Sales Increased 26% to $223.3 Million

Net Income Grew to $15.5 million from $7.6 million

Adjusted EBITDA Rose 20%

Funko, Inc. ("Funko,” or the “Company”) (Nasdaq: FNKO), a

leading pop culture consumer products company, today reported its

consolidated financial results for the third quarter ended

September 30, 2019.

Third Quarter 2019 Highlights1

- Net sales increased 26% to $223.3 million

- Gross profit2 increased 26% to $85.5 million

- Gross margin2 decreased 10 basis points to 38.3%

- Income from operations increased 36% to $22.6 million

- Net income increased to $15.5 million from $7.6 million

- Earnings per diluted share increased to $0.25

- Adjusted Net Income3 was $19.9 million compared to $13.6

million in the third quarter of 2018, and Adjusted Earnings per

Diluted Share3 was $0.38, compared to $0.27 in the third quarter of

2018

- Adjusted EBITDA3 increased 20% to $40.6 million

“Funko once again delivered another quarter of strong growth and

financial performance,” said Brian Mariotti, Funko’s CEO. “We are

driving results by executing against our strategic initiatives and

investing in the long-term success of Funko.

“More and more people are choosing Funko to be the platform in

which they engage with pop culture. We are focused on finding new

and innovative ways to connect people to their favorite

entertainment through fan experiences as well as digital and

physical goods.”

“There continues to be strong global demand for our products as

the proliferation of content persists around the world. We are

continuing to make the investments needed to capitalize on our

expanding growth opportunities in both new and existing

markets.”

Third Quarter 2019 Financial Results

Net sales increased 26% to $223.3 million in the third quarter

of 2019 from $176.9 million in the third quarter of 2018. The

growth was driven primarily by an increase in the number of active

properties and strong sales demand in the United States and

Europe.

In the third quarter of 2019, the number of active properties

increased 13% to 627 from 553 in the third quarter of 2018 and net

sales per active property increased 11%. On a geographical basis,

net sales in the United States increased 21% to $147.3 million and

net sales internationally increased 37% to $76 million with strong

growth in Europe. On a product category basis, net sales of figures

increased 24% to $176.5 million and net sales of other products

increased 33% to $46.8 million versus the third quarter of 2018,

driven primarily by continued growth of our Loungefly and other

softline products and the introduction of our games product

line.

The tables below show the breakdown of net sales on a

geographical and product category basis (in thousands):

Three Months Ended September

30,

Period Over Period

Change

2019

2018

Dollar

Percentage

Net sales by geography: United States

$

147,308

$

121,316

$

25,992

21.4

%

International

75,999

55,599

20,400

36.7

%

Total net sales

$

223,307

$

176,915

$

46,392

26.2

%

Three Months Ended September

30,

Period Over Period

Change

2019

2018

Dollar

Percentage

Net sales by product: Figures

$

176,480

$

141,762

$

34,718

24.5

%

Other

46,827

35,153

11,674

33.2

%

Total net sales

$

223,307

$

176,915

$

46,392

26.2

%

Gross margin2 in the third quarter of 2019 decreased 10 basis

points to 38.3% compared to 38.4% in the third quarter of 2018. The

decrease in gross margin2 in the third quarter of 2019 compared to

the third quarter of 2018 was driven primarily by higher duties

related to our Loungefly products, partially offset by lower

license and royalty costs as a percentage of net sales and lower

shipping and freight costs as a percentage of net sales.

SG&A expenses increased 27% to $52.4 million in the third

quarter of 2019 from $41.3 million in the third quarter of 2018,

primarily driven by growth and investment in the business and the

continued expansion of our office, retail and warehouse facilities,

reflecting an increase of $5.0 million in personnel and related

costs (including salary and related taxes/benefits, commissions and

stock compensation expense), an increase of $2.1 million in

administrative and other costs, an increase of $1.3 million in

warehouse and office support and an increase of $1.1 million in

rent and related facilities costs. In addition, SG&A expenses

included $2.9 million of legal, accounting and other related costs

incurred in connection with the Company’s investigation of the

underpayment of customs duties at Loungefly. SG&A expenses

increased 20 basis points as a percentage of net sales.

