Use these links to rapidly review the document

TABLE OF CONTENTS

Table of Contents

Filed pursuant to Rule 424(b)(5)

Registration No. 333-228149

PROSPECTUS SUPPLEMENT

(To Prospectus dated November 14, 2018)

$20,000,000

Common Stock

We have entered into a common stock sales agreement, or the sales agreement, with H.C. Wainwright & Co., LLC, or Wainwright,

relating to shares of our common stock. In accordance with the terms of the sales agreement, we may offer and sell shares of our common stock from time to time having an aggregate offering price of up

to $20,000,000 through or to Wainwright, as agent or principal, pursuant to this prospectus supplement and the accompanying prospectus.

Upon

our delivery of a placement notice and subject to the terms and conditions of the sales agreement, Wainwright may sell shares of our common stock by methods deemed to be an "at the

market offering" as defined in Rule 415 promulgated under the Securities Act of 1933, as amended, or the Securities Act. Wainwright will act as sales agent using its commercially reasonable

efforts consistent with its normal trading and sales practices, on mutually agreed terms between Wainwright and us. There is no arrangement for funds to be received in any escrow, trust or similar

arrangement.

Wainwright

will be entitled to compensation at a fixed commission rate of 3% of the gross proceeds of each sale of shares of our common stock. In connection with the sale of our shares

of common stock on our behalf, Wainwright will be deemed to be an "underwriter" within the meaning of the Securities Act and the compensation of Wainwright will be deemed to be underwriting

commissions or discounts. We have also agreed to provide indemnification and contribution to Wainwright with respect to certain liabilities, including liabilities under the Securities Act.

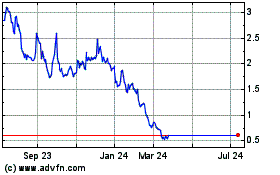

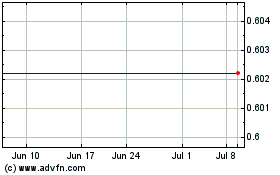

Our

common stock is listed on The Nasdaq Capital Market under the symbol "AGRX." The last reported sale price of our common stock on The Nasdaq Capital Market on November 7, 2019

was $2.03 per share.

We

are an emerging growth company as that term is used in the Jumpstart Our Business Startups Act of 2012 and, as such, have elected to comply with certain reduced public company

reporting requirements for this prospectus supplement and future filings.

Investing in our common stock involves a high degree of risk. See "Risk Factors" beginning on page S-5 and in the documents incorporated by

reference in this prospectus supplement.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these

securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

H.C. Wainwright & Co.

November 8, 2019

Table of Contents

TABLE OF CONTENTS

S-i

Table of Contents

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement and the accompanying prospectus form part of a registration statement on Form S-3 that we filed with the

Securities and Exchange Commission, or SEC, utilizing a "shelf" registration process. This document contains two parts. The first part consists of this prospectus supplement, which provides you with

specific information about this offering. The second part, the accompanying prospectus, provides more general information, some of which may not apply to this offering. Generally, when we refer only

to the "prospectus," we are referring to both parts combined. This prospectus supplement may add, update or change information contained in the accompanying prospectus. To the extent that any

statement we make in this prospectus supplement is inconsistent with statements made in the accompanying prospectus or any documents incorporated by reference herein or therein, the statements made in

this prospectus supplement will be deemed to modify or supersede those made in the accompanying prospectus and such documents incorporated by reference herein and therein. You should read this

prospectus supplement and the accompanying

prospectus, including the information incorporated by reference herein and therein, and any related free writing prospectus that we have authorized for use in connection with this offering.

You

should rely only on the information that we have included or incorporated by reference in this prospectus supplement, the accompanying prospectus and any related free writing

prospectus that we may authorize to be provided to you. We have not authorized any dealer, salesman or other person to give any information or to make any representation other than those contained or

incorporated by reference in this prospectus supplement, the accompanying prospectus or any related free writing prospectus that we may authorize to be provided to you. You must not rely upon any

information or representation not contained or incorporated by reference in this prospectus supplement, the accompanying prospectus or any related free writing prospectus. This prospectus supplement,

the accompanying prospectus and any related free writing prospectus do not constitute an offer to sell or the solicitation of an offer to buy any securities other than the registered securities to

which they relate, nor do this prospectus supplement, the accompanying prospectus or any related free writing prospectus constitute an offer to sell or the solicitation of an offer to buy securities

in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction.

You

should not assume that the information contained in this prospectus supplement, the accompanying prospectus or any related free writing prospectus is accurate on any date subsequent

to the date set forth on the front of the document or that any information we have incorporated by reference herein or therein is correct on any date subsequent to the date of the document

incorporated by reference, even though this prospectus supplement, accompanying prospectus or any related free writing prospectus is delivered, or securities are sold, on a later date.

Neither

we nor Wainwright have authorized anyone to provide any information or to make any representations other than those contained or incorporated by reference in this prospectus

supplement, the accompanying prospectus or in any free writing prospectuses we have authorized for use in connection with this offering. We take no responsibility for, and can provide no assurance as

to the reliability of, any other information that others may give you. This prospectus supplement and the accompanying prospectus together constitute an offer to sell only the securities offered

hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus supplement, the accompanying prospectus and any free writing

prospectuses that we have authorized for use in connection with this offering is current only as of its date. Our business, financial condition, results of operations and prospects may have changed

since those dates. You should read this prospectus supplement, the accompanying prospectus, the documents incorporated by reference herein and therein, and any free writing prospectus that we have

authorized for use in connection with this offering when making your investment decision. You should also read and consider the information in the documents we have referred you to in the section of

the accompanying prospectus entitled "Information Incorporated by Reference."

S-ii

Table of Contents

This

prospectus supplement contains or incorporates by reference summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual

documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been or will be filed or have

been or will be incorporated by reference as exhibits to the registration statement of which this prospectus supplement forms a part, and you may obtain copies of those documents as described

in this prospectus supplement under the heading "Where You Can Find More Information."

S-iii

Table of Contents

FORWARD-LOOKING STATEMENTS

This prospectus supplement, including the information incorporated by reference into our prospectus or this prospectus supplement, contains, and

any other prospectus supplement may contain, "forward-looking statements" within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934,

as amended, or the Exchange Act. You can identify these forward-looking statements by the use of words such as "outlook," "believes," "expects," "potential," "continues," "may," "will," "should,"

"seeks," "approximately," "predicts," "intends," "plans," "estimates," "anticipates" or the negative version of these words or other comparable words. These statements relate to future events or to

our future operating or financial performance and involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially

different from any future results, performances or achievements expressed or implied by the forward-looking statements.

