SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

31

October 2019

LLOYDS BANKING GROUP

plc

(Translation of registrant's name into

English)

5th Floor

25 Gresham Street

London

EC2V 7HN

United Kingdom

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual

reports

under

cover Form 20-F or Form 40-F.

Form

20-F..X.. Form 40-F

Indicate

by check mark whether the registrant by furnishing the

information

contained

in this Form is also thereby furnishing the information to

the

Commission

pursuant to Rule 12g3-2(b) under the Securities Exchange Act of

1934.

Yes

No ..X..

If

"Yes" is marked, indicate below the file number assigned to the

registrant in connection with Rule

12g3-2(b):

82- ________

Index

to Exhibits

Item

No.

1 Regulatory News Service Announcement, dated 31 October

2019

re: Non Executive Board Changes

31 October

2019

NON-EXECUTIVE BOARD CHANGES AND SUCCESSION PLANS

Lloyds Banking Group is pleased to announce the appointment of two

Non-Executive Directors, Sarah Legg and Catherine

Woods.

Sarah Legg, who will join the Board on 1 December 2019, was Group

Financial Controller of HSBC until earlier this year, and

previously CFO for HSBC's Asia Pacific region. Sarah will join the

Board's Audit and Risk Committees. Catherine Woods will join

the Board on 1 March 2020 after retiring as Deputy Chairman and

Senior Independent Director of Allied Irish Bank in October 2019.

Catherine will join the Board's Risk and Remuneration Committees.

As with other Group NEDs, both will also serve as Non-Executive

Directors of the Group's Ring-Fenced Bank Boards.

Anita Frew will have served 9 years as a Non-Executive Director in

December 2019, and accordingly plans to step down as Senior

Independent Director in December and retire as Deputy Chairman and

Non-Executive Director at the AGM in May 2020. Alan Dickinson will

succeed Anita as Senior Independent Director as of 1 December 2019,

and will also take on the role of Deputy Chairman following Anita's

retirement from the Board.

Lord Blackwell will have served 9 years on the Group Board in 2021,

and accordingly plans to retire as Group Chairman at or before the

AGM in 2021. The Board will therefore initiate a search process

early next year once the new Senior Independent Director is in

place to allow time to identify his successor and enable an orderly

handover.

Lord Blackwell, Group Chairman, comments "We look forward to

welcoming Sarah and Catherine as new Non-Executive Directors. They

will add significant financial services experience as well as

broader perspectives and diversity to the Board. At the same time

we will miss the enormous contribution Anita Frew has made to the

Group when she steps down from the Board after serving through a

period of extraordinary transformation for the

business."

Further information on the new Non-Executive Directors is set out

below. There is no other information regarding the appointment of

Sarah Legg or Catherine Woods to be disclosed under paragraph

9.6.13R of the Listing Rules.

The Group has also made a separate announcement today that Juan

Colombás, its Chief Operating Officer and an Executive

Director, plans to retire from the Group and the Board in July

2020.

Biographical details

Sarah Legg started her career as a graduate trainee accountant with

HSBC, where she gained her CIMA qualification. After a range of

Group roles she moved to Hong Kong in 2006 to become Chief

Accounting Officer for Asia Pacific, moving up to Chief Financial

Officer for Asia Pacific in 2010 and serving as a Non-Executive

Director of the Hong Kong listed Hang Seng Bank Limited. From 2015

to March 2019 Sarah served as a Group General Manager and the Group

Financial Controller of HSBC.

Catherine Woods has served as a Non-Executive Director of Allied

Irish Banks (AIB Group) since 2010, becoming Senior Independent

Director in 2015 and Deputy Chairman in 2018 before retiring from

the Group Board on 12 October 2019. Catherine will remain on the

boards of two subsidiaries of AIB until the end of the year. She

started her career with JP Morgan Securities, becoming Head of

European Banks Equity Research in 1994 until she left in 2001. She

has since held a range of Non-Executive and Advisory roles

including Financial Expert to the Electronic Communications Appeals

Panel and the National Broadband Panel in Dublin, and Non-Executive

Director of An Post. She currently has ongoing roles as a

Non-Executive Director of Beazley and of BlackRock Asset Management

Limited Ireland.

