Statement of Changes in Beneficial Ownership (4)

November 05 2019 - 12:41PM

Edgar (US Regulatory)

|

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

|

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Isett Thomas Francis 3rd |

2. Issuer Name and Ticker or Trading Symbol

iBio, Inc.

[

IBIO

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

__X__ Director _____ 10% Owner

_____ Officer (give title below) _____ Other (specify below)

|

|

(Last)

(First)

(Middle)

C/O IBIO, INC., 600 MADISON AVENUE SUITE 1601 |

3. Date of Earliest Transaction

(MM/DD/YYYY)

10/29/2019

|

|

(Street)

NEW YORK, NY 10022

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3)

|

2. Conversion or Exercise Price of Derivative Security

|

3. Trans. Date

|

3A. Deemed Execution Date, if any

|

4. Trans. Code

(Instr. 8)

|

5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

6. Date Exercisable and Expiration Date

|

7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4)

|

8. Price of Derivative Security

(Instr. 5)

|

9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4)

|

10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4)

|

11. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

(A)

|

(D)

|

Date Exercisable

|

Expiration Date

|

Title

|

Amount or Number of Shares

|

|

Series C Convertible Preferred Stock (1)

|

$0.20 (2)

|

10/29/2019

|

|

P

|

|

20

|

|

(2)

|

(3)

|

Common Stock

|

100000

|

$1000 (4)

|

350000 (5)

|

D

|

|

|

Series A Warrants (Right to Buy) (6)

|

$0.22

|

10/29/2019

|

|

P

|

|

100000

|

|

10/29/2019

|

10/29/2021

|

Common Stock

|

100000

|

$1000 (7)

|

350000 (5)

|

D

|

|

|

Series B Warrants (Right to Buy) (8)

|

$0.22

|

10/29/2019

|

|

P

|

|

100000

|

|

10/29/2019

|

10/29/2026

|

Common Stock

|

100000

|

$1000 (9)

|

350000 (5)

|

D

|

|

|

Explanation of Responses:

|

| (1)

|

The shares of Series C Convertible Preferred Stock, $0.001 par value (the "Series C Preferred Shares"), were acquired by Mr. Isett in a public offering by iBio, Inc. ("iBio").

|

| (2)

|

Each Series C Preferred Share has a stated value of $1,000 and is convertible into shares of iBio's common stock at any time and from time to time at the option of the holder at a price of $0.20 per share, subject to adjustment as provided in the Certificate of Designation of Preferences, Rights and Limitations of the Series C Convertible Preferred Stock, provided that the Series C Preferred Shares may not be converted if the holder, together with the holder's affiliates, would beneficially own over 4.99% (which may be increased up to 9.99% upon election by the holder on 61 days' notice) of iBio's outstanding common stock at the time of conversion.

|

| (3)

|

The Series C Preferred Shares have no expiration date.

|

| (4)

|

Each of Series C Preferred Share was sold together with Series A Warrants to purchase one share of common stock for each share of common stock issuable upon conversion of the Series C Preferred Share and Series B Warrants to purchase one share of common stock for each share of common stock issuable upon conversion of the Series C Preferred Share. Each Series C Preferred Share and accompanying Series A Warrants and Series B Warrants was sold at a combined public offering price of $1,000.

|

| (5)

|

Reflects number of securities beneficially owned following all transactions reported on this Form 4, on an as converted to common stock basis.

|

| (6)

|

The Series A Warrants were acquired by Mr. Isett in a public offering by iBio.

|

| (7)

|

The Series A Warrants were sold together with Series C Preferred Shares and Series B Warrants in the public offering. Each of Series C Preferred Share was sold together with Series A Warrants to purchase one share of common stock for each share of common stock issuable upon conversion of the Series C Preferred Share and Series B Warrants to purchase one share of common stock for each share of common stock issuable upon conversion of the Series C Preferred Share. Each Series C Preferred Share and accompanying Series A Warrants and Series B Warrants was sold at a combined public offering price of $1,000.

|

| (8)

|

The Series B Warrants were acquired by Mr. Isett in a public offering by iBio.

|

| (9)

|

The Series B Warrants were sold together with Series C Preferred Shares and Series A Warrants in the public offering. Each of Series C Preferred Share was sold together with Series A Warrants to purchase one share of common stock for each share of common stock issuable upon conversion of the Series C Preferred Share and Series B Warrants to purchase one share of common stock for each share of common stock issuable upon conversion of the Series C Preferred Share. Each Series C Preferred Share and accompanying Series A Warrants and Series B Warrants was sold at a combined public offering price of $1,000.

|

Reporting Owners

|

|

Reporting Owner Name / Address

|

Relationships

|

|

Director

|

10% Owner

|

Officer

|

Other

|

Isett Thomas Francis 3rd

C/O IBIO, INC.

600 MADISON AVENUE SUITE 1601

NEW YORK, NY 10022

|

X

|

|

|

|

Signatures

|

|

/s/Thomas Isett

|

|

11/5/2019

|

|

**Signature of Reporting Person

|

Date

|

|

Reminder: Report on a separate line for each class of securities beneficially owned directly or indirectly.

|

|

*

|

If the form is filed by more than one reporting person, see Instruction 4(b)(v).

|

|

**

|

Intentional misstatements or omissions of facts constitute Federal Criminal Violations. See 18 U.S.C. 1001 and 15 U.S.C. 78ff(a).

|

|

Note:

|

File three copies of this Form, one of which must be manually signed. If space is insufficient, see Instruction 6 for procedure.

|

|

Persons who respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number.

|

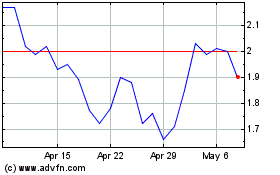

iBio (AMEX:IBIO)

Historical Stock Chart

From Mar 2024 to Apr 2024

iBio (AMEX:IBIO)

Historical Stock Chart

From Apr 2023 to Apr 2024

See More Message Board Posts

It looks like you are not logged in. Click the button below to log in and keep track of your recent history.