Filed

Pursuant to Rule 424(b)(3)

Registration No. 333-233021

Prospectus

dated November 5, 2019

GULFSLOPE

ENERGY, INC.

444,095,238

Shares of Common Stock

This

prospectus relates to the sale of up to 444,095,238 shares of our common stock which may be resold from time to time by the

selling security holders identified in this prospectus. The selling security holders acquired the shares of common stock

offered by this prospectus in a series of transactions beginning in March 2019. We are registering the offer and sale of the

shares of common stock to satisfy registration rights we have granted. See “Selling Security Holders” beginning

on page 18 in this prospectus for a complete description of the selling security holders.

The

selling security holders will receive all proceeds from the sale of our common stock, and therefore we will not receive any of

the proceeds from their sale of shares of our common stock. The shares which may be resold by the selling security holders constituted

approximately 41% of our issued and outstanding common stock on the date of this prospectus.

The

market for the common stock is limited, sporadic and volatile. The selling security holders are offering these shares of common

stock. The selling security holders may sell all or a portion of these shares from time to time in market transactions through

any market on which our common stock is then traded, in negotiated transactions or otherwise, and at prices and on terms that

will be determined by the then prevailing market price or at negotiated prices directly or through a broker or brokers, who may

act as agent or as principal or by a combination of such methods of sale. The selling security holders will receive all proceeds

from the sale of the common stock. For additional information on the methods of sale, you should refer to the section entitled

“Plan of Distribution.”

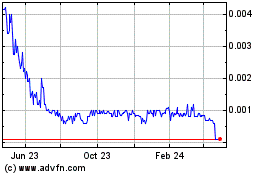

Our

common stock is quoted on both the OTC Bulletin Board (“OTCBB”) and the OTCQB quotation systems under the symbol “GSPE.”

The last bid price of our common stock on November 1, 2019 was $0.03 per share.

This

investment involves a high degree of risk. You should purchase shares only if you can afford a complete loss of your

investment. You should read this prospectus in its entirety and carefully consider the risk factors beginning on page 7 of

this prospectus and the financial data and related notes incorporated by reference before deciding to invest in the

shares.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities, or

determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this prospectus November 5, 2019

TABLE

OF CONTENTS

You

should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with information

that is different. This prospectus is not an offer to sell, nor is it seeking an offer to buy, these securities in any jurisdiction

where the offer or sale of these securities is not permitted. You should assume that the information contained in this prospectus

is accurate as of the date on the front of this prospectus only. Our business, financial condition, results of operations and

prospects may have changed since that date. This prospectus will be updated as required by law.

PROSPECTUS

SUMMARY

GULFSLOPE

ENERGY, INC.

SUMMARY

This

summary highlights selected information about GulfSlope and this offering. This summary is not complete and does not contain all

of the information that may be important to you. You should read carefully the entire prospectus, including “Risk Factors”

and the other information contained or incorporated by reference in this prospectus before making an investment decision. Unless

otherwise indicated or the context otherwise requires “we,” “us,” “our,” “GulfSlope”,

or “Company” refer to GulfSlope Energy, Inc.

The

Company

GulfSlope

Energy, Inc. is an independent crude oil and natural gas exploration and production company whose interests are concentrated in

the United States Gulf of Mexico federal waters. We are a technically driven company and we use our licensed 2.2 million acres

of three-dimensional (3-D) seismic data to identify, evaluate, and acquire assets with attractive economic profiles. GulfSlope

Energy commenced commercial operations in March 2013. GulfSlope Energy was originally organized as a Utah corporation in 2004

and became a Delaware corporation in 2012.

We

have focused our operations in the Gulf of Mexico because we believe this area provides us with favorable geologic and economic

conditions, including multiple reservoir formations, comprehensive geologic databases, extensive infrastructure, relatively favorable

royalty regime, and an attractive acquisition market and because our management and technical teams have significant experience

and technical expertise in this geologic province. Additionally, we licensed 2.2 million acres of advanced three-dimensional (3D)

seismic data, a significant portion of which has been enhanced by new, state-of-the-art reprocessing and noise attenuation techniques

including reverse time migration depth imaging. We use our broad regional seismic database and our reprocessing efforts to continuously

generate an inventory of high-quality prospects and since inception, we have generated a total of 25 prospects, advancing nine

of those prospects to drill ready status. The use of our extensive seismic database, coupled with our ability, knowledge, and

expertise to effectively reprocess this seismic data, allows us to further optimize our drilling program and to effectively evaluate

acquisition and joint venture opportunities. We consistently assess our prospect inventory in order to deploy capital as efficiently

as possible.

Competitive

Advantages

Experienced

management. Our management has significant experience in finding and developing oil and natural gas. Our team has a track

record of discovering and developing multi-billion dollar projects worldwide. Our management team has over 200 years of combined

industry experience exploring, discovering, and developing oil and natural gas. We successfully deployed a technical team with

over 150 years of combined industry experience exploring for and developing oil and natural gas in the development and execution

of our technical strategy. We believe the application of advanced geophysical techniques on a specific geographic area with unique

geologic features such as conventional reservoirs whose trapping configurations have been obscured by overlying salt layers provides

us with a competitive advantage.

Advanced

seismic image processing. Commercial improvements in 3-D seismic data imaging and the development of advanced processing

algorithms, including pre-stack depth, beam, and reverse time migration have allowed the industry to better distinguish hydrocarbon

traps and identify previously unknown prospects. Specifically, advanced processing techniques improve the definition of the seismic

data from a scale of time to a scale of depth, thus correctly locating the images in three dimensions. Our technical team has

significant experience utilizing advanced seismic image processing techniques in our core area, and applies the industry’s

most advanced noise reduction technology to generate clearer images.

Industry

leading position in our core area. We have licensed 2.2 million acres of 3D seismic data which covers over 440 OCS Federal

lease blocks on the highly prolific Louisiana outer shelf, offshore Gulf of Mexico. We believe the proprietary and state-of-the-art

reprocessing of our licensed 3-D seismic data, along with our proprietary and leading-edge geologic depositional reservoir sand

and petroleum trapping models, gives us an advantage in assembling a high quality drilling portfolio in our core area. We continuously

work to identify additional leasing opportunities to further enhance our drilling portfolio.

Key

Management

John

N. Seitz. Mr. Seitz has served as the Company’s chief executive officer and chairman of the board and director

since May 31, 2013, and served as a consultant to the Company from March 2013 through May 2013. Prior to joining the Company,

Mr. Seitz held positions of increasing responsibility at Anadarko Petroleum Corporation (NYSE: APC), serving most recently as

a director and as president and chief executive officer until 2003. Mr. Seitz also serves on the board of directors of ION

Geophysical Corporation (NYSE: IO), a leading technology focused seismic solutions company. Mr. Seitz is a Certified

Professional Geological Scientist from the American Institute of Professional Geologists and a licensed professional

geoscientist with the State of Texas. Mr. Seitz also serves as a trustee for the American Geological Institute Foundation. In

2000, the Houston Geological Society honored Mr. Seitz as a “Legend in Wildcatting,” and he is a member of the

All American Wildcatters. Mr. Seitz holds a Bachelor of Science degree in Geology from the University of Pittsburgh, a

Master of Science degree in Geology from Rensselaer Polytechnic Institute, and has completed the Advanced Management Program

at the Wharton School.

