– Conference call and webcast today at 4:30

p.m. ET –

Revance Therapeutics, Inc. (Nasdaq: RVNC), a biotechnology

company pioneering new innovations in neuromodulators for aesthetic

and therapeutic indications, today reported financial results for

the quarter ended September 30, 2019, and provided a corporate

update.

Third Quarter 2019 and Subsequent Updates

- Board Appointed Mark J. Foley as President and Chief

Executive Officer (CEO). In October, Revance announced

that Mark Foley had assumed the role of President and CEO, having

served on the Revance Board for the prior two years. He brings more

than 25 years of operational and investment experience in the

healthcare arena. Previously, Mr. Foley served as Chairman,

President and CEO of ZELTIQ Aesthetics from 2012 to 2017, where he

led the company through a period of significant transformation and

growth, culminating in its acquisition by Allergan.

- BLA On Track for Submission in November 2019. Revance

plans to submit its Biologics License Application (BLA) to the U.S.

Food and Drug Administration (FDA) for DaxibotulinumtoxinA for

Injection (DAXI) for the treatment of glabellar lines in November

2019.

- Enrollment Now Complete in Phase 2 Trials for DAXI in Both

Forehead Lines and Lateral Canthal Lines. In July, Revance

completed enrollment in its Phase 2 clinical trial of DAXI for

forehead lines. In August, the company also completed enrollment in

its Phase 2 trial of DAXI in lateral canthal lines (crow’s feet).

Topline results for both trials are expected in the first half of

2020.

- Completed Enrollment in ASPEN-1 Phase 3 Trial of DAXI in

Cervical Dystonia. Today, Revance announced completion

of enrollment in the company’s ASPEN-1 Phase 3 clinical trial for

DAXI for the treatment of cervical dystonia (CD). In total, 301

adult patients were enrolled at 60 sites across the U.S., Canada

and Europe. Topline data from this Phase 3 trial is expected in the

second half of 2020.

“Revance is entering a pivotal period, given the large number of

value-inflection points we have created for the company, beginning

in just a few weeks with the anticipated submission of our first

BLA for DAXI with the FDA,” said Mark J. Foley, President and Chief

Executive Officer at Revance. “In 2020, we expect to report topline

results for three Phase 2 clinical trials, as well as our ASPEN-1

Phase 3 trial in cervical dystonia. In addition, we anticipate 2020

will see FDA approval for, and the commercial launch of, our

long-acting neuromodulator, DAXI, in glabellar lines. I’m thrilled

to be taking the helm of this company at such a dynamic time. I

want to take this opportunity to acknowledge everyone who has

helped position Revance for the momentous period we are

entering.”

Financial Highlights

Cash, cash equivalents and short-term investments as of

September 30, 2019 were $209.0 million. In August, Mylan was

provided an extension to the collaboration and license agreement to

defer its decision to move forward with the development of a

biosimilar to BOTOX® in exchange for a $5.0 million payment, which

is expected to be received in fourth quarter of 2019. A decision on

whether Mylan intends to proceed is expected by April 30, 2020.

Revenue for the quarter ended September 30, 2019 was $46

thousand compared to $2.4 million for the same period in 2018. The

revenue recognized represents the portion of revenue earned from

the $30 million combined upfront and incremental payments from

Mylan under the biosimilar collaboration and license agreement.

Accordingly, revenue for the nine months ended September 30, 2019

was $0.3 million compared to $3.2 million for the same period in

2018.

Research and development expenses for the three and nine

months ended September 30, 2019 were $25.9 million and $75.4

million compared to $21.8 million and $67.0 million for the same

periods in 2018, respectively. The change in research and

development expenses is primarily due to the initiation and

continuation of clinical trials and studies for multiple

therapeutic and aesthetic indications and pre-BLA filing activities

for DAXI for the treatment of glabellar lines.

General and administrative expenses for the three and

nine months ended September 30, 2019 were $16.7 million and $43.2

million compared to $14.2 million and $40.5 million for the same

periods in 2018, respectively. The increase in general and

administrative expenses is primarily due to increased costs related

to personnel and infrastructure build-out.

