By Nora Naughton

The United Auto Workers' new labor deal with Ford Motor Co.

largely mirrors the contract agreement struck with General Motors

Co. last month after a 40-day strike, but with some exceptions.

Unionized workers at Ford will get pay increase, lump-sum

payouts and a path to full-time work for temporary workers --

similar to the gains the UAW won at GM, according to details

released Friday in Detroit. The Ford agreement, which workers still

must ratify, will also match the GM pact in holding employee

health-care contributions at 3% and shortening the time it takes

for new hires to reach the top tier of pay from eight years to four

years.

The UAW also strengthened contract language on the use of

temporary workers in the new Ford contract, requiring the company

to limit its number of temps to 8% of the total workforce and 10%

of the workforce at each plant.

But Ford workers will get a smaller $9,000 signing bonuses if

the contract is approved, and Ford has committed to $6 billion in

new U.S. factory investment, less than amount pledged by GM,

despite having a larger union-represented factory workforce than

its crosstown rival.

The agreement also allows Ford to close an engine plant in

Michigan that now employs 600 workers. Those affected will be

transferred to a nearby transmission plant, resulting in no job

loss, the UAW said.

Labor experts say it is a decent deal for Ford workers, who will

benefit from similar gains as their GM counterparts, but without

having to strike.

"The membership should be satisfied, not happy and tickled to

death," said Art Wheaton, a labor studies professor at Cornell

University. "It'll be ratified but it will probably be somewhat

close."

In 2015, the last time a tentative labor agreement was presented

for a vote, Ford's hourly workers narrowly passed it with 51%

approval. That same year, UAW-represented workers at Fiat Chrysler

voted down their first contract proposal, sending bargainers back

to the table to hash out another deal.

Union leaders will return to their plants this weekend to

present the proposed terms to members. Voting on this latest deal

will begin Monday and wrap up Nov. 15. Ford's UAW-represented

workers must ratify the agreement by a simple majority.

Chris Budnick, 34, a quality inspector at Ford's Kentucky Truck

Plant in Louisville, Ky., said he'd rather Ford commit more money

to its U.S. factories and nix tiered-pay altogether -- as opposed

to doling out big one-time bonuses.

"The bonus is to buy our votes, basically," Mr. Budnick

said.

If they back the deal, the UAW will next move onto negotiations

at Fiat Chrysler Automobiles NV, which labor experts expect to be

more complicated in part because of plans revealed this week for

the auto maker to merger with France's PSA Group.

While GM workers approved a deal to end the longest nationwide

strike at the company since 1970, it isn't immediately clear

whether members will back this latest deal with Ford. A rejection

would mark a significant setback, once again prolonging contract

talks that have already lasted longer than many in the industry

anticipated.

GM set a high bar for its U.S. rivals to meet in this latest

round of bargaining. While GM got the go-ahead to close three U.S.

factories, it also granted the UAW financial gains that will raise

labor costs over next contract's four-year period, analysts

say.

The UAW headed into negotiations with Ford, looking to match the

gains it secured at GM on wages, benefits and other big-picture

economic items.

Ford, in particular, was hoping to win some concessions on

health care at the bargaining table with medical bills for its

unionized workforce expected to top more than $1 billion next

year.

But those prospects dimmed once GM agreed to keep health-care

contributions at 3% -- a far lower rate than the average paid by

other private-sector workers.

Ford's all-in labor costs, which include wages and benefits, are

the second-highest of the Detroit car companies, averaging $61 an

hour this year, according to the Center for Automotive Research.

Foreign-based auto makers, which don't have unionized workforces at

their U.S. plants, spend about $50 an hour on labor costs,

according to the Center.

The Dearborn, Mich., car company is also in the midst of a

massive restructuring, which aims to generate billions in

cost-savings. Once the strongest financially of the Detroit car

companies, Ford has since slipped behind GM in profitability and is

trying to restore earnings growth by closing factories in Europe

and South America and by laying off salaried workers in North

America.

Ford last month dialed back its full-year profit forecast,

citing new cost pressures and a weaker-than-expected fourth

quarter.

Ben Foldy contributed to this article.

(END) Dow Jones Newswires

November 01, 2019 17:11 ET (21:11 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

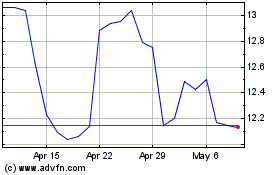

Ford Motor (NYSE:F)

Historical Stock Chart

From Mar 2024 to Apr 2024

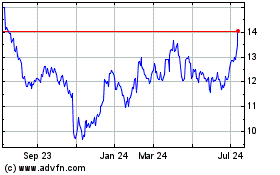

Ford Motor (NYSE:F)

Historical Stock Chart

From Apr 2023 to Apr 2024