John

H. Malanga. Mr. Malanga has served as chief financial officer since July 2014 and is responsible for leading the financial

function of the organization, overseeing strategic planning and analysis, accounting and reporting, treasury, tax, audit and risk

management. From 2005 to 2014, Mr. Malanga worked as a senior investment banker with the energy firms of Weisser, Johnson &

Co. and Sanders Morris Harris Inc. Mr. Malanga began his investment banking career with Jefferies & Co. Over his career, he

has participated in capital markets, mergers and acquisitions, and financial advisory transactions with particular emphasis on

providing strategic and financial advice to emerging growth companies. Mr. Malanga holds a Bachelor of Science in Economics from

Texas A&M University and a Master in Business Administration with a concentration in finance from Rice University.

Charles

G. Hughes. Mr. Hughes has served as vice president land since April 2014. Mr. Hughes’ executive responsibilities include

all land and industry partner related matters. He formerly served as general manager – land and business development for

Marubeni Oil & Gas (USA), Inc. from 2007 to 2014. From 1980 to 2007, Mr. Hughes served in roles of increasing responsibility

both onshore and offshore in the Gulf of Mexico at Anadarko Petroleum Corporation. Mr. Hughes is a member and former Chairman

of the OCS Advisory Board, a member of the Association of Professional Landmen, the Houston Association of Professional Landmen

and the Professional Landmen’s Association of New Orleans. Mr. Hughes received his Bachelor of Business Administration in

Petroleum Land Management from the University of Texas.

Richard

S. Langdon. Richard S. Langdon has served as a director of the Company since March 2014. Mr. Langdon is currently the executive

vice president and chief financial officer of Altamont Energy, Inc., a newly formed privately held exploration and production

company. Mr. Langdon served as the president, chief executive officer and outside director of Badlands Energy, Inc. and its predecessor

entity, Gasco Energy, Inc. since May 2013 and Debtor-in Possession since August 2017. Prior to assuming the President and CEO

role, Mr. Langdon had served as a Gasco Energy Inc. outside board member since 2003. Mr. Langdon serves as a member of the board

of managers of Sanchez Midstream Partners, LP, and is a member of its Audit, Nominating and Corporate Governance and Conflicts

Committees. Mr. Langdon was the president and chief executive officer of KMD Operating Company, LLC (“KMD Operating”),

and its predecessor entity, Matris Exploration Company LP (“Matris Exploration”), both privately held exploration

and production companies, from July 2004 through December 2015. Mr. Langdon was executive vice president and chief operating officer

of KMD Operating, from August 2009, until the merger of Matris Exploration into KMD Operating in November 2011. From 1997 until

2002, Mr. Langdon served as executive vice president and chief financial officer of EEX Corporation, a publicly traded exploration

and production company that merged with Newfield Exploration Company in 2002. Prior to that, he held various positions with the

Pennzoil Companies from 1991 to 1996, including executive vice president - International Marketing - Pennzoil Products Company;

senior vice president - Business Development - Pennzoil Company and senior vice president - Commercial & Control - Pennzoil

Exploration & Production Company. Mr. Langdon graduated from the University of Texas at Austin with a Bachelor of Science

degree in Mechanical Engineering in 1972 and a Masters of Business Administration in 1974.

Paul

L. Morris. Mr. Morris has served as a director of the Company since March 2014. Mr. Morris founded Elk River Resources, LLC

in August 2013 to explore and develop oil and gas potential in the oil-producing regions of the southwest United States. Mr. Morris

has served as chairman and chief executive officer of Elk River Resources since inception. Prior to Elk River Resources, Mr. Morris

served as president and chief executive officer from 1988 to September 2013 of Wagner & Brown, Ltd., an independent oil and

gas company headquartered in Midland, Texas. With Wagner & Brown, Mr. Morris oversaw all company operations, including exploration

and production activities, in eight states as well as in France, England and Australia. Mr. Morris also oversaw affiliates involved

in natural gas gathering and marketing, crude oil purchasing and reselling, pipeline development, construction and operation,

and compressed natural gas (CNG) design, fabrication and operations. Mr. Morris served as president of Banner Energy from 1981

until 1988. Mr. Morris graduated from the University of Cincinnati with a Bachelor of Science degree in Mechanical Engineering

in 1964. Mr. Morris has also completed the Executive Management Program in the College of Business Administration of Penn State

University.

Recent

Developments

Drilling

of Canoe and Tau Prospects

We

are currently the operator of two wells drilled in the Gulf of Mexico. We commenced drilling operations at the Canoe prospect

in August 2018 and drilling was completed later that month. The well was drilled to a total of 5,765 feet measured depth (5,700

feet true vertical depth) and no problems were encountered while drilling. Based on Logging-While-Drilling and Isotube analysis

of hydrocarbon samples, oil sands were encountered in the northwest center of the block. A full integration of the well information

and seismic data is being performed for further evaluation of the shallow potential of the wellbore and the block, and to define

commerciality of these oil pays. The well was temporarily abandoned and multiple open-hole plugs were set across several intervals.

The well is equipped with a mud-line suspension system for possible future re-entry. A deeper subsalt prospect on the Canoe lease

block, for which the block was originally leased, is not yet drill-ready and is pending further seismic enhancement.

The

second well, Tau prospect, is located approximately six miles northeast of the Mahogany Field, discovered in 1993. The Mahogany

Field is recognized as the first commercial discovery below allocthonous salt in the Gulf of Mexico. The Tau Prospect is defined

by mapping of 3D seismic reprocessed by RTM methods. Drilling operations on the Tau subsalt prospect commenced in September 2018.

The wellbore is designed to test multiple Miocene horizons trapped against a well-defined salt flank, including equivalent reservoir

sands discovered and developed at the nearby Mahogany Field. The surface location for Tau is located in 305 feet of water. In

January 2019, the Tau well experienced an underground control of well event and as a result, we filed an insurance claim with

its insurance underwriters for a net amount of approximately $10.8 million for 100% working interest. The insurance claim was

subsequently approved, and approximately $8 million was received in April and May 2019. On May 13, 2019, we announced the Tau

well was drilled to a measured depth of 15,254 feet, as compared to the originally permitted 29,857 foot measured depth. Producible

hydrocarbon zones were not established to the current depth, but hydrocarbon shows were encountered. Complex geomechanical conditions

required two by-pass wellbores, one sidetrack wellbore, and eight casing strings to reach the current depth. We were unable to

continue drilling due to equipment limitations and contractual obligations related to the drilling rig for another operator. Due

to these factors, we elected to temporarily abandon this well in a manner that would allow for re-entry at a later time. We are

currently evaluating various options related to future operations in this wellbore and testing of the deeper Tau prospect.