Net income for the third quarter of 2019 increased to $15.5

million from $7.6 million in the third quarter of 2018, and

Adjusted Net Income3 increased $6.3 million to $19.9 million from

$13.6 million in the third quarter of 2018. Factors that led to net

income and Adjusted Net Income3 growing faster than net sales in

the third quarter of 2019 compared to the third quarter of 2018

include lower depreciation and amortization expense as a percentage

of net sales, a reduction in interest expense, net and the reduced

impact of foreign currency gains and losses relating to

transactions denominated in currencies other than the US dollar

compared to the third quarter of 2018.

Adjusted EBITDA3 in the third quarter of 2019 rose 20% to $40.6

million or 18.2% of net sales from $33.9 million, or 19.2%, of net

sales in the third quarter of 2018. The decrease in Adjusted

EBITDA3 as a percentage of net sales in the third quarter of 2019

compared to the third quarter of 2018 resulted primarily from

higher SG&A as a percentage of net sales reflecting investments

we made in the business.

2019 Outlook

The Company is reiterating its outlook for the full year 2019.

The Company expects net sales to be in a range of $840 million to

$850 million. Adjusted EBITDA3 is expected to be in a range of $140

million to $145 million. Adjusted Earnings per Diluted Share3 is

expected to be in a range of $1.15 per share to $1.22 per share and

is based on estimated adjusted average diluted shares outstanding

of 53.5 million for the full year 2019.

Adjusted EBITDA and Adjusted EPS are non-GAAP measures. A table

at the end of this release reconciles Funko’s outlook for the full

year 2019 Adjusted EBITDA and Adjusted Earnings per Diluted Share

guidance to the most directly comparable U.S. GAAP financial

measures. Please refer to the “Non-GAAP Financial Measures” section

of this press release.

1 The prior period amounts have been

revised to reflect the correction of immaterial errors related to

an underpayment of certain duties owed to U.S. Customs as well as

other previously identified immaterial errors. Please see Note 1 to

our Form 10-Q for the period ended September 30, 2019 for further

information.

2 Gross profit is calculated as net sales

less cost of sales (excluding depreciation and amortization). Gross

margin is calculated as net sales less cost of sales (excluding

depreciation and amortization) as a percentage of net sales.

3Adjusted Net Income, Adjusted Earnings

per Diluted Share, EBITDA and Adjusted EBITDA are non-GAAP

financial measures. For a reconciliation of Adjusted Net Income,

Adjusted Earnings per Diluted Share, EBITDA and Adjusted EBITDA to

the most directly comparable U.S. GAAP financial measures, please

refer to the “Non-GAAP Financial Measures” section of this press

release.

Conference Call and Webcast

The Company will host a conference call at 4:30 p.m. Eastern

Time (1:30 p.m. Pacific Time) today, October 31, 2019, to further

discuss its third quarter results. Investors and analysts can

participate on the conference call by dialing (877) 407-9039 or

(201) 689-8470. Interested parties can also listen to a live

webcast or replay of the conference call by logging on to the

Investor Relations section on the Company’s website at

https://investor.funko.com/. The replay of the webcast will be

available for one year.

About Funko

Headquartered in Everett, Washington, Funko is a leading pop

culture consumer products company. Funko designs, sources and

distributes licensed pop culture products across multiple

categories, including vinyl figures, action toys, plush, apparel,

housewares and accessories for consumers who seek tangible ways to

connect with their favorite pop culture brands and characters.

Learn more at https://funko.com/, and follow us on Twitter

(@OriginalFunko) and Instagram (@OriginalFunko).

Forward Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. All statements contained in this press release that do not

relate to matters of historical fact should be considered

forward-looking statements, including statements regarding our

anticipated financial results, the underlying trends in our

business, growing demand for our products, our potential for

growth, plans for investments in our business and future

opportunities, including expanding into new product categories,

broadening our retailer network and increasing international sales.