Some

of the factors that we believe could cause actual results to differ from those anticipated or predicted include:

-

•

-

our available cash and our ability to obtain additional funding to fund our business plan without delay and to continue as a going concern;

-

•

-

the potential that the U.S. Food and Drug Administration, or FDA, determines that our data does not support approval of the Twirla new drug

application, or NDA, and requires us to conduct additional studies or reformulate Twirla to address the concerns raised in the second Twirla complete response letter, or 2017 CRL;

-

•

-

the potential that the FDA does not approve the Twirla NDA despite the favorable advisory committee vote regarding the benefit and risk profile

of Twirla, which occurred on October 30, 2019;

-

•

-

our ability to obtain and maintain regulatory approval of the Twirla NDA and our product candidates, and the labeling under any approval we may

obtain;

-

•

-

our ability to attract and retain key employees;

-

•

-

the accuracy of our estimates regarding expenses, future revenues, capital requirements and needs for additional financing;

-

•

-

the ability of our third-party manufacturer Corium International, Inc., or Corium, to complete any work or provide any data and other

information necessary to support the resubmission and approval of our Twirla NDA;

-

•

-

our ability along with Corium to pass an FDA pre-approval inspection, or PAI, and complete successfully the scale-up of the commercial

manufacturing process for Twirla, including the qualification and validation of equipment related to the expansion of Corium's manufacturing facility;

-

•

-

the performance and financial condition of Corium or any of the suppliers to our third-party manufacturer;

-

•

-

the success and timing of our clinical trials or other studies;

-

•

-

our ability along with our study investigators to pass any FDA inspections of our clinical sites;

-

•

-

regulatory and legislative developments in the United States and foreign countries, which could include, among other things, a government

shutdown;

-

•

-

our plans to commercialize Twirla and develop our other potential product candidates;

S-iv

Table of Contents

-

•

-

the size and growth of the potential markets for our product candidates and our ability to serve those markets;

-

•

-

the rate and degree of market acceptance of any of our product candidates;

-

•

-

our ability to obtain and maintain intellectual property protection for our product candidates;

-

•

-

the successful development of our sales and marketing capabilities;

-

•

-

our inability to timely obtain from our third-party manufacturer, Corium, sufficient quantities or quality of our product candidates or other

materials required for a clinical trial or other tests and studies;

-

•

-

our ability to successfully implement our business strategy; and

-

•

-

our use of the proceeds from this offering.

We

may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements.

Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements we make. We have included important cautionary statements in

our prospectus or this prospectus supplement or in the documents incorporated by reference in our prospectus and this prospectus supplement, particularly in the "Risk Factors" section, that we believe

could cause actual results or events to differ materially from the forward-looking statements that we make. For a summary of such factors, please refer to the section entitled "Risk Factors" in our

prospectus and this prospectus supplement, as updated and supplemented by the discussion of risks and uncertainties under "Risk Factors" contained in any further supplements to our prospectus and in

our most recent annual report on Form 10-K, as revised or supplemented by our subsequent quarterly reports on Form 10-Q or our current reports on Form 8-K, as well as any

amendments thereto, as filed with the SEC and which are incorporated herein by reference. The information contained in this

document is believed to be current as of the date of this document. We do not intend to update any of the forward-looking statements after the date of this document to conform these statements to

actual results or to changes in our expectations, except as required by law.

In

light of these assumptions, risks and uncertainties, the results and events discussed in the forward-looking statements contained in our prospectus or this prospectus supplement or in

any document incorporated herein by reference might not occur. Investors are cautioned not to place undue reliance on the forward-looking statements, which speak only as of the date of this prospectus

supplement or the date of the document incorporated by reference in this prospectus supplement. We are not under any obligation, and we expressly disclaim any obligation, to update or alter any

forward-looking statements, whether as a result of new information, future events or otherwise. All subsequent forward-looking statements attributable to us or to any person acting on our behalf are

expressly qualified in their entirety by the cautionary statements contained or referred to in this section.

S-v

Table of Contents

SUMMARY

This summary highlights information contained in other parts of this prospectus supplement. Because it is only a

summary, it does not contain all of the information that you should consider before investing in shares of our common stock and it is qualified in its entirety by, and should be read in conjunction

with, the more detailed information appearing elsewhere in this prospectus supplement, the accompanying prospectus, any applicable free writing prospectus and the documents incorporated by reference

herein and therein. You should read all such documents carefully, especially the risk factors and our financial statements and the related notes included or incorporated by reference herein or

therein, before deciding to buy shares of our common stock. Unless the context requires otherwise, references in this prospectus to "Agile," "we," "us" and "our" refer to Agile

Therapeutics, Inc.

Company Overview

We are a women's healthcare company dedicated to fulfilling the unmet health needs of today's women. Twirla® and our other current

potential product candidates are designed to provide women with contraceptive options that offer greater convenience and facilitate compliance. Our short-term goal is to establish a market-leading

franchise in the multi-billion-dollar U.S. hormonal contraceptive market built on the planned initial approval of our lead product candidate, Twirla, also known as AG200-15 in the U.S. Twirla is a

once-weekly prescription contraceptive patch that is at the end of Phase 3 clinical development. The new drug application, or NDA, for Twirla is currently under review by the U.S. Food and Drug

Administration, or FDA.

We

have had a long and complicated history seeking regulatory approval for Twirla in the U.S., which has included three submissions of our NDA for Twirla (first in 2012, second in 2017,

and third in 2019), the issuance of two complete response letters, or CRLs, from the FDA in 2013 and 2017, and the need to pursue formal dispute resolution with the FDA after the CRL issued in 2017,

which we refer to as the 2017 CRL. We resubmitted our Twirla NDA in the second quarter of 2019, and have been assigned a Prescription Drug User Fee Act, or PDUFA, goal date of November 16,

2019. Our resubmission included the results from a comparative wear study requested by the FDA, additional information on our manufacturing process, and other analyses responding to the 2017 CRL.

During the current review of the Twirla NDA, the FDA conducted a pre-approval inspection of our third-party manufacturer's, Corium International, or Corium, facility, following our resubmission, and

held a meeting of the Bone, Reproductive and Urologic Drugs Advisory Committee, or BRUDAC, on October 30, 2019, to review the safety and efficacy of Twirla, which included a discussion

regarding the Pearl Index, an efficacy measurement from our SECURE Phase 3 clinical trial that the FDA noted is substantially higher than other previously approved combined hormonal

contraceptives. The BRUDAC voted 14 to 1, with 1 abstention, that the benefits of Twirla in the prevention of pregnancy outweigh the risks to support approval. The BRUDAC non-binding vote is taken

into consideration by the FDA as part of its evaluation of the NDA, but there can be no assurances that the FDA will follow the vote of BRUDAC and approve the Twirla NDA. Following the BRUDAC meeting,

the FDA had sent us a follow-up information request to which we are currently responding.

If

Twirla is approved, we plan to commercialize Twirla in the United States, and accelerate our commercial preparations. In September 2019, we restarted manufacturing development at

Corium. We are currently working with Corium to complete manufacturing development and process improvements and plan to commence pre-validation work when that work is complete. Our goal is to

manufacture three validation batches of Twirla and complete the validation of the commercial manufacturing process in the second half of 2020.