Term

Loan

On

March 1, 2019, we entered into a Term Loan Agreement by and among GulfSlope, as borrower, and Delek, as lender. In the Term Loan

Agreement, Delek agreed to provide us with multiple draw term loans in an aggregate stated principal amount of up to $11.0 million

(the “Term Loan Facility” and the loans thereunder, the “Loans”). The maturity date of the Term Loan Facility

is six months following the closing date of the Term Loan Agreement. Until such maturity date, the Loans under the Term Loan Agreement

shall bear interest at a rate per annum equal to 5.0%, payable in arrears on the maturity date. If an event of default occurs,

all Loans under the Term Loan Agreement shall bear interest at a rate equal to 7.0%, payable on demand. In connection with the

Term Loan Agreement, the Company entered into: (i) a Subordination Agreement (the “Subordination Agreement”) by and

among GulfSlope, as borrower, John N. Seitz, as subordinated lender (the “Subordinated Lender”), and Delek, as senior

lender; (ii) a Security Agreement (the “Security Agreement”) among GulfSlope, as debtor, and Delek, as lender; and

(iii) warrants to purchase 238,095,238 shares of Common Stock, at an exercise price of $0.042 per share issued to Delek GOM. We

may elect, at our option, to prepay borrowings outstanding under the Term Loan Agreement in multiples of $100,000 and not less

than $500,000 without premium or penalty. We are required to prepay the Loans with any net cash proceeds resulting from an asset

sale, receipt of insurance proceeds from certain casualty events, proceeds from equity issuances or incurrence of indebtedness

other than the Loans (subject to a $500,000 carve-out to be applied toward our general corporate purposes) or receipt of any cash

proceeds from any payments, refunds, rebates or other similar payments and amounts under the joint operating agreement. Amounts

outstanding under the Term Loan Agreement are secured by a security interest in substantially all of our properties and assets.

We had borrowed a total of $11.0 million under the Term Loan Facility and issued to Delek GOM warrants to purchase 261,904,762

shares of Common Stock; and Delek GOM exercised warrants for 238,095,238 shares of Common Stock through a Loan Reduction Exercise,

thereby leaving $1 million of outstanding obligations to Delek GOM. In connection with the Term Loan, we entered into a registration

rights agreement with Delek pursuant to which we have agreed to register the shares of Common Stock issued to them for public

resale upon request. The maturity date of the $1,000,000 remaining balance of the term loan is October 19, 2019 and an

agreement is being negotiated to extend the maturity date.

On

October 22, 2019, the Company and Delek executed a Post-Drilling Agreement Regarding Certain Issues, pursuant to which, as payoff

for the Company’s outstanding obligations of $1,220,548 (“Term Loan Payoff Amount”) to Delek under the Term

Loan Facility, the Company issued a convertible debenture to Delek (the “Delek Convertible Debenture”) in a principal

amount equal to the Term Loan Payoff Amount, as a consequence of which the Term Loan Facility has been terminated.

The

Delek Convertible Debenture is convertible at the option of Delek at any time in whole or in part for up to 24,410,960 shares

of Common Stock at a conversion price of $0.05 per share. Interest on the Delek Convertible Debenture is accruable at 12%

per annum and the maturity of the Delek Convertible Debenture is October 22, 2020 (which interest rate will increase to 15% per

annum upon any Event of Default as defined in the Delek Convertible Debenture). The Company has a right to prepay the Delek

Convertible Debenture prior to maturity for an amount equal to the outstanding principal balance plus accrued and unpaid interest.

Absent any restrictions under the federal securities laws, Delek’s ability to sell shares of common stock of the Company

issued upon conversion of the Delek Convertible Debenture will be limited, in any one-month period, to 10% (ten percent) of the

total volume of such converted shares.

Issuance

of Convertible Debentures

On

June 21, 2019, we entered into a Securities Purchase Agreement (“SPA”) with a qualified institutional buyer

(“Buyer”). Under the terms of the SPA, we will issue and sell to Buyer up to an aggregate of $3.0 million of

convertible debentures (“Convertible Debentures”), which shall be convertible (as converted, the

“Conversion Shares”) into shares of Common Stock, of which $2,100,000 were purchased upon the signing of the SPA

(the “First Closing”), $400,000 were purchased upon the filing of a registration statement with the SEC

registering the resale of the Conversion Shares by the Buyer, and $500,000 shall be purchased on or about the date the

registration statement has first been declared effective by the SEC (collectively, the “Offering”). The

Convertible Debenture bears an annual interest rate equal to 8% and a maturity date of June 21, 2020, which may be

extended at the option of Buyer. At maturity, the Company is obligated to pay the holder an amount in cash representing all

outstanding principal and accrued and unpaid interest. Subject to the terms of the Convertible Debenture, at any time the

Holder is entitled to convert any portion of the outstanding and unpaid principal and accrued interest into fully paid and

nonassessable shares of Common Stock of the Company. The number of shares of Common Stock issuable upon conversion

is determined by dividing the amount to be converted by the lesser of (x) $0.05 per share or (y) 80% of the lowest daily VWAP

price (as reported by Bloomberg, LP) for the ten (10) consecutive trading days immediately preceding the date of

determination. At the First Closing, the Company also issued to Buyer warrants to purchase an aggregate of 50.0 million

shares of Common Stock at an exercise price of $0.04 per share. The warrants expire on the fifth (5 th )

anniversary after issuance.

In

connection with the issuance of the Convertible Debenture and warrants, we entered into registration rights agreement pursuant

to which we have, among other things, agreed to file a registration statement with the SEC within thirty days of the SPA registering

for public resale the shares of Common Stock underlying the Convertible Debenture and warrants.

Risk

Factors

Investing

in our common stock involves risks that include the speculative nature of oil and natural gas exploration, competition, volatile

oil and natural gas prices and other material factors. You should read carefully the section of this prospectus entitled “Risk

Factors” beginning on page 8 for an explanation of these risks before investing in our common stock. In particular, the

following considerations may offset our competitive strengths or have a negative effect on our strategy or operating activities,

which could cause a decrease in the price of our common stock and a loss of all or part of your investment:

|

|

●

|

Our

business is difficult to evaluate because of our limited operating history;

|

|

|

●

|

Failure

to enter into leases with BOEM on our prospects;

|

|

|

●

|

Failure

to enter into strategic partnerships, joint operating agreements and farm out agreements needed to exploit our prospects;

|

|

|

●

|

Failure

to raise sufficient capital needed to implement our business plan;

|

|

|

●

|

There exists substantial doubt about our ability to continue as

a going concern;

|

|

|

●

|

Difficulties

managing the growth of our business may adversely affect our financial condition and results of operations;

|

|

|

●

|

Failure

to develop our prospects;

|

|

|

●

|

Our

exploration and development operations require substantial capital that we may be unable to obtain, which could lead to a

loss of properties and a decline in our reserves;

|

|

|

●

|

Our

future success depends on our ability to find, develop or acquire oil and natural gas reserves;

|

|

|

●

|

The

volatility of oil and natural gas prices due to factors beyond our control greatly affects our profitability;

|

|

|

●

|

Our

prospects are all in the Gulf of Mexico, making us vulnerable to risks associated with a concentration of operations in a

single geographic area; and

|

|

|

●

|

Our

operations are subject to various governmental regulations which require compliance that can be burdensome and expensive;

|

Corporate

Information

Our

address is 1331 Lamar St., Suite 1665, Houston, Texas 77010, and our telephone number is (281) 918-4100. Our web site can be accessed

at www.gulfslope.com. The contents of our website do not form a part of, and are not incorporated by reference in, this prospectus

or any Offering Statement that we have filed with the SEC. You may access and read our SEC filings through the SEC’s web

site (www.sec.gov), which contains reports, proxy and information statements and other information regarding registrants, including

us, that file electronically with the SEC.

