Report of Foreign Issuer (6-k)

November 08 2019 - 5:19PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the Month of November 2019

Commission File Number: 001-38097

ARGENX SE

(Translation of registrant’s name into English)

Willemstraat 5

4811 AH, Breda, the Netherlands

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): o

argenx SE

Underwriting Agreement

On November 6, 2019, argenx SE (the “Company”) entered into an Underwriting Agreement (the “Underwriting Agreement”) with Morgan Stanley & Co. LLC, Cowen and Company, LLC, BofA Securities, Inc. and Evercore Group L.L.C. as representatives of the several underwriters named therein (the “Underwriters”), relating to a global offering (the “Offering”) of an aggregate of 4,000,000 ordinary shares of the Company, nominal value €0.10 per share (the “Ordinary Shares”), including in the form of American Depositary Shares (“ADSs”), comprised of (i) 1,410,057 ADSs at a public offering price of $121.00 per ADS in the United States and countries outside the European Economic Area (“EEA”) and (ii) 2,589,943 Ordinary Shares at an offering price of €109.18 per Ordinary Share in a concurrent private placement in the EEA to certain legal entities all of which are qualified investors within the meaning of Regulation 2017/1129 of the European Parliament and of the Council of June 14, 2017. In connection with the Offering, the Company granted the Underwriters an option to purchase up to 600,000 additional ADSs, which was exercised in full. The net proceeds to the Company from the sale of the ADSs and Ordinary Shares in the Offering, after deducting the underwriting discounts and commissions and estimated offering expenses payable by the Company, will be approximately $461.6 million (€416.5 million). The Offering is expected to close on November 12, 2019, subject to the satisfaction of customary closing conditions.

The Offering was made pursuant to the Company’s effective shelf registration statement on Form F-3ASR (File No. 333-225370) filed on June 1, 2018, as supplemented by a prospectus supplement dated November 6, 2019, filed with the Securities and Exchange Commission on November 6, 2019.

On November 6, 2019, the Company issued a press release announcing the Offering and a press release announcing the pricing of the Offering. Copies of these press releases are filed as Exhibit 99.1 and 99.2 to this Form 6-K and are incorporated by reference herein.

In the Underwriting Agreement, the Company makes customary representations, warranties and covenants and also agrees to indemnify the Underwriters against certain liabilities, including liabilities under the Securities Act of 1933, as amended, or to contribute to payments that the Underwriters may be required to make because of such liabilities. The foregoing is only a brief description of the terms of the Underwriting Agreement, does not purport to be a complete description of the rights and obligations of the parties thereunder, and is qualified in its entirety by reference to the Underwriting Agreement that is filed as Exhibit 1.1 to this Form 6-K and incorporated by reference herein. The legal opinion of Freshfields Bruckhaus Deringer LLP relating to the Ordinary Shares (including those underlying the ADSs) is filed as Exhibit 5.1 to this Form 6-K and incorporated by reference herein.

The information contained in this Current Report on Form 6-K, including the Exhibits, is incorporated by reference into the Company’s Registration Statements on Forms F-3 (File No. 333-225370) and S-8 (File No. 333-225375).

2

EXHIBITS

|

Exhibit

|

|

Description

|

|

|

|

|

|

1.1

|

|

Underwriting Agreement, dated as of November 6, 2019, among the Company and Morgan Stanley & Co. LLC, Cowen and Company, LLC, BofA Securities, Inc. and Evercore Group L.L.C. as representatives of the several Underwriters named therein

|

|

|

|

|

|

5.1

|

|

Opinion of Freshfields Bruckhaus Deringer LLP, Dutch counsel to the registrant

|

|

|

|

|

|

23.1

|

|

Consent of Freshfields Bruckhaus Deringer LLP (included in Exhibit 5.1)

|

|

|

|

|

|

99.1

|

|

Press Release dated November 6, 2019

|

|

|

|

|

|

99.2

|

|

Press Release dated November 6, 2019

|

3

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

ARGENX SE

|

|

|

|

|

Date: November 8, 2019

|

By:

|

/s/ Dirk Beeusaert

|

|

|

|

Dirk Beeusaert

|

|

|

|

General Counsel

|

4

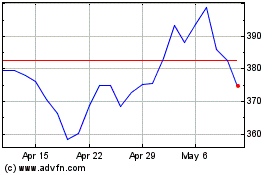

argenx (NASDAQ:ARGX)

Historical Stock Chart

From Mar 2024 to Apr 2024

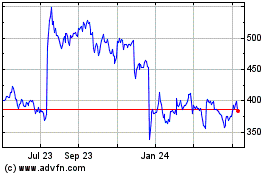

argenx (NASDAQ:ARGX)

Historical Stock Chart

From Apr 2023 to Apr 2024