If

Twirla is approved, in parallel, we plan to initiate work with managed care and patient payers to gain market access for Twirla in the first quarter of 2020. In the second quarter of

2020, we plan to hire and train an initial sales team, which we estimate to be in the range of 50 to 90 persons. We

S-1

Table of Contents

expect

to ship product to wholesalers and commence our commercial launch in fourth quarter of 2020. Our marketing efforts will initially focus on Obstetrician-gynecologists in the United States, and

we plan to use a significant number of samples in the early stage of commercial launch to gain patient trial and acceptance.

We

will need to raise additional funds to complete these activities and our ability to complete such activities according to our current planned timelines will depend on our ability to

successfully raise the necessary capital. We have structured our commercial plans in a manner that we believe will allow us to either scale-up or down as necessary in the event that the Twirla NDA is

not approved or such approval is delayed.

In

addition to Twirla, we have a potential pipeline of other new transdermal contraceptive products, including AG200-ER, which is a regimen designed to allow a woman to extend the length

of her cycle, AG200-SP, which is a regimen designed to provide a shortened hormone-free interval, and AG890, which is a progestin-only contraceptive patch intended for use by women who are unable or

unwilling to take estrogen. Substantially all of our resources are currently dedicated to developing and seeking regulatory approval for Twirla and we have halted advancing the development of our

other potential product candidates until we are able to obtain additional capital to fund these activities.

Information concerning our business is contained in the documents that we file with the SEC as a reporting company under the Securities Exchange

Act of 1934, which are accessible at www.sec.gov, and on our website at www.agiletherapeutics.com. The

information contained on, or that can be accessed through, our website is not a part of this prospectus. Investors should not rely on any such information in deciding whether to purchase our common

stock. We have included our website address in this prospectus solely as an inactive textual reference.

Our

principal executive offices are located at 101 Poor Farm Road, Princeton, New Jersey 08540, and our telephone number is (609) 683-1880.

As a company with less than $1.07 billion in revenue during our last fiscal year, we qualify as an "emerging growth company" as defined

in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. For so long as we remain an emerging growth company, we are permitted and intend to rely on exemptions from specified disclosure

requirements that are applicable to other public companies that are not emerging growth companies. These exemptions include:

-

•

-

being permitted to provide only two years of audited financial statements, in addition to any required unaudited interim financial statements,

with correspondingly reduced "Management's Discussion and Analysis of Financial Condition and Results of Operations" disclosure;

-

•

-

not being required to comply with the auditor attestation requirements in the assessment of our internal control over financial reporting;

-

•

-

not being required to comply with any requirement that may be adopted by the Public Company Accounting Oversight Board regarding mandatory

audit firm rotation or a supplement to the auditor's report providing additional information about the audit and the financial statements;

-

•

-

reduced disclosure obligations regarding executive compensation; and

-

•

-

exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden

parachute payments not previously approved.

S-2

Table of Contents

We

may take advantage of these provisions until December 31, 2019, or until such earlier time that we are no longer an emerging growth company. We would cease to be an emerging

growth company if we have more than $1.07 billion in annual revenues, have more than $700 million in market value of our capital stock held by non-affiliates or issue more than

$1 billion of non-convertible debt over a three-year period. We may choose to take advantage of some, but not all, of the available exemptions. We have taken advantage of some reduced reporting

burdens in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and therein. Accordingly, such information may be different than the information

you receive from other public companies in which you hold stock.

In

addition, the JOBS Act provides that an emerging growth company can take advantage of an extended transition period for complying with new or revised accounting standards. This

provision allows an emerging growth company to delay the adoption of some accounting standards until those standards would otherwise apply to private companies. We have irrevocably elected not to

avail

ourselves of this exemption from new or revised accounting standards and, therefore, we will be subject to the same new or revised accounting standards as other public companies that are not emerging

growth companies.

S-3

Table of Contents

THE OFFERING

|

|

|

|

|

Common stock offered by us

|

|

Shares of our common stock having an aggregate offering price of not more than $20,000,000.

|

|

Common stock to be outstanding after this offering

|

|

Up to 69,154,342 shares, assuming sales at a price of $2.03 per share, which was the closing price of our common stock on

the Nasdaq Capital Market on November 7, 2019. The actual number of shares issued will vary depending on the price at which shares may be sold from time to time.

|

|

Manner of offering

|

|

"At the market offering" that may be made from time to time through or to our sales agent, H.C.

Wainwright & Co., LLC. See "Plan of Distribution" on page S-17 of this prospectus supplement.

|

|

Use of proceeds

|

|

We intend to use the net proceeds for working capital and general corporate purposes, which include pursuing regulatory

approval for Twirla, the completion of our commercial plan for Twirla, which primarily includes validation of the commercial manufacturing process and the commercial launch of Twirla, if approved, and advancing the development of our other potential

product candidates. We may also use a portion of the net proceeds to invest in or acquire businesses or technologies that we believe are complementary to our own, although we have no current plans, commitments or agreements with respect to any

acquisitions as of the date of this prospectus supplement. See "Use of Proceeds" on page S-15 of this prospectus supplement.

|

|

Risk factors

|

|

You should read the "Risk Factors" section of this prospectus supplement beginning on page S-5 and the documents

referred to therein for a discussion of factors to consider carefully before deciding to invest in shares of our common stock.

|

|

Nasdaq Capital Market symbol

|

|

AGRX

|

The

number of shares of our common stock to be outstanding after this offering is based on 59,302,126 shares of our common stock outstanding as of September 30, 2019 and

excludes:

-

•

-

7,299,560 shares of common stock issuable upon the exercise of outstanding options to purchase common stock as of September 30, 2019 at

a weighted average exercise price of $3.46 per share;

-

•

-

2,130,243 shares of common stock reserved for future issuance under our 2014 Amended and Restated Incentive Compensation Plan as of

September 30, 2019; and

-

•

-

242,779 shares of common stock issuable upon the exercise of outstanding warrants as of September 30, 2019 at a weighted average

exercise price of $5.92 per share.

S-4

Table of Contents

RISK FACTORS

An investment in our common stock involves a high degree of risk. Before deciding whether to invest in our common stock,

you should carefully consider the risks described below and those discussed under the Section captioned "Risk Factors" contained in our

Annual Report on Form 10-K for the year ended December 31, 2018,

as revised or supplemented by our subsequent quarterly reports on

Form 10-Q or our current reports on Form 8-K, each

as filed with the SEC and which are incorporated by reference in this prospectus supplement and the accompanying prospectus, together with other information in this prospectus supplement, the

accompanying prospectus, the information and documents incorporated by reference herein and therein, and in any free writing prospectus that we have authorized for use in

connection with this offering. If any of these risks actually occurs, our business, financial condition, results of operations or cash flow could be seriously harmed. This could cause the trading

price of our common stock to decline, resulting in a loss of all or part of your investment. Please also read carefully the section above entitled "Forward-Looking Statements."

Risks Related to Our Business

We have not obtained regulatory approval for any of our product candidates in the United States or any other

country, and such approval or approvals may never be granted or may be substantially delayed if regulatory authorities require additional time or studies to assess the safety and efficacy of our

product candidates.