About

This Offering

|

Common

stock offered by selling security holders

|

A

total of up to 444,095,238 shares of common stock. The selling security holders may from time to time sell some, all or none

of the shares of common stock pursuant to which this prospectus is a part.

|

|

Shares

outstanding prior to the offering

|

1,092,266,844

shares as of October 14, 2019

|

|

Shares

to be outstanding after the offering

|

1,298,266,844

shares

|

|

Use

of proceeds

|

The

selling security holders will receive all of the proceeds from the sale of shares of our common stock. We will not receive

any proceeds from the sale of the common stock.

|

|

Risk

Factors

|

The

securities offered hereby involve a high degree of risk. See “Risk Factors.”

|

|

Stock

symbol

|

GSPE

|

RISK

FACTORS

Investing

in our common stock involves a high degree of risk. You should carefully consider each of the following risks, together with

all other information set forth in this prospectus, including the consolidated financial statements and the related notes and

“Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Annual

Report on Form 10-K for the fiscal year ended September 30, 2018, as updated in our Quarterly Reports on Form 10-Q for the

fiscal quarters ended December 31, 2018, March 31, 2019 and June 30, 2019, before deciding whether to invest in our

common stock.. The risks and uncertainties described below are not the only ones we face. Other risks and uncertainties,

including those that we do not currently consider material, may impair our business. If any of the adverse developments

discussed below actually occur, our business, financial condition, operating results or cash flows could be materially and

adversely affected. This could cause the value of our common stock to decline, and you may lose all or part of

your investment.

Risks

Related to Our Business and Financial Condition

Our

business plan requires substantial additional capital, which we may be unable to raise on acceptable terms, if at all, which may

in turn limit our ability to execute our business strategy.

We

have planned operating expenditures through September 2020, of approximately $10.0 million, which includes $6.0 million

for drilling related capital expenditures, $1.5 million of other operations related expenditures to include but not limited

to bonus payments for new leases and lease rentals to the BOEM and seismic reprocessing costs, and $2.5 million in general

and administrative expenses. We will need to raise additional capital in 2020 and may be required to enter into debt and

equity financing arrangements and joint ventures. There is no assurance that we will be able to raise the capital necessary

to fund our business plan and our operations through September 2020. Failure to raise the required capital to fund our 2020

operations, on favorable terms or at all, will have a material adverse effect on us, and will likely cause us to

curtail operations or suspend our 2020 business plan.

We

expect our capital outlays and operating expenditures to increase substantially over at least the next several years as we expand

our operations. Lease acquisition costs and drilling operations are very expensive, and if we are to expand our operations after

2019 we will need to raise substantial additional capital through additional equity offerings, strategic alliances or debt financing.

Our

future capital requirements will depend on many factors, including:

|

|

●

|

the

number, location, terms and pricing of our anticipated lease acquisitions;

|

|

|

●

|

our

financing of the lease acquisitions and associated bonding;

|

|

|

●

|

our

ability to enter into partnerships and farm-outs with other oil and gas E&P companies and/or financial investors on satisfactory

terms;

|

|

|

●

|

location

of any drilling activities, whether onshore or offshore, as well as the depth of any wells to be drilled;

|

|

|

●

|

cost

of additional seismic data to license as well as the reprocessing cost;

|

|

|

●

|

the

scope, rate of progress and cost of any exploration and production activities;

|

|

|

●

|

oil

and natural gas prices;

|

|

|

●

|

our

ability to locate and acquire hydrocarbon reserves;

|

|

|

●

|

our

ability to produce those oil or natural gas reserves;

|

|

|

●

|

access

to oil and gas services and existing pipeline infrastructure;

|

|

|

●

|

the

terms and timing of any drilling and other production-related arrangements that we may enter into;

|

|

|

●

|

the

cost and timing of governmental approvals and/or concessions;

|

|

|

●

|

the

cost, number, and access to qualified industry professionals we employ; and

|

|

|

●

|

the

effects of competition by larger companies operating in the oil and gas industry.

|

To

the extent we are able to raise capital through equity financings, they may be dilutive to our stockholders. Alternative forms

of future financings may include preferred stock with preferences or rights superior to our common stock. Debt financings may

involve a pledge of assets and will rank senior to our common stock. We have historically financed our operations through best

efforts private equity and debt financings. We do not have any credit or equity facilities available with financial institutions,

stockholders or third party investors, and will continue to rely on best efforts financings. There is no assurance that we can

raise the capital necessary to expand our operations. Failure to raise the required capital to fund operations, on favorable terms

or at all, will have a material adverse effect on us, and will likely cause us to curtail or cease operations.

Our

financial statements express substantial doubt about our ability to continue as a going concern, raising questions as to our continued

existence.

We

have incurred losses since our inception resulting in an accumulated deficit of approximately $54.6 million at June 30, 2019,

and we have a net capital deficiency. Further losses are anticipated as we continue to develop our business. To continue as a

going concern, we estimate that we will need approximately $10 million to meet our obligations and planned operating expenditures

through September 2020. The $10 million is comprised primarily of capital project expenditures as well as general and administrative

expenses. It does not include any amounts due under outstanding debt obligations, which amounted to $11.6 million of current principal

and interest as of June 30, 2019. We plan to finance our operations through equity and/or debt financings, and strategic

alliances. There are no assurances that financing will be available with acceptable terms, if at all. If we are not successful

in obtaining financing, our operations would need to be curtailed or ceased or the Company would need to sell assets or consider

alternative plans up to and including restructuring.

If

we fail to establish and maintain proper internal controls, our ability to produce accurate financial statements or comply with

applicable regulations could be impaired.

We

are required to comply with certain provisions of Section 404 of the Sarbanes-Oxley Act of 2002 (“Sarbanes-Oxley

Act”). Section 404 requires that we document and test our internal control over financial reporting and issue

management’s assessment of our internal control over financial reporting. In our annual report for the year ended

September 30, 2018, we identified and disclosed material weaknesses related to the failure to record interest on an interest

bearing payable and failure to accurately value a fair value financial instrument issued in settlement of a liability. These

errors are a result of insufficient control activities related to the review and monitoring of Company contracts to ensure

the proper accounting for such contracts. In connection with the restatement of our condensed financial statements, as of

March 31, 2019 and for the three and six-months ended, we identified an additional material weakness in our internal control

over financial reporting. This additional material weakness is due to a lack of effective controls over the valuation of

accounts receivable which resulted in a material error in the financial statements. In an attempt to remediate the material

weaknesses, management has developed a contract review process, increased the use of external consultants and

is investigating expansion of the accounting department in its ongoing remediation efforts of the material weaknesses. We also are

developing a plan for remediation of controls over the valuation of accounts receivable from joint operations.

If

we fail to comply with the requirements of Section 404 of the Sarbanes-Oxley Act, the accuracy and timeliness of the filing of

our annual and quarterly reports may be materially adversely affected and could cause investors to lose confidence in our reported

financial information, which could have a negative effect on the trading price of our Common Stock.

