)

116.5 million shares related to convertible debt that can be

converted at $0.0025 per share.

In addition, we have an unknown number of common shares to be

issued under the Chicago Venture, Iliad and St. George financing

agreements because the number of shares ultimately issued to

Chicago Venture depends on the price at which Chicago Venture

converts its debt to shares and exercises its warrants. The lower

the conversion or exercise prices, the more shares that will be

issued to Chicago Venture upon the conversion of debt to shares. We

won’t know the exact number of shares of stock issued to

Chicago Venture until the debt is actually converted to

equity. If all stock option grant and warrant and contingent

shares are issued, approximately 4.537 billion of our currently

authorized 6 billion shares of common stock will be issued and

outstanding. For purposes

of estimating the number of shares issuable upon the

exercise/conversion of all stock options, warrants and contingent

shares, we assumed the number of shares and average share prices

detailed above.

These

stock option grant, warrant and contingent shares could result in

further dilution to common stockholders and may affect the market

price of the common stock.

Significant

shares of common stock are held by our principal shareholders,

other Company insiders and other large shareholders. As affiliates

as defined under Rule 144 of the Securities Act or Rule 144 of the

Company, our principal shareholders, other Company insiders and

other large shareholders may only sell their shares of common stock

in the public market pursuant to an effective registration

statement or in compliance with Rule 144.

These

stock option grant, warrant and contingent shares could result in

further dilution to common stockholders and may affect the market

price of the common stock.

Some of our convertible debentures and warrants may require

adjustment in the conversion price.

Our

Convertible Notes Payable may require an adjustment in the current

conversion price of $0.002535 per share if we issue common stock,

warrants or equity below the price that is reflected in the

convertible notes payable. Our warrant with St. George may require

an adjustment in the exercise price. The conversion price of the

convertible notes and warrants will have an impact on the market

price of our common stock. Specifically, if under the terms of the

convertible notes the conversion price goes down, then the market

price, and ultimately the trading price, of our common stock will

go down. If under the terms of the convertible notes the conversion

price goes up, then the market price, and ultimately the trading

price, of our common stock will likely go up. In other words, as

the conversion price goes down, so does the market price of our

stock. As the conversion price goes up, so presumably does the

market price of our stock. The more the conversion price goes down,

the more shares are issued upon conversion of the debt which

ultimately means the more stock that might flood into the market,

potentially causing a further depression of our stock.

We do not anticipate paying any cash dividends on our capital stock

in the foreseeable future.

We have

never declared or paid cash dividends on our capital stock. We

currently intend to retain all of our future earnings, if any, to

finance the growth and development of our business, and we do not

anticipate paying any cash dividends on our capital stock in the

foreseeable future. In addition, the terms of any future debt

agreements may preclude us from paying dividends. As a result,

capital appreciation, if any, of our common stock will be your sole

source of gain for the foreseeable future.

Anti-takeover provisions may limit the ability of another party to

acquire our company, which could cause our stock price to

decline.

Our

certificate of incorporation, as amended, our bylaws and Delaware

law contain provisions that could discourage, delay or prevent a

third party from acquiring our company, even if doing so may be

beneficial to our stockholders. In addition, these provisions could

limit the price investors would be willing to pay in the future for

shares of our common stock.

We may issue preferred stock that could have rights that are

preferential to the rights of common stock that could discourage

potentially beneficially transactions to our common

shareholders.

An

issuance of additional shares of preferred stock could result in a

class of outstanding securities that would have preferences with

respect to voting rights and dividends and in liquidation over our

common stock and could, upon conversion or otherwise, have all of

the rights of our common stock. Our Board of Directors'

authority to issue preferred stock could discourage potential

takeover attempts or could delay or prevent a change in control

through merger, tender offer, proxy contest or otherwise by making

these attempts more difficult or costly to achieve. The

issuance of preferred stock could impair the voting, dividend and

liquidation rights of common stockholders without their

approval.

If the company were to dissolve or wind-up, holders of our common

stock may not receive a liquidation preference.

If we

were too wind-up or dissolve the Company and liquidate and

distribute our assets, our shareholders would share ratably in our

assets only after we satisfy any amounts we owe to our

creditors. If our liquidation or dissolution were

attributable to our inability to profitably operate our business,

then it is likely that we would have material liabilities at the

time of liquidation or dissolution. Accordingly, we

cannot give you any assurance that sufficient assets will remain

available after the payment of our creditors to enable you to

receive any liquidation distribution with respect to any shares you

may hold.