Total operating expenses for the three and nine months

ended September 30, 2019 were $42.6 million and $118.6 million

compared to $36.0 million and $107.5 million for the same periods

in 2018, respectively. Stock-based compensation for the three and

nine months ended September 30, 2019 was $4.3 million and $12.9

million, respectively. When excluding depreciation and stock-based

compensation, total operating expenses for the three and nine

months ended September 30, 2019 were $37.5 million and $103.6

million, respectively.

Net loss for the three and nine months ended September

30, 2019 was $41.4 million and $114.1 million compared to $32.8

million and $102.0 million for the same periods in 2018,

respectively.

Near-Term Milestone Expectations

Aesthetics:

- Submission of a Biologics License Application (BLA) to the FDA

for DAXI for the treatment of glabellar (frown) lines in November

2019.

- Topline results from Phase 2 study of DAXI in forehead lines

expected in 1H 2020.

- Topline results from Phase 2 study of DAXI in lateral canthal

lines (crow’s feet) expected in 1H 2020.

Therapeutics:

- Completion of patient enrollment in Phase 2 plantar fasciitis

study expected in 4Q 2019.

- Completion of patient enrollment in Phase 2 upper limb

spasticity study expected in 1H 2020.

- Topline results from Phase 3 study of DAXI in cervical dystonia

expected in 2H 2020.

- Topline results from Phase 2 study of DAXI in plantar fasciitis

expected in 2H 2020.

2019 Financial Outlook

Revance reiterates its financial guidance provided in February

2019. Revance expects 2019 GAAP operating expense to be in the

range of $173 to $185 million and non-GAAP operating expense, which

excludes depreciation and stock-based compensation costs, to be in

the range of $148 to $158 million as driven by increased research

and development expenditures and launch preparation activities.

With five clinical programs and preparations to file the BLA

underway, Revance anticipates 2019 non-GAAP research and

development (R&D) expense to be $93 to $100 million. With the

successful capital infusion through partnering agreements in 2018

and an equity raise in January, management believes the company has

adequate cash reserves to fund its current operations through

2020.

Conference Call

Individuals interested in listening to the conference call may

do so by dialing 855-453-3827 for domestic callers, or 484-756-4301

for international callers and reference conference ID: 3774965; or

from the webcast link in the investor relations section of the

company’s website at: www.revance.com. A replay of the call will be

available beginning November 4, 2019 at 4:30 p.m. PT/7:30 p.m. ET

to November 5, 2019 at 4:30 p.m. PT/7:30 p.m. ET. To access the

replay, dial 855-859-2056 or 404-537-3406 and reference conference

ID: 3774965. The webcast will be available in the investor

relations section on the company's website for 30 days following

the completion of the call.

About Revance Therapeutics, Inc.

Revance Therapeutics is a Silicon Valley-based biotechnology

company, pioneering new innovations in neuromodulators for

aesthetic and therapeutic indications. Revance’s lead product

candidate, DaxibotulinumtoxinA for Injection (DAXI), combines a

proprietary stabilizing peptide excipient with a highly purified

botulinum toxin that does not contain human or animal-based

components. Revance has successfully completed a Phase 3 program

for DAXI in glabellar (frown) lines, delivering unprecedented

efficacy and long-lasting duration of effect, and is pursuing U.S.

regulatory approval in 2020. Revance is also evaluating DAXI in

forehead lines and lateral canthal lines (crow’s feet), as well as

in three therapeutic indications – cervical dystonia, adult upper

limb spasticity and plantar fasciitis, with plans to study

migraine. Beyond DAXI, Revance has begun development of a

biosimilar to BOTOX®, which would compete in the existing

short-acting neuromodulator marketplace. Revance is dedicated to

making a difference by transforming patient experiences. For more

information or to join our team, visit us at www.revance.com.

“Revance Therapeutics” and the Revance logo are registered

trademarks of Revance Therapeutics, Inc.

BOTOX® is a registered trademark of Allergan, Inc.