We

have no proved reserves and areas that we decide to drill may not yield oil and natural gas in commercial quantities or quality,

or at all.

We

have no proved reserves. We have identified prospects based on available seismic and geological information that indicates the

potential presence of oil and natural gas. However, the areas we decide to drill may not yield oil and natural gas in commercial

quantities or quality, or at all. Most of our current prospects are in various stages of evaluation that will require substantial

additional seismic data reprocessing and interpretation. Even when properly used and interpreted, 3-D seismic data and visualization

techniques are only tools used to assist geoscientists in identifying subsurface structures and hydrocarbon indicators and do

not enable the interpreter to know whether hydrocarbons are, in fact, present in those structures. We have drilled two wells,

one of which is currently being evaluated. Accordingly, we do not know if our prospects will contain oil and natural gas in sufficient

quantities or quality to recover drilling and completion costs or to be economically viable. Even if oil and natural gas is found

on our prospects in commercial quantities, construction costs of pipelines and other transportation costs may prevent such prospects

from being economically viable. If one or more of our prospects do not prove to be successful, our business, financial condition

and results of operations will be materially adversely affected.

We

are substantially dependent on certain members of our management and technical team.

Investors

in our common stock must rely upon the ability, expertise, judgment and discretion of our management and the success of our technical

team in identifying and acquiring leasehold interests, as well as discovering and developing any oil and gas reserves. Our performance

and success are dependent, in part, upon key members of our management and technical team, and their loss or departure could be

detrimental to our future success. In making a decision to invest in our common stock, you must be willing to rely to a significant

extent on our management’s discretion and judgment. The loss of any of our management and technical team members could have

a material adverse effect on our business prospects, results of operations and financial condition, as well as on the market price

of our common stock. We may not be able to find replacement personnel with comparable skills. If we are unable to attract and

retain key personnel, our business may be adversely affected. We do not currently maintain key-man insurance on any member of

the management team.

The

seismic data we use are subject to non-exclusive license arrangements and may be licensed to our competitors, which could adversely

affect the execution of our acquisition strategy and business plan.

Our

3-D seismic license agreements are non-exclusive, industry-standard agreements. Accordingly, the licensor of such seismic data

has the right to license the same data that we acquired to our competitors, which could adversely affect our acquisition strategy

and the execution of our business plan. We are not authorized to assign any of our rights under our license agreements, including

a transaction with a potential joint venture partner or acquirer, without complying with the terms of the license agreements and

a payment to the licensor (by us or the acquirer in the event of a change of control transaction or our partner in a joint venture

transaction). However, our interpretation of this seismic data and importantly, reprocessing and the modeling of certain seismic

data utilized to identify and technically support oil and gas prospects, is unique and proprietary to the Company.

We

are an oil and natural gas exploration company with limited operating history, and there can be no assurance that we will be successful

in executing our business plan. We may never attain profitability.

We

commenced our business activity in March 2013, when we entered into 3-D license agreements covering approximately 2.2

million acres, and have entered into additional 3-D license agreements with seismic companies to acquire additional data and

reprocess seismic data. While we intend to engage in the drilling, development, and production of oil and natural gas in the

future, we currently have no reserves or production. As we are a relatively new business, we are subject to all the risks and

uncertainties, which are characteristic of a new business enterprise, including the substantial problems, expenses and

other difficulties typically encountered in the course of its business, in addition to normal business risks, as well as

those risks that are specific to the oil and gas industry. Investors should evaluate us in light of the delays, expenses,

problems and uncertainties frequently encountered by companies developing markets for new products, services and

technologies. We may never overcome these obstacles.

We

may be unable to access the capital markets to obtain additional capital that we will require to implement our business plan,

which would restrict our ability to grow.

Our

current capital on hand is insufficient to enable us to execute our business strategy beyond December 2019. Though,

our inability to complete the agreement to extend the maturity date of the $1.0 million remaining balance of the Delek term

loan due October 19, 2019 could further effect our liquidity and business plan. Because we are a company with limited

resources, we may not be able to compete in the capital markets with much larger, established companies that have ready

access to capital. Our ability to obtain needed financing may be impaired by conditions and instability in the capital

markets (both generally and in the oil and gas industry in particular), our status as a new enterprise without a demonstrated

operating history, the location of our leases and prices of oil and natural gas on the commodities markets (which will impact

the amount of financing available to us), and/or the loss of key consultants and management. Further, if oil and/or natural

gas prices on the commodities markets continue to decrease, then potential revenues, if any, will decrease, which

may increase our requirements for capital. Some of the future contractual arrangements governing our operations may require

us to maintain minimum capital (both from a legal and practical perspective), and we may lose our contractual rights if we

do not have the required minimum capital. If the amount of capital we can raise is not sufficient, we may be required to

curtail or cease our operations.

We

have a limited operating history with significant losses and expect losses to continue for the foreseeable future.

We

have incurred annual operating losses since our inception. As a result, at June 30, 2019, we had an accumulated deficit of approximately

$54.6 million. We had no revenues in 2018 and do not anticipate generating revenues in fiscal 2019, or in subsequent periods unless

we are successful in discovering economically recoverable oil or gas reserves. We expect that our operating expenses will increase

as we develop our projects. We expect continued losses in fiscal year 2019, and thereafter until future discoveries are brought

online and we begin producing oil and gas.

The

terms of the definitive documents governing the Term Loan Facility may restrict our operations, particularly our ability to respond

to changes or take certain actions. If we are unable to repay the Term Loan Facility as it becomes due, we may be unable to continue

as a going concern.

On

March 1, 2019, we entered into a Term Loan Agreement by and among GulfSlope, as borrower, and Delek, as lender. In the Term

Loan Agreement, Delek agreed to provide us with multiple draw term loans in an aggregate stated principal amount of up to

$11.0 million (the “Term Loan Facility” and the loans thereunder, the “Loans”). Borrowings under the

Term Loan Facility mature in six months and bear interest at the rate of 5.0% and are secured by the assets of the Company.

As of the date of this prospectus there is $1.0 million outstanding under the Term Loan Facility and no additional amounts

available to be borrowed. The maturity date of the $1,000,000 remaining balance of the term loan is October 19, 2019

and an agreement is being negotiated to extend the maturity date.

The

definitive documents governing the Term Loan Facility contain a number of restrictive covenants that impose operating and financial

restrictions on us and limit our ability to engage in acts that may be in our long-term best interest, including restrictions

on the ability to: incur indebtedness, grant liens, undergo certain fundamental changes, dispose of assets, make investments,

enter into transactions with affiliates, and make certain restricted payments, in each case subject to limitations and exceptions

to be set forth in the definitive documentation for the Term Loan Facility. The definitive documentation governing the Term Loan

Facility also contains customary events of default that include, among other things, certain payment defaults, covenant defaults,

cross-defaults to other indebtedness, change of control defaults, judgment defaults, and bankruptcy and insolvency defaults. Such

events of default may allow the creditor to accelerate the related debt and may result in the acceleration of any other debt to

which a cross-acceleration or cross-default provision applies which could have a material adverse effect on our business, operations

and financial results. Furthermore, if we are unable to repay the amounts due and payable under the definitive documentation governing

our Term Loan Facility, the lender could proceed against the collateral granted to them to secure that indebtedness which could

force us into bankruptcy or liquidation. In the event our lender accelerated the repayment of the borrowings, we may not have

sufficient assets to repay that indebtedness. Any acceleration of amounts due under the Term Loan Facility would likely have a

material adverse effect on us and would threaten our ability to continue as a going concern. As a result of these restrictions,

we may be limited in how we conduct business; unable to continue our business operations; unable to raise additional debt or equity

financing to operate during general economic or business downturns; or unable to compete effectively or to take advantage of new

business opportunities.