These forward-looking statements are based on management’s current

expectations. These statements are neither promises nor guarantees,

but involve known and unknown risks, uncertainties and other

important factors that may cause our actual results, performance or

achievements to be materially different from any future results,

performance or achievements expressed or implied by the

forward-looking statements, including, but not limited to, the

following: our ability to maintain and realize the full value of

our license agreements; the ongoing level of popularity of our

products with consumers; changes in the retail industry and markets

for our consumer products; our ability to maintain our

relationships with retail customers and distributors; our ability

to compete effectively; fluctuations in our gross margin; our

dependence on content development and creation by third parties;

our ability to develop and introduce products in a timely and

cost-effective manner; our ability to obtain, maintain and protect

our intellectual property rights or those of our licensors;

potential violations of the intellectual property rights of others;

risks associated with counterfeit versions of our products; our

ability to attract and retain qualified employees and maintain our

corporate culture; risks associated with our international

operations; changes in U.S. tax law; foreign currency exchange rate

exposure; the possibility or existence of global and regional

economic downturns; our dependence on vendors and outsourcers;

risks relating to government regulation; risks relating to

litigation, including products liability claims and securities

class action litigation; any failure to successfully integrate or

realize the anticipated benefits of acquisitions or investments;

reputational risk resulting from our e-commerce business and social

media presence; risks relating to our indebtedness and our ability

to secure additional financing; the potential for our electronic

data to be compromised; the influence of our significant

stockholder, ACON, and the possibility that ACON’s interests may

conflict with the interests of our other stockholders; risks

relating to our organizational structure; volatility in the price

of our Class A common stock; and the potential that we will fail to

establish and maintain effective internal control over financial

reporting. These and other important factors discussed under the

caption “Risk Factors” in our quarterly report on Form 10-Q for the

quarter ended September 30, 2019 and our other filings with the

Securities and Exchange Commission could cause actual results to

differ materially from those indicated by the forward-looking

statements made in this press release. Any such forward-looking

statements represent management’s estimates as of the date of this

press release. While we may elect to update such forward-looking

statements at some point in the future, we disclaim any obligation

to do so, even if subsequent events cause our views to change.

These forward-looking statements should not be relied upon as

representing our views as of any date subsequent to the date of

this press release.

Funko, Inc. and

Subsidiaries

Condensed Consolidated

Statements of Operations

(Unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

2019

2018 (1)

2019 (1)

2018 (1)

(In thousands, except per share data) Net sales

$

223,307

$

176,915

$

581,571

$

452,849

Cost of sales (exclusive of depreciation and amortization shown

separately below)

137,801

109,046

361,455

281,574

Selling, general, and administrative expenses

52,424

41,267

136,539

110,306

Acquisition transaction costs — — —

28

Depreciation and amortization

10,472

9,961

31,127

28,912

Total operating expenses

200,697

160,274

529,121

420,820

Income from operations

22,610

16,641

52,450

32,029

Interest expense, net

3,620

5,750

11,455

17,230

Other expense, net

577

1,434

423

2,594

Income before income taxes

18,413

9,457

40,572

12,205

Income tax expense

2,865

1,906

6,464

2,661

Net income

15,548

7,551

34,108

9,544

Less: net income attributable to non-controlling interests

6,909

5,981

18,142

7,307

Net income attributable to Funko, Inc.

$

8,639

$

1,570

$

15,966

$

2,237

Earnings per share of Class A common stock: Basic

$

0.27

$

0.07

$

0.54

$

0.10

Diluted

$

0.25

$

0.06

$

0.50

$

0.09

Weighted average shares of Class A common stock outstanding: Basic

32,055

23,765

29,555

23,484

Diluted

34,503

26,286

31,712

25,124

- The prior period amounts have been revised to reflect the

correction of immaterial errors related to an underpayment of

certain duties owed to U.S. Customs as well as other previously

identified immaterial errors. Please see Note 1 to our Form 10-Q

for the period ended September 30, 2019 for further

information.