We currently do not have any product candidates that have gained regulatory approval for sale in the United States or any other country, and we

cannot guarantee that we will ever have marketable products. Our business is substantially dependent on our ability to complete the development of, obtain regulatory approval for and successfully

commercialize product candidates in a timely manner. We cannot commercialize product candidates in the United States without first obtaining regulatory approval to market each product candidate from

the FDA; similarly, we cannot commercialize product candidates outside of the United States without obtaining regulatory approval from comparable foreign regulatory authorities. We are not currently

pursuing any regulatory approvals for Twirla or any other potential product candidate outside the United States.

Before

obtaining regulatory approvals for the commercial sale of any product candidate for a target indication, we must demonstrate in, or rely on data from, preclinical studies and

well-controlled clinical trials and, with respect to approval in the United States, to the satisfaction of the FDA, that the product candidate is safe and effective for use for that target indication

and that the manufacturing facilities, processes and controls are adequate. In the United States, it is necessary to submit an NDA to obtain FDA approval. An NDA must include extensive preclinical and

clinical data and supporting information to establish the product candidate's safety and efficacy for each desired indication, although we may partially rely on published scientific literature or the

FDA's prior approval of similar products. The NDA must also include significant information regarding the chemistry, manufacturing and controls, or CMC, for the product. The FDA may further inspect

our manufacturing facilities to ensure that the facilities can manufacture our product candidates and our products, if and when approved, in compliance with the applicable regulatory requirements, as

well as inspect our clinical trial sites to ensure that our studies are properly conducted. Obtaining approval of an NDA is a lengthy, expensive and uncertain process, and approval may not be

obtained. Upon submission, or resubmission, of an NDA, the FDA must make an initial determination that the application is sufficiently complete to accept the submission for filing. We cannot be

certain that any submissions we might make will be accepted for filing and review by the FDA, or ultimately be approved.

If

the application is not approved, the FDA may require that we conduct additional clinical or preclinical trials, reformulate the product, address issues with our manufacturing process

or facilities, or take other actions before it will reconsider our application. If the FDA requires additional studies or

S-5

Table of Contents

data,

or if the FDA determines that our comparative wear study of Twirla and Xulane does not support the conclusion of adequate Twirla adhesion and requires us to reformulate Twirla, or if the FDA, an

FDA Advisory Committee or other regulatory authority recommends non-approval or restrictions on approval, we may never receive marketing approval or we would incur delays in the marketing approval

process and increased costs, which may require us to expend more resources than we have available. Studies required to demonstrate the safety and efficacy of our product candidates are time consuming,

expensive and together take several years or more to complete, and approval policies, regulations or the type and amount of clinical data necessary to gain approval may change during the course of a

product candidate's clinical development and may vary among jurisdictions and could lead to additional costs and delays. In addition, the FDA may not consider any additional information to be complete

or sufficient to support approval.

For

instance, we have had a long and complicated history seeking regulatory approval for Twirla in the U.S., which has included three submissions of our NDA for Twirla (first in 2012,

second in 2017, and third in 2019), the issuance of two complete response letters, or CRLs, from the FDA in 2013 and 2017, and the need to pursue formal dispute resolution with the FDA after the CRL

issued in 2017, which we refer to as the 2017 CRL. We resubmitted our Twirla NDA in the second quarter of 2019, and have been assigned a Prescription Drug User Fee Act, or PDUFA, goal date of

November 16, 2019. Our resubmission included the results from a comparative wear study requested by the FDA, additional information on our manufacturing process, and other analyses responding

to the 2017 CRL. During the current review of the Twirla NDA, the FDA conducted a pre-approval inspection of our third-party manufacturer's, Corium International, or Corium, facility, following our

resubmission, and held a meeting of the Bone, Reproductive and Urologic Drugs Advisory Committee, or BRUDAC, on October 30, 2019, to review the safety and efficacy of Twirla, which included a

discussion regarding the Pearl Index, an efficacy measurement from our SECURE Phase 3 clinical trial that the FDA noted is substantially higher than other previously approved combined hormonal

contraceptives. The BRUDAC voted 14 to 1, with 1 abstention, that the benefits of Twirla in the prevention of pregnancy outweigh the risks to support approval. The BRUDAC non-binding vote is taken

into consideration by the FDA as part of its evaluation of the NDA, but there can be no assurances that the FDA will follow the vote of BRUDAC and approve the Twirla NDA.

There

is no guarantee that the result of the BRUDAC vote or the data obtained from the SECURE clinical trial, our comparative wear study, or any other clinical trial, or our changes to

the manufacturing testing process and specifications to address the 2017 CRL's findings will be supportive of, or guarantee, or result in our successfully obtaining timely FDA approval

of Twirla for a commercially viable indication, if at all. The FDA could determine that the SECURE clinical trial did not meet its objectives, or the FDA could still have concerns about the conduct of

the SECURE

clinical trial, including regarding discontinuance of subjects from the trial, the rate of unscheduled bleeding, and subject delays in patch application, which were factors mentioned in the 2017 CRL.

While we designed the protocol for the SECURE clinical trial in consultation with the FDA after the 2013 CRL, and completed analyses and other requested items to address the issues raised in the 2013

and 2017 CRLs, there is no guarantee that the FDA will deem such steps to be sufficient to address those issues when they are formally reviewed as a part of an NDA resubmission or to demonstrate

safety and efficacy to the satisfaction of the FDA. The FDA may also find that our manufacturing testing and specification changes do not address its CRL findings.

In

addition to a review of the safety and efficacy of Twirla, the FDA must determine that Corium's manufacturing facilities meet certain FDA requirements for product manufacturing,

before granting product approval and before we can use them in the commercial manufacture of our products. We cannot assure you that Corium's responses and actions to rectify to the objectionable

conditions found during the FDA's facility inspection will adequately address the issues communicated by the FDA in the 2017 CRL. The FDA may also determine that our responses to the deficiencies in

the 2017 CRL and

S-6

Table of Contents

Corium's

responses to the manufacturing facility inspection objectionable conditions are not sufficient or require product development and additional analyses and/or studies and deny approval of the

Twirla NDA on this basis as well. If the FDA does not approve the Corium facility for the manufacture of Twirla, or if Corium is not able to address the objectionable conditions found by the FDA, or

if the FDA finds other objectionable conditions at Corium, the FDA could withhold approval or we may need to find an alternative supplier, which will take time and monetary expenditures, and which we

may not be able to do on favorable terms to us or at all.

We

resubmitted our Twirla NDA in the second quarter of 2019. Consistent with our previous NDA resubmission in 2017, the 2019 resubmission was categorized as a Type 2 resubmission

and received a review period of six months from the date of resubmission of the NDA. There can be no assurance that we will address the outstanding FDA questions in a manner sufficient for approval in

the U.S.