- END -

For further information:

Investor Relations

Douglas

Radcliffe

+44 (0) 20 7356 1571

Group Investor Relations Director

douglas.radcliffe@lloydsbanking.com

Corporate Affairs

Matt

Smith

+44 (0) 20 7356 3522

Head of Media Relations

matt.smith@lloydsbanking.com

FORWARD LOOKING STATEMENTS

This document contains certain forward looking statements with

respect to the business, strategy, plans and/or results of the

Group and its current goals and expectations relating to its future

financial condition and performance. Statements that are not

historical facts, including statements about the Group's or its

directors' and/or management's beliefs and expectations, are

forward looking statements. By their nature, forward looking

statements involve risk and uncertainty because they relate to

events and depend upon circumstances that will or may occur in the

future. Factors that could cause actual business, strategy, plans

and/or results (including but not limited to the payment of

dividends) to differ materially from forward looking statements

made by the Group or on its behalf include, but are not limited to:

general economic and business conditions in the UK and

internationally; market related trends and developments;

fluctuations in interest rates, inflation, exchange rates, stock

markets and currencies; any impact of the transition from IBORs to

alternative reference rates; the ability to access sufficient

sources of capital, liquidity and funding when required; changes to

the Group's credit ratings; the ability to derive cost savings and

other benefits including, but without limitation as a result of any

acquisitions, disposals and other strategic transactions; the

ability to achieve strategic objectives; changing customer

behaviour including consumer spending, saving and borrowing habits;

changes to borrower or counterparty credit quality; concentration

of financial exposure; management and monitoring of conduct risk;

instability in the global financial markets, including Eurozone

instability, instability as a result of uncertainty surrounding the

exit by the UK from the European Union (EU) and as a result of such

exit and the potential for other countries to exit the EU or the

Eurozone and the impact of any sovereign credit rating downgrade or

other sovereign financial issues; political instability including

as a result of any UK general election; technological changes and

risks to the security of IT and operational infrastructure,

systems, data and information resulting from increased threat of

cyber and other attacks; natural, pandemic and other disasters,

adverse weather and similar contingencies outside the Group's

control; inadequate or failed internal or external processes or

systems; acts of war, other acts of hostility, terrorist acts and

responses to those acts, geopolitical, pandemic or other such

events; risks relating to climate change; changes in laws,

regulations, practices and accounting standards or taxation,

including as a result of the exit by the UK from the EU, or a

further possible referendum on Scottish independence; changes to

regulatory capital or liquidity requirements and similar

contingencies outside the Group's control; the policies, decisions

and actions of governmental or regulatory authorities or courts in

the UK, the EU, the US or elsewhere including the implementation

and interpretation of key legislation and regulation together with

any resulting impact on the future structure of the Group; the

ability to attract and retain senior management and other employees

and meet its diversity objectives; actions or omissions by the

Group's directors, management or employees including industrial

action; changes to the Group's post-retirement defined benefit

scheme obligations; the extent of any future impairment charges or

write-downs caused by, but not limited to, depressed asset

valuations, market disruptions and illiquid markets; the value and

effectiveness of any credit protection purchased by the Group; the

inability to hedge certain risks economically; the adequacy of loss

reserves; the actions of competitors, including non-bank financial

services, lending companies and digital innovators and disruptive

technologies; and exposure to regulatory or competition scrutiny,

legal, regulatory or competition proceedings, investigations or

complaints. Please refer to the latest Annual Report on Form 20-F

filed with the US Securities and Exchange Commission for a

discussion of certain factors and risks together with examples of

forward looking statements. Except as required by any applicable

law or regulation, the forward looking statements contained in this

document are made as of today's date, and the Group expressly

disclaims any obligation or undertaking to release publicly any

updates or revisions to any forward looking statements contained in

this document to reflect any change in the Group's expectations

with regard thereto or any change in events, conditions or

circumstances on which any such statement is based. The

information, statements and opinions contained in this document do

not constitute a public offer under any applicable law or an offer

to sell any securities or financial instruments or any advice or

recommendation with respect to such securities or financial

instruments.

Signatures

Pursuant

to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

LLOYDS

BANKING GROUP plc

(Registrant)

By: Douglas

Radcliffe

Name: Douglas

Radcliffe

Title: Group

Investor Relations Director

Date: 31

October 2019

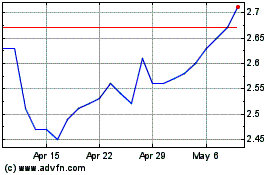

Lloyds Banking (NYSE:LYG)

Historical Stock Chart

From Mar 2024 to Apr 2024

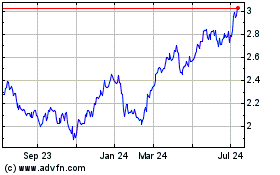

Lloyds Banking (NYSE:LYG)

Historical Stock Chart

From Apr 2023 to Apr 2024