Funko, Inc. and

Subsidiaries

Condensed Consolidated Balance

Sheets

(Unaudited)

September 30,

December 31,

2019

2018 (1)

(In thousands, except per

share amounts)

Assets Current assets: Cash and cash equivalents

$

13,492

$

13,486

Accounts receivable, net

163,088

148,627

Inventory

94,347

86,622

Prepaid expenses and other current assets

14,039

11,904

Total current assets

284,966

260,639

Property and equipment, net

53,954

44,296

Operating lease right-of-use assets

61,847

— Goodwill

124,282

116,078

Intangible assets, net

225,165

233,645

Deferred tax asset

55,232

7,407

Other assets

4,859

4,275

Total assets

$

810,305

$

666,340

Liabilities and Stockholders' Equity Current

liabilities: Line of credit

$

18,542

$

20,000

Current portion long-term debt, net of unamortized discount

10,722

10,593

Current portion of operating lease liability

9,525

— Accounts payable

61,415

36,130

Income taxes payable

937

4,492

Accrued royalties

37,767

39,020

Accrued expenses and other current liabilities

26,932

33,015

Total current liabilities

165,840

143,250

Long-term debt, net of unamortized discount

208,460

216,704

Operating lease liabilities, net of current portion

61,093

— Deferred tax liability

38

5

Liabilities under tax receivable agreement, net of current portion

61,061

6,504

Deferred rent and other long-term liabilities

7,225

6,623

Commitments and contingencies

Stockholders'

equity: Class A common stock, par value $0.0001 per share,

200,000 shares authorized; 34,658 shares and 24,960 shares issued

and outstanding as of September 30, 2019 and December 31, 2018,

respectively

3

2

Class B common stock, par value $0.0001 per share, 50,000 shares

authorized; 14,567 shares and 23,584 shares issued and outstanding

as of September 30, 2019 and December 31, 2018, respectively

1

2

Additional paid-in-capital

200,365

146,154

Accumulated other comprehensive loss

(874

)

(167

)

Retained earnings

24,683

8,717

Total stockholders' equity attributable to Funko, Inc.

224,178

154,708

Non-controlling interests

82,410

138,546

Total stockholders' equity

306,588

293,254

Total liabilities and stockholders' equity

$

810,305

$

666,340

- The prior period amounts have been revised to reflect the

correction of immaterial errors related to an underpayment of

certain duties owed to U.S. Customs as well as other previously

identified immaterial errors. Please see Note 1 to our Form 10-Q

for the period ended September 30, 2019 for further

information.

Funko, Inc. and Subsidiaries Non-GAAP

Financial Measures

Adjusted Net Income, Adjusted Earnings per Diluted Share, EBITDA

and Adjusted EBITDA are supplemental measures of our performance

that are not required by, or presented in accordance with, U.S.

GAAP. Adjusted Net Income, Adjusted Earnings per Diluted Share,

EBITDA and Adjusted EBITDA are not measurements of our financial

performance under U.S. GAAP and should not be considered as an

alternative to net income (loss), earnings per share or any other

performance measure derived in accordance with U.S. GAAP. We define

Adjusted Net Income as net income attributable to Funko, Inc.

adjusted for the reallocation of income attributable to

non-controlling interests from the assumed exchange of all

outstanding common units and options in FAH, LLC for newly

issued-shares of Class A common stock of Funko, Inc. and further

adjusted for the impact of certain non-cash charges and other items

that we do not consider in our evaluation of ongoing operating

performance. These items include, among other things, reallocation

of net income attributable to non-controlling interests, non-cash

charges related to equity-based compensation programs, acquisition

transaction costs and other expenses, foreign currency transaction

gains and losses, the Loungefly customs investigation and related

costs, certain severance, relocation and related costs, and other

unusual or one-time items, and the income tax expense (benefit)

effect of these adjustments. We define Adjusted Earnings per

Diluted Share as Adjusted Net Income divided by the

weighted-average shares of Class A common stock outstanding,

assuming (1) the full exchange of all outstanding common units and

options in FAH, LLC for newly issued-shares of Class A common stock

of Funko, Inc. and (2) the dilutive effect of stock options and

unvested common units, if any. We define EBITDA as net income

(loss) before interest expense, net, income tax expense (benefit),

depreciation and amortization. We define Adjusted EBITDA as EBITDA

further adjusted for non-cash charges related to equity-based

compensation programs, acquisition transaction costs and other

expenses, the Loungefly customs investigation and related costs,

certain severance, relocation and related costs, foreign currency

transaction gains and losses and other unusual or one-time items.