Our

lack of diversification increases the risk of an investment in our common stock.

Our

business will focus on the oil and gas industry in commercially advantageous offshore areas of the United States. Larger companies

have the ability to manage their risk by diversification. However, we lack diversification, in terms of both the nature and geographic

scope of our business. As a result, factors affecting our industry, or the regions in which we operate, will likely impact us

more acutely than if our business were diversified.

Strategic

relationships upon which we rely are subject to change, which may diminish our ability to conduct our operations.

Our

ability to successfully bid on and acquire properties, to discover resources, to participate in drilling opportunities and to

identify and enter into commercial arrangements with customers and partners, depends on developing and maintaining close working

relationships with industry participants and on our ability to select and evaluate suitable properties. Further, we must consummate

transactions in a highly competitive environment. These realities are subject to change and may impair our ability to grow.

To

develop our business, we will endeavor to use the relationships of our management and to enter into strategic relationships, which

may take the form of joint ventures with other private parties or with local government bodies or contractual arrangements with

other oil and gas companies, including those that supply equipment and other resources that we will use in our business. We may

not be able to establish these strategic relationships, or if established, we may not be able to maintain them. In addition, the

dynamics of our relationships with strategic partners may require that we incur expenses or undertake activities we would not

otherwise incur or undertake in order to fulfill our obligations to these partners or maintain our relationships. If our strategic

relationships are not established or maintained, our business prospects may be limited, which could diminish our ability to conduct

our operations.

Competition

in obtaining rights to explore and develop oil and gas reserves may impair our business.

The

oil and gas industry is extremely competitive. Present levels of competition for oil and gas leases and drilling rights are high

worldwide. Other oil and gas companies with greater resources may compete with us by bidding for leases and drilling rights, as

well as other properties and services we may need to operate our business. Additionally, other companies may compete with us in

obtaining capital from investors. Competitors include larger, established exploration and production companies, which have access

to greater financial and other resources than we have currently, and may be more successful in the recruitment and retention of

qualified employees and may conduct their own refining and petroleum marketing operations, giving them a competitive advantage.

In addition, actual or potential competitors may be strengthened through the acquisition of additional assets and interests. Because

of some or all of these factors, we may not be able to compete.

We

may not be able to effectively manage our growth, which may harm our future profitability.

We

are currently not profitable however, our strategy envisions building and expanding our business in order to become profitable.

If we fail to effectively manage our growth, our financial results will be adversely affected. Growth may place a strain on our

management systems and resources. We must continue to refine and expand our business development capabilities, our systems, processes,

and our access to financing sources. As we grow, we must continue to hire, train, supervise and manage new employees. We cannot

assure you that we will be able to:

|

|

●

|

expand

our systems effectively or efficiently or in a timely manner;

|

|

|

●

|

optimally

allocate our human resources; or

|

|

|

●

|

identify

and hire qualified employees or retain valued employees.

|

If

we are unable to manage our growth and our operations, our financial results could be adversely affected, which could prevent

us from ever attaining profitability.

Any

change to government regulation/administrative practices may have a negative impact on our ability to operate profitably.

The

laws, regulations, policies or current administrative practices of any government body, organization or regulatory agency impacting

any jurisdiction where we might conduct our business activities, including the BOEM and EPA, may be changed, applied or interpreted

in a manner which may fundamentally alter the ability of the Company to conduct business. The actions, policies or regulations,

or changes thereto, of any government body or regulatory agency or other special interest groups, may have a detrimental effect

on us. Any or all of these situations may have a negative impact on our ability to operate profitably. Additionally, certain bonding

and/or insurance may be required in jurisdictions in which we chose to have operations, increasing our costs to operate.

Risks

Related to Our Industry

An

extended decline in oil prices and significant fluctuations in energy prices may continue indefinitely, affecting the commercial

viability of our projects and negatively affecting our business prospects and viability.

The

commercial viability of our projects is highly dependent on the price of oil and natural gas. Prices also affect our ability to

borrow money or raise additional capital. We will need to obtain additional financing to fund our activities. Our ability to do

so may be adversely affected by an extended decline in oil prices. If we are unable to obtain such financing when needed, on commercially

reasonable terms, we may be required to cease our operations, which could have a materially adverse impact on the market price

of our stock. An extended decline in oil prices may have a material adverse effect on our planned operations, financial condition

and level of expenditures that we may ultimately have to make for the development of any oil and natural gas reserves we may acquire.

The

oil and gas markets are very volatile, and we cannot predict future oil and natural gas prices. Historically, oil and natural

gas prices have been volatile and are subject to fluctuations in response to changes in supply and demand, market uncertainty

and a variety of additional factors that are beyond our control. In addition, the prices we receive for any future production

and the levels of any future production and reserves will depend on numerous factors beyond our control. These factors include,

but are not limited to, the following:

|

|

●

|

changes

in global supply and demand for oil and natural gas by both refineries and end users;

|

|

|

●

|

the

ability of the members of the Organization of Petroleum Exporting Countries to agree to and maintain oil price and production

controls;

|

|

|

●

|

the

price and volume of imports of foreign oil and natural gas;

|

|

|

●

|

political

and economic conditions, including embargoes, in oil-producing countries or affecting other oil-producing activity;

|

|

|

●

|

the

level of global oil and gas exploration and production activity;

|

|

|

●

|

the

level of global oil and gas inventories;

|

|

|

●

|

government

policies to discourage use of fuels that emit GHGs and encourage use of alternative energy;

|

|

|

●

|

technological

advances affecting energy consumption;

|

|

|

●

|

domestic

and foreign governmental regulations and taxes;

|

|

|

●

|

proximity

and capacity of oil and gas pipelines and other transportation facilities;

|

|

|

●

|

the

price and availability of competitors’ supplies of oil and gas in captive market areas;

|

|

|

●

|

the

introduction, price and availability of alternative forms of fuel to replace or compete with oil and natural gas;

|

|

|

●

|

import

and export regulations for LNG and/or refined products derived from oil and gas production from the US;

|

|

|

●

|

speculation

in the price of commodities in the commodity futures market;

|

|

|

●

|

the

availability of drilling rigs and completion equipment; and

|

|

|

●

|

the

overall economic environment.

|

Further,

oil and natural gas prices do not necessarily fluctuate in direct relationship to each other. The price of oil has been extremely

volatile, and we expect this volatility to continue for the foreseeable future. For example, during the period from January 1,

2014 to December 31, 2018, NYMEX West Texas Intermediate oil prices ranged from a high of $107.95 per bbl to a low of $26.19 per

bbl. Average daily prices for NYMEX Henry Hub gas ranged from a high of $8.15 per MMBtu to a low of $1.49 per MMBtu during the

same period. This near term volatility may affect future prices in 2019 and beyond. The volatility of the energy markets makes

it difficult to predict future oil and natural gas price movements with any certainty.