In

addition to the factors discussed above, delays in regulatory approvals or rejections of applications for regulatory approval in the United States, or any other markets may result

from many other factors, including:

-

•

-

Lack of adequate funding to commence or continue our clinical trials due to unforeseen costs or other business decisions;

-

•

-

Our inability to obtain sufficient funds required to complete clinical development, manufacturing development or regulatory review processes;

-

•

-

Regulatory requests for additional analyses, reports, data, non-clinical and preclinical studies and clinical trials;

-

•

-

Our inability to adequately address the cited deficiencies in the 2017 CRL;

-

•

-

A government shutdown delays or constrains the FDA's ability to complete NDA reviews according to PDUFA timelines;

-

•

-

Regulatory requests for additional product design work and testing;

-

•

-

Regulatory questions regarding interpretations of data and results and the emergence of new information regarding our product candidates or

other products;

-

•

-

Regulators may take longer than we anticipate to reach a decision on our marketing applications. For example, the FDA may request extension of

the PDUFA goal date for its review of the Twirla NDA. The FDA may also consider our response to an FDA request for information to be a major amendment to the application, and consequently extend the

PDUFA date;

-

•

-

Regulators may not agree with our analyses or proposals, may interpret our data and study results differently than we do, or many not find our

study results supportive of approval;

-

•

-

Clinical holds, other regulatory objections to commencing or continuing a clinical trial or the inability to obtain regulatory approval to

commence a clinical trial in countries that require such approvals;

-

•

-

Failure to reach agreement with the FDA or non-U.S. regulators regarding the scope or design of our clinical trials;

-

•

-

Unfavorable or inconclusive results of clinical trials and supportive nonclinical studies, including unfavorable results regarding safety or

efficacy of our product candidates during clinical trials;

-

•

-

Any determination that a product candidate presents an unacceptable health risk or that the product candidate's risks are not sufficiently

outweighed by associated benefits;

S-7

Table of Contents

-

•

-

Corium's inability to adequately resolve the objectionable conditions observed by the FDA when inspecting the facility or our inability to find

an alternative supplier;

-

•

-

Our inability to obtain approval for the manufacturing processes or Corium's facilities with whom we contract for clinical and commercial

supplies;

-

•

-

An FDA determination that our statistical analyses are not sufficient to support approval;

-

•

-

Failure of manufacturers to comply with FDA's or comparable regulatory authorities' requirements for the manufacture of products and product

candidates;

-

•

-

FDA or comparable regulatory authority determinations that our manufacturing processes, specifications, or tests are not sufficient or

acceptable;

-

•

-

FDA or comparable regulatory authority determinations that our clinical trials were not properly conducted or that such conduct did not comply

with regulatory requirements;

-

•

-

Our inability to obtain agreement from the FDA on product labeling; and

-

•

-

Insufficient funds to pay the significant user fees required by the FDA upon the filing of any future NDAs.

On October 30, 2019, the FDA convened a meeting of the Bone, Reproductive and Urologic Drugs Advisory

Committee to discuss the Twirla NDA. The outcome of this meeting was favorable, however, the advisory committee opinion may not result in the receipt of FDA approval for Twirla.

On October 30, 2019, the FDA convened a meeting of the BRUDAC to discuss the Twirla NDA. The BRUDAC voted 14 to 1, with 1 abstention,

that the benefits of Twirla in the prevention of pregnancy outweigh the risks to support approval.

Based

on the FDA's Advisory Committee Briefing Document, the FDA has expressed significant concerns regarding Twirla's approvability. By example, the FDA noted that the Twirla Pearl

Index is substantially higher than other previously approved combined hormonal contraceptives and stated that it is concerned that Twirla is not adequately effective in the general population of women

in the U.S., as well as in non-obese women. For this and other reasons, it does not appear the FDA agreed with our proposal to include a limitation of used based on patient weight and BMI in the

product label. The FDA also discussed its view that Twirla is not a "low-dose" contraceptive, does not address an unmet need, and does not appear to demonstrate a safety advantage over other combined

hormonal contraceptives. By example, the FDA stated that it does not believe that levonorgestrel-containing products are safer than combined hormonal contraceptives containing newer generation

progestins. The FDA also stated that there is considerable uncertainty about the magnitude of venous thromboembolism risk associated with Twirla and how that risk compares to other combined hormonal

contraceptive products. This conclusion may ultimately impact the FDA's risk/benefit analysis of the product candidate as the FDA believes that a high level of efficacy in preventing pregnancy must be

demonstrated to justify the risks associated with combined hormonal contraceptives. The FDA further stated that it does not agree that the SECURE study results are attributable to the study's design

and population, and that the SECURE study does not reflect real-world use. Moreover, the FDA noted that the SECURE study results relating to cycle control, discontinuation rates, and patch adhesion

raise questions regarding potential patient compliance, and patch usability and tolerability.

Typically,

Advisory Committees will provide responses to specific questions asked by the FDA, including the committee's view on the approvability of the product candidate under review.

Advisory Committee decisions are not binding. Even though the Advisory Committee determined that the benefits of Twirla outweigh its risks and recommended approval, the FDA could still conclude that

the Pearl Index is too high to demonstrate efficacy and an adequate risk/benefit profile for either the overall study population or a subgroup of the study population. Accordingly, the FDA may not

approve

S-8

Table of Contents

the

Twirla NDA. Alternatively, the FDA may determine that for a specific subgroup of patients, Twirla has lower efficacy and presents a higher risk, necessitating labeling restrictions, statements or

warnings. For instance, the FDA may require labeling restrictions, statements or warnings on the use of Twirla for

patients in certain BMI categories. We may also need to implement risk management strategies to educate health care providers and patients on any risks or limitations associated with our products, if

approved, and to potentially improve patient compliance. The FDA may also ask us to conduct additional clinical studies or perform additional work to address questions that arise as a result of the

FDA's review of the Twirla NDA. Failure to receive approval or significant additional delay in obtaining a decision from FDA, on whether to approve our NDA for Twirla would have a material adverse

effect on our business and results of operations, including possible termination of Twirla development and restructuring of our organization, which could include reducing, or even terminating, our

operations. Even if Twirla is approved, the labeling approved by the FDA and any other post-approval obligations that the FDA may require, may restrict how and to whom we and our potential partners,

if any, may market the product or the manner in which our product may be administered and sold, which could significantly limit the commercial opportunity for Twirla.

Risks Related to This Offering

The price of our common stock may be volatile and fluctuate substantially, and you may not be able to resell

your shares at or above the public offering price.