We caution investors that amounts presented in accordance with our

definitions of Adjusted Net Income, Adjusted Earnings per Diluted

Share, EBITDA and Adjusted EBITDA may not be comparable to similar

measures disclosed by our competitors, because not all companies

and analysts calculate these measures in the same manner. We

present Adjusted Net Income, Adjusted Earnings per Diluted Share,

EBITDA and Adjusted EBITDA because we consider them to be important

supplemental measures of our performance and believe they are

frequently used by securities analysts, investors, and other

interested parties in the evaluation of companies in our industry.

Management believes that investors’ understanding of our

performance is enhanced by including these non-GAAP financial

measures as a reasonable basis for comparing our ongoing results of

operations. Management uses Adjusted Net Income, Adjusted Earnings

per Diluted Share, EBITDA and Adjusted EBITDA as a measurement of

operating performance because they assist us in comparing the

operating performance of our business on a consistent basis, as

they remove the impact of items not directly resulting from our

core operations; for planning purposes, including the preparation

of our internal annual operating budget and financial projections;

as a consideration to assess incentive compensation for our

employees; to evaluate the performance and effectiveness of our

operational strategies; and to evaluate our capacity to expand our

business.

By providing these non-GAAP financial measures, together with

reconciliations, we believe we are enhancing investors’

understanding of our business and our results of operations, as

well as assisting investors in evaluating how well we are executing

our strategic initiatives. In addition, our senior secured credit

facilities use Adjusted EBITDA to measure our compliance with

covenants such as senior leverage ratio. Adjusted Net Income,

Adjusted Earnings per Diluted Share, EBITDA and Adjusted EBITDA

have limitations as analytical tools, and should not be considered

in isolation, or as an alternative to, or a substitute for net

income (loss) or other financial statement data presented in this

press release as indicators of financial performance. Some of the

limitations are:

- such measures do not reflect our cash expenditures, or future

requirements for capital expenditures or contractual

commitments;

- such measures do not reflect changes in, or cash requirements

for, our working capital needs;

- such measures do not reflect the interest expense, or the cash

requirements necessary to service interest or principal payments on

our debt;

- although depreciation and amortization are non-cash charges,

the assets being depreciated and amortized will often have to be

replaced in the future and such measures do not reflect any cash

requirements for such replacements; and

- other companies in our industry may calculate such measures

differently than we do, limiting their usefulness as comparative

measures.

Due to these limitations, Adjusted Net Income, Adjusted Earnings

per Diluted Share, EBITDA and Adjusted EBITDA should not be

considered as measures of discretionary cash available to us to

invest in the growth of our business. We compensate for these

limitations by relying primarily on our GAAP results and using

these non-GAAP measures only supplementally. As noted in the table

below, Adjusted Net Income, Adjusted Earnings per Diluted Share and

Adjusted EBITDA include adjustments for non-cash charges related to

equity-based compensation programs, acquisition transaction costs

and other expenses, foreign currency transaction gains and losses,

and other unusual or one-time items. It is reasonable to expect

that these items will occur in future periods. However, we believe

these adjustments are appropriate because the amounts recognized

can vary significantly from period to period, do not directly

relate to the ongoing operations of our business and complicate

comparisons of our internal operating results and operating results

of other companies over time. Each of the normal recurring

adjustments and other adjustments described herein and in the

reconciliation table below help management with a measure of our

core operating performance over time by removing items that are not

related to day-to-day operations.

The following tables reconcile Adjusted Net Income, Adjusted

Earnings per Diluted Share, EBITDA and Adjusted EBITDA to the most

directly comparable U.S. GAAP financial performance measure:

Three Months Ended September

30,

Nine Months Ended September

30,

2019

2018 (10)

2019 (10)

2018 (10)

(In thousands, except per share data) Net income

attributable to Funko, Inc.