Exploration

for oil and natural gas is risky and may not be commercially successful, impairing our ability to generate revenues.

Oil

and natural gas exploration involves a high degree of risk. These risks are more acute in the early stages of exploration. We

may not discover oil or natural gas in commercially viable quantities. It is difficult to project the costs of implementing an

exploratory drilling program due to the inherent uncertainties of drilling in unknown formations, the costs associated with encountering

various drilling conditions, such as over pressured zones (which may lead to blowouts, fires, and explosions) and tools lost in

the hole, and changes in drilling plans, locations as a result of prior exploratory wells or additional seismic data and interpretations

thereof, and final commercial terms negotiated with partners. Developing exploratory oil and gas properties requires significant

capital expenditures and involves a high degree of financial risk. The budgeted costs of drilling, completing, and operating exploratory

wells are often exceeded and can increase significantly when drilling costs rise. Drilling may be unsuccessful for many reasons,

including title problems, adverse weather conditions (which may be more frequent as climate changes), cost overruns, equipment

shortages, mechanical difficulties, and environmental hazards (including spills and toxic gas releases). There is no assurance

that we will successfully complete any wells or if successful, that the wells would be economically successful. Moreover, the

successful drilling or completion of any oil or gas well does not ensure a profit on investment. Exploratory wells bear a much

greater risk of loss than development wells. We cannot assure you that our exploration, exploitation and development activities

will result in profitable operations, the result of which will materially adversely affect our business.

Oil

and natural gas operations are subject to comprehensive regulation which may cause substantial delays or require capital outlays

in excess of those anticipated, causing an adverse effect on the Company.

Oil

and natural gas operations are subject to national, state, and local laws relating to the protection of the environment, including

laws regulating removal of natural resources from the ground, spill response capabilities, and the discharge of materials into

the environment. Oil and natural gas operations are also subject to national, state, and local laws and regulations, which seek

to maintain health and safety standards by regulating the design and use of drilling methods and equipment. Environmental standards

imposed by national, state or local authorities may be changed and any such changes may have material adverse effects on our activities.

Moreover, compliance with such laws may cause substantial delays or require capital outlays in excess of those anticipated, thus

causing an adverse effect on us. Additionally, we may be subject to liability for pollution or other environmental damages which

we are unlikely to insure against fully due to prohibitive premium costs and other reasons. To date, we have not been required

to spend any amounts on compliance with environmental regulations; however, we may be required to expend substantial sums in the

future as we develop projects, and this may affect our ability to begin, maintain, or expand our operations.

We

may be dependent upon third party operators of any oil and natural gas properties we may acquire.

Third

parties may act as the operators of our oil and natural gas wells and control the drilling and operating activities to be conducted

on our properties, if and when such assets are acquired. Therefore, we may have limited control over certain decisions related

to activities on our properties relating to the timing, costs, procedure, and location of drilling or production activities, which

could affect the Company’s results.

Our

leases may be terminated if we are unable to make future lease payments or if we do not drill in a timely manner.

The

failure to timely affect all lease related payments could cause the leases to be terminated by the BOEM. Net lease rental

obligations on our existing prospects are expected to be approximately $0.5 million in fiscal year 2019. Our leases have a

five-year primary term, expiring in 2020, 2022 and 2023. Each lease may be extended by drilling a well capable of producing

hydrocarbons and submitting a Plan of Production approved by the regulatory authorities. In addition, the terms of our leases

may be extended for an additional three years, provided a well is spud targeting hydrocarbons with a true vertical depth in

excess of 25,000 feet within the primary term of the lease. In addition, the terms of our leases may also be extended by the

granting of a Subsalt Lease Term Extension, should we elect to apply and qualify for said extension on any lease(s). If we

are not successful in raising additional capital, we may be unable to successfully exploit our properties, and we may lose

the rights to develop these properties upon the expiration of our leases. If not successful in securing extensions, those

leases will be subject to the competitive bid process in the twice a year BOEM OCS Lease Sales.

We

may not be able to develop oil and natural gas reserves on an economically viable basis.

To

the extent that we succeed in discovering oil and/or natural gas reserves, we cannot assure that these reserves will be capable

of production levels we project or in sufficient quantities to be commercially viable. On a long-term basis, our viability depends

on our ability to find, develop and commercially produce oil and gas reserves, assuming we acquire leases or drilling rights.

Our future reserves, if any, will depend not only on our ability to develop then-existing properties, but also on our ability

to identify and acquire additional suitable producing properties or prospects, to find markets for the oil and natural gas we

develop and to effectively distribute our production into markets.

Future

oil and gas exploration may involve unprofitable efforts, not only from dry wells, but from wells that are productive but do not

produce sufficient net revenues to return a profit after drilling, operating and other costs. Completion of a well does not assure

a profit on the investment or recovery of drilling, completion and operating costs. In addition, drilling hazards or environmental

damage could greatly increase the cost of operations and various field operating conditions may adversely affect the production

from successful wells. These conditions include delays in obtaining governmental approvals or consents, shut-downs of wells resulting

from extreme weather conditions, problems in storage and distribution and adverse geological and mechanical conditions. While

we will endeavor to effectively manage these conditions, we cannot be assured of doing so optimally, and we will not be able to

eliminate them completely in any case. Therefore, these conditions could adversely impact our operations.

We

may not be able to obtain drilling rigs and other equipment and geophysical service crews necessary to exploit any oil and natural

gas resources we may acquire.

We

may not be able to procure the necessary drilling rigs and related services and equipment or the cost of such items may be prohibitive.

Our ability to comply with future license obligations or otherwise generate revenues from the production of operating oil and

natural gas wells could be hampered as a result of this, and our business could suffer.

Environmental

risks may adversely affect our business.

All

phases of the oil and natural gas business present environmental risks and hazards and are subject to environmental regulation

pursuant to a variety of federal, state and local laws and regulations. Environmental legislation provides for, among other things,

restrictions and prohibitions on spills, releases or emissions of various substances produced in association with oil and natural

gas operations, including products, byproducts, and wastes. The legislation also requires that wells and facility location be

sited, operated, maintained, abandoned and reclaimed to the satisfaction of applicable regulatory authorities. Compliance with

such legislation can require significant expenditures, and a breach may result in the imposition of fines and penalties, some

of which may be material. Environmental legislation is evolving in a manner we expect may result in stricter standards and enforcement,

larger fines and liability, prevention of the right to operate or participate in leasing, and potentially increased capital expenditures

and operating costs. The discharge of oil, natural gas or other pollutants into the air, soil or water may give rise to liabilities

to foreign governments and third parties and may require us to incur costs to remedy such discharge. The application of environmental

laws to our business may cause us to curtail our production or increase the costs of our production, development or exploration

activities.

Any

insurance that we may acquire will likely be inadequate to cover liabilities we may incur.