Forward-Looking Statements

This press release contains forward-looking statements,

including statements related to Revance Therapeutics' 2019

financial outlook, milestone expectations, expected cash runway and

other financial performance; the process and timing of, and ability

to complete, current and anticipated future clinical development of

our investigational drug product candidates; the initiation,

design, enrollment, submission, timing and results of our clinical

studies, including the near-term milestone expectations described

above; development of a biosimilar to BOTOX®; results of our

non-clinical programs; statements about our business strategy,

timeline and other goals and market for our anticipated products,

plans and prospects, including our pre-commercialization plans and

timing of our anticipated BLA submission to treat glabellar (frown)

lines and potential regulatory approach and product launch;

statements about our ability to obtain, and the timing relating to,

regulatory approval with respect to our drug product candidates;

and potential benefits of our drug product candidates and our

excipient peptide and other technologies.

Forward-looking statements are subject to risks and

uncertainties that could cause actual results to differ materially

from our expectations. These risks and uncertainties include, but

are not limited to: the outcome, cost, and timing of our product

development activities and clinical trials; the uncertain clinical

development process, including the risk that clinical trials may

not have an effective design or generate positive results; our

ability to obtain and maintain regulatory approval of our drug

product candidates; our ability to obtain funding for our

operations; our plans to research, develop, and commercialize our

drug product candidates; our ability to achieve market acceptance

of our drug product candidates; unanticipated costs or delays in

research, development, and commercialization efforts; the

applicability of clinical study results to actual outcomes; the

size and growth potential of the markets for our drug product

candidates; our ability to successfully commercialize our drug

product candidates and the timing of commercialization activities;

the rate and degree of market acceptance of our drug product

candidates; our ability to develop sales and marketing

capabilities; the accuracy of our estimates regarding expenses,

future revenues, capital requirements and needs for financing; our

ability to continue obtaining and maintaining intellectual property

protection for our drug product candidates; and other risks.

Detailed information regarding factors that may cause actual

results to differ materially from the results expressed or implied

by statements in this press release may be found in Revance's

periodic filings with the Securities and Exchange Commission (the

"SEC"), including factors described in the section entitled "Risk

Factors" of our quarterly report on Form 10-Q filed November 4,

2019. These forward-looking statements speak only as of the date

hereof. Revance disclaims any obligation to update these

forward-looking statements.

Use of Non-GAAP Financial Measures

Revance has presented certain non-GAAP financial measures in

this release. This release and the reconciliation tables included

herein include total non-GAAP operating expense and non-GAAP

R&D expense, both of which exclude depreciation, stock-based

compensation, and non-recurring milestone costs. Revance excludes

depreciation, stock-based compensation, and non-recurring milestone

costs because management believes the exclusion of these items is

helpful to investors to evaluate Revance's recurring operational

performance. Revance management uses these non-GAAP financial

measures to monitor and evaluate its operating results and trends

on an on-going basis, and internally for operating, budgeting and

financial planning purposes. The non-GAAP financial measures should

be considered in addition to results prepared in accordance with

GAAP, but should not be considered a substitute for or superior to

GAAP results.

REVANCE THERAPEUTICS,

INC.

Condensed Consolidated Balance

Sheets

(In thousands, except share

and per share amounts)

(Unaudited)

September 30,

December 31,

2019

2018

ASSETS

CURRENT ASSETS

Cash and cash equivalents

$

58,922

$

73,256

Short-term investments

150,110

102,556

Accounts receivable

5,000

27,000

Prepaid expenses and other current

assets

6,536

5,110

Total current assets

220,568

207,922

Property and equipment, net

14,917

14,449

Operating lease right of use assets

27,078

—

Restricted cash

730

730

Other non-current assets

2,519

3,247

TOTAL ASSETS

$

265,812

$

226,348

LIABILITIES AND STOCKHOLDERS’

EQUITY

CURRENT LIABILITIES

Accounts payable

$

6,902

$

8,434

Accruals and other current liabilities

18,694

14,948

Deferred revenue, current portion

5,241

8,588

Operating lease liabilities, current

portion

3,317

—

Total current liabilities

34,154

31,970

Derivative liability associated with the

Medicis settlement

2,892

2,753

Deferred revenue, net of current

portion

50,707

42,684

Operating lease liabilities, net of

current portion

26,778

—

Deferred rent

—

3,319

TOTAL LIABILITIES

114,531

80,726

STOCKHOLDERS’ EQUITY

Convertible preferred stock, par value

$0.001 per share — 5,000,000 shares authorized, and no shares

issued and outstanding as of September 30, 2019 and December 31,

2018

—

—

Common stock, par value $0.001 per share —

95,000,000 shares authorized as of September 30, 2019 and December

31, 2018; 44,108,407 and 36,975,203 shares issued and outstanding

as of September 30, 2019 and December 31, 2018, respectively

44

37

Additional paid-in capital

950,073

830,368

Accumulated other comprehensive income

(loss)

42

(8

)

Accumulated deficit

(798,878

)

(684,775

)

TOTAL STOCKHOLDERS’ EQUITY

151,281

145,622

TOTAL LIABILITIES AND STOCKHOLDERS’

EQUITY

$

265,812

$

226,348

REVANCE THERAPEUTICS,

INC.