$

8,639

$

1,570

$

15,966

$

2,237

Reallocation of net income attributable to non-controlling

interests from the assumed exchange of common units of FAH, LLC for

Class A common stock (1)

6,909

5,981

18,142

7,307

Equity-based compensation (2)

3,715

3,607

9,830

5,750

Acquisition transaction costs and other expenses (3)

733

2,663

383

2,691

Customs investigation and related costs (4)

2,907

—

3,357

— Certain severance, relocation and related costs (5)

180

1,031

180

1,031

Foreign currency transaction loss (6)

577

1,434

423

2,594

Income tax expense (7)

(3,766

)

(2,642

)

(7,222

)

(3,407

)

Adjusted net income

19,894

13,644

41,059

18,203

Adjusted net income margin (8)

8.9

%

7.7

%

7.1

%

4.0

%

Weighted-average shares of Class A common stock outstanding

- basic

32,055

23,765

29,555

23,484

Equity-based compensation awards and

common units of FAH, LLC that are convertible into Class A common

stock

20,510

27,682

22,556

27,046

Adjusted weighted-average shares of Class A stock

outstanding - diluted

52,565

51,447

52,111

50,530

Adjusted earnings per diluted share

$

0.38

$

0.27

$

0.79

$

0.36

Three Months Ended September

30,

Nine Months Ended September

30,

2019

2018 (10)

2019 (10)

2018 (10)

(amounts in thousands)

Net income

$

15,548

$

7,551

$

34,108

$

9,544

Interest expense, net

3,620

5,750

11,455

17,230

Income tax expense

2,865

1,906

6,464

2,661

Depreciation and amortization

10,472

9,961

31,127

28,912

EBITDA

$

32,505

$

25,168

$

83,154

$

58,347

Adjustments: Equity-based compensation (2)

3,715

3,607

9,830

5,750

Acquisition transaction costs and other expenses (3)

733

2,663

383

2,691

Customs investigation and related costs (4)

2,907

—

3,357

—

Certain severance, relocation and related costs (5)

180

1,031

180

1,031

Foreign currency transaction loss (6)

577

1,434

423

2,594

Adjusted EBITDA

$

40,617

$

33,903

$

97,327

$

70,413

Adjusted EBITDA margin (9)

18.2

%

19.2

%

16.7

%

15.5

%

(1)

Represents the reallocation of net income

attributable to non-controlling interests from the assumed exchange

of common units of FAH, LLC for Class A common stock in periods in

which income was attributable to non-controlling interests.

(2)

Represents non-cash charges related to

equity-based compensation programs, which vary from period to

period depending on timing of awards.

(3)

Represents legal, accounting, and other

related costs incurred in connection with acquisitions and other

potential transactions.

(4)

Represents legal, accounting and other

related costs incurred in connection with the Company's

investigation of the underpayment of customs duties at Loungefly.

For the nine months ended September 30, 2019, includes the accrual

of a contingent liability of $0.5 million related to potential

penalties that may be assessed by U.S. Customs in connection with

the underpayment of customs duties at Loungefly.

(5)

For the three and nine months ended

September 30, 2019, represents severance, relocation and related

costs associated with the consolidation of our warehouse facilities

in the United Kingdom. For the three and nine months ended

September 30, 2018, represents severance costs incurred in

connection with the departure of certain executives, including the

founders of Loungefly.

(6)

Represents both unrealized and realized

foreign currency losses on transactions other than in U.S.

dollars.

(7)

Represents the income tax expense effect

of the above adjustments. This adjustment uses an effective tax

rate of 25% for all periods presented.

(8)

Adjusted net income margin is calculated

as Adjusted net income as a percentage of net sales.

(9)

Adjusted EBITDA margin is calculated as

Adjusted EBITDA as a percentage of net sales.

(10)

The prior period amounts have been revised

to reflect the correction of immaterial errors related to an

underpayment of certain duties owed to U.S. Customs as well as

other previously identified immaterial errors. Please see Note 1 to

our Form 10-Q for the period ended September 30, 2019 for further

information.

