Telecom veteran is among the potential candidates being

considered for post

By Sarah Krouse and Maureen Farrell

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (November 12, 2019).

WeWork is in discussions with T-Mobile US Inc. Chief Executive

John Legere to take over leadership of the troubled office-sharing

startup, according to people familiar with the matter.

WeWork's parent, formally known as We Co., is searching for a

CEO who can stabilize the company following the erratic tenure of

its co-founder Adam Neumann. After WeWork's failed attempt at an

initial public offering, SoftBank Group Corp. bought a majority

stake in the company last month in a bailout, severing most ties

with Mr. Neumann.

The startup is looking for a new leader who could join as soon

as January, some of the people said. There is no guarantee that Mr.

Legere, who stands to receive a windfall if T-Mobile completes its

proposed takeover of Sprint Corp. next year, would accept the

position or that another candidate won't emerge. WeWork is also

talking to other potential candidates, one of the people said.

Like Mr. Neumann, Mr. Legere is known as an unconventional

executive. The 61-year-old has spent the past six years running

T-Mobile with a pugnacious style, trashing his rivals on Twitter as

"Dumb and Dumber," using foul language and dressing in the

company's signature magenta. He has turned around T-Mobile's

operations, luring millions of cellphone customers from larger

players and initiating the pending takeover of Sprint.

Two WeWork executives, Artie Minson and Sebastian Gunningham,

have served as co-CEOs since September when Mr. Neumann resigned

under pressure as chief executive. SoftBank executives are seeking

to replace the duo with a high-profile candidate who they hope can

turn the company around with an eye toward potentially taking it

public in the future, the people said.

As WeWork ran dangerously low on cash, SoftBank stepped in with

nearly $10 billion to steady the company and installed one of its

own top executives, Marcelo Claure, as chairman and de facto head

of the turnaround effort. SoftBank and its Vision Fund now own

about 80% of WeWork.

When WeWork promoted Mr. Minson, the company's former finance

chief, and Mr. Gunningham, a vice chairman, it didn't designate

them interim CEOs. When asked last month at an employee town hall

whether the two men would remain, Mr. Claure remarked only that the

arrangement was unusual. It isn't known what roles, if any, they

might have should WeWork hire a new CEO.

Mr. Claure, who is chairman of Sprint, another SoftBank

portfolio company, has been analyzing WeWork's business and costs,

pledging to work four days a week at its New York headquarters. Mr.

Claure has sought help from another Sprint executive: CEO Michel

Combes has spent time at WeWork's New York office in recent weeks,

some of the people said. Mr. Claure has told people that Mr. Combes

is unlikely to become WeWork's CEO.

WeWork's parent, with revenue of $1.8 billion last year and a

recent valuation around $8 billion, is far smaller than T-Mobile,

which had revenue of more than $43 billion last year and a market

cap of nearly $70 billion.

Mr. Legere is a veteran of the telecom business, a boom-and-bust

industry in which technological changes can shift companies'

fortunes quickly. A Fitchburg, Mass., native, he worked previously

at AT&T Inc. and was chief executive of fiber-optic network

provider Global Crossing Ltd. before joining T-Mobile.

He has worked closely with Mr. Claure over the last year and a

half to secure U.S. government approval for T-Mobile's proposed $26

billion acquisition of Sprint. Both prolific Twitter users --

unusual among big-company executives -- they posted selfies riding

electric scooters and running on the National Mall as they made

their case to regulators.

But the deal hasn't been sealed. Though approved by federal

officials, it has been delayed by an antitrust suit filed by

several state attorneys general. The trial is set to start next

month. Mr. Legere said last week that the parties are discussing

how to extend the deal's deadline and didn't rule out the

possibility of renegotiating the price.

When it announced the Sprint deal, T-Mobile said Mr. Legere

would run the combined company. But executives at the time told

investors they expected the merger to close in the first half of

2019; they now say the transaction won't close until next year.

T-Mobile's share price is up nearly 240% since Mr. Legere became

CEO in September 2012, compared with a 114% gain in the S&P 500

index over that same period. Shares of T-Mobile closed 1.6% lower

Monday following The Wall Street Journal's report on his potential

departure, while Sprint shares closed down 3.3%.

T-Mobile paid Mr. Legere $66.5 million last year, and he was

eligible to receive up to $109 million if the company met certain

performance targets. When T-Mobile struck the merger deal with

Sprint, it also extended Mr. Legere's employment contract through

April 30, 2020.

Mr. Legere has cleaned up messes before. He spent a decade at

Global Crossing, leading it through a bankruptcy and to an eventual

sale in 2011.

During his time as CEO, T-Mobile grew from a struggling No. 4

U.S. wireless carrier to a strong No. 3 that routinely wins

customers from larger rivals AT&T and Verizon Communications

Inc.

T-Mobile has spent years positioning Mr. Legere's deputy, Mike

Sievert, to take on more responsibilities. He was named chief

operating officer and appointed to the board in early 2018.

T-Mobile's marketing events have increasingly featured Mr.

Sievert's voice. When the company last week unveiled a series of

consumer-friendly promises designed to win over skeptical state

officials, Messrs. Legere and Sievert shared the stage.

--Drew FitzGerald and Liz Hoffman contributed to this

article.

Write to Sarah Krouse at sarah.krouse@wsj.com and Maureen

Farrell at maureen.farrell@wsj.com

(END) Dow Jones Newswires

November 12, 2019 02:47 ET (07:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

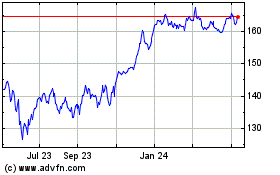

T Mobile US (NASDAQ:TMUS)

Historical Stock Chart

From Mar 2024 to Apr 2024

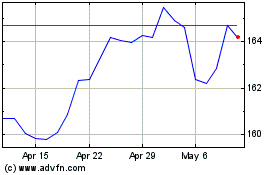

T Mobile US (NASDAQ:TMUS)

Historical Stock Chart

From Apr 2023 to Apr 2024