Global Stocks Drift Lower Ahead of Fed Decision

October 30 2019 - 7:07AM

Dow Jones News

By Will Horner

Global stocks edged lower amid disappointing earnings Wednesday

as investors awaited the Federal Reserve's decision on interest

rates.

Stock futures linked to the Dow Jones Industrial Average were

largely flat. General Electric jumped over 5% in premarket trading

after the company's third-quarter profit beat Wall Street's

expectations.

Johnson & Johnson shares rose 3% offhours after it said

Tuesday that a test of its baby powder didn't find traces of

asbestos, rebutting U.S. regulators' claims about the product.

Advanced Micro Devices fell 2.2%. The chip maker issued a

forecast for the current quarter late Tuesday that was slightly

lower than expected.

Investors are awaiting earnings later Wednesday from a raft of

major U.S. companies, including Apple, Facebook, Lyft and

Starbucks.

Meanwhile, the pan-continental Stoxx Europe 600 index ticked

down 0.2%, with some of the region's biggest banks leading

declines.

Shares of troubled German lender Deutsche Bank fell 5.8%, making

it the worst performer in Europe, after it said efforts to overhaul

its global operations had taken a large chunk out of its revenue.

Banco Santander declined 3% as third-quarter profit fell 75%.

Fiat Chrysler Automobiles and Peugeot maker PSA Group surged

after the companies confirmed they were discussing a merger that

would create the world's fourth-largest auto maker by volume. Fiat

shares rose 8.3% in Milan and PSA gained 5.9%. Rival Renault, which

had previously received an offer to combine its operations with

Fiat, slumped 3.5%.

In the U.K., major stock indexes slipped after lawmakers agreed

to hold an early election on Dec. 12 in an attempt to break the

stalemate over Brexit. The nation's blue-chip FTSE 100 gauge

slipped 0.1%, while the yield on U.K. government bonds fell to

0.694%. Bond yields fall as prices rise.

Investors are largely holding off from making major moves until

the conclusion of the Fed's monetary policy meeting later in the

day, said Daniel Lacalle, chief economist and chief investment

officer at Madrid-based investment firm Tressis.

"With the two main negative catalysts in the mind of market

participants -- Brexit and the U.S.-China trade war -- having been

not resolved, but at least showing some light at the end of the

tunnel, then monetary policy becomes the key factor," he said.

The central bank is widely expected to cut interest rates by a

quarter of a percentage point after markets close. Key data,

including the first reading of U.S. third-quarter gross domestic

product and a gauge of private-sector employment, will also give

investors and policy makers additional clues on the state of the

economy.

In Asia, the Shanghai Composite Index fell 0.5%, while Japan's

Nikkei 225 gauge dropped 0.6%.

(END) Dow Jones Newswires

October 30, 2019 06:52 ET (10:52 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

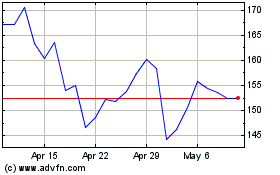

Advanced Micro Devices (NASDAQ:AMD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Advanced Micro Devices (NASDAQ:AMD)

Historical Stock Chart

From Apr 2023 to Apr 2024