Guidance Reconciliation of Net Income

to EBITDA, Adjusted EBITDA, Adjusted Net Income and Adjusted

Earnings per Diluted Share

Estimated Range for the Year Ending December 31, 2019

(In millions, except per share amounts) Net income

$

54.0

$

58.3

Interest expense, net

15.8

15.6

Income tax expense

10.2

11.1

Depreciation and amortization

42.5

42.5

EBITDA

$

122.5

$

127.5

Adjustments: Equity-based compensation (1)

13.2

13.2

Acquisition transaction costs and other expenses (2)

0.4

0.4

Customs investigation and related costs (3)

3.4

3.4

Certain severance, relocation and related costs (4)

0.2

0.2

Foreign currency transaction gain (5)

0.4

0.4

Adjusted EBITDA

$

140.0

$

145.0

Net income

$

54.0

$

58.3

Equity-based compensation (1)

13.2

13.2

Acquisition transaction costs and other expenses (2)

0.4

0.4

Customs investigation and related costs (3)

3.4

3.4

Certain severance, relocation and related costs (4)

0.2

0.2

Foreign currency transaction gain (5)

0.4

0.4

Income tax expense (6)

(10.2

)

(10.6

)

Adjusted net income

$

61.3

$

65.2

Weighted-average shares of Class A common stock outstanding

25.5

25.5

Equity-based compensation awards and common units of FAH, LLC that

are convertible into Class A common stock

28.0

28.0

Adjusted weighted-average shares of Class A stock outstanding -

diluted

53.5

53.5

Adjusted earnings per diluted share

$

1.15

$

1.22

(1)

Represents non-cash charges

related to equity-based compensation programs, which vary from

period to period depending on timing of awards.

(2)

Represents legal, accounting, and

other related costs incurred in connection with potential and

completed acquisitions and other transactions.

(3)

Represents legal, accounting and other

related costs incurred through the nine months ended September 30,

2019 in connection with the Company's investigation of the

underpayment of customs duties at Loungefly and the accrual of a

contingent liability of $0.5 million related to potential penalties

that may be assessed by U.S. Customs in connection with the

underpayment of customs duties at Loungefly.

(4)

Represents severance, relocation and

related costs associated with the consolidation of our new

warehouse facilities in the United Kingdom through the nine months

ended September 30, 2019.

(5)

Represents both unrealized and realized

foreign currency gains and losses on transactions other than in

U.S. dollars through the nine months ended September 30, 2019.

(6)

Represents the income tax expense effect

of the above adjustments. This adjustment uses an effective tax

rate of 25% for the year ending December 31, 2019.

Note: The Company is not able to provide the expected impact of

unrealized and realized foreign currency gains and losses for the

three months ending December 31, 2019 on transactions without

unreasonable efforts because the calculation for that change is

primarily driven by changes in foreign currency exchange rates,

principally British pounds and euros. Additionally, the impacts are

also driven by fluctuations in product sales and operating expenses

in each of those local currencies, which can fluctuate month to

month. Therefore, the Company’s Adjusted EBITDA, Adjusted Net

Income and Adjusted Earnings per Diluted Share for the year ending

December 31, 2019, including the above adjustments, may differ

materially from that forecasted in the table above.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20191031005892/en/

Investor Relations: Sean McGowan Gateway Investor

Relations FNKO@gatewayir.com (949) 574-3860

Andrew Harless Funko Investor Relations andrewh@funko.com (425)

783-3616

Media: Jessica Piha-Grafstein, Funko jessicap@funko.com

425-783-3616

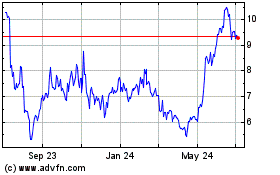

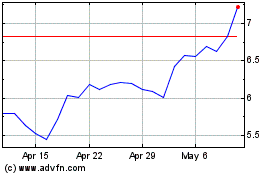

Funko (NASDAQ:FNKO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Funko (NASDAQ:FNKO)

Historical Stock Chart

From Apr 2023 to Apr 2024