Condensed Consolidated

Statements of Operations and Comprehensive Loss

(In thousands, except share

and per share amounts)

(Unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

2019

2018

2019

2018

Revenue

$

46

$

2,362

$

324

$

3,242

Operating expenses:

Research and development

25,847

21,848

75,368

66,968

General and administrative

16,739

14,155

43,245

40,505

Total operating expenses

42,586

36,003

118,613

107,473

Loss from operations

(42,540

)

(33,641

)

(118,289

)

(104,231

)

Interest income

1,329

996

4,495

3,099

Interest expense

—

—

—

(44

)

Change in fair value of derivative

liability associated with the Medicis settlement

(68

)

(45

)

(139

)

(150

)

Other expense, net

(130

)

(144

)

(170

)

(626

)

Net loss

(41,409

)

(32,834

)

(114,103

)

(101,952

)

Unrealized gain (loss) and adjustment on

securities included in net loss

(74

)

90

50

(133

)

Comprehensive loss

$

(41,483

)

$

(32,744

)

$

(114,053

)

$

(102,085

)

Basic and diluted net loss

$

(41,409

)

$

(32,834

)

$

(114,103

)

$

(101,952

)

Basic and diluted net loss per share

$

(0.96

)

$

(0.91

)

$

(2.67

)

$

(2.82

)

Basic and diluted weighted-average number

of shares used in computing net loss per share

43,314,831

36,272,445

42,730,983

36,116,745

REVANCE THERAPEUTICS,

INC.

Reconciliation of GAAP

Operating Expense to Non-GAAP Operating Expense

(In thousands)

(Unaudited)

Three Months Ended September

30, 2019

Nine Months Ended September

30, 2019

Operating expense:

GAAP operating expense

$

42,586

$

118,613

Adjustments:

Stock-based compensation

(4,303

)

(12,882

)

Depreciation

(734

)

(2,152

)

Non-GAAP operating expense

$

37,549

$

103,579

REVANCE THERAPEUTICS,

INC.

Reconciliation of GAAP R&D

Expense to Non-GAAP R&D Expense

(In thousands)

(Unaudited)

Three Months Ended September

30, 2019

Nine Months Ended September

30, 2019

R&D expense

GAAP R&D expense

$

25,847

$

75,368

Adjustments:

Stock-based compensation

(2,106

)

(6,438

)

Depreciation

(492

)

(1,525

)

Non-GAAP R&D expense

$

23,249

$

67,405

View source

version on businesswire.com: https://www.businesswire.com/news/home/20191104005237/en/

INVESTORS Revance Therapeutics, Inc.: Jeanie Herbert,

714-325-3584 jherbert@revance.com or Gilmartin Group, LLC.:

Laurence Watts, 619-916-7620 laurence@gilmartinir.com

MEDIA Revance Therapeutics, Inc.: Sara Fahy, 949-887-4476

sfahy@revance.com or General Media: Y&R: Jenifer Slaw,

347-971-0906 jenifer.slaw@YR.com or Trade Media: Nadine Tosk,

504-453-8344 nadinepr@gmail.com

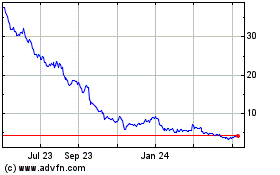

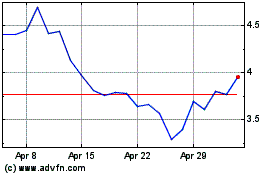

Revance Therapeutics (NASDAQ:RVNC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Revance Therapeutics (NASDAQ:RVNC)

Historical Stock Chart

From Apr 2023 to Apr 2024