Shares of Hasbro Fall as Tariff Threat Weighs on Toy Orders

October 22 2019 - 1:27PM

Dow Jones News

By Patrick Thomas

Shares of Hasbro Inc. tumbled Tuesday after the company reported

that trade tensions with China cut into its latest quarterly

results.

Retailers, spooked by potential tariffs on imports from China,

canceled or changed their orders during the third quarter, the toy

maker said.

President Trump plans to impose new tariffs on about $156

billion in goods from China, including consumer items such as toys.

The 10% duty is scheduled to go into effect on Dec. 15 after being

delayed in early August due to concern over the holiday shopping

season.

"The threat of and the implementation of tariffs in certain

instances impacted our shipments and our ability to fully meet

demand," Chief Executive Brian Goldner said on an earnings call.

"The prospect had our retailers cancel major direct import program

orders and rewrite many of those orders as domestic shipments."

The Pawtucket, R.I.-based company said its third-quarter revenue

rose slightly to $1.58 billion. Analysts were expecting $1.72

billion, according to FactSet. Revenue in the U.S. and Canada

declined 2% from a year earlier while international sales were

flat.

Shares of Hasbro were off 15% in midday trading. They are up

about 26% for the year and roughly 8% over the past 12 months.

Mr. Goldner said on Tuesday that retailers could continue to

alter their orders before the Dec. 15 tariff is implemented.

"We are working diligently to improve our approach to domestic

shipments and still face the prospect of more direct import

cancellations and shifts to domestic orders as the December 15 List

4 day approaches for most of our product lines," he said on the

call.

The CEO said the company plans to reduce the portion of products

it sources from China to below 50% by the end of 2020. Earlier this

year, Hasbro said it sourced about two-thirds of its products from

China, down from more than 80% in 2012.

Sales of its Magic: The Gathering and Monopoly products grew

during the quarter, but revenue from the company's franchise brands

fell 8% to $779.7 million due to lower demand for its My Little

Pony and Play-Doh products.

Hasbro's Nerf brand also continued to struggle. The brand's

high-end toy blasters have been undercut by rivals that have

entered the category with lower-price items.

Overall, the company reported a profit of $212.9 million, or

$1.67 a share, down from $263.9 million, or $2.06 a share, a year

earlier. Analysts polled by FactSet were expecting earnings of

$2.21 a share. Excluding one-time charges, the company reported

adjusted earnings of $1.84 a share for the latest period.

The company said it expects its deal for Entertainment One Ltd.

to close in its fourth quarter. In August, Hasbro agreed to pay $4

billion in cash to acquire Entertainment One, an entertainment

company that produces content for children and adults. Its lineup

includes Peppa Pig, which follows a family of pigs; PJ Masks, about

a trio of heroes, and Ricky Zoom, a series whose main character is

a red rescue bike.

(END) Dow Jones Newswires

October 22, 2019 13:12 ET (17:12 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

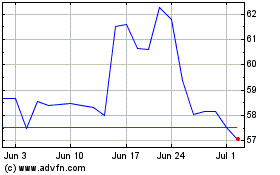

Hasbro (NASDAQ:HAS)

Historical Stock Chart

From Mar 2024 to Apr 2024

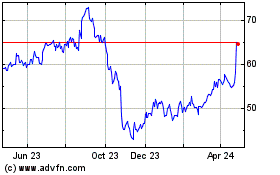

Hasbro (NASDAQ:HAS)

Historical Stock Chart

From Apr 2023 to Apr 2024