SPECIAL NOTE REGARDING FORWARD-LOOKING

STATEMENTS

This

prospectus includes statements that are, or may be deemed,

"forward-looking statements." In some cases, these forward-looking

statements can be identified by the use of forward-looking

terminology, including the terms "believes", "estimates",

"anticipates", "expects", "plans", "intends", "may", "could",

"might", "will", "should", "approximately" or, in each case, their

negative or other variations thereon or comparable terminology,

although not all forward-looking statements contain these words.

They appear in a number of places throughout this prospectus and

include statements regarding our intentions, beliefs, projections,

outlook, analyses or current expectations concerning, among other

things, our results of operations, financial condition, liquidity,

prospects, growth and strategies, the length of time that we will

be able to continue to fund our operating expenses and capital

expenditures, our expected financing needs and sources of

financing, the industry in which we operate and the trends that may

affect the industry or us.

By

their nature, forward-looking statements involve risks and

uncertainties because they relate to events, competitive dynamics,

and market developments and depend on the economic circumstances

that may or may not occur in the future or may occur on longer or

shorter timelines than anticipated. Although we believe that we

have a reasonable basis for each forward-looking statement

contained in this prospectus, we caution you that forward-looking

statements are not guarantees of future performance and that our

actual results of operations, financial condition and liquidity,

and the development of the industry in which we operate may differ

materially from the forward-looking statements contained in this

prospectus. In addition, even if our results of operations,

financial condition and liquidity, and the development of the

industry in which we operate are consistent with the

forward-looking statements contained in this prospectus, they may

not be predictive of results or developments in future

periods.

Any

forward-looking statements that we make in this prospectus speak

only as of the date of such statement, and we undertake no

obligation to update such statements to reflect events or

circumstances after the date of this prospectus.

You

should also read carefully the factors described in the "Risk

Factors" section of this prospectus to better understand the risks

and uncertainties inherent in our business and underlying any

forward-looking statements. As a result of these factors, we cannot

assure you that the forward-looking statements in this prospectus

will prove to be accurate. Furthermore, if our forward-looking

statements prove to be inaccurate, the inaccuracy may be material.

In light of the significant uncertainties in these forward-looking

statements, you should not regard these statements as a

representation or warranty by us or any other person that we will

achieve our objectives and plans in any specified timeframe, or at

all. We disclaim any obligation to update or revise any

forward-looking statement as a result of new information, future

events or for any other reason.

Our

offering is being made in a direct public offering on a

self-underwritten basis - no minimum of shares must be sold in

order for the offering to proceed. The offering price per share is

$0.004 There is no assurance that we will raise the full $2,500,000

as anticipated.

Not

taking into account any possible additional funding or revenues,

the Company intends to use the proceeds from this offering as

follows. The following chart indicates the amount of funds that we

will allocate to each item, but does not indicate the total

fee/cost of each item. The amount of proceeds we allocate to

each item is dependent upon the amount of proceeds we receive from

this offering:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Use of Proceeds

|

$

|

|

$

|

|

$

|

|

|

Gross Proceeds from Offering

|

$2,500,000

|

|

$1,250,000

|

|

$625,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Use of Proceeds

|

|

|

|

|

|

|

|

Debt

reduction

|

$1,000,000

|

40.0%

|

$500,000

|

40.0%

|

$250,000

|

50.0%

|

|

EZ-Clone

Enterprises, Inc.extension fee

|

171,000

|

6.8%

|

85,500

|

6.8%

|

-

|

0.0%

|

|

Sales

and marketing

|

250,000

|

10.0%

|

125,000

|

10.0%

|

-

|

0.0%

|

|

Expansion

into clone business

|

250,000

|

10.0%

|

250,000

|

20.0%

|

125,000

|

25.0%

|

|

Payment

of liabilities

|

200,000

|

8.0%

|

100,000

|

8.0%

|

100,000

|

20.0%

|

|

Working

capital

|

629,000

|

25.2%

|

189,500

|

15.2%

|

25,000

|

5.0%

|

|

|

|

|

|

|

|

|

|

Total

use of proceeds

|

$2,500,000

|

100.0%

|

$1,250,000

|

100.0%

|

$500,000

|

100.0%

|

|

|

|

|

|

|

|

|

|

Offering Expenses (1)

|

|

|

|

|

|

|

|

Securities

and Exchange Commission registration fee

|

$303

|

|

$303

|

|

$303

|

|

|

Accounting

fees and expenses

|

5,000

|

|

5,000

|

|

5,000

|

|

|

Legal

fees and expenses

|

15,000

|

|

15,000

|

|

15,000

|

|

|

Registrar