UNITED

STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON

D.C.

SCHEDULE 13D

Under the

Securities Exchange Act of 1934

FasT

LANE Holdings, INC.

|

|

|

(Name

of Issuer)

|

|

|

Common Stock & Preferred Stock

|

|

(Title

of Class of Securities)

|

|

31189D109

|

|

|

|

(CUSIP

Number)

|

|

Lykato

Group, LLC

1830

Oak Creek Drive

Dunedin,

Florida 34698

(727)

424-3277

|

|

|

|

|

|

(Name,

Address and Telephone Number of Person

Authorized

to Receive Notices and Communications)

|

|

|

October 21, 2019

|

|

(Date

of Event which Requires Filing of this Statement)

|

If the

filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D,

and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. .

Note:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See §240.13d-7

for other parties to whom copies are to be sent.

*

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect

to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided

in a prior cover page. The information required on the remainder of this cover page shall not be deemed to be “filed”

for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities

of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

|

1

|

Names of Reporting Persons.

I.R.S. IDENTIFICATION NOS.

OF ABOVE PERSONS (ENTITIES ONLY)

Lykato Group, LLC; IRS No.

84-3327123

|

|

2

|

Check the Appropriate Box

if a Member of a Group (See Instructions)

(a) [

]

(b)

[ ]

|

|

3

|

SEC Use Only

|

|

4

|

Source of Funds OO

|

|

5

|

Check

if Disclosure of Legal Proceedings is Required Pursuant to Items 2(d) or 2(e) ☐

|

|

6

|

Citizenship or Place of Organization

Florida

|

|

Number

of Shares Beneficially Owned by Each Reporting Person With

|

7

|

Sole Voting Power

60,000,000 common shares.

|

|

8

|

Shared Voting Power

0

|

|

9

|

Sole Dispositive Power

60,000,000 common shares.

|

|

10

|

Shared Dispositive Power

0

|

|

11

|

Aggregate Amount Beneficially

Owned by Each Reporting Person

60,000,000

common shares.

|

|

12

|

Check

if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) ☐

|

|

13

|

Percentage of Class Represented

by Amount in Row (11)

82.25%

|

|

14

|

Type of Reporting Person

(See Instructions)

OO

|

|

|

|

|

|

The following constitutes

the Schedule 13D filed by the undersigned (the “Schedule 13D”).

The following constitutes the

Schedule 13D filed by the undersigned (the “Schedule 13D”).

Item 1. Security and Issuer.

The class of security to which

this statement relates is common stock, par value $.001 per share and preferred stock, par value $.001 per share, of Fast Lane

Holdings, Inc. a Delaware corporation (the “Company”). The address of the principal executive office of the Company

is 640 Douglas Avenue, Dunedin, Florida 34698.

Item 2. Identity and

Background.

(a) This statement is filed by:

(i) Lykato Group, LLC, with respect

to the Shares directly and beneficially owned by it as of October 21, 2019;

(ii) James Xilas, as the managing

and sole member of Lykato Group, LLC, (“Lykato”) with respect to the Shares indirectly and beneficially owned by him

as of October 21, 2019;

Each of the foregoing is referred

to as a “Reporting Person” and collectively as the “Reporting Persons.”

(b) The address of the principal

office of each of the Reporting Persons is 1830 Oak Creek Drive, Dunedin, Florida, 34698.

(c) Lykato Group is principally

engaged in the business of a holding company. Mr. James Xilas, CEO of Fast Lane Holdings, Inc. is the Managing and sole member

of Lykato.

(d) No Reporting Person has,

during the last five years, been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors).

(e) No Reporting Person has,

during the last five years, has been party to civil proceeding of a judicial or administrative body of competent jurisdiction

and as a result of such proceeding was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting

or mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws.

(f) Lykato is organized under

the laws of the State of Florida.

Item 3. Source or

Amount of Funds or Other Consideration.

The common stock purchased by

Lykato from Giant Consulting Services, LLC on October 21, 2019 was purchased with private funds provided by James Xilas on behalf

of Lykato.

Item 4. Purpose of

Transaction.

Lykato Group, LLC entered into

a share purchase agreement on October 11, 2019 with Giant Consulting Services, LLC. Upon closing of the agreement on October 21,

2019 Giant Consulting Services, LLC sold 60,000,000 shares of common stock and 2,550 shares of preferred stock to Lykato Group,

LLC in consideration of three hundred twenty-five thousand dollars ($325,000).

Previous to the above transaction,

Giant Consulting Services, LLC was the controlling shareholder of Fast Lane Holdings. Lykato Group, LLC is now the controlling

shareholder of Fast Lane Holdings.

The share purchase agreement

is attached as Exhibit 10.1 in Form 8-K filed on October 24, 2019 which is incorporated herein by reference.

Item 5. Interest in

Securities of the Issuer.

The aggregate percentage of common

shares owned by each Reporting Person is based upon approximately 72,948,316 common shares outstanding as of October 21, 2019.

Lykato Group, LLC

(a) As of the close of business

on October 21, 2019, Lykato directly owns 60,000,000 shares of the Issuer’s Common Stock and 2,550 Series A preferred shares.

The Series A preferred shares have no voting rights.

Percentage: 82.25%

(b) 1. Sole Power to vote or

direct vote: 60,000,000

2. Shared power to vote or direct

vote: 0

3. Sole power to dispose or direct

the disposition: 60,000,000

(c) There are no transactions

in the shares of Fast Lane Hodings, Inc. by Lykato during the past sixty days notwithstanding 60,000,000 common shares that Lykato

purchased from Giant on October 21, 2019 and 2,550 Series A preferred shares that have no voting rights.

James Xilas

(a) Mr. Xilas is deemed to be

the indirect beneficial owner of 60,000,000 common shares and 2,550 Series A preferred shares held in Fast Lane Holdings, Inc.

since he is the sole and managing member of Lykato.

(b) No person other than the

Reporting Persons is known to have the right to receive, or the power to direct the receipt of dividends from, or proceeds from

the sale of the Shares.

Item 6. Contracts,

Arrangements, Understandings or Relationships with Respect to Securities of the Issuer.

Other than as described herein,

there are no contracts, arrangements, understandings or relationships other than as disclosed among the Reporting Persons, or

between the the Reporting Persons and any other person, with respect to the securities of the Issuer.

Item 7. Material to

Be Filed as Exhibits.

None.

Item 6. Contracts,

Arrangements, Understandings or Relationships with Respect to Securities of the Issuer.

There are no contracts, arrangements,

understandings or relationships other than as disclosed among the Reporting Persons, or between the Reporting Persons and any

other person, with respect to the securities of the Issuer.

|

|

|

|

|

|

CUSIP

No. 31189D109

|

|

SCHEDULE

13D

|

|

|

|

|

|

|

SIGNATURE

After

reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true,

complete and correct.

Dated: October

29, 2019

LYKATO GROUP, LLC

By: /s/

James Xilas

Name: James

Xilas

Title: Managing

Member

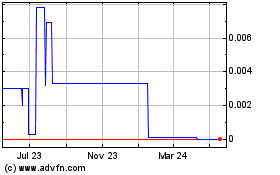

Blubuzzard (CE) (USOTC:BZRD)

Historical Stock Chart

From Mar 2024 to Apr 2024

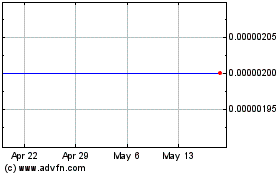

Blubuzzard (CE) (USOTC:BZRD)

Historical Stock Chart

From Apr 2023 to Apr 2024