Our

involvement in the exploration for, and development of, oil and natural gas properties may result in our becoming subject to liability

for pollution, blow-outs, property damage, personal injury or other hazards. Although we intend to obtain insurance in accordance

with industry standards to address such risks, such insurance has limitations and so will be unlikely to cover the full extent

of such liabilities. In addition, such risks may not, in all circumstances be insurable or, in certain circumstances, we may choose

not to obtain insurance to protect against specific risks due to the high premiums associated with such insurance or for other

reasons. The payment of such uninsured liabilities would reduce the funds available to us. If we suffer a significant event that

is not fully insured or if the insurer of such event is not solvent or denies coverage, we could be required to divert funds from

capital investment or other uses towards covering our liability for such events.

We

are subject to cyber security risks. A cyber incident could occur and result in information theft, data corruption, operational

disruption or financial loss.

The

oil and natural gas industry has become increasingly dependent on digital technologies to conduct certain exploration, development,

production, processing and distribution activities. For example, we depend on digital technologies to interpret seismic data,

conduct reservoir modeling and record financial and other data. Our industry faces various security threats, including cyber-security

threats. Cyber-security attacks in particular are increasing and include, but are not limited to, malicious software, attempts

to gain unauthorized access to data, and other electronic security breaches that could lead to disruptions in critical systems,

unauthorized release of confidential or otherwise protected information and corruption of data. Although to date we have not experienced

any material losses related to cyber-security attacks, we may suffer such losses in the future. Moreover, the various procedures

and controls we use to monitor and protect against these threats and to mitigate our exposure to such threats may not be sufficient

in preventing security threats from materializing. If any of these events were to materialize, they could lead to losses of intellectual

property and other sensitive information essential to our business and could have a material adverse effect on our business prospects,

reputation and financial position.

Risks

Related to our Common Stock

There

is a limited trading market for our shares. You may not be able to sell your shares if you need money.

Our

common stock is traded on the OTC Markets (QB Marketplace Tier), an inter-dealer automated quotation system for equity securities.

During the three calendar months preceding filing of this report, the average daily trading volume of our common stock was approximately

502,000 shares. As of October 2, 2019, we had approximately 190 record holders of our common stock (not including an indeterminate

number of stockholders whose shares are held by brokers in “street name”). There has been limited trading activity

in our stock, and when it has traded, the price has fluctuated widely. We consider our common stock to be “thinly traded”

and any last reported sale prices may not be a true market-based valuation of the common stock. Stockholders may experience difficulty

selling their shares if they choose to do so because of the illiquid market and limited public float for our common stock. This

situation is attributable to a number of factors, including, but not limited to:

|

|

●

|

we are

a small company that is relatively unknown to stock analysts, stock brokers, institutional investors and others in the investment

community that generate or influence sales volume; and

|

|

|

●

|

stock

analysts, stock brokers and institutional investors may be risk-averse and reluctant to follow a company such as ours that

faces substantial doubt about its ability to continue as a going concern or to purchase or recommend the purchase of our shares

until such time as we become more viable.

|

As

a result, an investor may find it difficult to dispose of, or to obtain accurate quotations of the price of our common stock.

Accordingly, investors must assume they may have to bear the economic risk of an investment in our common stock for an indefinite

period of time, and may lose their entire investment. There can be no assurance that a more active market for our common stock

will develop, or if one should develop, there is no assurance that it will be sustained. This severely limits the liquidity of

our common stock and would likely have a material adverse effect on the market price of our common stock and on our ability to

raise additional capital.

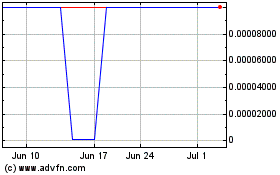

The amount of common stock registered

for resale may significantly impact our share price and volatility.

The amount of our common

stock to be registered for resale in the Registration Statement represents a significant percentage of our currently outstanding

common stock. The 444,095,238 shares of our common stock in registered for resale in this Registration Statement equals approximately

41% of our issued and outstanding common stock. We cannot predict what effect this may have on the price of our common stock

or the volume of transactions involving our shares in the market. Sales of a substantial amount of our common stock or the perception

that such sales may occur could adversely affect the liquidity of the market for our common stock or their price. Large price

changes or low trading volume may preclude you from buying or selling our common stock at all, or at any particular price or during

a time frame that satisfies your investment objectives.

We

may issue preferred stock.

Our

Certificate of Incorporation authorizes the issuance of up to 50 million shares of “blank check” preferred stock with

designations, rights and preferences determined from time to time by the Board of Directors. Accordingly, our Board of Directors

is empowered, without stockholder approval, to issue preferred stock with dividend, liquidation, conversion, voting, or other

rights, which could adversely affect the voting power or other rights of the holders of the common stock. In the event of issuance,

the preferred stock could be utilized, under certain circumstances, as a method of discouraging, delaying or preventing a change

in control of the Company. Although we have no present intention to issue any shares of its authorized preferred stock, there

can be no assurance that we will not do so in the future.

Future

sales of our common stock could lower our stock price.

We

will likely sell additional shares of common stock to fund working capital obligations in future periods. We cannot predict the

size of future issuances of our common stock or the effect, if any, that future issuances and sales of shares of our common stock

will have on the market price of our common stock. Sales of substantial amounts of our common stock, or the perception that such

sales could occur, may adversely affect prevailing market prices for our common stock. Moreover, sales of our common stock by

existing shareholders could also depress the price of our common stock. For instance, we have issued instruments that are convertible

into or exercisable for 350 million shares of our Common Stock, which may have conversion or exercise rights that are at prices

lower than the trading price of our Common Stock. In particular, the holder of the $2.1 million in Convertible Debentures we have

issued may convert at any time a price equal to the lesser of (x) $0.05 per share or (y) 80% of the lowest daily VWAP of a share

of our Common Stock (as reported by Bloomberg, LP) for the ten (10) consecutive trading days immediately preceding the date of

determination.

Our

issuance of additional shares of Common Stock, or options or warrants to purchase those shares, would dilute your proportionate

ownership and voting rights.

We

are authorized to issue up to 1,550,000,000 shares of capital stock, comprising 1,500,000,000 shares of Common Stock, par value

$0.001 per share, and 50,000,000 shares of preferred stock, par value $0.001 per share (“Preferred Stock”). We have

issued and outstanding, as of June 30, 2019, 1,092,266,844 shares of Common Stock and 0 shares of Preferred Stock, plus another

approximately 350 million shares may be issued by us if all of the securities we have issued that are exercisable for, or convertible

into, shares of Common Stock are exercised or converted. Our board of directors (the “Board”) may generally issue

shares of Common Stock, Preferred Stock or options or warrants to purchase those shares without further approval by our shareholders,

based upon such factors as the Board may deem relevant at that time. See “Description of Capital Stock.” It is likely

that we will be required to issue a large amount of additional securities to raise capital to further our development. It is also

likely that we will issue a large amount of additional securities to directors, officers, employees and consultants as compensatory

grants in connection with their services, both in the form of stand-alone grants or under our stock plans. We cannot assure you

that we will not issue additional shares of Common Stock, Preferred Stock, or options or warrants to purchase those shares, under

circumstances we may deem appropriate at the time.

Our

common stock is subject to the “penny stock” rules of the SEC and FINRA, which makes transactions in our common stock

cumbersome and may reduce the value of an investment in the stock.

The