The shares sold in this offering, if any, will be sold from time to time at various prices. The market price for shares of our common stock may

be subject to wide fluctuations in response to many risk factors, including:

-

•

-

regulatory actions with respect to Twirla, including, for example, the FDA's failure to approve Twirla or the issuance of another complete

response letter in connection with our resubmitted NDA;

-

•

-

any adverse development or perceived adverse development with respect to the FDA's review of our resubmission of the NDA for Twirla which

could, or could be perceived to, result in the FDA's refusal to approve Twirla or any change to or inability by the FDA to meet the target PDUFA goal date of November 16, 2019;

-

•

-

the potential that the FDA does not approve the Twirla NDA despite the favorable advisory committee vote regarding the benefit and risk profile

of Twirla, which occurred on October 30, 2019;

-

•

-

our failure to commercialize Twirla, if approved, or develop and commercialize additional product candidates;

-

•

-

unanticipated efficacy, safety or tolerability concerns related to the use of Twirla;

-

•

-

additions or departures of key management or scientific personnel;

-

•

-

inability to obtain adequate product supply of Twirla or to do so at acceptable prices;

-

•

-

inability for Twirla to receive reimbursement from third party payors or other actions that limit a patient's access to Twirla;

-

•

-

our lack of sufficient funds to commercially launch Twirla, if approved, and the need to raise additional capital;

-

•

-

changes in laws or regulations applicable to Twirla or any future product candidates, including but not limited to clinical trial requirements

for approvals;

-

•

-

actual or anticipated fluctuations in our financial condition and operating results;

S-9

Table of Contents

-

•

-

actual or anticipated changes in our growth rate relative to our competitors;

-

•

-

competition from existing products or new products that may emerge;

-

•

-

announcements by us, our collaborators or our competitors of significant acquisitions, strategic partnerships, joint ventures, collaborations

or capital commitments;

-

•

-

failure to meet or exceed financial estimates and projections of the investment community or that we provide to the public;

-

•

-

issuance of new or updated research or reports by securities analysts;

-

•

-

fluctuations in the valuation of companies perceived by investors to be comparable to us;

-

•

-

share price and volume fluctuations attributable to inconsistent trading volume levels of our shares;

-

•

-

disputes or other developments related to proprietary rights, including patents, litigation matters and our ability to obtain patent protection

for our technologies;

-

•

-

announcement or expectation of additional debt or equity financing efforts;

-

•

-

sales of our common stock by us, our insiders or our other stockholders; and

-

•

-

general economic, industry and market conditions.

In

addition, the stock market has recently experienced significant volatility, particularly with respect to pharmaceutical and other life sciences company stocks. The volatility of such

stocks often does not relate to individual company performance. As we operate in a single industry, we are especially vulnerable to these factors to the extent that they affect our industry or our

product candidates or, to a lesser extent, our markets. In the past, securities class-action litigation has often been instituted against companies following periods of volatility in their stock

price. We may face securities class-action litigation if we cannot obtain regulatory approvals for, or if we otherwise fail to commercialize, our product candidates, including Twirla. Such litigation,

if instituted against us, could cause us to incur

substantial costs to defend such claims and divert management's attention and resources, which could materially harm our financial condition and results of operations.

Management will have broad discretion as to the use of the proceeds from this offering, and we may not use

the proceeds effectively.

Our management will have broad discretion with respect to the use of proceeds of this offering, including for any of the purposes described in

the section of this prospectus supplement entitled "Use of Proceeds." You will be relying on the judgment of our management regarding the application of the proceeds of this offering. The results and

effectiveness of the use of proceeds are uncertain, and we could spend the proceeds in ways that you do not agree with or that do not improve our results of operations or enhance the value of our

common stock. Our failure to apply these funds effectively could have a material adverse effect on our business, delay the development of our product candidates and cause the price of our common stock

to decline.

You will experience immediate and substantial dilution in the net tangible book value per share of the common

stock you purchase.

Since the public offering price for our common stock in this offering is substantially higher than the net tangible book value per share of our

common stock outstanding prior to this offering, you will suffer immediate and substantial dilution in the net tangible book value of the common stock you purchase in this offering. The shares sold in

this offering, if any, will be sold from time to time at various prices. After giving effect to the sale of our common stock in the maximum aggregate offering

S-10

Table of Contents

amount

of $20,000,000 at an assumed offering price of $2.03 per share (the last reported sale price of our common stock on The Nasdaq Capital Market on November 7, 2019), and after deducting

estimated offering commissions and expenses payable by us, you would suffer immediate dilution of $1.29 per share in the net tangible book value of the common stock. See the section entitled

"Dilution" below for a more detailed discussion of the dilution you will incur if you purchase shares in this offering.

We will need to obtain additional financing to fund our operations and, if we are unable to obtain such

financing, we may be unable to complete the development and commercialization of our product candidates.

Our operations have consumed substantial amounts of cash since inception. From our inception to September 30, 2019, we have cumulative

net cash flows used by operating activities of $224.0 million. As of September 30, 2019, we had an accumulated deficit of approximately $254.3 million. We believe that our cash

and cash equivalents as of September 30, 2019, will be sufficient to meet our operating requirements through the end of the first quarter of 2020 and will not be sufficient to fund our current

and planned operations through the next 12 months, which raises substantial doubt about our ability to continue as a going concern. Substantial doubt about our ability to continue as a going

concern may create negative reactions to the price of our common stock and we may have a more difficult time obtaining financing in the future. We will need to obtain large amounts of additional

capital to fund our future operations, including completing the development and commercialization of our product candidates. We will need to obtain additional financing to develop our other potential

product candidates, for the approval of our product candidates if requested by regulatory authorities, and to complete the development of any additional product candidates we might acquire. Moreover,

our fixed expenses such as rent, interest expense and other contractual commitments are substantial and are expected to increase in the future.

Our

future funding requirements will depend on many factors, including, but not limited to:

-

•

-

time and cost necessary to obtain regulatory approvals that may be required by regulatory authorities;

-

•

-

our ability to successfully commercialize our product candidates, if approved;

-

•

-

our ability to have commercial product successfully manufactured consistent with FDA regulations;

-

•

-

amount of sales and other revenues from product candidates that we may commercialize, if any, including the selling prices for such potential

products and the availability of adequate third-party coverage and reimbursement;

-

•

-

sales and marketing costs associated with commercializing our products, if approved, including the cost and timing of expanding our marketing

and sales capabilities;

-

•

-

progress, timing, scope and costs of our clinical trials, including the ability to timely enroll subjects in our ongoing, planned and potential

future clinical trials;

-

•

-

terms and timing of any potential future collaborations, licensing or other arrangements that we may establish;

-

•

-

cash requirements of any future acquisitions or the development of other product candidates;

-

•

-

costs of operating as a public company;

-

•

-

time and cost necessary to respond to technological and market developments;

-

•

-

costs of filing, prosecuting, defending and enforcing any patent claims and other intellectual property rights; and

S-11

Table of Contents

-

•

-

costs associated with any potential business or product acquisitions, strategic collaborations, licensing agreements or other arrangements that

we may establish.

Until

we can generate a sufficient amount of revenue, we may finance future cash needs through public or private equity offerings, license agreements, debt financings, collaborations,

strategic alliances and marketing or distribution arrangements. Additional funds may not be available when we need them on terms that are acceptable to us, or at all. If adequate funds are not

available, we may be required to delay or reduce the scope of or eliminate one or more of our research or development programs or our commercialization efforts. We may seek to access the public or

private capital markets whenever conditions are favorable, even if we do not have an immediate need for additional capital at that time. In addition, if we raise additional funds through

collaborations, strategic alliances or marketing, distribution or licensing arrangements with third parties, we may have to relinquish valuable rights to our technologies, future revenue streams or

product candidates or to grant licenses on terms that may not be favorable to us.

