Activist Investor Behind CSX Overhaul Sells Most of Its Stake

October 21 2019 - 5:17PM

Dow Jones News

By Paul Ziobro and Corrie Driebusch

The activist that shook up CSX Corp. has wound down most of its

investment in the railroad operator, marking an end to a three-year

saga that helped spur a massive overhaul of the U.S. railroad

industry.

Paul Hilal's investment vehicle, Mantle Ridge LP, has sold off

nearly all of its $1 billion position in CSX, according to

securities filings. About 4.7 million shares were bought back by

the railroad.

Mr. Hilal retains ownership of about 3.4 million shares of CSX,

according to a regulatory filing, and he will continue to serve as

a director and vice chairman of the company's board.

Shares of CSX have roughly doubled since January 2017 when The

Wall Street Journal reported that Mantle Ridge would mount a

campaign to shake up transform the railroad company.

A CSX spokesman declined to comment on the stock sale.

Mr. Hilal launched a brief boardroom battle to install railroad

veteran Hunter Harrison as the CSX's CEO. Mr. Harrison had

previously turned around operations at two large Canadian

railroads, including once with the backing of William Ackman's

Pershing Square Capital Management, where Mr. Hilal previously

worked.

Though Mr. Harrison was 72 years old, had battled health

problems and was nearing retirement at Canadian Pacific Railway

Co., CSX agreed to pay about $84 million to bring him on board as

CEO.

The plan was for Mr. Harrison to implement his so-called

precision scheduled railroading strategy, which focuses on running

fewer, longer trains on tighter schedules and removing unnecessary

steps like sorting railcars. Mr. Harrison immediately went to work

by closing facilities, idling hundreds of locomotives and laying

off thousands of employees.

The changes were disruptive at CSX and across the broader U.S.

freight-railroad network, causing widespread congestion and

shipping problems. Federal regulators summoned Mr. Harrison to

Washington for hearings.

Mr. Harrison, who often used an oxygen tank as he battled

unspecified health problems, died suddenly just nine months into

the turnaround.

Eventually, the gridlock cleared and CSX began operating a

leaner railroad more nimbly. Profit rose and the railroad's

operating ratio, which shows how much revenue is consumed by

operating expenses, where a lower figure is better, fell

dramatically.

Last week, CSX posted a 4% increase in quarterly profit, even as

revenue fell 5%, as cost cuts helped prop up income. The operating

ratio came in at 56.8%, a new low for the railroad.

The financial success has prompted other railroads, including

Kansas City Southern, Norfolk Southern Corp. and Union Pacific

Corp., to enact similar turnaround strategies modeled after Mr.

Harrison's work.

Write to Paul Ziobro at Paul.Ziobro@wsj.com and Corrie Driebusch

at corrie.driebusch@wsj.com

(END) Dow Jones Newswires

October 21, 2019 17:02 ET (21:02 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

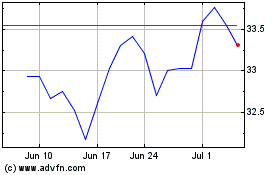

CSX (NASDAQ:CSX)

Historical Stock Chart

From Mar 2024 to Apr 2024

CSX (NASDAQ:CSX)

Historical Stock Chart

From Apr 2023 to Apr 2024