P&G Adds To Streak Of Sales Increases -- WSJ

October 23 2019 - 3:02AM

Dow Jones News

By Sharon Terlep

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (October 23, 2019).

Procter & Gamble Co. posted another quarter of strong sales

of household staples and said it was well positioned to ride out

any pullback in consumer spending.

Helped by price increases, the maker of Tide laundry detergent

and Pampers diapers said revenue rose across all of its business

lines, including its beleaguered Gillette shaving unit. P&G is

now growing at a faster pace than competitors such as Unilever PLC

and Kimberly-Clark Corp.

The Cincinnati company said organic sales, a measure that

excludes currency moves and deals, rose 7% from a year ago.

Kimberly-Clark, maker of Huggies diapers and Kleenex tissues, on

Tuesday said organic sales rose 4%. Unilever, with brands including

Dove soap, last week reported organic sales growth of 2.9%

P&G's growth sputtered in the years following the 2008

financial crisis and only last year returned to levels seen before

the economy soured. Its turnaround has been driven by higher

prices, new products and a leaner portfolio of brands.

"We are better positioned now than in 2008 to handle a

downturn," P&G finance chief Jon Moeller said Tuesday in a call

with analysts who questioned whether the company's results would

hold up should consumers curtail spending. He said the company sees

"no signs of weakness, but that can change."

Economies have been slowing around the globe recently. Household

spending in the U.S. ticked up 0.1% on a seasonally adjusted basis

in August compared with July, lower than the average gains during

the first seven months of the year. Last week, the International

Monetary Fund cut its forecast for global economic growth this year

to 3%.

Mr. Moeller said P&G has largely stopped selling products

that tend to suffer amid consumer belt-tightening, such as makeup

and perfume. Instead, the company has focused on developing pricier

offerings in essential products such as laundry soap and

toothpaste.

Consumers' willingness to pay higher prices for household

staples, with increases driven largely by P&G as the industry's

biggest player, has fueled the company's growth. This summer,

P&G reported its strongest fiscal year since before the

recession. It was a marked reversal from the previous year, when

P&G was lagging rivals and the company was growing 1% to 2% a

quarter. Activist investor Nelson Peltz joined P&G's board the

spring of 2018 following the most expensive proxy contest in

history.

Consumer-products executives have said they expect higher

pricing to abate in coming quarters. That has already begun to

happen in some areas. Pricing accounted for 1% of P&G's sales

gains in the most recent quarter, compared with a 3% contribution

the previous quarter.

P&G is betting that shoppers will nonetheless continue to

favor higher-end variations, such as specialty toothpaste, adult

diapers made to resemble lingerie and laundry scent-beads designed

to make loads more fragrant.

If they don't, Mr. Moeller said, P&G believes it can

continue to drive sales gains by offering items packaged in smaller

quantities and with marketing aimed at budget-conscious consumers.

"If there is a downturn, we're as best positioned for consumers who

are in a pinch," he said.

P&G's net sales were $17.8 billion for the quarter ended

Sept. 30; net earnings rose to $3.6 billion, from $3.2 billion a

year earlier. The company notched its best sales gains in its

beauty segment, where organic sales increased 10% in part on higher

demand for P&G's skin care products in China, namely its

high-end SK-II brand.

Organic sales in the company's health care segment rose 9%. Mr.

Moeller said the unit was buoyed by brands acquired in last year's

$4.2 billion purchase of the consumer-health business from

Germany's Merck KGaA, which added vitamins and food supplements to

its lineup of over-the-counter medicines.

Kimberly-Clark said higher prices largely drove the company's

latest quarterly sales increase. CEO Michael Hsu said the company,

like P&G, is betting that shoppers will continue to favor

premium products, such as a line of Huggies diapers launched this

year that costs roughly 40% more than the priciest offering

previously on the market.

"Premiumization is the path a company like ours needs to take,"

Mr. Hsu said Tuesday on a call with analysts.

Both P&G and Kimberly-Clark raised their full-year

forecasts.

--Micah Maidenberg contributed to this article

Write to Sharon Terlep at sharon.terlep@wsj.com

(END) Dow Jones Newswires

October 23, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

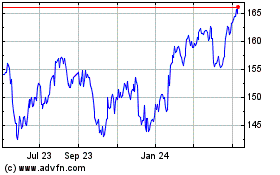

Procter and Gamble (NYSE:PG)

Historical Stock Chart

From Mar 2024 to Apr 2024

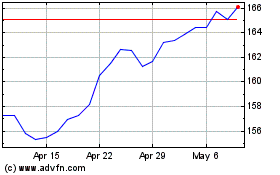

Procter and Gamble (NYSE:PG)

Historical Stock Chart

From Apr 2023 to Apr 2024