We

believe that our cash and cash equivalents as of September 30, 2019, will be sufficient to meet our projected operating requirements through the end of the first quarter of

2020. We will require additional capital to fund our operating needs for the rest of 2020 and beyond, which will primarily be used for the completion of our commercial plan for Twirla, if approved,

including the completion of the validation of our commercial manufacturing process, the commercial launch, and advancing the development of our other potential product candidates. Accordingly, we will

be required to obtain further funding through other public or private offerings, debt financing, collaboration or licensing arrangements or other sources.

If

we receive approval of the Twirla NDA, we plan to accelerate our commercial activities. In September 2019, we restarted manufacturing development at Corium. We are currently working

with Corium to complete manufacturing development and process improvements and plan to commence pre-validation work when that work is complete. Our goal is to manufacture three validation batches of

Twirla and complete the validation of the commercial manufacturing process in the second half of 2020.

In

parallel, we plan to initiate work with managed care and patient payers to gain market access for Twirla in the first quarter of 2020. In the second quarter of 2020, we plan to hire

and train an initial sales team, which we estimate to be in the range of 50 to 90 persons. We expect to ship product to wholesalers and commence our commercial launch in fourth quarter of 2020. Our

marketing efforts will

initially focus on Obstetrician-gynecologists in the United States, and we plan to use a significant number of samples in the early stage of commercial launch to gain patient trial and acceptance.

We

will need to raise additional funds to complete these activities and our ability to complete such activities according to our current planned timelines will depend on our ability to

successfully raise the necessary capital. We have structured our commercial plans in a manner that we believe will allow us to either scale-up or down as necessary in the event that the Twirla NDA is

not approved or such approval is delayed.

Our

planned timeline for seeking approval of Twirla and our ability to fund our operations through the period of time necessary to receive approval of Twirla, if at all, could be

adversely affected based on our ability to complete the activities and gather the information necessary to respond to the issues raised in the 2017 CRL and funding available to complete these

activities. We may not be able to obtain sufficient additional funding to continue our operations at planned levels and be forced to reduce, or even terminate, our operations. Adequate additional

funding may not be available to us on acceptable terms, or at all. If we are unable to raise additional capital when needed or on attractive terms, or we are unable to enter into strategic

collaborations, we then may be unable to complete the development of Twirla and may also be required to further cut operating costs, delay, reduce or eliminate our research and development programs or

future commercialization efforts or even terminate our operations, which may involve seeking bankruptcy protection. Our forecast of the period

S-12

Table of Contents

of

time through which our financial resources will be adequate to support our operating requirements is a forward-looking statement and involves risks and uncertainties, and actual results could vary

as a result of a number of factors, including the factors discussed elsewhere in this "Risk Factors" section. For instance, we cannot assure you that the FDA will approve Twirla, that the FDA's

timeline for review will be within six months, or that we will timely complete the qualification and validation of our commercial manufacturing process. We have based this estimate on a number of

assumptions that may prove to be wrong and changing circumstances beyond our control may cause us to consume capital more rapidly than we currently anticipate. If we choose to accelerate elements of

our commercial plan or we encounter any unforeseen events that affect our business plan, we may choose to raise additional funds to provide us with additional working capital. Our inability to obtain

additional funding when we need it could seriously harm our business and we may be unable to continue our operations at planned levels and be forced to reduce, or even terminate, our operations.

Our

forecast of the period of time through which our financial resources will be adequate to support our operating requirements is a forward- looking statement and involves risks and

uncertainties, and actual results could vary as a result of a number of factors, including the factors discussed elsewhere in this "Risk Factors" section and Part I, Item 1A "Risk

Factors" of our Annual Report on Form 10-K filed with the SEC on March 12, 2019, as revised or supplemented by our subsequent quarterly reports on Form 10-Q or our current reports

on Form 8-K, each as filed with the SEC. We have based this estimate

on a number of assumptions that may prove to be wrong, and changing circumstances beyond our control may cause us to consume capital more rapidly than we currently anticipate. Our inability to obtain

additional funding when we need it could seriously harm our business.

A significant portion of our total outstanding shares is restricted from immediate resale but may be sold

into the market in the near future, which could cause the market price of our common stock to decline significantly, even if our business is doing well.

Sales of a substantial number of shares of our common stock in the public market could occur at any time. These sales, or the perception in the

market that the holders of a large number of shares of common stock intend to sell shares, could reduce the market price of our common stock. As of September 30, 2019, we had 59,302,126 shares

of common stock outstanding. Additionally, 6,911,401 shares are held by our largest shareholder, which were acquired in a private placement that closed in March 2019 and are currently restricted

securities. These shares will become eligible for sale in the public market to the extent permitted by Rule 144 under the Securities Act of 1933, as amended, which we refer to as the Securities

Act, or in the event the shares become registered under the Securities Act. The balance of our outstanding shares of common stock may be freely sold in the public market at any time.

In

addition, as of September 30, 2019, there were 7,299,560 shares subject to outstanding grants under our equity incentive plans, all of which shares we have registered under the

Securities Act, on a registration statement on Form S-8. These shares, once vested and issued upon exercise, will be able to be freely sold in the public market, subject to volume limits

applicable to affiliates. Furthermore, as of September 30, 2019, there were 242,779 shares subject to outstanding warrants. These shares will become eligible for sale in the public market to

the extent such warrants are exercised and to the extent permitted by Rule 144 under the Securities Act.

The shares of common stock offered under this prospectus supplement and the accompanying prospectus may be

sold in "at the market offerings," and investors who buy shares at different times will likely pay different prices.

Investors who purchase shares under this prospectus supplement and the accompanying prospectus at different times will likely pay different

prices, and so may experience different outcomes in their

S-13

Table of Contents

investment

results. We will have discretion, subject to market demand, to vary the timing, prices, and numbers of shares sold, and there is no minimum or maximum sales price. Investors may experience

declines in the value of their shares as a result of share sales made at prices lower than the prices they paid.

It is not possible to predict the aggregate proceeds resulting from sales made under the sales agreement.

Subject to certain limitations in the sales agreement and compliance with applicable law, we have the discretion to deliver a placement notice

to Wainwright at any time throughout the term of the sales agreement. The number of shares that are sold through Wainwright after delivering a placement notice will fluctuate based on a number of

factors, including the market price of our common stock during the sales period, the limits we set with Wainwright in any applicable placement notice, and the demand for our common stock during the

sales period. Because the price per share of each share sold will fluctuate during the sales period, it is not currently possible to predict the aggregate proceeds to be raised in connection with

those sales.

S-14

Table of Contents

USE OF PROCEEDS

We estimate that the net proceeds from the sale of the shares of common stock that we are offering may be up to approximately

$19.1 million, after deducting Wainwright's estimated discounts and commissions and estimated offering expenses payable by us. The amount of the proceeds from this offering will depend upon the

number of shares of our common stock sold and the market price at which they are sold. There can be no assurance that we will be able to sell any shares under or fully utilize the sales agreement as a

source of financing.

We

intend to use the net proceeds, if any, for working capital and general corporate purposes, which include pursuing regulatory approval for Twirla, the completion of our commercial

plan for Twirla, which primarily includes validation of the commercial manufacturing process and the commercial launch of Twirla, if approved, and advancing the development of our other potential

product

candidates. We may also use a portion of the net proceeds to invest in or acquire businesses or technologies that we believe are complementary to our own, although we have no current plans,

commitments or agreements with respect to any acquisitions as of the date of this prospectus supplement. Pending these uses, we plan to invest these net proceeds in investment-grade, interest bearing

securities.

These

expected uses represent our intentions based upon our current plans and business conditions, which could change in the future as our plans and business conditions evolve. The

amounts and timing of our actual expenditures may vary significantly depending on numerous factors, including the progress of our development, the status of and results from clinical trials, and any

unforeseen cash needs. As a result, our management will have broad discretion in the application of the net proceeds from this offering, and investors will be relying on the judgment of our management

regarding the application of the net proceeds from this offering. The timing and amount of our actual expenditures will be based on many factors, including cash flows from operations and the

anticipated growth of our business.

DIVIDEND POLICY

We currently intend to retain all available funds and any future earnings for use in the operation of our business and do not anticipate paying

any dividends on our common stock in the foreseeable future. Any future determination to declare dividends will be made at the discretion of our board of directors and will depend on our financial

condition, operating results, capital requirements, general business conditions and other factors that our board of directors may deem relevant.

S-15

Table of Contents

DILUTION

If you invest in our common stock, your interest will be diluted immediately to the extent of the difference between the public offering price

per share you will pay in this offering and the as adjusted net tangible book value per share of our common stock after this offering. Net tangible

book value per share represents our total tangible assets less total liabilities, divided by the number of shares of our common stock outstanding.

As

of September 30, 2019, our net tangible book value was $31.9 million, or $0.54 per share of common stock. After giving effect to our issuance and sale of the aggregate

amount of $20,000,000 of shares of common stock in this offering at the assumed public offering price of $2.03 per share (the last reported sale price of our common stock on The Nasdaq Capital Market

on November 7, 2019), after deducting the estimated underwriting discounts and commissions and the estimated offering expenses payable by us, the as adjusted net tangible book value as of

September 30, 2019 would have been $51.0 million, or $0.74 per share. This represents an immediate increase in as adjusted net tangible book value to existing stockholders of $0.20 per

share and an immediate dilution to new investors purchasing common stock in this offering of $1.29 per share.

The

following table illustrates this per share dilution to the new investors purchasing shares of common stock in this offering:

|

|

|

|

|

|

|

|

|

|

Assumed public offering price per share

|

|

|

|

|

$

|

2.03

|

|

|

Net tangible book value per share at September 30, 2019

|

|

$

|

0.54

|

|

|

|

|

|

Increase in net tangible book value per share attributable to new investors purchasing shares in this offering

|

|

|

0.20

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As adjusted net tangible book value per share after this offering

|

|

|

|

|

|

0.74

|

|

|

|

|

|

|

|

|

|

|

|

Dilution per share to new investors in this offering

|

|

|

|

|

$

|

1.29

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Each

$0.25 increase or decrease in the assumed public offering price of $2.03 per share would increase or decrease, as applicable, our as adjusted net tangible book value per share by

approximately $0.01 and $(0.02), respectively, and would increase or decrease, as applicable, dilution per share to new

investors in this offering by $0.24 and $(0.23), respectively, assuming that the aggregate dollar amount of the shares offered by us remains the same and after deducting estimated underwriting

discounts and commissions and estimated offering expenses payable by us. The foregoing as adjusted information is illustrative only and will be adjusted based on the actual public offering price of

this offering determined at pricing.

The

foregoing table and calculations are based on 59,302,126 shares of our common stock outstanding as of September 30, 2019 and

excludes:

-

•

-

7,299,560 shares of common stock issuable upon the exercise of outstanding options to purchase common stock as of September 30, 2019 at

a weighted average exercise price of $3.46 per share;

-

•

-

2,130,243 shares of common stock reserved for future issuance under our 2014 Amended and Restated Incentive Compensation Plan as of

September 30, 2019; and

-

•

-

242,779 shares of common stock issuable upon the exercise of outstanding warrants as of September 30, 2019 at a weighted average

exercise price of $5.92 per share.

S-16

Table of Contents

PLAN OF DISTRIBUTION

We have entered into a sales agreement with H.C. Wainwright & Co., LLC, or Wainwright, under which we may issue and sell

from time to time shares of our common stock through or to Wainwright as our sales agent or principal. In accordance with the terms of the sales agreement, we may offer and sell shares of our common

stock from time to time having an aggregate offering price of not more than $20,000,000 pursuant to this prospectus supplement and the accompanying prospectus.

Sales

of the common stock, if any, will be made by any method permitted by law deemed to be an "at the market offering" as defined in Rule 415 promulgated under the Securities

Act. Wainwright will offer our common stock at prevailing market prices subject to the terms and conditions of the sales agreement as agreed upon by us and Wainwright. We will designate the number or

dollar value of shares which we desire to sell, the time period during which sales are requested to be made, any limitation on the number of shares that may be sold in one day and any minimum price

below which sales may not be made. Subject to the terms and conditions of the sales agreement, Wainwright will use its commercially reasonable efforts to sell on our behalf all of the shares of common

stock requested to be sold by us. We or Wainwright may suspend the offering of the common stock being made through Wainwright under the sales agreement upon proper notice to the other party.

Settlement

for sales of common stock will occur on the second trading day or such shorter settlement cycle as may be in effect under Exchange Act Rule 15c6-1 from time to time,

following the date on which any sales are made, or on some other date that is agreed upon by us and Wainwright in connection with a particular transaction, in return for payment of the net proceeds to

us. There is no arrangement for funds to be received in an escrow, trust or similar arrangement.

We

will pay Wainwright in cash, upon each sale of our shares of common stock pursuant to the sales agreement, a commission equal to 3.0% of the gross proceeds from each sale of shares of

our common stock. Because there is no minimum offering amount required as a condition to this offering, the actual total public offering amount, commissions and proceeds to us, if any, are not

determinable at this time. Pursuant to the terms of the sales agreement, we agreed to reimburse Wainwright for the documented fees and costs of its legal counsel reasonably incurred in connection with

entering into the transactions contemplated by the sales agreement in an amount not to exceed $50,000 in the aggregate. Additionally, pursuant to the terms of the sales agreement, we agreed to

reimburse Wainwright for the documented fees and costs of its legal counsel reasonably incurred in connection with Wainwright's ongoing diligence, drafting and other filing requirements arising from

the transactions contemplated by the sales agreement in an amount not to exceed $2,500 in the aggregate per calendar quarter. We estimate that the total expenses of the offering payable by us,

excluding commissions payable to Wainwright under the sales agreement, will be approximately $250,000. We will report at least quarterly the number of shares of common stock sold through Wainwright

under the sales agreement, the net proceeds to us and the compensation paid by us to Wainwright in connection with the sales of common stock.

In

connection with the sales of common stock on our behalf, Wainwright will be deemed to be an "underwriter" within the meaning of the Securities Act, and the compensation paid to